Bitcoin indicate Joe Consorti has predicted a capability BTC rate fall due to the US Buck’s rising strength. In a put up on X, Consorti explained that USD is at its strongest stage in twenty-six months, which has historically been tough for BTC.

He talked about:

“By the blueprint in which, the final time USD had reinforced from this stage on its formula to the finish, $BTC dropped 25% — $BTC has corrected 15% to this level. Buck strength may per chance per chance also spill extra $BTC blood sooner than it will get higher.”

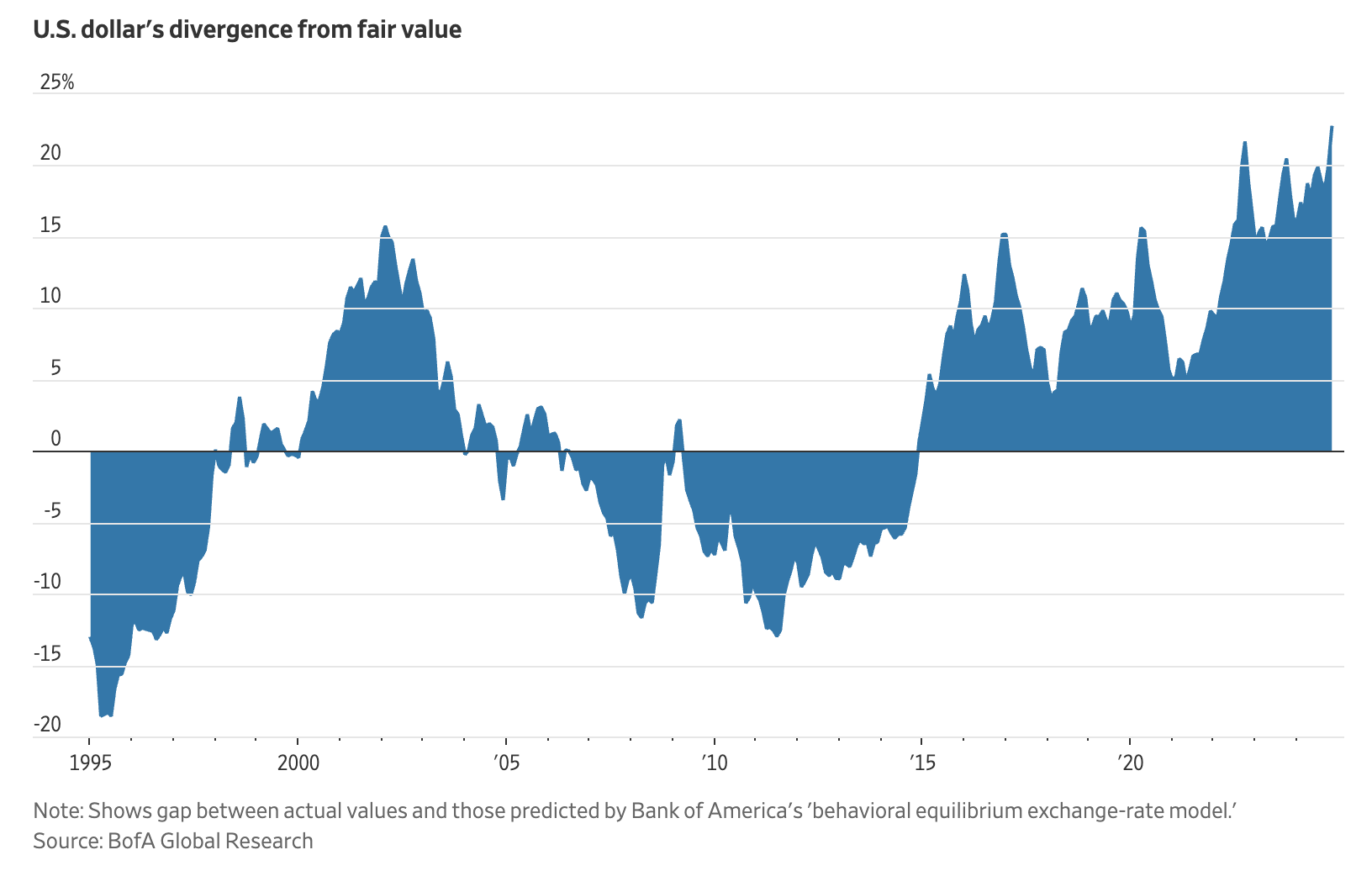

His watch is now not shapely, given that many in the crypto neighborhood occupy additionally current the rising strength of the USD with concern. The US Buck Index (DXY), which tracks the cost of the USD relative to a basket of completely different fiat currencies, together with the Euros, Kilos Sterling, and Yen, has been rising since Donald Trump turned into once elected president, reaching a two-twelve months excessive on Thursday.

With over 3% good points relative to completely different fiat currencies prior to now three months, there are concerns that Bitcoin may per chance per chance undergo if the USD continues to present a elevate to. Historically, risk sources much like BTC and stocks bear poorly when the USD is solid.

Moreover that, there are concerns that a stronger buck will impact Bitcoin request. Timothy Peterson current that a stronger buck makes Bitcoin extra costly for non-buck merchants since it’s a long way typically priced and traded in USD. Thus, it should always make it less realistic and establish downward stress on the BTC heed.

What’s driving DXY performance

Several components occupy introduced about the DXY to enhance, together with Trump’s menace of imposing tariffs on trading partners, which may per chance per chance lead to market turbulence and entice request for bucks. With the specter of tariffs from the incoming Trump administration, Euros and completely different currencies had been struggling in opposition to USD, causing the DXY index to enhance.

Previous that, the US economy has additionally performed higher compared to its trading partners. It has achieved the much-desired gentle landing, defending inflation minimal and seeing astronomical inform in substandard home product (GDP). The country saw an sudden eight-month low in weekly jobless claims this week, with around 9,000 declining to 211,000.

