Trump’s tariffs uncovered a systemic weakness around the resilience of world markets relating to U.S. policy. The President’s bulletins of in style tariffs observed markets skills an unprecedented amount of turmoil. May perchance well well well crypto be a figuring out substitute when the financial system is melting? This files explores why Bitcoin would possibly perchance well most definitely be a refuge all the device thru a U.S. recession.

- What is a refuge all the device thru a recession?

- Why Bitcoin would possibly perchance well most definitely be a refuge in a U.S. recession

- Drawbacks of Bitcoin as a refuge

- Greatest time will repeat

- Commonly asked questions

What is a refuge all the device thru a recession?

A recession is a vital decline in financial activity, particularly over an extended length of time. About a of the methods that you can method a recession are in style bankruptcies, unemployment, and diminished discretionary spending.

History of safe havens

What patrons imagine safe havens has modified at some level of time. Historically, many folk held their wealth in precious metals be pleased gold and silver, jewelry, property and land, grain, silverware, and even currencies. On the opposite hand, as time went on, the safety of these resources fluctuated, and fresh safe havens modified into famed.

Across the 18th century, sure kinds of debt (e.g., govt and non-public debt) began to develop utility as safe resources around the area. Nowadays, these resources play a gargantuan characteristic in monetary policy, macroeconomic activity, and, yes — recessions.

Some examples of non-public and govt debt that folk exercise as safe resources are sovereign bonds or govt-insured question of deposits.

Why does this topic?

The financial landscape began to shift in the slack Twentieth century. As short-term wholesale funding markets grew in importance, privately produced safe resources be pleased repos took center stage until the 2008 financial disaster uncovered their fragility.

On the opposite hand, starting in the slack Seventies, the US financial diagram underwent a vital transformation all the device thru which the characteristic of question of deposits declined dramatically, and short-term wholesale funding modified into very sizeable and, thus, crucial. The financial disaster of 2007–2008 showed, as soon as as soon as more, that privately produced safe resources [i.e., short-term debt like sale and repurchase agreements (repo)] are no longer continually safe. Short-term safe debt is area to runs, threatening systemic crumple of the financial diagram.

— Gary Gorton, The History and Economics of Safe Resources

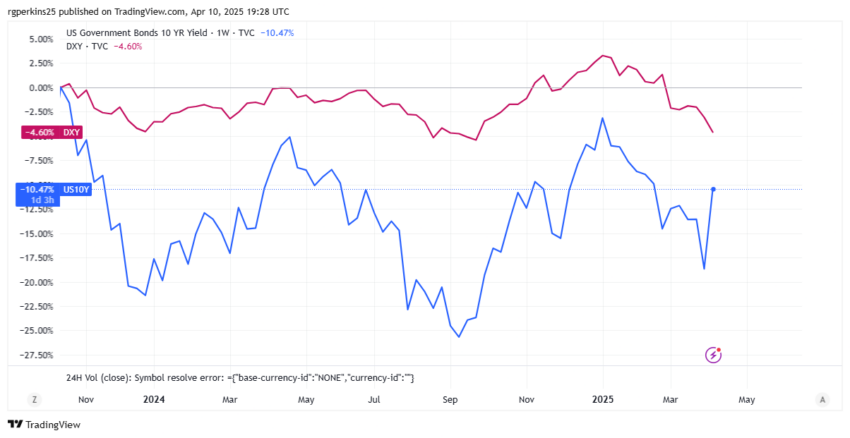

Additionally, the chance of sweeping tariffs in the U.S. sparked a wave of business uncertainty, igniting fears of inflation, alternate wars, and policy instability. In response, markets despatched sure wretchedness indicators.

The U.S. 10-three hundred and sixty five days Treasury yields spiked, and the DXY (U.S. Dollar Index) dropped sharply. These are highly uncommon moves to occur concurrently. In most cases, Treasuries and the greenback make stronger in instances of disaster. This time, both faltered.

This rare dynamic reflects a deeper shift: a rising lack of self belief in the outdated pillars of business security. Merchants are questioning whether or no longer this day’s safe resources — be pleased sovereign bonds or the U.S. greenback — can serene provide the safety they as soon as promised.

