XRP has faced a well-known downturn in most up-to-date days, with its mark shedding virtually 20% from an intraday excessive of $2.7255 on December 17 to $2.20 as of December 23, 2024. This decline comes amid broader struggles within the cryptocurrency market, the attach macroeconomic factors hang pushed a pointy promote-off. Whatever the absence of classic considerations relate to XRP, a aggregate of tightening world liquidity and a hawkish Federal Reserve stance has attach rigidity on the total crypto sector.

Dispute of the Crypto Market on December 23, 2024

The broader cryptocurrency market is displaying sure indicators of weak point. As of December 23, the area crypto market cap stands at $3.459 trillion, down 2.4% over the past 24 hours. Trading volumes remain strong, with $193.75 billion in process at some level of the identical duration, nonetheless promoting rigidity dominates across major cryptocurrencies.

- Bitcoin (BTC), the largest cryptocurrency, is priced at $95,998.96, down 8.4% over the past week and nil.9% within the past 24 hours. Its market cap stands at $1.9 trillion.

- Ethereum (ETH) is trading at $3,337.48, with steeper losses of 15.5% over the week. It has shed 1.2% within the past 24 hours, leaving its market cap at $401.98 billion.

- XRP, ranked 4th by market cap, is priced at $2.20, down 8.0% over the week and 3.2% within the past day. Its 24-hour trading quantity of $11.09 billion highlights active participation nonetheless inadequate query to counter promoting rigidity.

- Other top altcoins, including BNB ($673.30) and Solana (SOL) ($184.55), hang also struggled, with Solana shedding 15.9% over the week. The market’s synchronized downturn underscores the impact of exterior macroeconomic factors.

Impact of the Federal Reserve on XRP and the Crypto Market

The fascinating decline in XRP, alongside diversified cryptocurrencies, began straight after the Federal Reserve’s December 18 policy assembly. While the Fed diminished its benchmark rate by 0.25 percentage points to a draw vary of 4.25%–4.5%, the accompanying assertion and press conference from Chair Jerome Powell presented an all straight away hawkish tone.

The Fed’s updated projections published that completely two further quarter-level rate cuts are anticipated in 2025, down from the four cuts forecasted in September. Powell emphasized that inflation, while easing, stays above the Fed’s 2% draw, and further cuts will rely on persisted growth. This cautious stance signaled that liquidity prerequisites would remain tight into 2025, catching investors off guard.

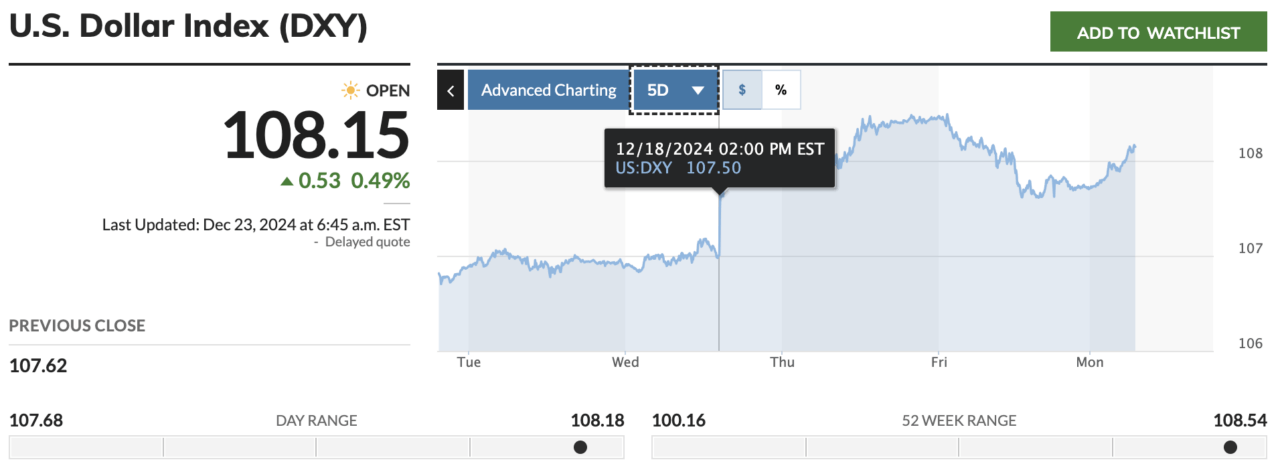

The market’s response turn into swift. At 2:00 p.m. ET on December 18, the U.S. Buck Index (DXY) spiked from 107.50 to above 108, reflecting a stronger greenback. By December 23, the DXY reached 108.15, its absolute most practical level in months. A stronger greenback tightens world financial prerequisites, making speculative sources admire cryptocurrencies much less beautiful.

XRP’s Designate Action

XRP’s one-month mark chart highlights its dramatic reversal since December 17, when it reached an intraday excessive of $2.7255. XRP began to utter no sharply following the Fed’s bulletins. This drop aligns with the broader crypto market’s response to tightening liquidity and rising danger aversion.

XRP’s 24-hour trading quantity of $11.09 billion reflects well-known market process, nonetheless the power promoting rigidity pushed by macroeconomic factors has saved the value on a downward trajectory.

Tightening Liquidity and Global Market Dynamics

Jamie Coutts, Chief Crypto Strategist at True Imaginative and prescient, acknowledged final week on X that tightening liquidity is a key driver of the crypto market’s struggles. Over the past two months, world liquidity has diminished in dimension as a result of petrified central bank stability sheets and rising bond market volatility. Powell’s hawkish remarks at some level of the December 18 press conference completely added to these concerns.

Coutts notorious that cryptocurrencies are significantly gentle to shifts in liquidity prerequisites. Historically, sessions of tightening financial prerequisites hang coincided with fascinating declines in speculative sources. The most up-to-date spike within the DXY and rising Treasury yields—now at 4.54% for the 10-year level to—underscore these restrictive prerequisites. With danger appetite petrified, crypto sources are bearing the brunt of the fallout.

Tightening liquidity turn into evident for 2 months. Brace and ask the whites within the eyes of the central planners if this escalates. Procuring for opp incoming. https://t.co/ftgesVUq4H

— Jamie Coutts CMT (@Jamie1Coutts) December 20, 2024

Conclusion: What’s Next for XRP?

XRP’s decline appears to be like to be pushed fully by macroeconomic factors in preference to asset-relate traits. The Federal Reserve’s resolution to sluggish the high-tail of rate cuts, coupled with an actual greenback and rising yields, has created a tough ambiance for speculative sources. As of December 23, XRP stays at $2.20, with broader market sentiment likely to dictate its rapid-term trajectory.