The Plasma blockchain, a Layer 1 community furious by stablecoin transactions, facets the $XPL token as its native asset, which supports community security and transaction facilitation. Launched in September 2025, Plasma aims to facilitate excessive-quantity stablecoin transfers with facets such as zero costs for obvious operations and compatibility with Ethereum Virtual Machine requirements.

The XPL token, with an initial offer of 10 billion, performs a central role within the system’s proof-of-stake consensus and incentive structures, drawing comparisons to tokens esteem Bitcoin on its community or Ether on Ethereum. This text examines the token’s distribution, financial mechanisms, market efficiency, and up to the moment developments in step with available knowledge as of October 8, 2025.

What Is the Plasma Blockchain?

Plasma is a proof-of-stake blockchain optimized for stablecoins such as USDT. It supports transaction speeds exceeding 1,000 per second, with block cases below one second and low operational charges. The community facets custom gas tokens, enabling customers to pay costs in stablecoins or varied resources, somewhat than completely within the native token. It also gives confidential payment alternatives and a bridge for integrating Bitcoin into neat contracts, reducing have confidence requirements.

The project has acquired investments from entities including Founders Fund, Framework Ventures, Bitfinex, DRW, Float Traders, and Nomura, totaling about $24 million. These funds be pleased supported the advance of infrastructure aimed against stablecoin adoption. Indispensable figures connected to the project encompass Paolo Ardoino, CEO of Tether; Scott Bessent, a nominee for U.S. Treasury Secretary; Chris Giancarlo, dilapidated chairman of the Commodity Futures Buying and selling Commission; and David Sacks.

Plasma’s fabricate prioritizes seamless integration with present monetary systems, including those of weak establishments. It permits gasless transfers for stablecoins, allowing customers to send resources with out incurring community costs in obvious eventualities. The blockchain is EVM-effectively matched, allowing developers to deploy capabilities the same to those on Ethereum. This compatibility extends to tools and protocols familiar to Ethereum customers, facilitating simpler migration of decentralized finance capabilities.

Role and Functions of the XPL Token

XPL serves a few capabilities internal the Plasma ecosystem.

Role of XPL as Native Token

- Transaction Costs and Validator Rewards: As the native token, XPL is frail to pay transaction costs on the Plasma community. It also rewards validators who preserve the community’s consensus mechanism. Validators stake XPL to participate in block production and transaction validation, earning rewards in return for their contributions to community security and operations.

- Incentive Alignment for Explain: The token helps align incentives for general community expansion, including provisions for liquidity and partnerships with decentralized finance (DeFi) protocols.

Proof-of-Stake Model and Staking Aspects

- Delegation Mechanism: Within the proof-of-stake (PoS) mannequin, XPL holders will seemingly be in a plot to delegate their stakes to validators once this selection is utilized. This permits holders to fragment in rewards with out wanting to characteristic their possess nodes. The delegation system is planned for future rollout.

- Present Staking Benefits: Currently, staking XPL gives yields and opportunities for governance participation. Promotional staking intervals on platforms esteem KuCoin be pleased supplied annual share charges (APRs) up to 150% for runt intervals.

Token Originate for Ecosystem Growth

- Mechanisms for Enhance: The fabricate of XPL entails built-in mechanisms to foster ecosystem advise. Let’s keep in mind, parts of the token offer are explicitly dispensed for incentives in DeFi, integrations with exchanges, and campaigns to enhance adoption.

- Present Management Tips: XPL held in locked allocations by the crew or merchants is no longer eligible for staking rewards. This restriction helps arrange offer dynamics and quit undue inflation or reward dilution.

