An on-chain analyst has explained signals in several metrics to transfer looking out out for if Bitcoin is in a bearish allotment.

These Bitcoin Indicators Would possibly perchance perhaps well even Be To Apply For Undergo Market Signals

In a brand new post on X, on-chain analyst Checkmate answered to a user asking about an on-chain metric indicating when it’s time to flip bearish on cryptocurrency.

Checkmate has shared two indicators: the Brief-Duration of time Holder Realized Profit/Loss Momentum and the Brief-Duration of time Holder MVRV Ratio Momentum. “Brief-Duration of time Holders” (STHs) right here direct over with the Bitcoin investors who equipped their coins in some unspecified time in the future of the past 155 days, which skill that both of these metrics are excellent for the present investors within the market.

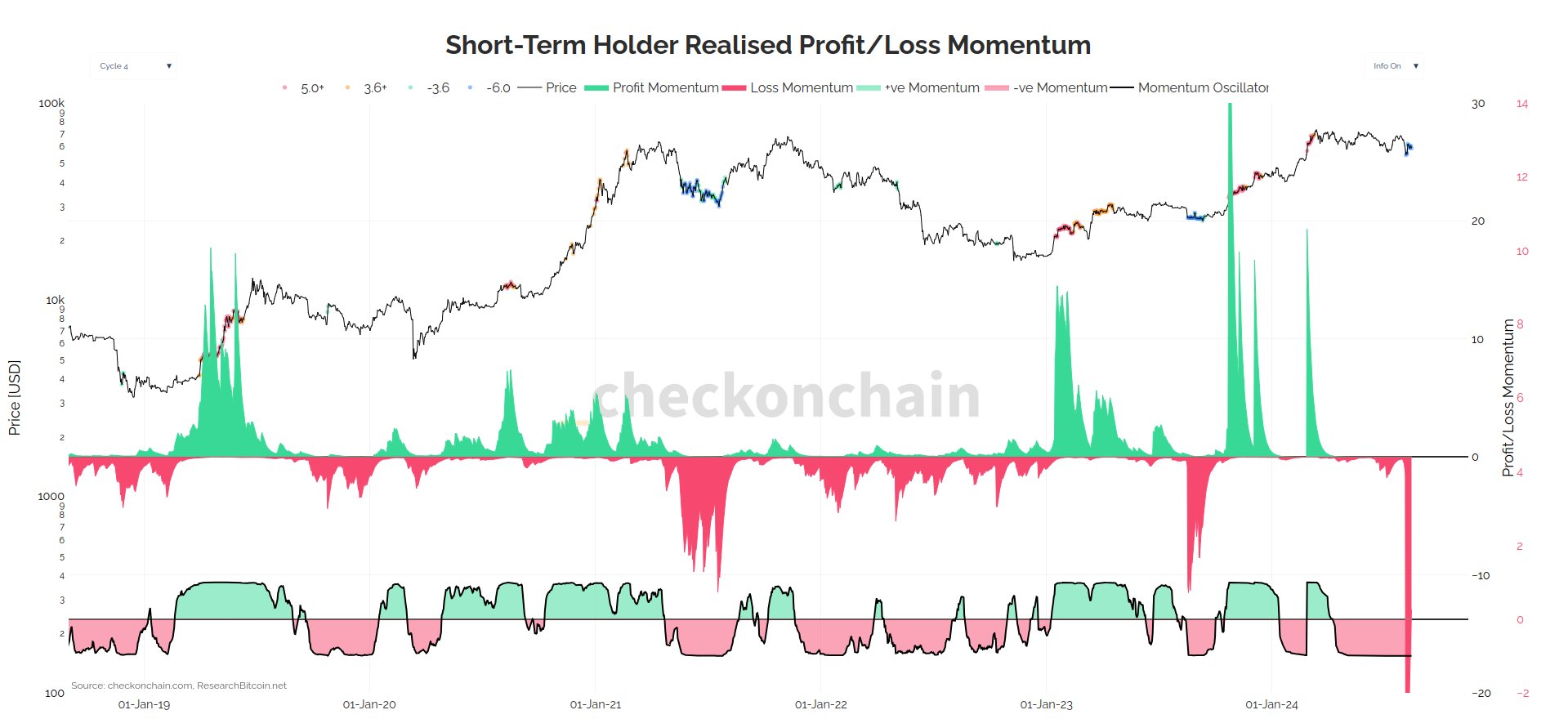

First, the “Realized Profit/Loss Momentum” measures, as its title suggests, the momentum within the ratio of the profit and loss that the STHs are realizing by their promoting.

Beneath is the chart for the indicator posted by the analyst.

In response to the analyst, it is time to be bearish when the oscillator on the bottom of this chart turns red (an identical to negative momentum within the STH Realized Profit/Loss).

The graph shows that this oscillator assumed negative values rapidly after the value bring collectively 22 situation its new all-time excessive (ATH) and has since remained within the plan. And indeed, whereas the indicator has considered these values, Bitcoin has been going by a rough allotment.

