In a video released on August 2, stylish pseudonymous analyst and vendor Crypto Jebb presents an in-depth diagnosis of the hot bearish indicators within the Bitcoin market and what they point out for the scheme forward for the cryptocurrency.

Introduction

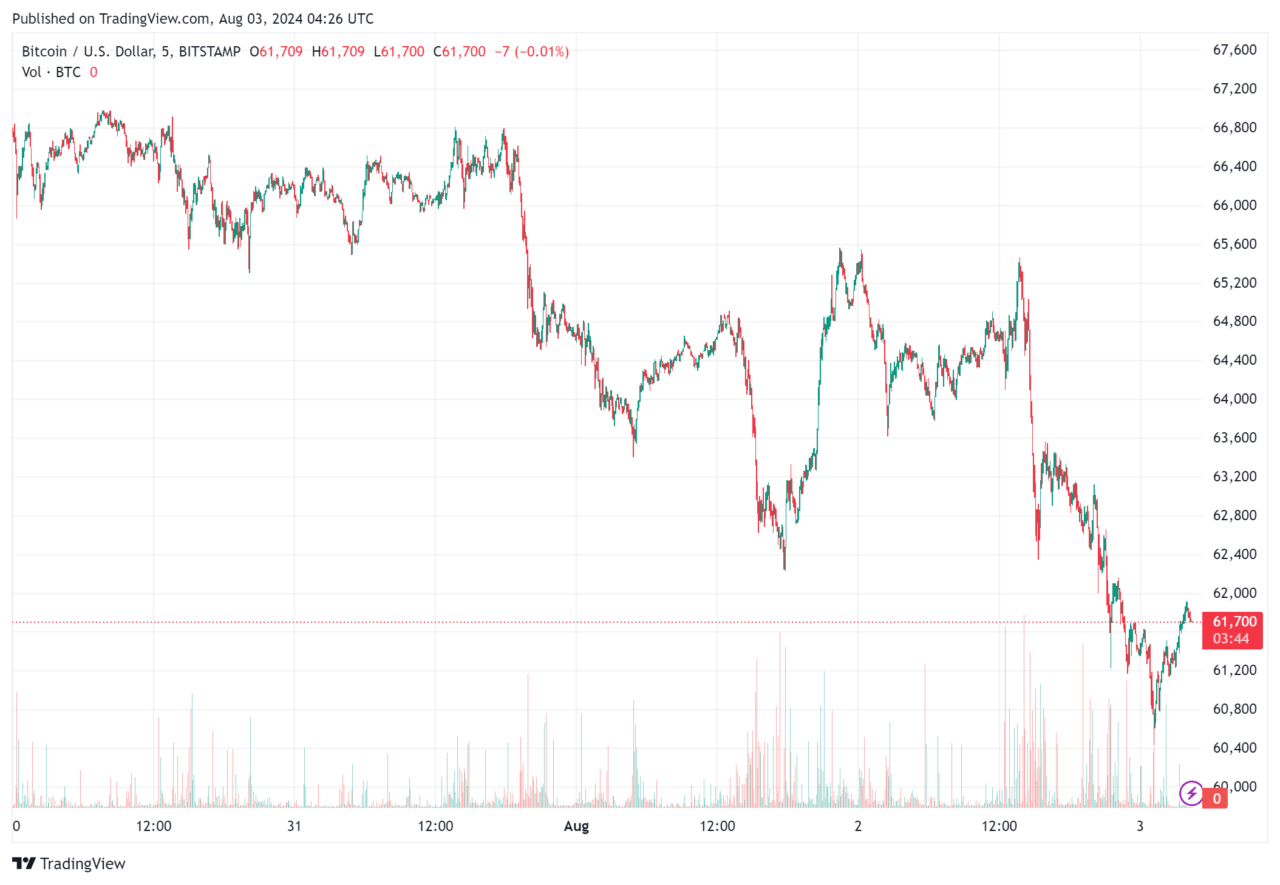

Jebb notes that Bitcoin has now not too long within the past experienced a serious fall, falling to $64,000 and extra to a native backside of $62,000. This decline modified into once anticipated attributable to plenty of bearish indicators which had been flashing over the previous few days.

Key Technical Indicators

Bearish MACD Unsightly

One among the precious technical indicators Jebb highlights is the bearish MACD (Transferring Realistic Convergence Divergence) inappropriate on Bitcoin’s daily chart. This indicator suggests a doable shift from bullish to bearish momentum, indicating that the Bears are gaining regulate.