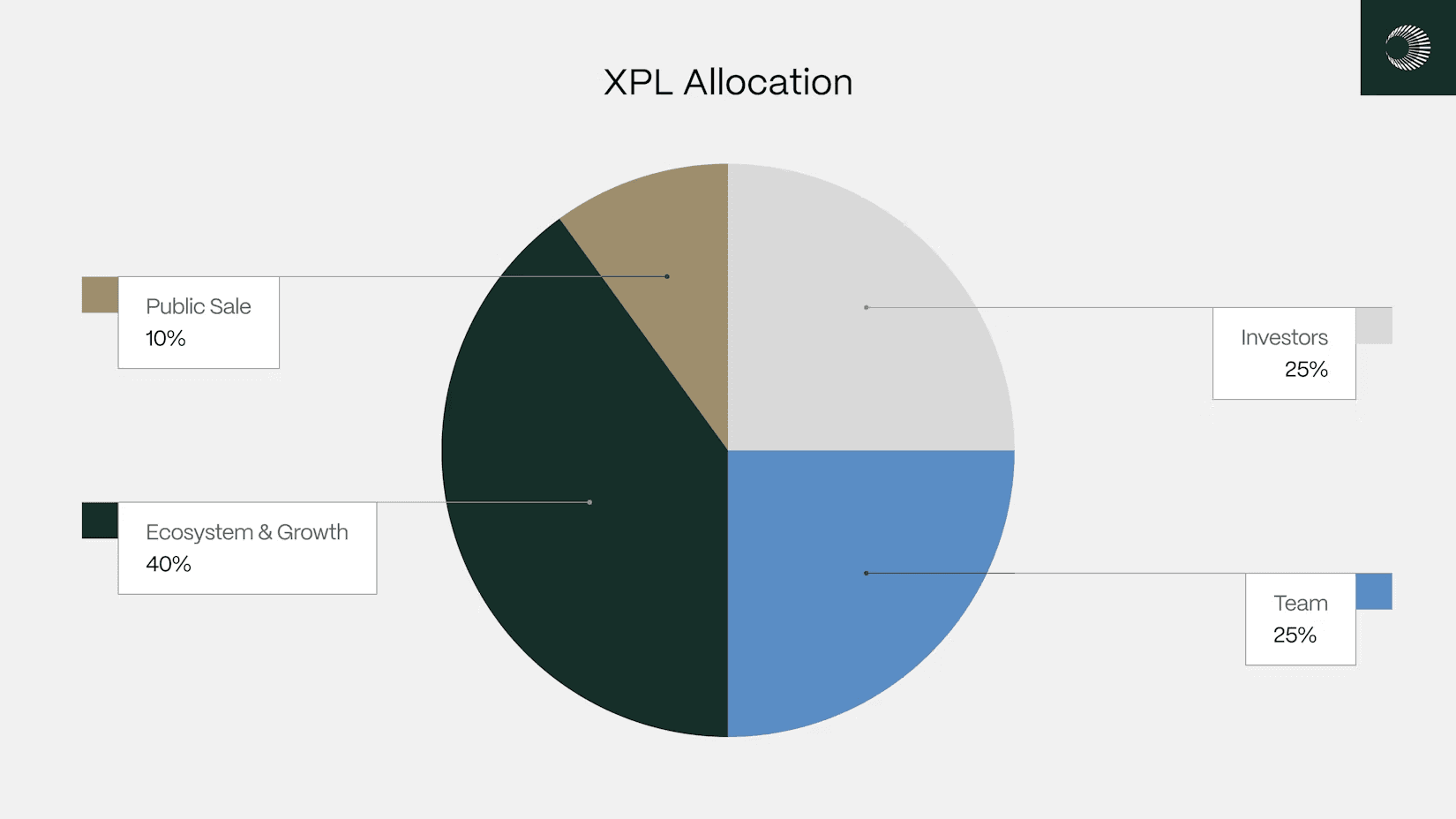

XPL Tokenomics and Distribution Dinky print

The tokenomics of XPL emphasize controlled offer advise and long-duration of time incentive alignment. At the mainnet beta delivery on September 25, 2025, the initial offer of XPL stood at 10 billion. This offer is distributed across four critical courses, with disclose unlock schedules in set to manipulate circulation:

Public Sale Allocation:

- Represents 10% of the entire offer, the same to 1 billion XPL.

- Executed earlier in 2025 by skill of the Sonar platform by Echo.

- Attracted $273 million in commitments, which exceeded the $50 million cap.

- Required know-your-customer verification for all individuals.

- Liberate schedule: Tokens for non-U.S. purchasers had been entirely unlocked at delivery.

- Tokens for U.S. purchasers are subject to a 12-month lockup, becoming entirely available on July 28, 2026.

Ecosystem and Explain Allocation:

- Represents 40% of the entire offer, the same to 4 billion XPL.

- Reserved for initiatives to increase utility, liquidity, and institutional adoption.

- Rapid unlock: 8% of the entire offer, or 800 million XPL, unlocked at delivery.