This is the place Bitcoin enters the dialog. Born in the aftermath of the 2008 financial disaster, Bitcoin used to be designed as a substitute to centralized monetary systems and an approach to financial crises such as these. With a mounted provide and no ties to govt policy, it represents a essentially varied methodology to storing payment.

Why Bitcoin would possibly perchance well most definitely be a refuge in a U.S. recession

Wealth is by no methodology destroyed. It is merely transferred. And that methodology that on the reverse aspect of each disaster, there would possibly be a chance.

— Mike Maloney.

No topic the volatility of the S&P500, advanced discussions of basis and lift trades, and the divergence of the U.S. 10-three hundred and sixty five days Treasury and DXY, it’s sure that patrons are losing self belief in outdated safe havens. Which means, the area is at a turning level. Satoshi Nakomoto created Bitcoin for these exact kinds of scenarios.

Wealth will naturally gain its balance and lunge alongside with the circulation into other precious resources as time passes. This on my own puts Bitcoin in the dialog as a hedge. So, how would possibly perchance well most definitely this work in be conscious? Let’s glimpse at a number of methods that Bitcoin would possibly perchance well most definitely be in a situation to be a refuge all the device thru a U.S. recession.

1. “Deflationary” properties

In crypto, the term deflation is typically misused. The actual definition is a sustained decrease in the overall worth level of issues and companies and products interior an financial system. What crypto users typically suggest when they stammer Bitcoin is deflationary is that its provide decreases over time.

A crucial financial theory is is named provide and question of. Normally talking, provide and question of contain an inverse relationship practically about worth.

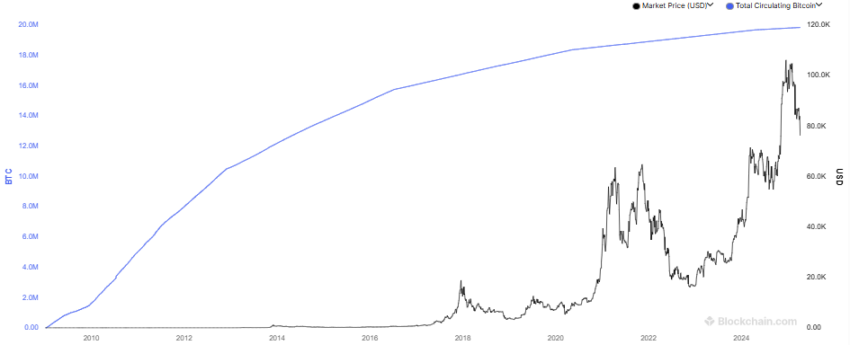

Bitcoin’s provide decreases by non-public. The total provide of Bitcoin is 21 million BTC, after which the protocol will stop to insist fresh Bitcoins. We also await some level of a additional reduction in on hand provide as BTC holders (sadly) pass away, eradicating unheard of extra coins from circulation.

If question of holds trusty or will enhance, this puts upward rigidity on the payment of BTC. Additionally, the Bitcoin protocol issues 50% fewer Bitcoins every halving.

The chart below reveals the amount of Bitcoin in circulation when put next to its worth.

As said previously, idea to be one of the foremost hallmarks of a refuge is steadiness or increased payment over time. As this chart reveals, Bitcoin satisfies this property, making it a capability hedge in a U.S. recession.

