A sudden selloff in meme cash has sent tremors via the crypto market, as investors react to a finest storm of macroeconomic and structural triggers. The downturn comes amid mounting uncertainty surrounding U.S. trade policies and broader market rebalancing developments.

Despite the reality that predominant cryptocurrencies love Bitcoin had stable institutional pork up in Can also, meme-primarily based digital property are in actuality beneath heavy stress. Investors seem like taking flight, waiting for a weaker summer time and reacting to increased volatility tied to regulatory and political developments.

Portfolio Rebalancing Provides Stress

Undoubtedly one of the most predominant drivers of the sizzling downturn looks to be end-of-month portfolio rebalancing. Per K33 Be taught, Bitcoin convey ETFs seen sturdy inflows throughout Can also, averaging $238 million on an on a traditional foundation foundation.

Alternatively, the trend reversed over the last three days, breaking a 10-day inflow hump. Analysts bear right here is seemingly attributable to mandated rebalancing, as Bitcoin outpaced historical benchmarks love the S&P 500 and NASDAQ for the third consecutive month.

This adjustment generally outcomes in profit-taking, especially when property exceed target allocations. In consequence, meme cash, generally viewed as increased-risk holdings, change into the predominant to face promote-side stress. Mixed with the historical pattern of weaker crypto efficiency throughout summer time months, this has created a finest ambiance for a selloff.

Meme Money in Level of curiosity: WIF, SHIB, POPCAT, and MOG

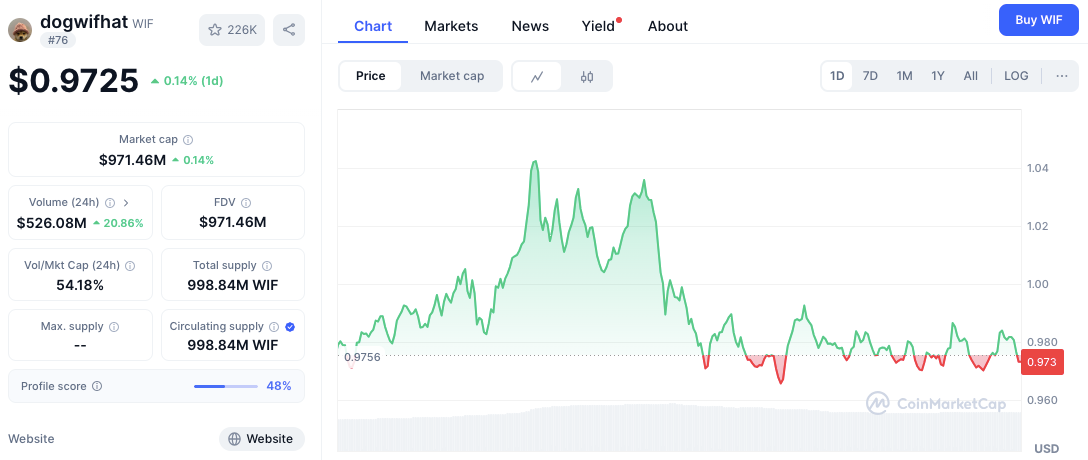

Several meme cash comprise been hit specifically laborious. Dogwifhat (WIF) fell to $0.9742, facing power resistance shut to the $1.04 level and testing rapid-term pork up at $0.975. No subject heavy trading quantity, the coin is caught in a consolidation segment with restricted bullish momentum.

Associated: PEPE, BONK, FARTCOIN, DOGE: Particular individual Catalysts Force Meme Coin Market Cap Above 75 Billion

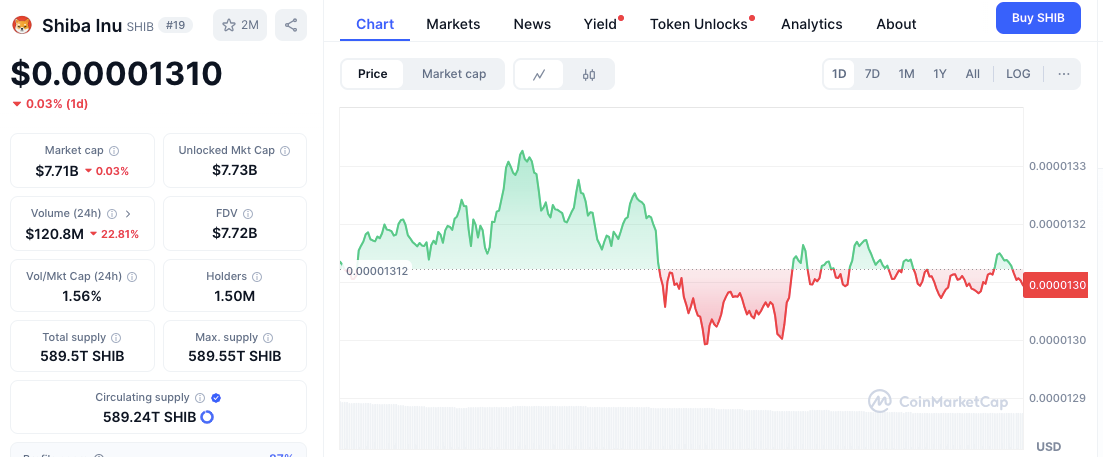

Meanwhile, Shiba Inu (SHIB) stays moderately stable at $0.00001310 but is exhibiting indicators of exhaustion. Quantity dropped by over 24%, reflecting an absence of investor curiosity within the rapid term. With stable resistance shut to $0.00001335 and 2 failed breakouts, the outlook stays hazardous.

