Bitcoin’s extremely effective rally over the outdated couple of weeks has driven the value support on the subject of the $95,000 designate, nonetheless most modern chart signals are pointing to that you just would also take into consideration turbulence ahead. The most modern building, as considered on each and every the day-to-day and hourly timeframes, unearths that BTC designate would be preparing for a healthy pullback or perhaps a sharper correction if serious give a enhance to stages fail. Let’s dive deep into what the charts are in actual fact asserting.

Bitcoin Mark Prediction: Momentum Falters Intention Multi-Month Resistance

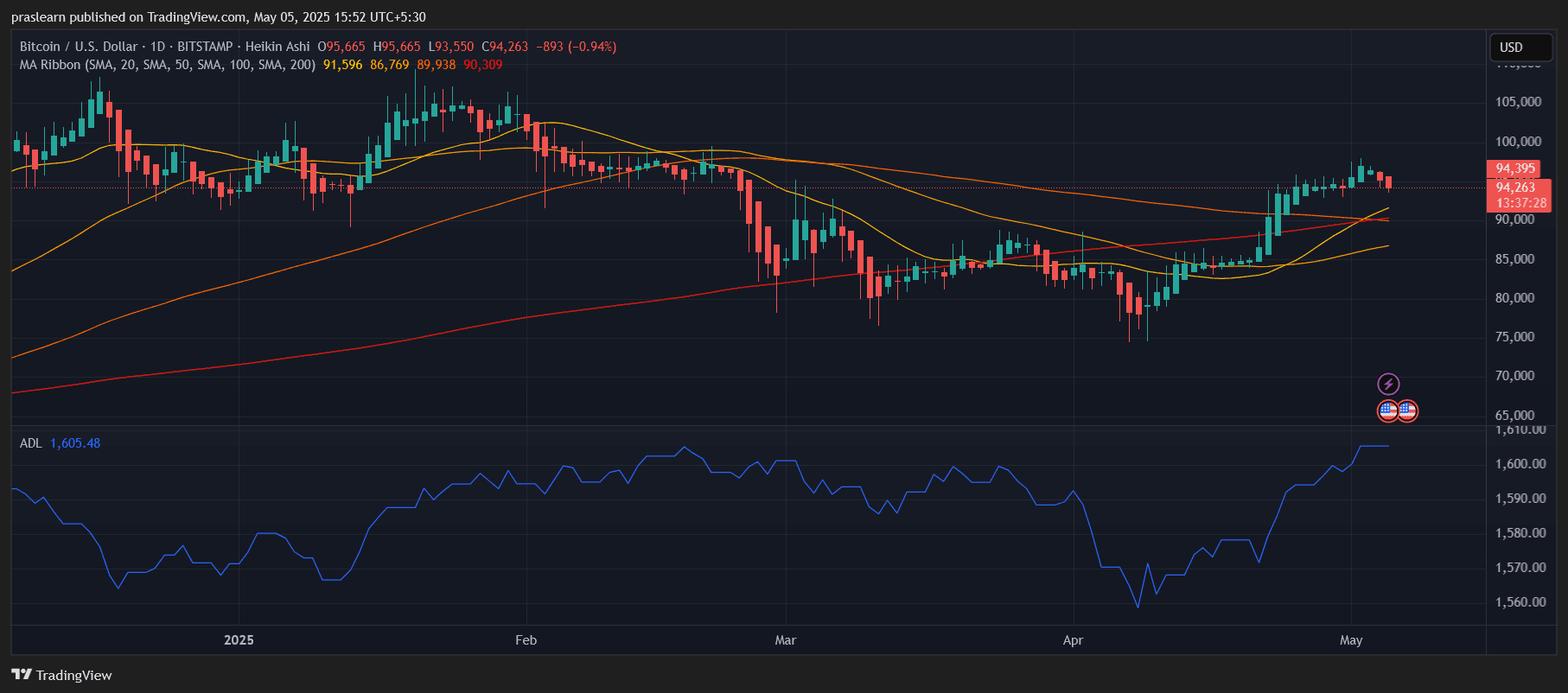

On the day-to-day Heikin Ashi chart, Bitcoin designate has printed its first crimson candle after quite a lot of consecutive green classes—indicating a potential non permanent top forming around $95,000. This zone, previously marked by rejection support in March, is proving to be a continual barrier. The MA Ribbon, which contains the 20, 50, 100, and 200 SMAs, offers a extraordinarily critical resistance confluence between $91,500 and $94,000. The designate is now procuring and selling magnificent a little bit of above the 200-day SMA ($90,309), which historically acts as a get-or-spoil zone for improvement continuation.

What makes this setup magnificent is the flat building of the 50-day and 100-day SMAs. These shifting averages are now now not sloping steeply upward yet, indicating that even supposing the momentum has returned, the medium-timeframe improvement hasn’t fully shifted into bullish territory. The day-to-day Accumulation/Distribution Line (ADL) stays elevated, suggesting that natty cash hasn’t aggressively exited yet—nonetheless any signs of additional weakness would possibly trigger critical profit-taking.

Hourly Chart: Early Signs of Breakdown?

