Pendle is main the potential for a fashion of DeFi 2.0, a original batch of networks building up its liquidity. Some initiatives in DeFi 2.0 are trending and rarely surpassing the disclose of Bitcoin (BTC). DeFi 2.0 involves original L2 scaling networks, which hang grown their infrastructure within the previous few years.

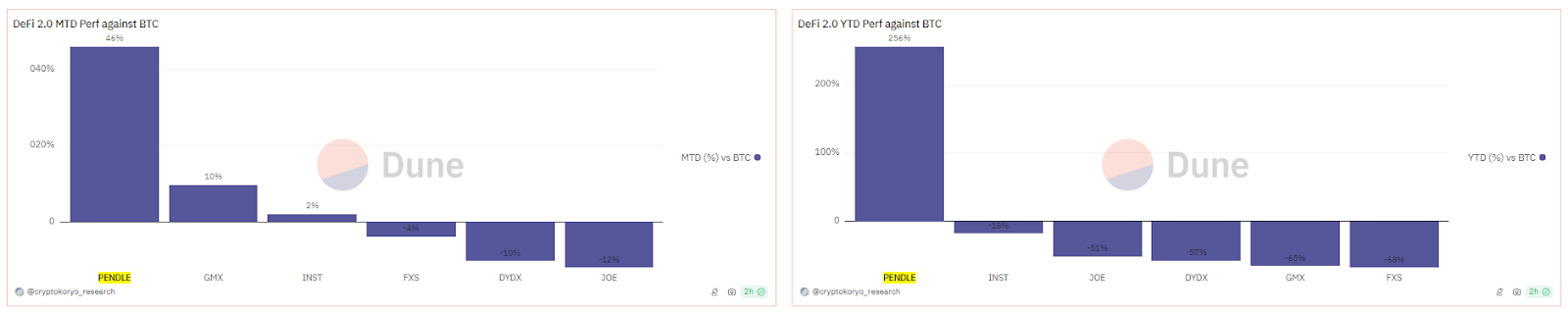

DeFi 2.0 designates just a few narratives, but most modern analysis considers quite loads of e book initiatives. Pendle emerged because the rational leader in brand disclose, each and each in greenback terms and in opposition to BTC. Other initiatives within the DeFi 2.0 niche consist of Trader Joe (JOE), GameX (GMX), Instadapp (INST), Frax Portion(FXS) and DyDx(DYDX).

The assortment of tokens managed to develop in opposition to BTC within the previous month, and Pendle executed the greatest disclose within the twelve months to this level. DeFi 2.0 contains smaller tokens, just a few of which took a step assist. Nonetheless, within the twelve months-to-date chart, DeFi 2.0 has a 46% chance-adjusted return and is the third-handiest legend after Liquid Staking Derivatives and BTC itself.

The upward thrust of DeFi 2.0 follows disclose within the utterly different broad assortment of initiatives identified as DeFi 1.0. These initiatives benefitted from the bull market with rising volumes and growing brand beneath administration.

DeFi 1.0 moreover observed a equal performance, boosted by Uniswap (UNI), Aave (AAVE), Sushi Swap (SUSHI), Curve (CRV), Compound (COMP), and Maker (MKR). DeFi 1.0 quiet advantages from high and stable ETH market costs and extra agile ways to forestall liquidations.

DeFi 2.0 will not be in declare competitors but rises alongside DeFi 1.0. A brand original location of DEX hinges on utterly different communities but follows the equal sample of expansion. DeFi 2.0 is moreover linked to the expansion by Liquidity Restaking Tokens, a original instrument for tapping the liquidity of staked ETH.

Pendle Leads Yield Sector in DeFi 2.0

Pendle is a yield protocol revealing a return to passive income. After the break of FTX and utterly different lending and yield protocols, a original bull market made these industry gadgets viable once more.

The price locked in Pendle has been rising for the explanation that open up of 2024, reaching $6.15B. Pendle carries brand, which is mature as collateral for USDC within the design, and yields tokens. The impartial of Pendle is to serve as a platform for trading tokenized future yield.

Also read: Pendle Finance Regains Control: Swift Movement versus the Unauthorized Exhaust of Property

Pendle is dependent on declare user deposits and is a custodian of just a few crypto resources. When users deposit tokens, they fetch Ownership Tokens (OT) and Yield Tokens (YT), representing a correct to future yield. Yield tokens can then be traded to lock within the gains straight away.

Pendle thus takes tokenization a step extra. In location of a passive yield, depositors fetch the fast freedom to re-alternate their yield. Token holders can moreover provide liquidity to enhance the brand of OT and YT resources. Additionally, Pendle carries USDC and cDAI stablecoins for added intuitive trading.

Pendle Trades Conclude to All-Time High

Seek info from for yield helped Pendle attain a double document in 2024. PENDLE market costs returned shut to their all-time high in direction of the discontinuance of Might presumably also simply. The token traded at $6.80, with volumes above $43M in 24 hours.

PENDLE broke out because it accumulated brand. At the beginning, the token used to be listed on the experimental Binance market, but it then obtained two rather liquid trading pairs.

Pendle moreover grows by including original swimming pools and incubating liquidity. By Pendle, users can generate aspects and hang the relieve of “tokenless protocols.” To this level, Pendle’s cumulative yield trading quantity has reached $18B.

Also read: EigenLayer is Enhancing Ethereum’s Ecosystem with Six Contemporary Validated Companies and products

The Pendle platform is moreover a instrument to tokenize and extract brand from Liquid Restaking Tokens, a original asset launched with few brand discovery instruments. Pendle, within the origin a fair market, can provide liquidity and attainable merchants for the Liquid Restaking Token and Eigen Layer initiatives.

Pendle moreover has few competitors, especially after weeks of marking all-time highs relating to brand locked and fee action.

Cryptopolitan reporting by Hristina Vasileva