Lately, abilities the Ahead Guidance newsletter on Blockworks.co. Tomorrow, rep the news delivered straight to your inbox. Subscribe to the Ahead Guidance newsletter.

Digging into the tips sooner than the following day’s noteworthy jobs picture

In recent months, the steadiness of dangers has shifted from fears about getting a handle on inflation to concerns around whether the Fed is unhurried to the game, and the plot in which this ongoing growth slowdown may possibly well well well evolve into an outright recession.

Paired with that comes the market’s shift from caring about CPI prints to caring about employment recordsdata prints. With the following day’s crucial jobs picture being a key macro driver at this stage of the trade cycle, let’s dig into seemingly the most tips.

Labor market recordsdata signals resilience

After falling for a pair of months, the job vacancy price ticked up from 4.6% to 4.8%. This implies there were more jobs on hand than the outdated month. And when brooding a pair of classic Beveridge curve fabricate of diagnosis that compares job vacancy to unemployment price, there is successfully a decrease threat of an accelerating unemployment price when compared with the month sooner than.

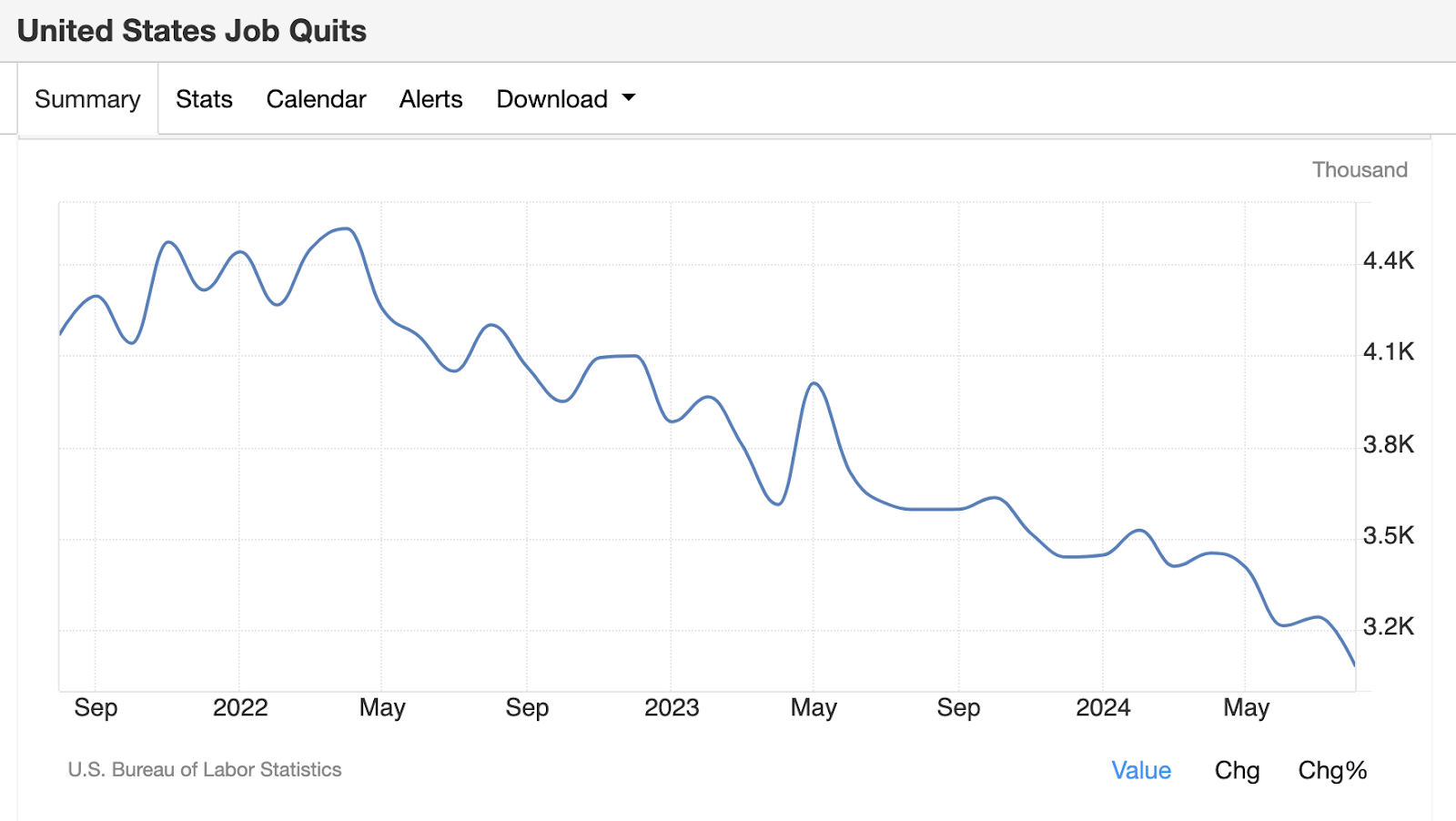

Nonetheless despite a right JOLTS picture in the case of the job openings, the quit price headed decrease — implying employees are now not as assured as they were to plod away their recent job within the hopes of discovering something better-paying. This provides a key cap on the amount of wage growth the labor market is experiencing, as it’s often through job-switching that the biggest wage growth impulses happen.

