Here’s a section from the Forward Steering e-newsletter. To be taught stout editions, subscribe.

While dozens of public corporations for the time being preserve bitcoin on their stability sheets, a world the build thousands — sure, thousands — extra apply suit is inevitable. A minimal of per panelists at Bitwise’s Bitcoin Approved Companies Investor Day.

“To everyone wearing an orange tie…It’s simply to be on the team with you,” Approach founder Michael Saylor urged the Thursday tournament crowd.

He then wanted the Pier 59 window shades lowered to finish mild from obfuscating his PowerPoint presentation. As if the bitcoin Gods heard him, they started coming down a 2nd later.

It used to be Saylor’s same previous spiel, one you would want heard earlier than: Most asset classes don’t beat monetary inflation. Bitcoin enables an Uber driver in Nigeria to outperform the neatest cash managers in NYC. It’s an even bigger version of gold that he expects to hit $13 million a coin by 2045. Yada yada yada.

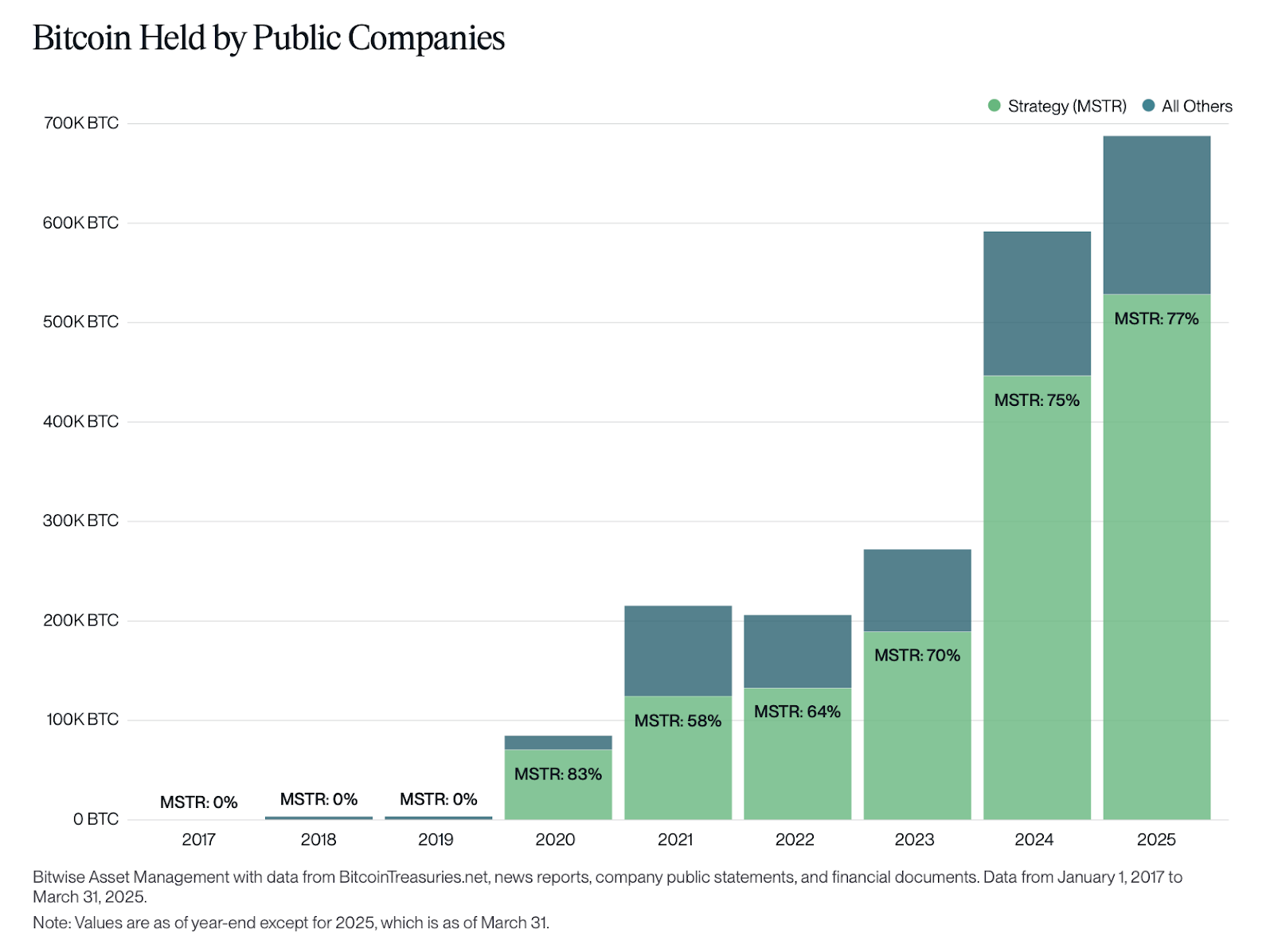

Approach owns 538,200 BTC. (Here’s, in a nutshell, how they idea to abet procuring.)

“I don’t declare this to brag, because of the the truth is the style we did it used to be so brainless,” Saylor mentioned. “All the pieces that every these corporations assemble is extremely subtle — we would possibly possible possible now not develop NVIDIA chips or develop iPhones. Every body of you would replica me.”

Nonetheless will they?

Bitwise, in a Q1 chronicle, build the sequence of public corporations holding BTC at 79.

Kraken CFO Stephanie Lemmerman made maybe basically the most attention-grabbing prediction. She expects about 20% of the roughly 55,000 public corporations to preserve BTC a pair years from now.

That’s loads of corporations. Indulge in 11,000.

A key piece of the nebulous “broader adoption” legend you hear loads about, corporations leaping in can transfer prices whereas offering extra endorsements.

Semler Scientific Chair Eric Semler noted how the clinical tech provider — sitting on plenty of cash — used to be facing challenges inner its core commerce. The company first bought BTC final one year and now owns 3,303 BTC.

While it took the worn SEC months to approve Semler’s first at-the-market (ATM) offering to back it aquire extra bitcoin, Semler mentioned, the unusual-peek company instant greenlit its most current one.

There are possible “thousands” of what the manager known as “zombie” corporations in a identical danger that would possibly possible possible possess the merit of a BTC treasury procedure, he added.

Then there are these having a mediate to head bigger. Twenty One Capital — a peculiar entity backed by Tether and Softbank that’s combining with Cantor Equity Partners — appears to be like to delivery with roughly 42,000 BTC. That is more possible to be gradual superb Approach and bitcoin miner Marathon Digital.

“There’re a style of smaller-scale…bitcoin treasury corporations, which possess a position to play,” Cantor Fitzgerald’s Robert Harrington mentioned. “Nonetheless I mediate this market calls for scale.”

Once one of many Involving 7 corporations begins procuring BTC, many extra will apply, panelists noted all around the day. It’s possible you will most definitely possible possible take into accout Microsoft shareholders rejected a connected proposal in December.

Each person knows, clearly, that bitcoin is unstable. An viewers member asked what happens if BTC’s stamp falls under the charge at which a company received it.

Establishing “board alignment” that here’s a long-time interval play is well-known, mentioned Fold Approved Counsel Hailey Lennon. She added: “Unless the fundamentals of bitcoin alternate, the procedure is now not to promote.”

Lemmerman noted too: “It’s now not necessarily the build you came in however the build you depend on [BTC] to be and what you’re forecasting.”

Fundstrat Capital CIO Tom Lee argued, too, that there’s “great extra to the [bitcoin] treasury story” than procuring a speculative asset that can treasure. It’s a peculiar accounting strange of kinds — “the premise that you just don’t must possess cash holdings superb within the US buck.”