In a comprehensive prognosis shared thru X (beforehand Twitter), Alex Thorn, the Head of Firmwide Study at Galaxy, delved into the intricacies of the fresh Bitcoin market cycle, answering the inquire “The place Are We In This Bitcoin Cycle?” As Bitcoin trades robustly spherical $62,000, with a important spike to $64.000 the previous day, the crypto landscape is witnessing unheard of dynamics, marked by a surge in ETF inflows, strategic acquisitions by company entities, and a palpable shift in investor sentiment in direction of digital resources.

Thorn emphasised how completely different this cycle is:

Successfully, the bull runs of 2017 and 2020 hadn’t but begun at this stage in Bitcoin’s provide schedule.

52 days before 2nd Halving (9-JUL-16) BTCUSD $455.22 (-59.86% from ATH)

52 days before 3rd Halving (11-MAY-20) BTCUSD $6,174 (-68.56% from ATH)

52 days before 4th Halving (20-APR-24) BTCUSD $59,330 (-12.16% from ATH)

Why This Bitcoin Cycle Is Different

Central to his prognosis is the sage-breaking influx of capital into sigh Bitcoin ETFs, with Thorn highlighting, “The BTC ETFs took in a whopping win $576m of BTC the previous day (Tuesday Feb. 27), with BlackRock alone seeing $520m of inflows, its supreme ever day.” This foremost circulate of funds now not supreme underscores the rising institutional ardour in Bitcoin but additionally marks a pivotal moment within the cryptocurrency’s gallop in direction of mainstream monetary recognition.

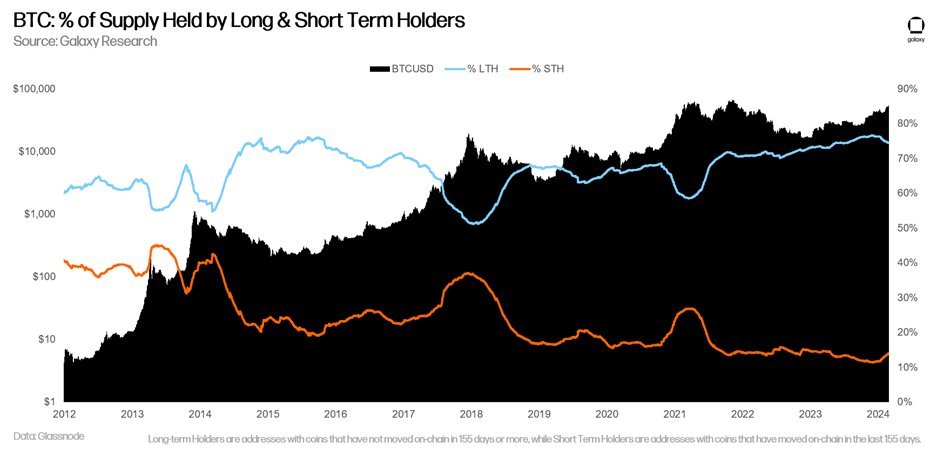

A key element of Thorn’s prognosis is the unwavering strength of Bitcoin’s prolonged-time period holder inaccurate, which he estimates to again about 75% of the total BTC provide. “Long-time period holders are easy largely maintaining real,” Thorn notes, emphasizing the neighborhood’s resilience and faith in Bitcoin’s prolonged-time period price proposition. This demographic, characterized by their ‘diamond hands’, performs an most foremost role in stabilizing the market and buffering in opposition to the volatility that on the total defines the crypto plot.