2. Retailer of payment

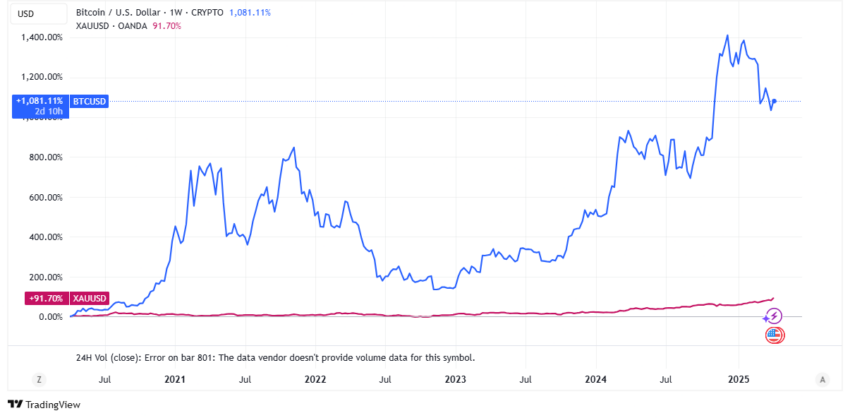

One in every of Bitcoin’s earliest narratives used to be its exercise case as digital money for admire-to-admire payments. On the opposite hand, as a result of many factors, it not straight away pivoted to develop into a retailer of payment (SoV). This exercise case draws comparisons as to how gold is regularly seen this day — as a SoV.

Gold has a prolonged history as a outdated recession hedge. It tends to develop well when inflation is high, equity markets fall, or there would possibly be geopolitical or financial uncertainty. Although many folk imagine Bitcoin a SoV be pleased gold. Right here is how Bitcoin compares with gold as an funding:

| Bitcoin | Gold | |

|---|---|---|

| History | Less than two decades | Centuries of exercise as a retailer of payment |

| 2022-2023 hobby charges/quantitative tightening | Fell onerous, traded be pleased a tech stock | Nearly flat |

| Covid recession (2020) | Crashed all the device thru Covid but rallied in 2021 | Hit an ATH all the device thru Covid |

| Counterparty wretchedness | None | None |

| Adoption | Rising, but cramped | Wide |

| Provide | Restricted | Unknown |

Gold’s worth tends to remain rather flat, with miniature will enhance over time and cramped downside. Bitcoin is serene unsafe and, at one level, crashed practically 80% from its all-time high.

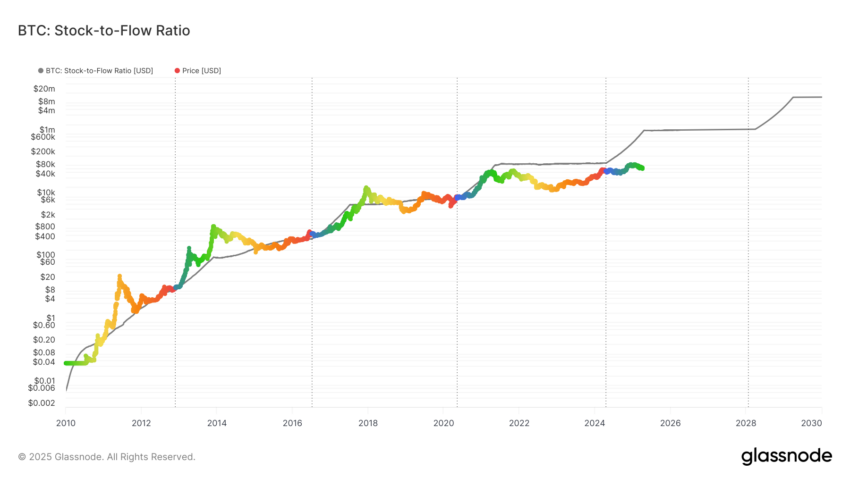

Additionally, Bitcoin has a mounted issuance or block reward that limits the stock-to-lunge alongside with the circulation (S2F). The next S2F methodology the asset is extra scarce relative to its production/issuance rate, which makes it extra “onerous money” and theoretically higher at conserving payment. Gold’s lunge alongside with the circulation is rather earn and tough to inflate hastily (despite the indisputable truth that it would possibly well maybe well most definitely upward thrust with passable capital funding in mining).

In conclusion, when both equities (wretchedness resources) and Treasuries (outdated safe havens) essentially feel unsafe or unattractive, patrons open on the lookout for substitute hedges or neutral zones, be pleased gold, on tale of sure properties kind it a SoV. Bitcoin has some similar properties to gold, which makes it a capability refuge in a U.S. recession.

