Right here is a segment from the 0xResearch newsletter. To read elephantine editions, subscribe.

I’m a Firefox user. I bellow that with pride and shame.

Pleasure because I’ve stayed actual to a browser that as soon as upon a time was the “frigid” alternative to Net Explorer.

Disgrace because I do know the field has moved on to Chrome.

The irony is that despite my “loyalty” to Firefox, it handiest exists thanks to Chrome.

85% of the Mozilla Foundation’s income ($570 million) comes from a income-sharing agreement with Google, the save Mozilla takes a share of advert income generated by Google searches from Firefox customers.

Google can even pay out billions to OEMs enjoy Samsung, Motorola and AT&T to manufacture certain Chrome (and Google Search) is preinstalled on their hardware devices.

It’s the associated charge Google can pay for striking forward the browser’s dominant (~70%) market share.

It was also for all time the plan. All over Chrome’s 2008 open, Sundar Pichai acknowledged upfront that Google’s core industry is dependent on dominating the browser market.

If Google doesn’t regulate the browser market, less of us are Googling, that methodology less advert income.

In various words, it all comes appropriate down to owning the stay user.

Now Chrome’s many years-lengthy dominance can be facing its first-ever serious competitive threat.

A slew of AI-first browsers, particularly Perplexity’s no longer too lengthy up to now-launched Comet, are having a behold to reinvent the browser abilities.

Based mostly mostly to your complete data our browsers learn about us — our history, bookmarks, credentials, web behavior — AI-first browsers enjoy Comet can change into an “lively participant” and “embedded” phase of our workflows, Delphi’s Can Gurel identified in “Browser Wars Got Private.”

If a browser-integrated AI agent can rep and manufacture restaurant reservations for me, I now no longer need Google.

Again, it comes appropriate down to owning the stay user.

Crypto isn’t an exception to this rule. A a similar phenomenon is taking part in out in Solana’s memecoin land.

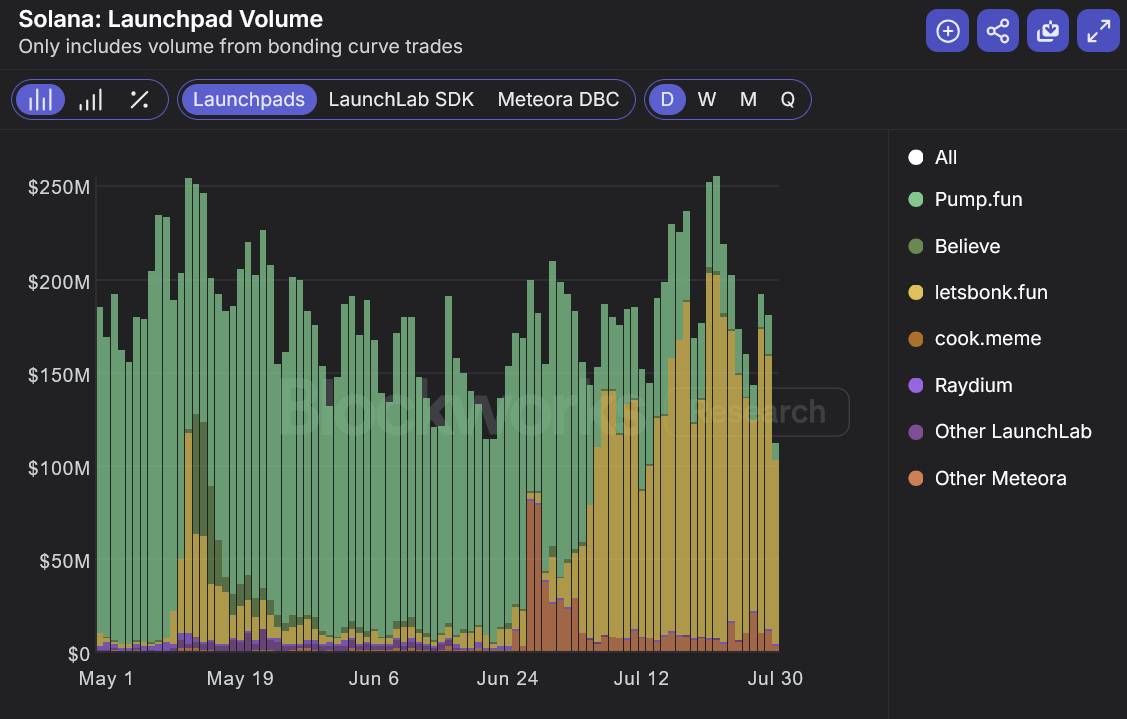

Of uninteresting, Pump has been losing market share to LetsBonk — striking out $229 million in buying and selling volumes when put next to LetsBonk’s $1.1 billion in the closing week.