On the opposite hand, now not all americans appears to be like to be happy that the DXY will proceed rising. Steno Analysis CEO Andreas Steno current that the USD may per chance per chance also need peaked in opposition to the Euro if the old performance in 2016/17 is anything else to streak by. Thus, merchants should always be cautious about their positions.

On the opposite hand, crypto analyst Benjamin Cowen believes DXY unexcited has extra room to scurry. He predicted that DXY would reach a local high by 2025 Q1 and may per chance per chance also cease at that stage for a whereas.

Consultants bear in mind Bitcoin will thrive even with a solid USD

Whereas the USD’s strengthening raises concerns, all americans agrees that a reinforced buck will now not impact BTC’s performance much. Bitcoin Creator Mitchell Askew believes that the USD’s strength is ultimate when it comes to completely different fiat currencies and now not relative to commodities much like Bitcoin.

To buttress this level, monetary analyst John Kicklighter user current that US Frightening performance.

He talked about:

“The US buck is solid compared to completely different predominant currencies, however now not essentially when leveled up to commodities. US coarse has charged elevated for a fourth consecutive session and cleared a zone that has performed each and each give a elevate to and resistance.”

Thus, Askew believes the same applies to BTC since the DXY has been rising since September however did now not quit BTC from hitting its all-time excessive in December.

Onchain metrics additionally uncover that BTC is unexcited in the middle of a bull scurry despite the practically 10% decline from its peak. CryptoQuant analyst Avocadoonchain seen that metrics much like Adjusted SOPR (Spent Output Earnings Ratio), Miner Tell Index (MPI), and Entire community charges over 7-day SMA give a elevate to this thesis.

They wrote:

“On-chain data suggests the bull market is unexcited intact, and the present segment looks to be a cooling-off duration as a replace of a cycle peak.”

On the opposite hand, data additionally shows that Coinbase Top fee has fallen to a 12-month low, which analysts bear in mind signals US merchants’ lack of institutional request and cautious formula.

A Step-By-Step Device To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.