The FTX saga, irrespective of Sam Bankman-Fried’s allure, has concluded with the extinct FTX CEO receiving a 25-300 and sixty five days sentence. The ramifications of this landmark trial will endure.

In November, the extinct CEO of the now-defunct cryptocurrency alternate changed into convicted on seven counts of fraud and conspiracy to launder cash. His gradual-March sentencing resulted in additional than two decades within the abet of bars.

Throughout the trial, three extinct shut friends testified against Bankman-Fried, alleging that he directed them to employ FTX funds for various purposes, including paying Alameda’s cash owed, making political donations and acquiring luxurious right property within the Bahamas. They confessed to fraud and are attempting forward to sentencing.

In his protection, Bankman-Fried acknowledged making mistakes in possibility management but vehemently denied any accusations of theft.

Crypto dream grew to changed into into nightmare

FTX, once valued at $32 billion, collapsed in gradual 2022, filing for financial catastrophe amid a broader cryptocurrency rupture. The firm’s downfall changed into attributed to the misuse of buyer funds for dreadful investments by blueprint of a closely associated hedge fund, Alameda Review. Bankman-Fried, the founding father of FTX, moreover passe buyer funds for interior most excessive-possibility ventures, contributing to the firm’s loss of life, per the court docket’s decision.

Bankman-Fried is no longer the fully crypto resolve going by blueprint of exact woes. Currently, Terraform Labs and its extinct CEO Stop Kwon had been held to blame for fraud in a Original York Metropolis case, with Kwon detained in Montenegro since early final 300 and sixty five days.

22) And that possibility changed into correlated–with the opposite collateral, and with the platform.

After which the rupture came.

In about a day period, there changed into a historic rupture–over 50% in most correlated resources, without a characterize side liquidity.

And at the identical time there changed into a droop on the bank.

— SBF (@SBF_FTX) November 16, 2022

Changpeng Zhao, extinct CEO of Binance, faces sentencing in gradual April for failing to position in power anti-cash laundering protocols at his firm. He agreed to a $50 million magnificent and resignation as CEO.

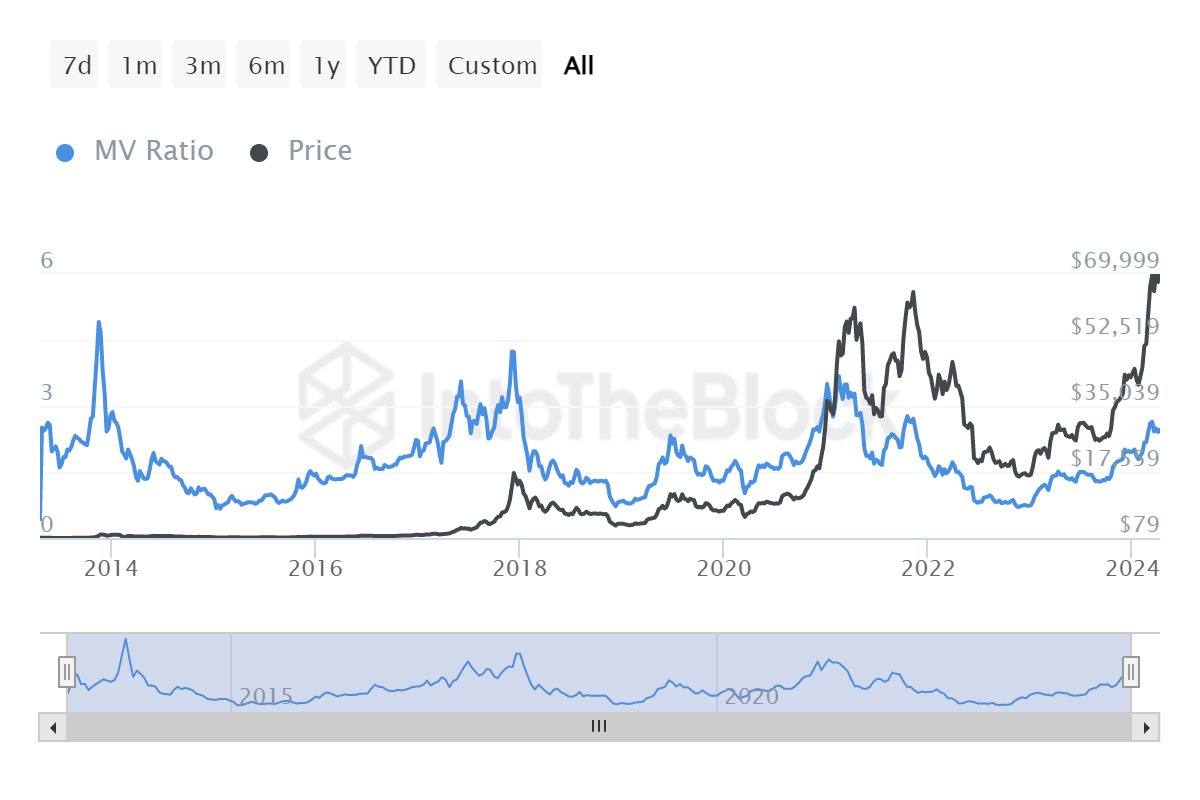

The fallout from FTX’s fall down prolonged beyond financial losses, tarnishing the reputations of vital figures associated with FTX. This tournament triggered a sequence response of crypto failures within the industry, from which it has yet to fully salvage greater. Moreover, the incident triggered regulatory scrutiny and dampened public sentiment toward cryptocurrencies at a a have to indulge in time when the asset class changed into gaining mainstream acceptance.

No one cares until rupture arrives

Throughout indispensable market surges, merchants steadily put out of your mind risks. Bankman-Fried rose to prominence within the wake of the crypto market inflow after 2020, attracting novel merchants from outmoded finance. Michael Saylor’s $250 million funding in Bitcoin marked a turning level in this novel technology.

The Sequoia FTX eulogy underscores how VCs customarily neglect due diligence when entering the crypto cash-making machine.

Alameda Review changed into closely backed by FTT tokens, working below the conclusion that FTT costs would live stable and customers wouldn’t withdraw from FTX. The sphere changed into no longer that FTX customers and merchants trusted SBF and his companions without verification — they merely failed to care at the time.

Regulators to determine paradigm

Of course, the easy option to the field would be legislation. As SEC Chair Gary Gensler emphasised following the FTX pronounce of affairs: “The alleged fraud committed by Mr. Bankman-Fried is a be-cautious call to crypto platforms that they have to follow our rules. Compliance protects both merchants and those invested in crypto platforms with time-tested safeguards, resembling moral buyer fund protection and alternate line separation.”

On the other hand, turning the crypto industry into outmoded finance also can honest no longer salvage rid of fraud entirely. Efforts to red meat up regulatory frameworks and promote self-legislation within the crypto industry have a tendency to yield greater outcomes.

These questions are severe for the duration of all-time market highs, as ignoring them now we possibility shedding our personal future.