Associated: Meme Money Love PEPE, WIF, and BONK Outshine Tech Tokens in 2025

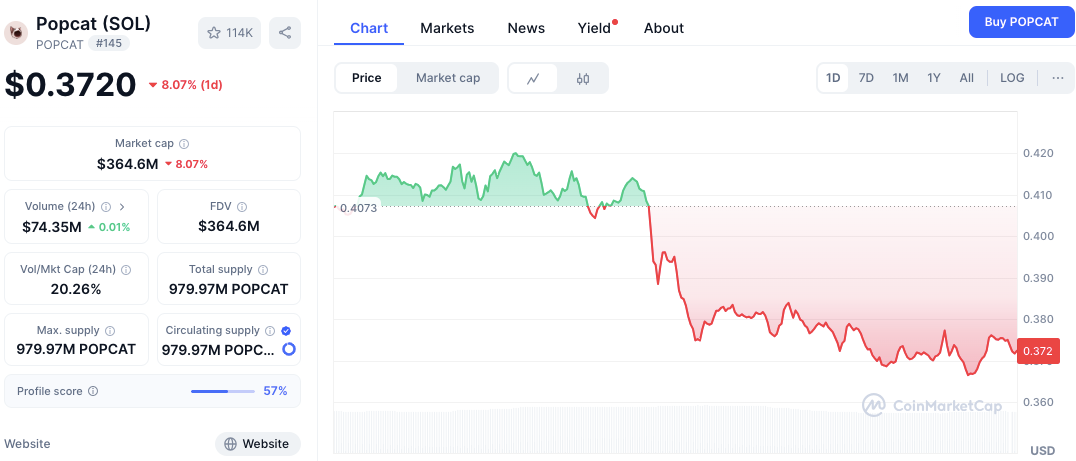

Popcat (POPCAT) seen the steepest on an on a traditional foundation foundation loss, shedding 7.84% to $0.3742. It broke quite loads of key pork up levels and now risks additional declines if $0.370 is breached. The excessive trading quantity signifies heightened job, but promoting stress stays dominant.

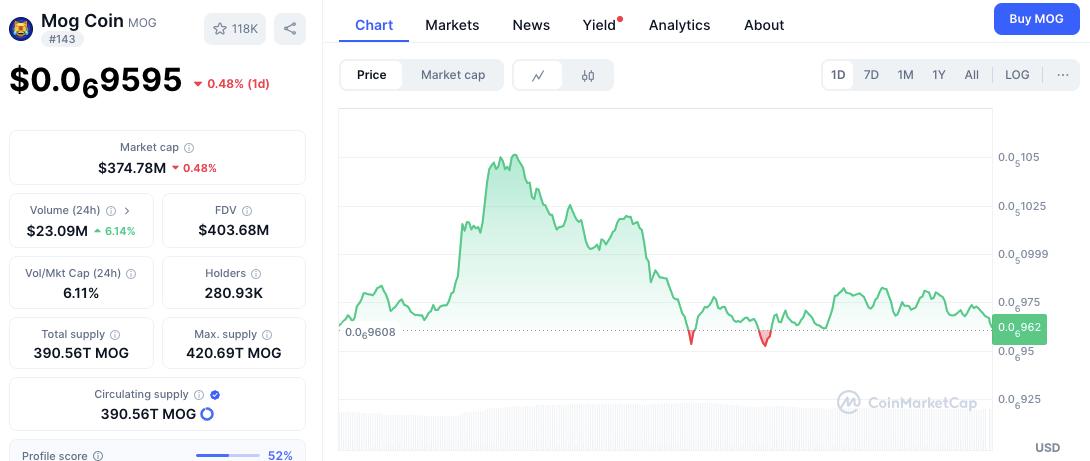

Mog Coin (MOG), after peaking above $0.105, slipped into a glorious range shut to $0.0696. Despite the reality that it’s retaining key pork up, weaker momentum and consistent lower highs hint at seemingly design back risk.

Disclaimer: The tips introduced in this article is for informational and tutorial purposes handiest. The article would now not portray financial advice or advice of any kind. Coin Edition isn’t any longer accountable for any losses incurred as a outcomes of the utilization of yelp, merchandise, or companies mentioned. Readers are informed to exercise warning before taking any action linked to the corporate.