As July approaches, discipline Ethereum ETFs, which obtained the US SEC partial green gentle on Can even 23, shut to their legitimate launch. Many buyers marvel if the associated rate of Ethereum (ETH) will put together Bitcoin’s (BTC) reaction to its linked financial devices in January.

That reply, alternatively, lies eventually, that can also simply start up in a few days. Whereas waiting, the on-chain diagnosis affords actionable insights that can predict if the altcoin is following a probable pattern.

The Altcoin Traders Are in High Spirits

Modification of registration paperwork is one ingredient that has delayed the stay shopping and selling of the discipline Ethereum ETFs. Then again, in a newest interview, SEC Chair Gary Gensler confirmed that issues possess been going smoothly.

Furthermore, a document from nameless sources on the regulatory company finds that the products will launch on July 4.

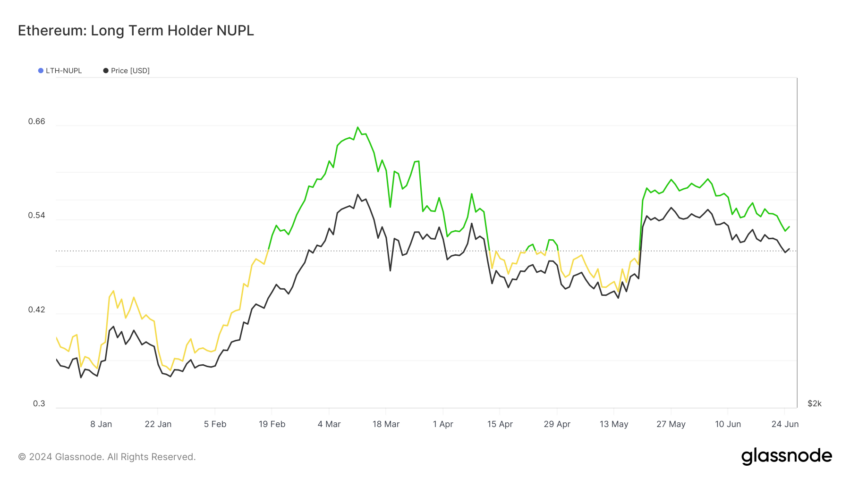

Following the vogue, BeInCrypto displays holder behavior against ETH. In step with our findings, ETH holders reward resolute self belief within the cryptocurrency. We learned this after examining the LTH-NUPL supplied by the analytic platform Glassnode.

The metric stands for Lengthy Time interval Holder-Come by Unrealized Profit/Loss. It measures the behavior of holders who possess owned a cryptocurrency for over 155 days. As seen within the chart underneath, totally different colors exist for various sentiments.

Be taught extra: Ethereum ETF Outlined: What It Is and How It Works

Whereas red indicates capitulation, orange methodology agonize. Yellow indicates optimism, whereas blue suggests greed. At demonstrate, Ethereum’s LTH-NUPL is within the realization (green) zone. When this occurs, long-time frame buyers are assured a couple of drawing shut rate enhance.

Then again, ETH has skilled a 12.75% decline within the final 30 days whereas it trades at $3,365. In eventualities address this, the broader sentiment is anticipated to be bearish. Thus, as concept tilts toward self belief, the noteworthy-anticipated vogue appears to be like to be to be the reason. If sustained till launch day, it will propel elevated inquire for ETH.

Ethereum Is Taking Bitcoin Out of the Method

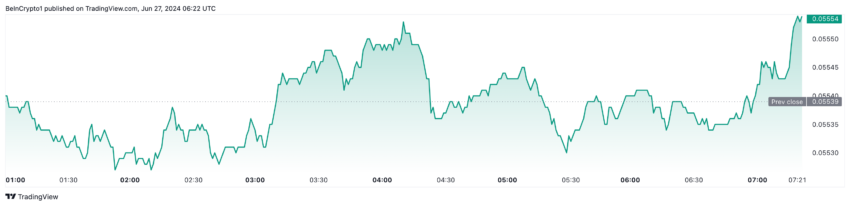

Within the intervening time, concept on my own can now now not push the associated rate. Therefore, we review one other indicator that can possess an impact on the altcoin’s rate, which is the ETH/BTC ratio. This ratio tells whether Bitcoin is outperforming Ethereum or the totally different formulation around. Particularly, if the ETH/BTC ratio is high, it methodology that ETH is performing better than Bitcoin.

Then again, a low ratio implies that BTC is outperforming ETH. As of this writing, the ratio is 0.055—up 2.33% all via the final seven days. This methodology that this day, one ETH can hang 0.055 BTC.

Must the ratio proceed increasing, Bitcoin’s market dominance will decrease. As such, Ethereum can step up whereas its rate can also simply climb noteworthy elevated. Concerned with Bitcoin’s performance, the associated rate rose by 56.95% in decrease than two months after approval.

If ETH mirrors a identical switch, the associated rate of the cryptocurrency will be rate $5,308 before the terminate of the third quarter (Q3). Now, let’s explore the altcoin’s momentary doable.

ETH Notice Prediction: It Is No longer Priced In

In step with the day to day chart, the 20 (blue) and 50 (yellow) EMAs take a seat above Ethereum’s rate. EMA stands for Exponential Transferring Average. It is a hallmark measuring vogue direction over a given interval.

When the EMA is underneath the associated rate, it indicates that bulls are defending it. Then again, the indicator being above the associated rate gives credence to the downside. If prerequisites remain the identical, ETH can also simply tumble to $3,278. This suppose additionally exhibits that ETH is now now not yet priced in.

In straight forward terms, this implies that the commercial impact of the upcoming vogue has yet to be reflected within the newest market rate. Hence, it will be assumed that the associated rate peaceable has the doable to bounce.

Then again, both EMAs are on the purpose of reaching the identical point. If this occurs, ETH’s rate will switch sideways, potentially consolidating between $3,355 and $3,610. Then again, if the 20 EMA flips the 50 EMA (bullish crossover), the altcoin can also simply key into the $3,866 resistance.

Be taught extra: Ethereum (ETH) Notice Prediction 2024/2025/2030

In a highly bullish scenario, ETH can also simply replicate its performance between February and March, reaching $4,059 before the terminate of July.

In addition, the associated rate of inflows is one major area that customers possess. From comments online, a series of analysts are now now not particular if the Ethereum ETFs can pull the extra or much less quantity Bitcoin did.

Then again, a outdated prediction positioned the inflows at $569 million month-to-month. Must Ethereum match this quantity, a rally previous the altcoin’s all-time high can also simply occur within a short interval.

But when the reception to the vogue is “all talk no action”, ETH’s rate can also simply nosedive, presumably reaching one other 10% decline.