dogwifhat (WIF) impress has skilled a pointy decline, falling roughly 15% within the closing 24 hours and shedding below $1.60 for the first time in four months. This most as a lot as the moment dip adds to a 47% loss all the plan in which by the final 30 days, reflecting essential bearish momentum within the market, with a pair of of the greatest meme money shedding extra than 10% within the closing 24 hours.

The most as a lot as the moment downtrend shows no signs of abating, with technical indicators suggesting extra doable procedure back. If WIF fails to stabilize, it is going to also rapidly take a look at the red meat up at $1.32, and losing that diploma can also push it as little as $1.07. On the opposite hand, a reversal can also happen if market sentiment around meme money improves, offering WIF a possibility to disadvantage resistance ranges at $1.73 and doubtlessly climb support toward $2.2.

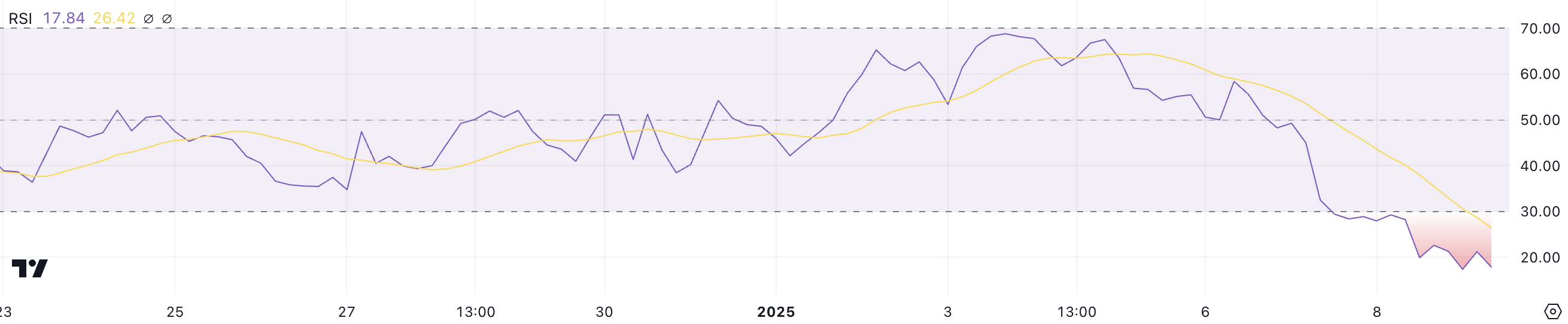

WIF RSI Dropped to Oversold Zone

The Relative Energy Index (RSI) for dogwifhat has plunged to 17.8, marking a pointy switch into the oversold territory after final fair between December 20 and January 7. RSI is a broadly outdated momentum indicator that measures the jog and magnitude of impress movements on a scale of 0 to 100.

Values above 70 existing overbought conditions and a doable for a pullback, while values below 30 counsel oversold conditions, on the complete signaling the chance of a impress rebound.

At its most as a lot as the moment diploma of 17.8, WIF RSI indicates crude bearish momentum and heavy selling stress within the market. This kind of low RSI reading suggests that perchance the most as a lot as the moment promote-off can also were overdone. That will well even doubtlessly form conditions for a restoration if customers re-enter the market.

On the opposite hand, the steep decline also shows worn sentiment, and unless renewed making an strive to search out passion emerges, WIF impress can also proceed to consolidate or decline extra within the quick term.

Dogwifhat Downtrend Is Rising Rapidly

WIF Common Directional Index (ADX) has surged to 43.7, rising sharply from 19.9 in very finest in some unspecified time in the future. The ADX is a technical indicator outdated to measure the strength of a vogue, regardless of its direction, on a scale from 0 to 100.

Values above 25 existing a solid vogue, while these below 20 counsel worn or absent momentum. The rapid amplify in WIF’s ADX signals a essential strengthening of perchance the most as a lot as the moment vogue.

Provided that WIF is for the time being in a downtrend, the ADX at 43.7 highlights the rising dominance of bearish momentum.

Which skill selling stress is intensifying, and extra impress declines might perchance be expected unless customers step in to counteract this negative vogue.

WIF Ticket Prediction: A Capacity 30% Additional Correction?

If the ongoing downtrend for dogwifhat impress continues, it is going to also rapidly take a look at its subsequent foremost red meat up at $1.32. A rupture below this diploma can also deepen the decline, driving WIF all the vogue down to $1.07 — its lowest impress since mid-August 2024. This kind of switch would signify a doable 30% correction from most as a lot as the moment ranges.

On the plenty of hand, if the market sentiment around meme money improves, WIF impress can also rob pleasure in renewed enthusiasm. In this kind of case, the associated rate can also upward push to disadvantage the resistance at $1.73. A a success breakout above this diploma can also pave the vogue for extra gains, with $2.2 as the following target.