- Purposes for immediate unlock Embrace Decentralized finance incentives, liquidity give a take to, switch integrations, and early advise campaigns.

- Final allocation: 3.2 billion XPL unlocks monthly on a pro-rata foundation over three years.

- Full availability: Reached by September 25, 2028.

Crew Allocation:

- Represents 25% of the entire offer, the same to 2.5 billion XPL.

- Supposed to entice and preserve personnel.

- Liberate schedule: One-third subject to a one-year cliff from the delivery date.

- Final two-thirds: Unlocks monthly over the next two years.

- Full vesting: By September 25, 2028.

- Further condition: Vesting tied to particular person delivery dates.

Investor Allocation:

- Represents 25% of the entire offer, the same to 2.5 billion XPL.

- Follows the the same unlock schedule because the crew allocation.

- Involves early backers from the seed round.

- Seed round featured a community-aligned methodology throughout the critical Echo sale.

Inflation Time table and Validator Rewards

Plasma’s inflation mannequin supports validator rewards whereas aiming to limit dilution for holders. Annual inflation starts at 5 p.c, reducing by 0.5 p.c once a year till it reaches a baseline of three p.c. This inflation activates simplest after exterior validators and stake delegation facets are utilized.

Rewards are distributed to stakers through validators, with locked tokens from crew and investor allocations ineligible for unlocked rewards. To offset recent emissions, the community employs a payment-burning mechanism the same to Ethereum Enchancment Proposal 1559, where substandard transaction costs are completely a ways off from circulation. As community utilization will enhance, this burning is anticipated to balance in opposition to inflation..

Initiating Timeline and Most modern Network Developments

Plasma’s mainnet beta went are residing on September 25, 2025, coinciding with the unlock of the XPL token. Integrations with protocols esteem Aave, Fluid, Euler, Ethena, and Pendle followed quickly after. Contained within the critical week, stablecoin deposits surpassed $7.25 billion, basically in USDT, and the entire value locked in decentralized finance reached over $5 billion, including borrowed resources. This positioned Plasma because the fifth-splendid chain by entire value locked and stablecoin liquidity.

On September 25, Plasma mainnet beta went are residing alongside the XPL token.

In exactly over a week, extra than $7.25B of stablecoins sit on Plasma. The entire value locked across our onchain DeFi ecosystem is over $5.25B.

Plasma is now the Fifth-splendid chain by stablecoin liquidity and…

— Plasma (@Plasma) October 6, 2025

On an everyday foundation active customers be pleased doubled since September, with roughly 5,000 recent customers added each day. Partnerships encompass shut collaboration with Tether and Bitfinex for USDT give a take to, as effectively as integration with Binance Earn, making yields on Plasma-basically based entirely USDT available to over 280 million customers.

Upcoming facets encompass stake delegation, expanded validator participation, and integration of USDO, a regulated yield-bearing stablecoin. Plasma One, a neobank utility, has launched to handle on-chain dollar-basically based entirely saving, spending, sending, and earning.

Liquidity metrics present over $420 million in entire value locked, representing a 62 p.c month-over-month amplify. The community’s zero-payment mannequin for USDT transfers and neobank user skills are celebrated in discussions.

Conclusion

The Plasma blockchain and its XPL token provide a structured methodology to stablecoin infrastructure, featuring proof-of-stake security, controlled token distribution, and mechanisms such as payment burning to manipulate offer. Key facets encompass the ten billion initial offer dispensed for public gain entry to, advise initiatives, crew retention, and investor give a take to, alongside an inflation schedule that prioritizes community security with out outrageous dilution.

Market knowledge shows a $1.57 billion capitalization amid volatility, whereas developments such as excessive stablecoin deposits and protocol integrations present operational capacity. This setup positions Plasma as a unquestionably fair appropriate community for stablecoin transactions, providing tools for validators and customers.

Sources:

- Plasma Legit Documentation: https://docs.plasma.to/docs/gain-started/xpl/tokenomics

- CoinMarketCap XPL Internet page: https://coinmarketcap.com/currencies/plasma/

- DefiLlama Plasma Dashboard: https://defillama.com/chain/Plasma

- Plasma Mainnet Beta Goes Are residing: https://www.theblock.co/post/372300/stablecoin-layer-1-plasma-goes-are residing-introducing-xpl-token-and-defi-integrations