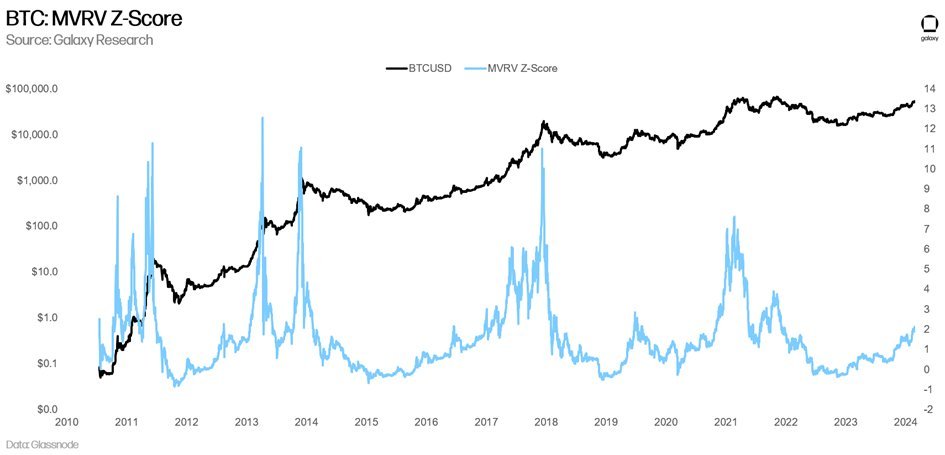

Thorn extra elaborates on the analytical instruments and metrics that offer perception into Bitcoin’s market habits. He introduces the MVRV Z-Rating, a novel attain to knowing the cyclicality of Bitcoin’s value action by evaluating its market price to its realized price. This metric supplies a window into the perceived overvaluation or undervaluation of Bitcoin at any given point. At display, the MVRV Z-Rating is stop to 2, while old cycle tops saw the metric spike to eight (in 2021) or even above 12 (in prior halving cycles).

Addressing the hypothesis spherical the acceleration of the Bitcoin cycle, Thorn firmly dispels considerations that the market is in approach peaking. He argues in opposition to the idea that we’re “speedrunning the ‘cycle’”, as a replacement asserting that the creation of Bitcoin ETFs within the US represents a transformative shift with some distance-reaching implications. “This time is totally different,” Thorn asserts, pointing to the ETFs’ disruption of outmoded Bitcoin value cycles and their affect on investor habits and intra-crypto dynamics.

The Situation Bitcoin ETF Pause

Thorn underscored the transformative affect of Bitcoin ETFs, positing that we’re merely at the starting of a foremost shift in how Bitcoin is accessed and invested in, particularly by the institutional sector. “No matter not most likely volumes and flows, there’s loads of motive to evaluate that the Bitcoin ETF sage is easy simply getting began,” he acknowledged, pointing to the untapped doable throughout the wealth administration sector.

In their October 2023 document titled “Sizing the Market for the Bitcoin ETF,” Galaxy laid out a compelling case for the prolonged scoot growth of Bitcoin ETFs. The document highlights that wealth managers and monetary advisors signify the main win fresh accessible market for these vehicles, offering a beforehand unavailable avenue for allocating consumer capital to BTC publicity.

The magnitude of this untapped market is substantial. In accordance to Galaxy’s compare, there may perhaps be approximately $40 trillion of resources under administration (AUM) all over banks and broker/dealers that has but to set off score loyal of entry to to sigh BTC ETFs. This entails $27.1 trillion managed by broker-dealers, $11.9 trillion by banks, and $9.3 trillion by registered funding advisors, cumulating to a complete US Wealth Administration AUM of $forty eight.3 trillion as of October 2023. This recordsdata underscores the large doable for Bitcoin ETFs to penetrate deeper into the monetary ecosystem, catalyzing a fresh wave of funding flows into Bitcoin.

Thorn extra speculated on the upcoming April spherical of put up-ETF-originate 13F filings, suggesting that these filings may perhaps maybe expose foremost Bitcoin allocations by about a of the supreme names within the funding world. “In April, we can additionally score the first spherical of put up-ETF-originate 13F filings, and (I’m simply guessing right here…) we’re more seemingly to note some astronomical names maintain dispensed to Bitcoin,” Thorn anticipated. This building, he argues, may perhaps maybe score a solutions loop where fresh platforms and investments force greater prices, which in flip attracts more funding.

The implications of this solutions loop are profound. As more wealth administration platforms beginning as a lot as provide score loyal of entry to to Bitcoin ETFs, the influx of latest capital may perhaps maybe very a lot affect BTC’s value dynamics, liquidity, and general market structure. This transition represents a key moment within the maturation of Bitcoin as an asset class, transferring from a speculative funding to a staple in varied portfolios managed by monetary advisors and wealth managers.

We Are Peaceable Early

Thorn’s optimism extends past the instantaneous market indicators to the broader implications of Bitcoin’s integration into the monetary mainstream. He anticipates a fresh all-time high for Bitcoin within the stop to time period, fueled by a mixture of issues including the ETFs’ momentum, rising acceptance of BTC as a decent asset class, and the anticipatory buzz surrounding the upcoming halving occasion. “All right here’s to snarl, my resolution to that burning inquire – where are we within the cycle? – is that we haven’t even begun to achieve the heights right here’s more seemingly to scuttle,” he concludes.

Thorn’s prognosis culminates in a bullish forecast for Bitcoin. Because the neighborhood stands on the cusp of the fourth BTC halving, Thorn’s insights offer a compelling vision of a market poised for unheard of growth, pushed by a confluence of technological innovation, regulatory evolution, and transferring global economic currents. “Bitcoin is top time now, and while it must also very successfully be laborious to evaluate, issues are simply starting to score provocative,” Thorn declares, capturing the essence of a market at the threshold of a fresh period.

At press time, BTC traded at $62,065.