Aligned within a one year of its three halving events, Bitcoin had three necessary bull runs in its 15-one year history. After every, in 2013, 2017 and 2021, Bitcoin worth in general drops considerably till the following one.

On the opposite hand, the publish-Bitcoin ETF landscape appears to be like to have created fresh tips of engagement. Since February 16th, Bitcoin ETF flows since January 11th racked up practically $5 billion in uncover inflows. This represents 102,887.5 BTC buying rigidity for that length, per BitMEX Analysis.

As anticipated, BlackRock’s iShares Bitcoin Belief (IBIT) leads with $5.3 billion, adopted by Fidelity’s Wise Foundation Bitcoin Fund (FBTC) at $3.6 billion, and ARK 21Shares Bitcoin ETF (ARKB) in third plight with $1.3 billion.

Over five weeks of Bitcoin ETF trading brought in $10 billion AUM cumulative funds, bringing the final crypto market cap closer to $2 trillion.This level of market engagement used to be final seen in April 2022, sandwiched between Terra (LUNA) collapse and a month after the Federal Reserve began its ardour rate mountain mountain climbing cycle.

The quiz is, how does the fresh Bitcoin ETF-driven market dynamic search to shape the crypto landscape interesting forward?

Impression of $10 Billion AUM on Market Sentiment and Institutional Passion

To attain how Bitcoin worth impacts the total crypto market, we first have to achieve:

- What drives Bitcoin worth?

- What drives the altcoin market?

The answer to the first quiz is easy. Bitcoin’s restricted 21 million BTC present translates to shortage, one which is enforced by a extremely efficient computing community of miners. Without it, and its proof-of-work algorithm, Bitcoin would’ve been right one other copypasted digital asset.

This digital shortage, backed by bodily sources in hardware and vitality, is heading for the fourth halving in April, bringing Bitcoin’s inflation rate below 1%, at 93.49% bitcoins already mined. Furthermore, the sustainability cyber internet hosting vector in opposition to Bitcoin miners has been waning as they increased renewable sources.

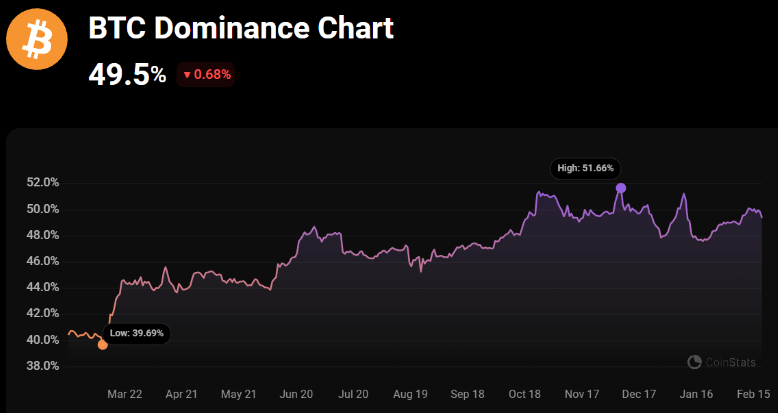

In vibrant phrases, this paints Bitcoin’s idea as sustainable and permissionless sound money, unavailable for arbitrary tampering as is the case with all fiat currencies. In turn, Bitcoin’s easy proposition and pioneering place dominates the crypto market, on the 2d at 49.5% dominance.

Which skill that, the altcoin market revolves round Bitcoin, serving as the reference level for market sentiment. There are hundreds of altcoins to establish between, which creates a barrier to entry, as their comely worth is never any longer easy to gauge. The upward thrust in Bitcoin worth boosts investor self belief to have interaction in such speculation.

As a consequence of altcoins have a considerably decrease market cap per particular particular person token, their worth actions lead to bigger earnings gains. Within the final three months, this has been demonstrated by SOL (+98%), AVAX (+93%) and IMX (+130%) among many other altcoins.

Investors having a ogle to expose themselves to greater profits from smaller-cap altcoins then gain pleasure from Bitcoin ardour spillover end. On high of this dynamic, altcoins present unfamiliar use-conditions that transcend Bitcoin’s sound money side:

- decentralized finance (DeFi) – lending, borrowing, alternate

- tokenized play-to-agree with gaming

- tainted-border remittances at near-quick settlements and negligible prices

- utility and governance tokens for DeFi and AI-primarily based protocols.

With Bitcoin ETFs now in play, institutional capital is within the utilizing seat. The like a flash AUM mumble in place-traded Bitcoin ETFs has been unadulterated success. Working instance, when SPDR Gold Shares (GLD) ETF launched in November 2004, it took one one year for the fund to reach the final uncover sources level of $3.5 billion, which BlackRock’s IBIT reached within a month.

Though-provoking forward, whales will proceed to force up Bitcoin worth with strategic allocations.