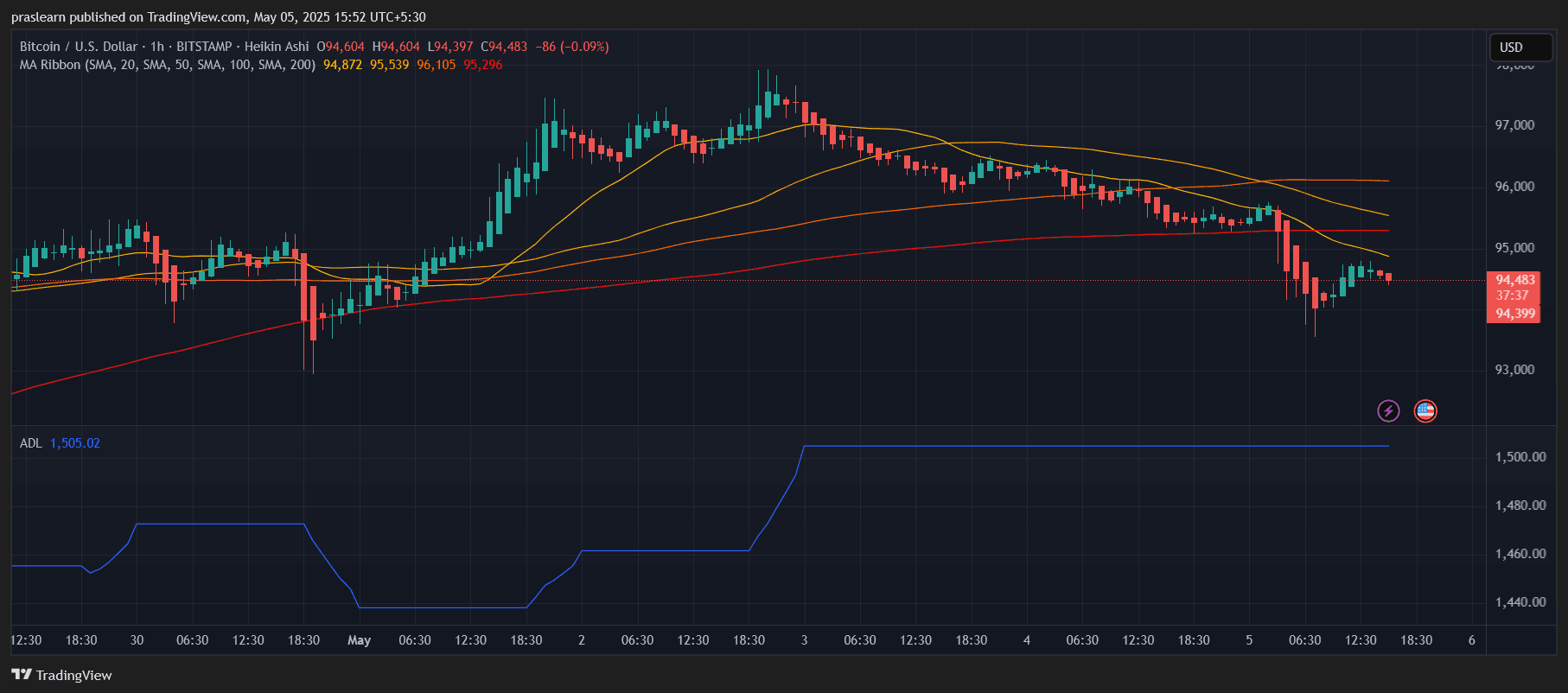

The hourly chart offers us a more granular see of non permanent weakness. After failing to interrupt above $96,000, Bitcoin retraced sharply and is for the time being hovering on the subject of $94,400. The designate has slipped below the 20- and 50-SMA traces, with the 100- and 200-SMAs now acting as overhead resistance around $95,000–$96,000. This crossover from give a enhance to to resistance would possibly even be a crimson flag that momentum is waning.

The Bitcoin designate building is additionally forming a potential descending triangle pattern, which generally precedes bearish breakdowns. Furthermore, the most modern restoration candles lack conviction, suggesting that bulls would be running out of steam. ADL on the hourly chart is beginning to flatten after rising incessantly sooner or later of the outdated rally. This would possibly thunder a pause in accumulation, and presumably the beginning of comfy distribution.

Key Toughen Stages: Where Could Bitcoin Drop Subsequent?

The first main give a enhance to to search is the 200-day SMA on the day-to-day chart at $90,309. If Bitcoin closes a day-to-day candle below this stage, it would possibly trigger additional promote stress and shake frail hands. Below $90K, the $86,000–$88,000 station turns into the next serious station, which aligns with the 50-day SMA. Could perhaps soundless this zone fail, a steeper drop in direction of $78,000 turns into more and more likely.

The worst-case scenario would be a revisit of $70,000, which served as a macro give a enhance to zone sooner or later of outdated consolidation phases. Whereas this drop would listing a ~25% correction from most modern highs, such pullbacks are now now not uncommon in Bitcoin’s historical bull market cycles.

Bitcoin Mark Prediction: Healthy Correction or Delivery up of a Dart?

Bitcoin designate is soundless in an overall bullish building, nonetheless the non permanent signals are flashing yellow. Consolidation below $95,000, weakening hourly momentum, and resistance from key shifting averages imply the route of least resistance will likely be lower within the approaching days. A breakdown below $90,000 would possibly high-tail downside momentum, doubtlessly dragging the value into the low $80,000s or even the $70,000 station in a excessive-volatility scenario.

On the opposite hand, unless we scrutinize large quantity accompanying this transfer, the form of pullback would possibly listing a noteworthy-wished reset before the next leg up. Long-timeframe improvement supporters would likely see any dip in direction of $78K–$70K as a strategic taking a test opportunity.

BTC designate hotfoot over the following few days will likely be pivotal in figuring out whether or now now not here’s magnificent a pause or the beginning of a broader correction.