The crypto market, in particular Bitcoin, has viewed a downturn as Treasury yields upward thrust and hopes for Would perchance well also’s Federal Reserve interest-fee cuts disappear.

This swap aligns with unique data, igniting concerns over power inflation and dampening the previously bullish crypto market sentiment.

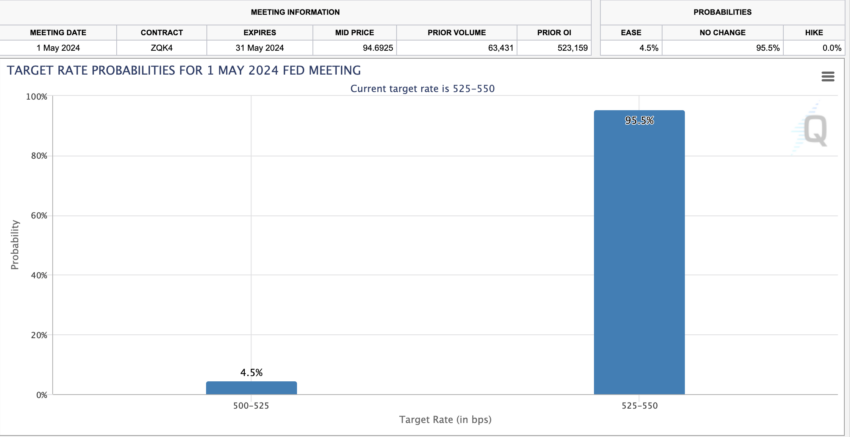

95% Likelihood of Fed Conserving Passion Price Unchanged in Would perchance well also

On Tuesday Bitcoin’s tag diminished, falling around 7% from its fresh excessive, to replace near $65,000. This decline highlights Bitcoin’s sensitivity to shifts in interest fee expectations and broader monetary policy.

“Bitcoin continues to strive in opposition to to elevate a stage above its aged excessive, and your entire crypto sector rolled over when interest charges jumped,” Wall Avenue Investor Louis Navellier acknowledged.

Which ability that, the market’s reaction to financial indicators is reshaping investment flows.

Read extra: The answer to Give protection to Your self From Inflation The disclose of Cryptocurrency

Furthermore, the crypto market faces stress from gargantuan outflows from Bitcoin ETFs. Significantly, the Grayscale Bitcoin Belief (GBTC) reported a withdrawal of $302.6 million on Monday, contributing to an entire outflow of $15.07 billion.

The market downturn extends past Bitcoin to incorporate previously appreciated tokens adore Pepe and Dogwifhat (WIF), main to a prime decline in smaller digital sources. This marks their ideally suited downturn in approximately two weeks.

Market analysts are truly focusing on the Federal Reserve’s forthcoming decisions. Knowledge from the CME community suggests a 95% likelihood that the Fed will abet goal charges in the Would perchance well also Fed assembly.

“The changed views referring to the Fed are having an influence across crypto, the place there changed into a selloff as the week will get underway,” notorious vendor Stefan von Haenisch acknowledged.

However, the long shuffle could possess a silver lining for cryptocurrencies. Analysts from Deutsche Financial institution, including Marion Laboure and Cassidy Ainsworth-Grace, speculate that a fee nick in June could reinvigorate the market.

They argue that diminished charges would give a enhance to threat shuffle for food and market liquidity, encouraging investment in replacement sources adore cryptocurrencies. Furthermore, in December 2023, the Fed hinted at three fee cuts in 2024.

Read extra: TradFi Explained: Exploring Key Choices of Feeble Finance

Whereas the near-term outlook appears to be like no longer easy, changes in the Fed’s monetary policies could yet offer a resurgence in the crypto market.