Strategic Integration of Put Bitcoin ETFs into Investment Portfolios

Having acquired the legitimacy blessing from the Securities and Rate Alternate (SEC), Bitcoin ETFs gave financial advisors the vitality to allocate. There might be no longer any greater indicator to this than US banks searching for the SEC approval to grant them the the same vitality.

At the side of the Bank Coverage Institute (BPI) and the American Bankers Association (ABA), banking foyer groups are pleading with the SEC to revoke the Workers Accounting Bulletin 121 (SAB 121) rule, enacted in March 2022. By having a ogle to exempt banks from on-steadiness sheet necessities, they are going to scale up cryptocurrency exposure for his or her customers.

Even with out the banking share of Bitcoin allocation, the aptitude for inflows into funding portfolios is huge. As of December 2022, the scale of the US ETF market is $6.5 trillion in total uncover sources, representing 22% of sources managed by funding companies. With Bitcoin being a exhausting counter in opposition to inflation, the case for its allocation is never any longer no longer easy to agree with.

Stefan Rust, Truflation CEO per Cointelegraph stated:

“In this ambiance, Bitcoin is a legit stable-haven asset. It’s a finite resource, and this shortage will most certainly be sure its worth grows along with quiz, making it finally a legit asset class for storing worth or even increasing worth.”

Without conserving precise BTC and tackling self-custody risks, financial advisors can with out problems agree with the case that even 1% of Bitcoin allocation has the aptitude for increased returns whereas limiting market likelihood exposure.

Balancing Enhanced Returns with Risk Management

In accordance to Sui Chung, CEO of CF Benchmarks, mutual fund managers, Registered Investment Advisors (RIA) and wealth administration companies the use of RIA networks are abuzz with the Bitcoin exposure thru Bitcoin ETFs.

“We are talking about platforms who for my fragment depend sources below administration and sources below advisory in some distance more than a trillion greenbacks…A extraordinarily gigantic sluice gate that used to be beforehand shut will commence, very likely in about two months time.”

Sui Chung to CoinDesk

Earlier to Bitcoin ETF approvals, Normal Chartered projected that this sluice gate might perhaps maybe divulge in $50 to $100 billion inflows in 2024 by myself. Matt Hougan, Chief Investment Officer for Bitwise Bitcoin ETF (now at $1 billion AUM) eminent that RIAs have plight portfolio allocations between 1% and 5%.

Right here’s primarily based on the Bitwise/VettaFi ogle published in January, in which 88% of business advisors seen Bitcoin ETFs as a necessary catalyst. The identical share eminent that their purchasers asked about crypto exposure final one year. Most considerably, the share of business advisors who repeat greater crypto allocations, above 3% of portfolio, has greater than doubled from 22% in 2022 to 47% in 2023.

Interestingly, 71% of advisors prefer Bitcoin exposure over Ethereum. Given that Ethereum is an ongoing coding project fit for capabilities as opposed to sound money, here is never any longer that fair.

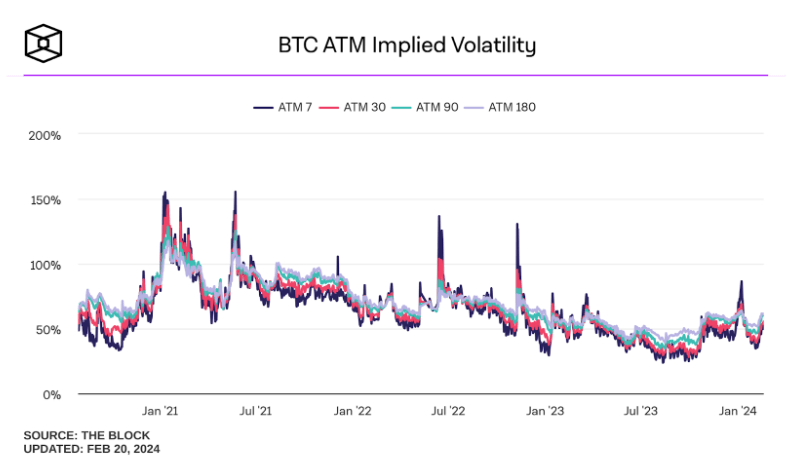

In a recommendations loop, greater Bitcoin allocations would stabilize Bitcoin’s implied volatility. Right now, Bitoin’s at-the-money (ATM) implied volatility, reflecting market sentiment on likely worth circulation, has subsided when put next with the moving spike main to Bitcoin ETF approvals in January.

With all four time sessions (7-day, 30-day, 90-day, 180-day) heading above the 50% differ, the market sentiment is aligned with the crypto anguish & greed index going into the high “greed” zone. At the the same time, because a greater wall of traders and sellers is erected, a greater liquidity pool ends in additional ambiance friendly worth discovery and diminished volatility.

On the opposite hand, there are peaceable some hurdles forward.

