Crypto markets are down on primarily the most traditional inflation numbers, as traders take earnings from the sizzling market rally, which pushed BTC above $100,000.

Income-taking and inflation records have pushed the crypto markets down at the present time. On Tuesday, Could maybe also 13, the total crypto market cap fell by 0.Forty eight% to $3.32 trillion, whereas Bitcoin (BTC) was down 0.21% to $103,228. Despite this, several signs repeat that the markets live solid.

The market decline coincided with the discharge of primarily the most traditional U.S. inflation figures, which confirmed the bottom inflation price since 2021. In April, user costs rose at a yearly price of 2.3%, down from 2.4% in March. Low inflation can demonstrate slowing user search recordsdata from resulting from recession issues.

As of April, novel tariffs from the Trump administration hadn’t hit patrons but. Tranquil, low figures will probably no longer rapid the Federal Reserve to lower passion charges, despite strain from President Donald Trump. Lower passion charges are additionally something that the crypto markets were hoping for, resulting from their function on market liquidity.

With passion charges probably to live regular, traders opted to take profits as Bitcoin held above $100,000. Tranquil, there are signs that the market is in a bullish impart, especially with altcoins.

Crypto markets live solid

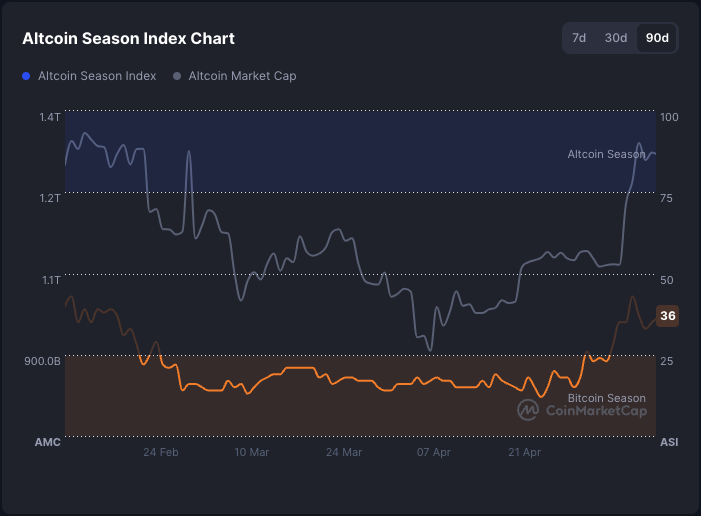

At some stage within the final few weeks, altcoins have seen improved efficiency, with the altcoin index reaching the very best stamp since February. In the previous 90 days, 36 out of the 100 altcoins have shown higher efficiency than Bitcoin. What is more, over the final week, the altcoin market cap rose from $1.1 trillion to $1.35 trillion.

The strength of the altcoin market suggests bullish momentum for crypto and possibility resources typically. Tranquil, persevered progress within the market will rely on what the Fed decides to manufacture within the arriving months. Notably, the Fed could presumably well additionally merely assume to lend a hand with price cuts till September, to behold what the effects of the novel trade settlement between the U.S. and China will probably be.