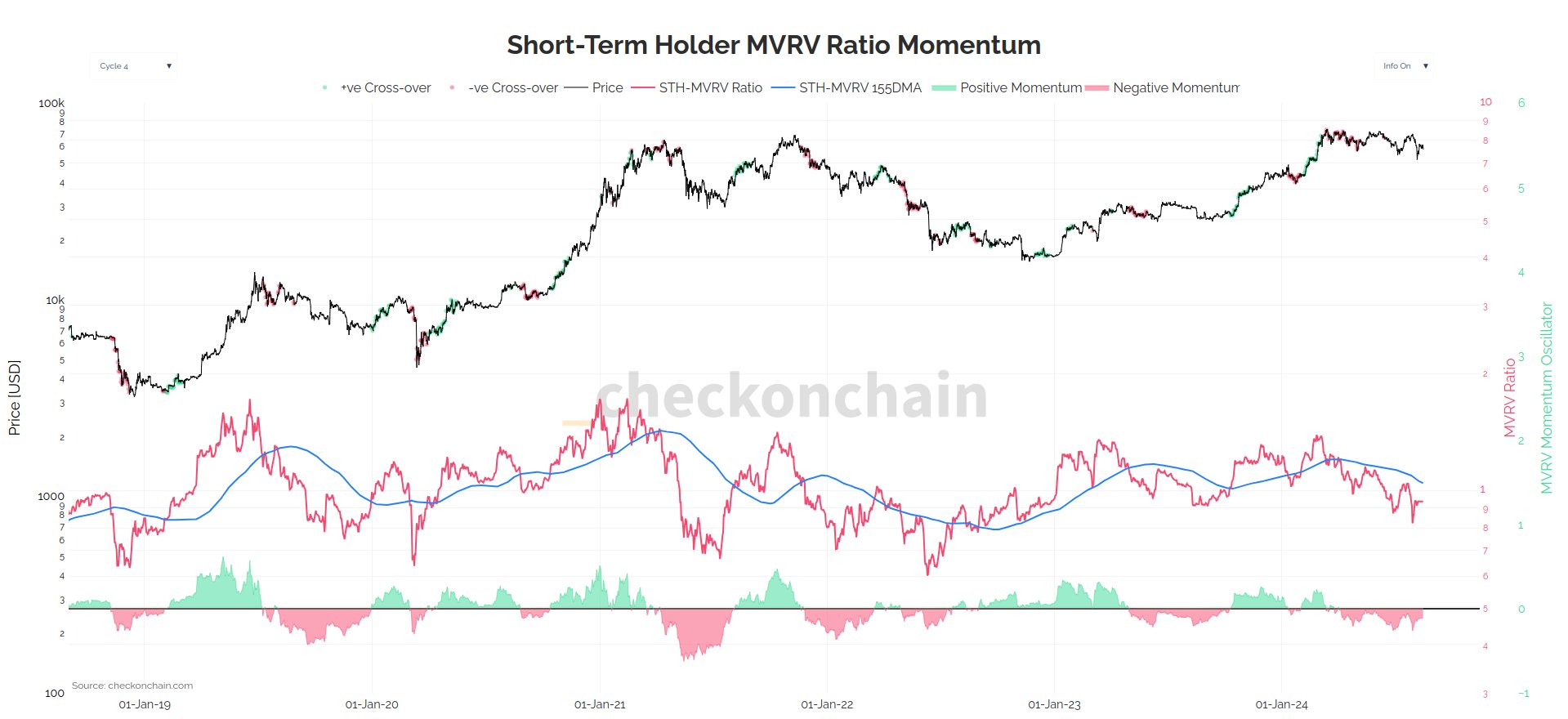

The STH MVRV Ratio Momentum’s 2d indicator works similarly and retains track of the gap between the Market Tag to Realized Tag (MVRV) Ratio for this cohort and its 155-day involving average (MA).

The MVRV Ratio is a popular indicator that tells us how the value held by the investors (the market cap) compares in opposition to what they ragged to secure their coins (the Realized Cap). In diverse words, the metric offers records in regards to the unrealized profit/lack of the holders.

Thus, whereas the Realized Profit/Loss retains track of the on-line profit/loss the investors are harvesting by their promoting, this metric tells us in regards to the profit/loss they have yet to beget shut.

Right here is the records for the momentum indicator for the MVRV Ratio particularly for the STHs:

In response to the analyst, excellent treasure with the primary indicator, this one moreover offers a bearish brand when the momentum turns red. As the chart shows, the STH MVRV Ratio has been below its 155-day MA for the same interval because the bearish momentum within the Realized Profit/Loss, thus providing confluence to the brand.

BTC Tag

Bitcoin had pushed in direction of $62,000 earlier within the week, however the asset has since slipped up because it’s now help at $57,800.