Future traits in crypto funding and place Bitcoin ETFs

Against Bitcoin ETF inflows, Grayscale Bitcoin Belief BTC (GBTC) has been to blame for $7 billion worth of outflows. This selling rigidity resulted from the fund’s somewhat high price of 1.50% when put next with IBIT’s 0.12% price (for the 12-month waiver length). Blended with earnings-taking, this exerted gigantic selling rigidity.

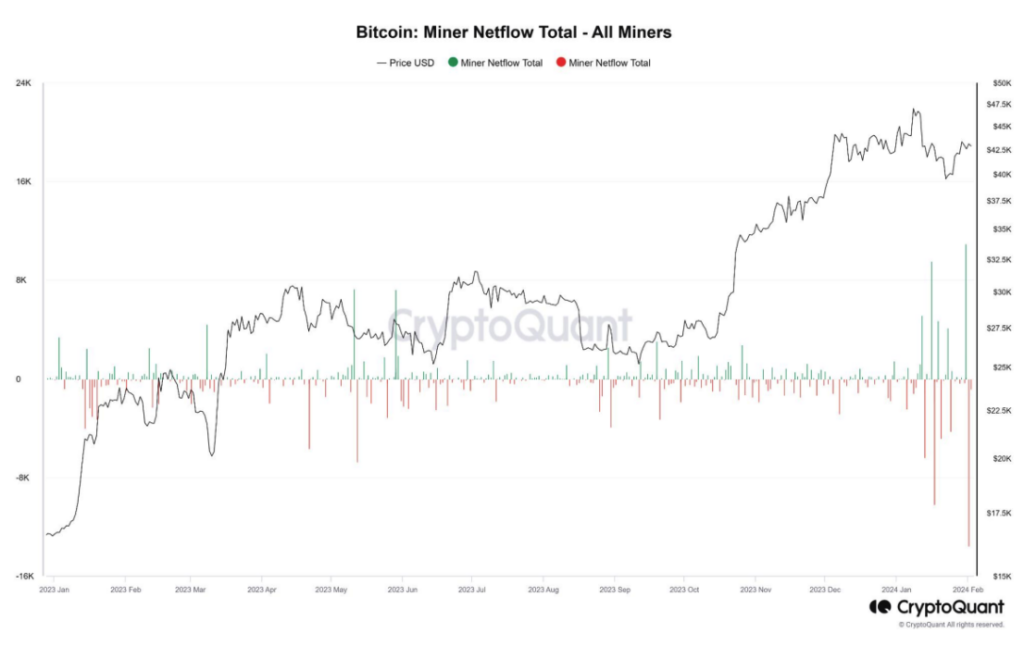

As of February 16th, GBTC holds 456,033 bitcoins, four times greater than the full Bitcoin ETFs combined. As well to this yet-resolved selling rigidity, miners were gearing up for Bitcoin’s publish-4th halving by selling BTC to reinvest. In accordance to Bitfinex, this resulted in 10,200 BTC worth of outflows.

On a each day basis, Bitcoin miners generate round 900 BTC. For the weekly ETF inflows, as of February 16th, BitMEX Analysis reported +6,376.4 BTC added.

To this level, this dynamic has elevated BTC worth to $52.1k, the the same worth Bitcoin held in December 2021, right a month after its ATH level of $68.7 on November tenth, 2021. Though-provoking forward, 95% of Bitcoin present is in earnings, which is plug to exert selling pressures from earnings-taking.

Yet, the rigidity on the SEC from the banking foyer indicates that the buying rigidity will overshadow such market exits. By Might presumably maybe moreover, the SEC might perhaps maybe additional boost the total crypto market with the Ethereum ETF approval.

In that downside, Normal Chartered projected that ETH worth might perhaps maybe high $4k. Barring necessary geopolitical upheaval or stock market crash, the crypto market will most certainly be buying for a repeat of 2021 bull dawdle.

Conclusion

The erosion of cash is a worldwide order. An amplify in wages is insufficient to outpace inflation, forcing of us to have interaction in ever-more volatile funding habits. Secured by cryptographic math and computing vitality, Bitcoin represents a cure to this vogue.

Because the digital economy expands and Bitcoin ETFs reshape the financial world, investor and consultant behaviors are increasingly more digital-first. This shift displays broader societal strikes in direction of digitalization, highlighted by 98% of of us searching some distance-off work choices and, because of the this truth preferring purely digital communications. Such digital preferences affect no longer right our work nevertheless also funding decisions, pointing to a broader acceptance of digital sources love Bitcoin in as a lot as the moment portfolios.

Monetary advisors are poised to search Bitcoin exposure as a portfolio returns booster. All the way in which thru 2022, Bitcoin worth used to be severely suppressed following an extended string of crypto bankruptcies and sustainability issues.

This FUD present has been depleted, leaving bare market dynamics at work. The approval of Bitcoin ETFs for institutional exposure represents a game-changing reshaping of the crypto landscape, main BTC worth to roam ever closer to its old ATH.