3. Structural independence

Recessions aren’t continually predictable. Whereas many recessions lead to deflation or disinflation as a result of falling question of and rising unemployment, others (particularly these precipitated by provide shocks or policy) would possibly perchance well most definitely terminate up in stagflation, the place inflation rises at the same time as enhance slows.

These advanced and regularly contradictory environments insist the effectiveness of outdated safe havens be pleased sovereign bonds, fiat currencies, or equities, all of that are carefully tied to central financial institution actions, govt policy, and company performance.

Bitcoin, alternatively, is structurally self passable of these forces. It is no longer an organization entity area to earnings reports, layoffs, or provide chain shocks (that can maybe well most definitely come up from tariffs or lockdowns). Bitcoin operates outside of the outdated financial diagram. It has:

- No central issuer

- No monetary policy

- No nationwide allegiance

Drawbacks of Bitcoin as a refuge

There are many the clarification why Bitcoin typically is a capability refuge in the event of a U.S. recession; alternatively, there are also causes it is no longer perfect in sure circumstances. There are accurate barriers to BTC as a refuge, looking on who you are and what your financial insist appears to be like to be like be pleased.

Downside 1

For starters, Bitcoin is typically when put next to gold — and in plenty of methods, that comparability holds. Take care of gold, it’s seen as a retailer of payment. Nonetheless, also, be pleased gold, it’s costly, unsafe, and no longer especially accessible to of us with cramped profits.

Ought to you’re completely in a situation to aquire a diminutive fragment of a Bitcoin for your local currency, high community expenses can kind even transferring or spending it impractical. It’s onerous to call one thing a “safe” asset when using it will worth extra than what you’re looking to present protection to.

This isn’t a deal-breaker for the prosperous. They’ll manage to pay for to contain and ignore volatility and weather downturns. On the opposite hand, if you are going to contain a cramped profits and most definitely purchased Bitcoin shut to a peak and desire liquidity, it will essentially feel extra be pleased a liability than a refuge.

Downside 2

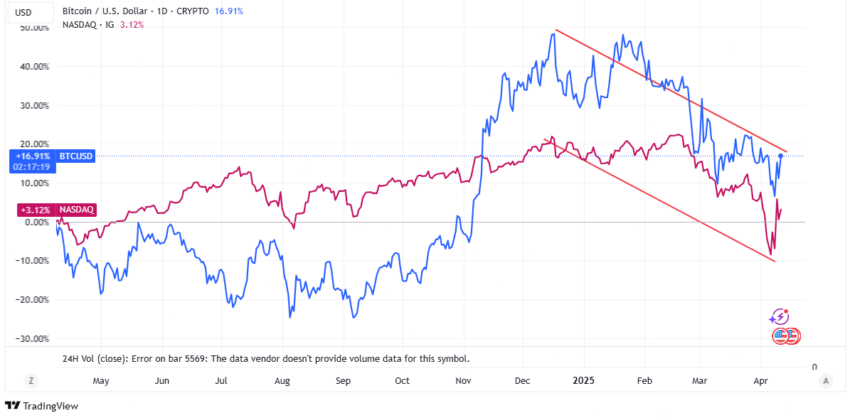

One other limitation is that Bitcoin doesn’t continually behave be pleased a hedge; most incessantly, it trades be pleased a tech stock. In different downturns, especially all the device thru liquidity crunches or Fed tightening cycles, Bitcoin has shown a high correlation to equity markets, particularly the Nasdaq.

This methodology that after outdated finance (TradFi) takes a hit, Bitcoin typically goes down with it — no longer a long way from it. This isn’t perfect for an asset that goals to stand other than the legacy financial diagram.

For Bitcoin to evolve correct into a reliable refuge, it needs to decouple additional from wretchedness resources and set extra self passable behavior especially all the device thru moments of systemic stress.

Greatest time will repeat

Attributable to the parable around Bitcoin as digital gold and its onerous money properties, it has the doable to develop into a refuge in the event of a U.S. recession, especially as the area changes. On the opposite hand, as this files facets out, BTC has a kind of containers to ascertain earlier than this becomes a actuality. In plenty of methods, Bitcoin remains a highly unsafe asset as a result of its short history and high volatility.