Bitcoin (BTC) has commenced March on a excessive label, establishing its tag above the $60,000 make stronger zone and reaching the ideal month-to-month shut since October 2021, moments earlier than it reached an all-time excessive.

Indeed, essentially the most up-to-date sure momentum is supported by several bullish formulation, collectively with the upcoming halving and the ongoing performance of commerce-traded funds (ETF). In accordance with this, a well-known market consensus means that the rally will likely proceed its upward pattern.

Commenting on what to set apart a question to from Bitcoin, crypto procuring and selling knowledgeable Shopping and selling Shot, in a TradingView submit on March 2, highlighted that, based totally on technical indicators and historic patterns, Bitcoin is poised to attain a contemporary all-time excessive earlier than the next halving.

With Bitcoin having broken the 0.382 Fibonacci level on the weekly chart in early February for the first time since June 6, 2022, the knowledgeable seen that the vogue is necessary in cyclical terms, drawing parallels with outdated cycles.

Making use of the Fibonacci Channel to the final two cycles, Shopping and selling Shot pointed out that every time Bitcoin surpassed the 0.382 Fibonacci level in the previous cycle, it additionally hit the 0.5 Fib level. This commentary holds significance as it has came about twice earlier than.

Particularly, the time it took for Bitcoin to attain the 0.5 Fib level after breaking the 0.382 Fib level in those circumstances used to be seven weeks (49 days) and eight weeks (56 days).

Based on this historic sample, the analyst estimated a maximum of eight weeks for Bitcoin to hit the 0.5 Fib level but again. If this sample repeats exactly, the aim week may perchance well perchance be April 1, 2024. In this type of relate, Bitcoin may perchance well perchance attain $81,000. On the opposite hand, if the step forward happens earlier, the fluctuate can also very correctly be between $78,000 and $81,000.

Market willing for parabolic rally

On the a similar time, amid prevailing bullish sentiments dominating the market, Shopping and selling Shot urged that the cryptocurrency market would be coming into essentially the most aggressive share of essentially the most up-to-date cycle.

“The 1W CCI indicator (green circles) means that we are able to also be nearer to a November 2020 fractal than Might perchance perchance – June 2019 (which used to be needless to utter brought about by the Libra euphoria). This means that in the in the period in-between we are able to also be at the very originate of this Cycle’s most aggressive piece, the Parabolic Rally,” he mentioned.

Particularly, Bitcoin’s most up-to-date tag has coincided with what seems to be to be well-known seek data from for the product’s ETF, with merchants increasingly extra having a wager on BTC to reclaim the $69,000 sage excessive. As of March 1, the cumulative plight Bitcoin ETF quantity reached an all-time excessive of $73.91 billion after weeks of consistent positive aspects.

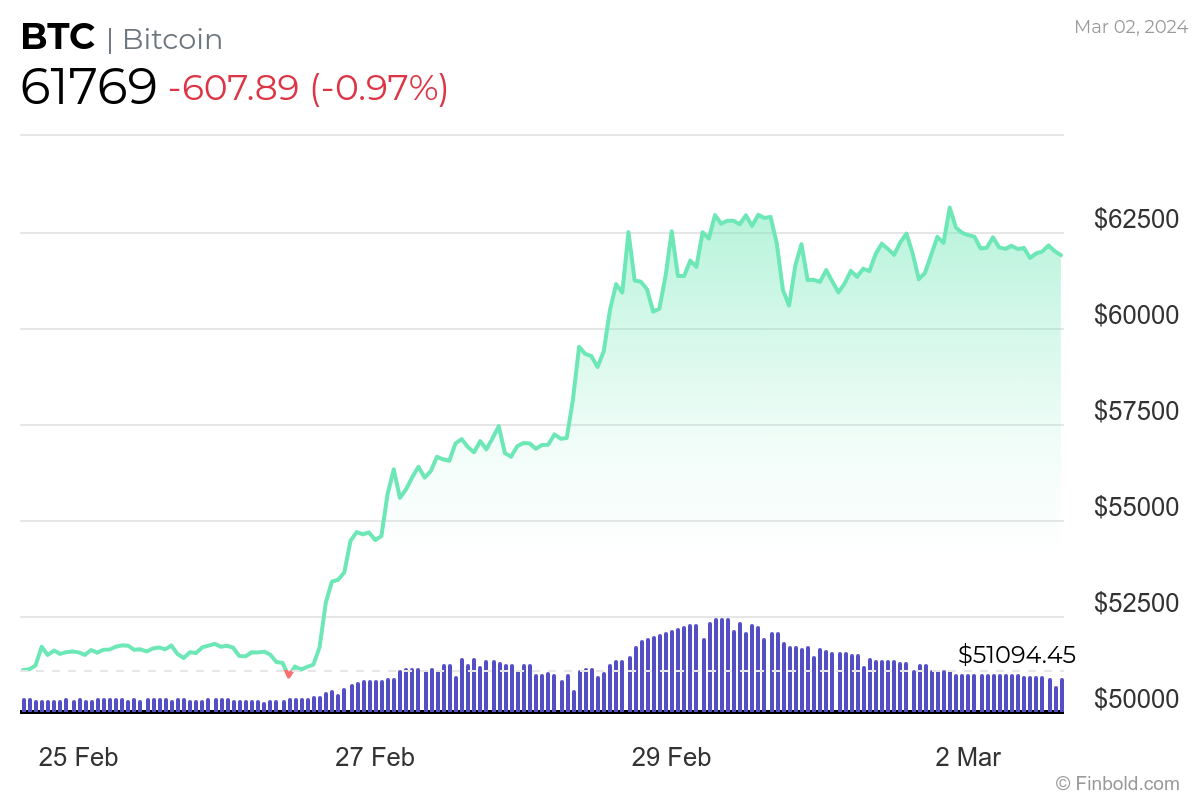

The aptitude affect of the ETF in rapid propelled Bitcoin to the contact $64,000 earlier than retracing a little below the $62,000 plight.

Bitcoin tag analysis

By press time, Bitcoin is valued at $61,769 with day-to-day positive aspects of practically 1%. Over the final seven days, Bitcoin has rallied 20%.

Despite the bulk consensus pointing towards sustained Bitcoin positive aspects, warning is warranted, because the asset will likely trip a correction, especially in the event of increased earnings-taking.

Disclaimer: The order on this set can also aloof no longer be belief to be funding advice. Investing is speculative. When investing, your capital is at probability.