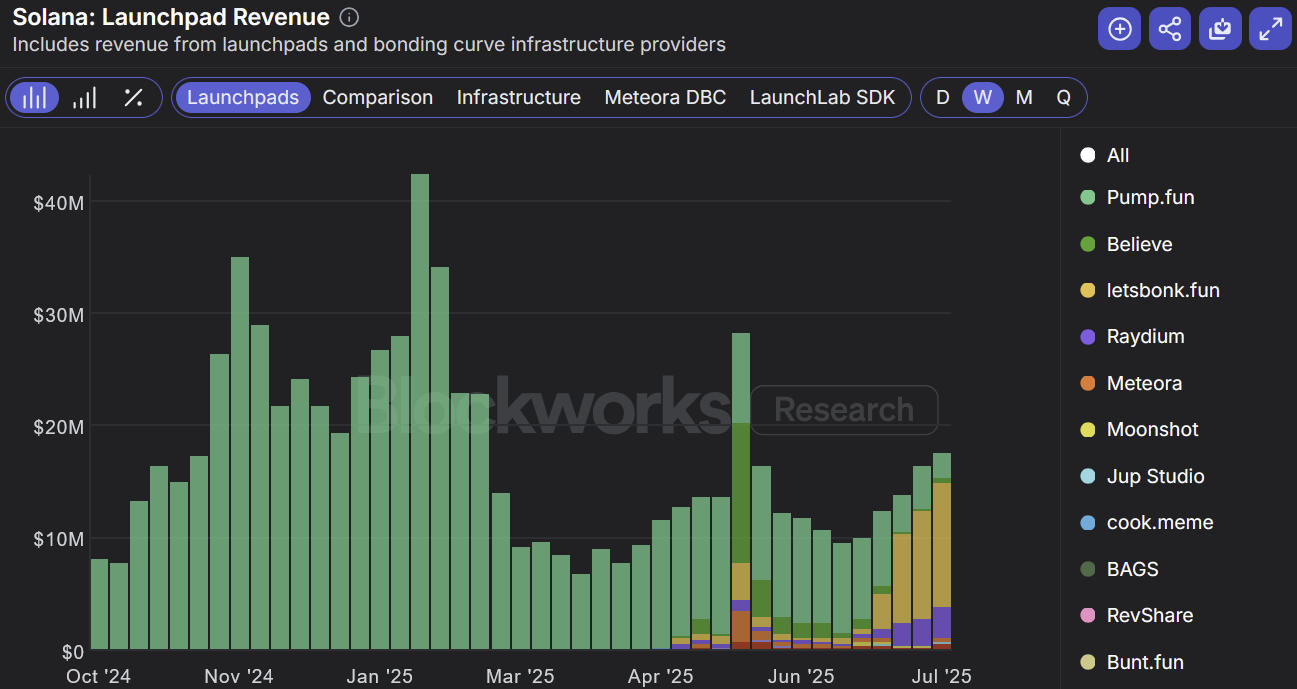

Pump’s revenues maintain considered a steep decline.

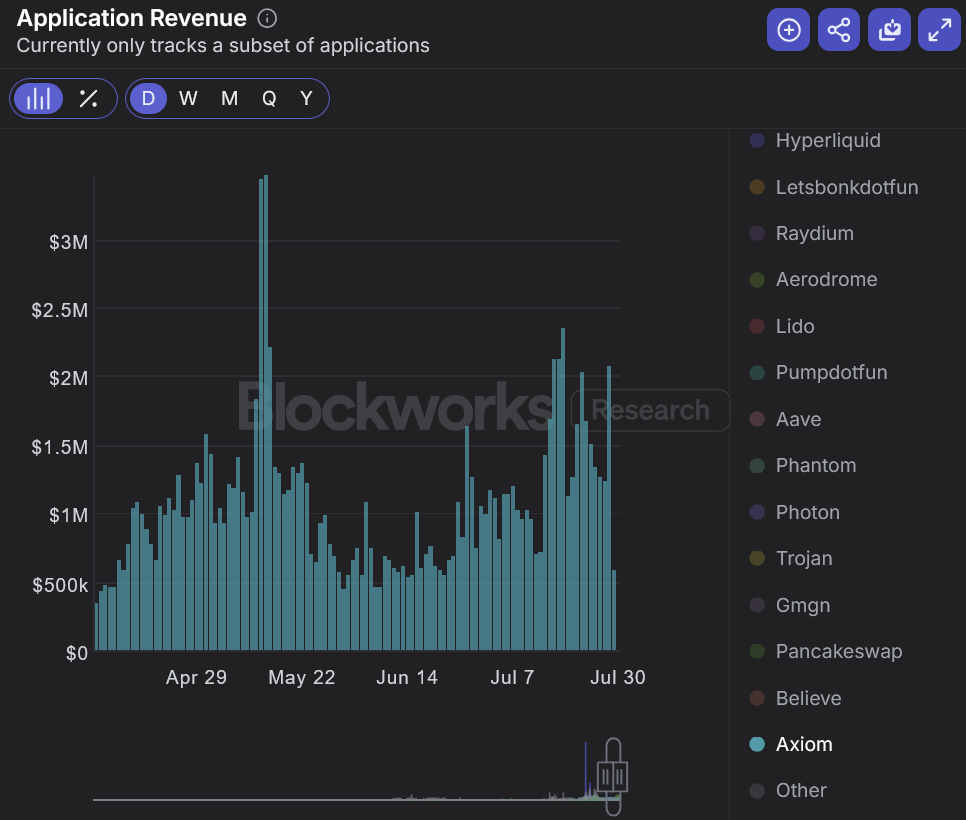

Yet while show-waft volumes are bouncing between Pump and LetsBONK, it doesn’t impact the revenues of the dominant buying and selling bot Axiom.

That’s because while memecoins are launched on Pump or LetsBonk, degen merchants are in Axiom’s frontend UI.

Launchpad bonding curves are permissionless, so Axiom simply looks at each and every fresh token, detects which launchpad contract it came from and builds a buy/promote button round it.