Crypto Jebb Oscillator

Jebb also discusses the Crypto Jebb Oscillator, a custom indicator he developed in partnership with Lux Algo. This oscillator showed a downtick now not too long within the past, signaling that the bullish power is waning and bearish power is increasing. The oscillator helps visualize the bullish and bearish acceleration, providing insights into market momentum.

Lux Algo Sell Signal

Any other fundamental indicator is the promote signal from Lux Algo, which Jebb explains is a legitimate tool for predicting market actions. The Lux Algo indicator showed a purple promote signal, confirmed by a purple trend catcher, indicating a stable bearish trend. He says tsignal suggests that Bitcoin may possibly continue to experience downward power within the approaching days.

Fundamental Elements

Non-Farm Payroll and Unemployment Files

Jebb highlights most stylish non-farm payroll and unemployment knowledge from the U.S. Division of Labor. The recordsdata showed an enlarge in unemployment to 4.3%, which has contributed to market uncertainty. He says that this upward push in unemployment, mixed with plenty of business components, has created a bearish environment for Bitcoin and plenty of menace resources.

U.S. Stock Market Correlation

The U.S. stock market has also been experiencing a downturn, which Jebb notes is influencing Bitcoin’s label. He explains that the stock market’s performance on the overall correlates with Bitcoin, and the most stylish fall in U.S. equities has added to the detrimental sentiment within the cryptocurrency market.

Short-Term and Lengthy-Term Outlook

Short-Term Bearish Trend

Jebb emphasizes that Bitcoin is currently in a confirmed downtrend, with plenty of indicators pointing to continued bearish power. He advises patrons to be cautious and ready for doable extra declines, possibly to the $60,000 level and at the same time as low as $55,000.

Lengthy-Term Bullish Perspective

Despite the temporary bearish indicators, Jebb stays optimistic about Bitcoin’s long-time period doable. He urges patrons to keep a long-time period level of view and continue their investment methods. He believes that the hot downturn gifts an different to fetch extra Bitcoin at lower prices.

Political and Financial Traits

Aid from Political Figures

Jebb discusses the rising political pork up for Bitcoin, declaring that both former President Donald Trump and Senator Cynthia Lumis possess proposed that the U.S. keep Bitcoin on its steadiness sheet. He believes this political backing may possibly consequence in elevated institutional adoption and extra legitimization of Bitcoin as an asset class.

Rate Cuts and Financial Insurance policies

Jebb also covers most stylish tendencies in economic policies, equivalent to the Bank of England’s resolution to lower hobby charges. He explains that lower hobby charges may possibly enhance the stock and cryptocurrency markets by making borrowing much less expensive and stimulating economic growth. He suggests that an identical price cuts from the U.S. Federal Reserve may possibly consequence in fundamental rallies in both equities and Bitcoin.

Actionable Recommendation for Merchants

Buck-Price Averaging

Jebb advises patrons to continue greenback-price averaging into Bitcoin and plenty of stable cryptocurrencies. He suggests increasing the weekly or monthly allotment for Bitcoin investments by 10-25% within the course of this bearish segment. This approach, he says, permits patrons to fetch extra Bitcoin at lower prices, potentially making the most of future label increases.

Warding off Awe Selling

Jebb cautions in opposition to dismay selling primarily based mostly on temporary market fluctuations. He emphasizes the importance of declaring a long-time period investment level of view and never reacting impulsively to non eternal market downturns. He encourages patrons to keep mute and centered on their long-time period objectives.

Ethereum and Other Cryptocurrencies

Ethereum’s Efficiency

Jebb also touches on Ethereum’s most stylish performance, noting that it has been in a downtrend identical to Bitcoin. He attributes this to components equivalent to the most stylish delivery of Ethereum ETFs, which possess viewed mixed reactions within the market. Despite the hot bearish trend, Jebb believes that Ethereum has stable long-time period doable, in particular as the Ethereum ecosystem continues to grow and evolve.

Altcoins and Diversification

To boot to to Bitcoin and Ethereum, Jebb discusses the importance of diversifying correct into plenty of altcoins. He advises patrons to fairly analysis and judge altcoins with stable fundamentals and growth doable. He says diversification can befriend unfold menace and present publicity to a broader vary of opportunities within the cryptocurrency market.

Featured Image by strategy of Pixabay