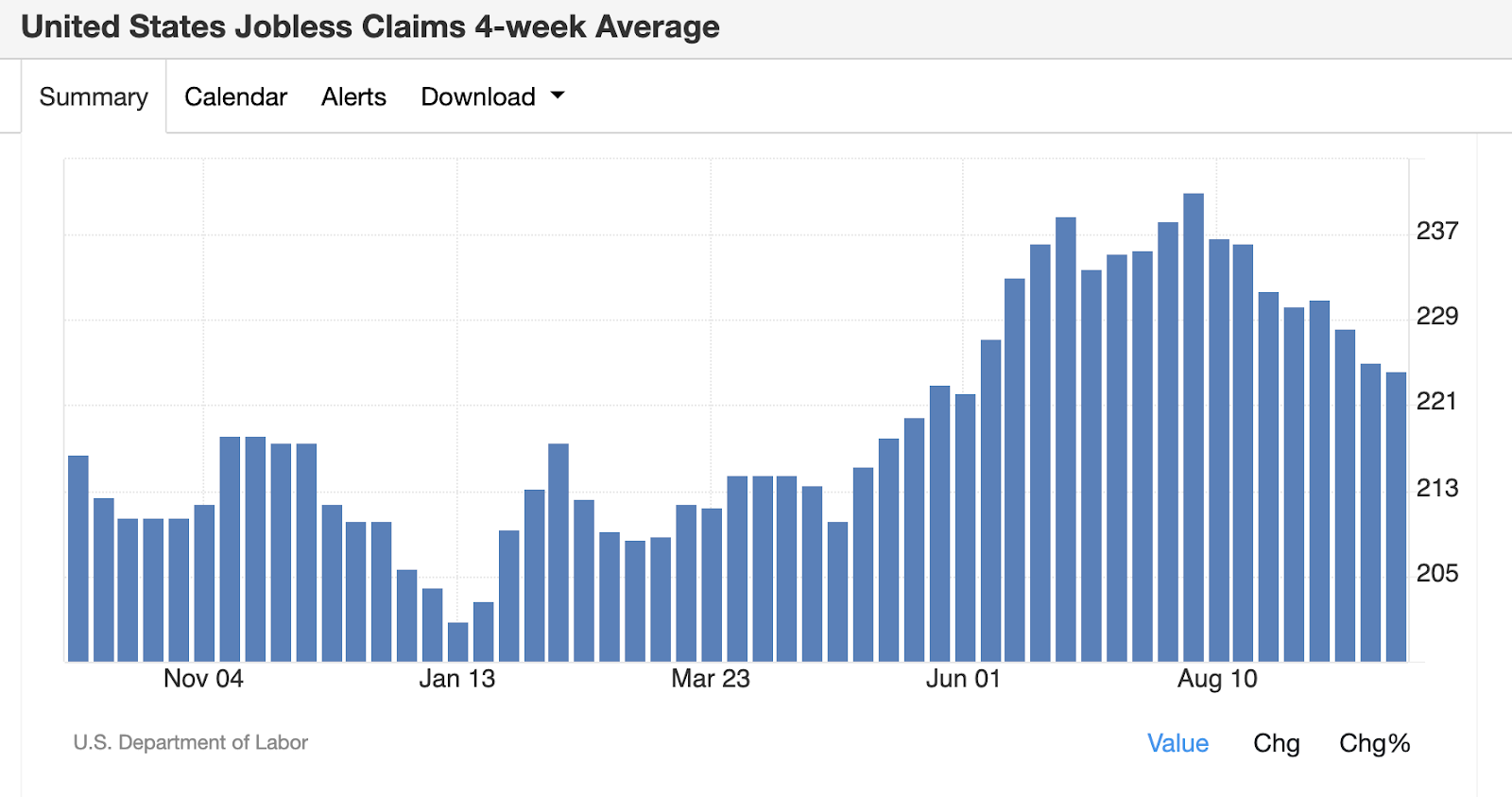

Despite an upside surprise presently in preliminary jobless claims of 225,000 (vs. the forecasted 220,000), the four-week real looking of jobless claims has been in a right downtrend and hit its lowest stage since June.

The outdated three weeks were additionally downside surprises on jobless claims, which paints a high-frequency verbalize of a a minute neutral labor market.

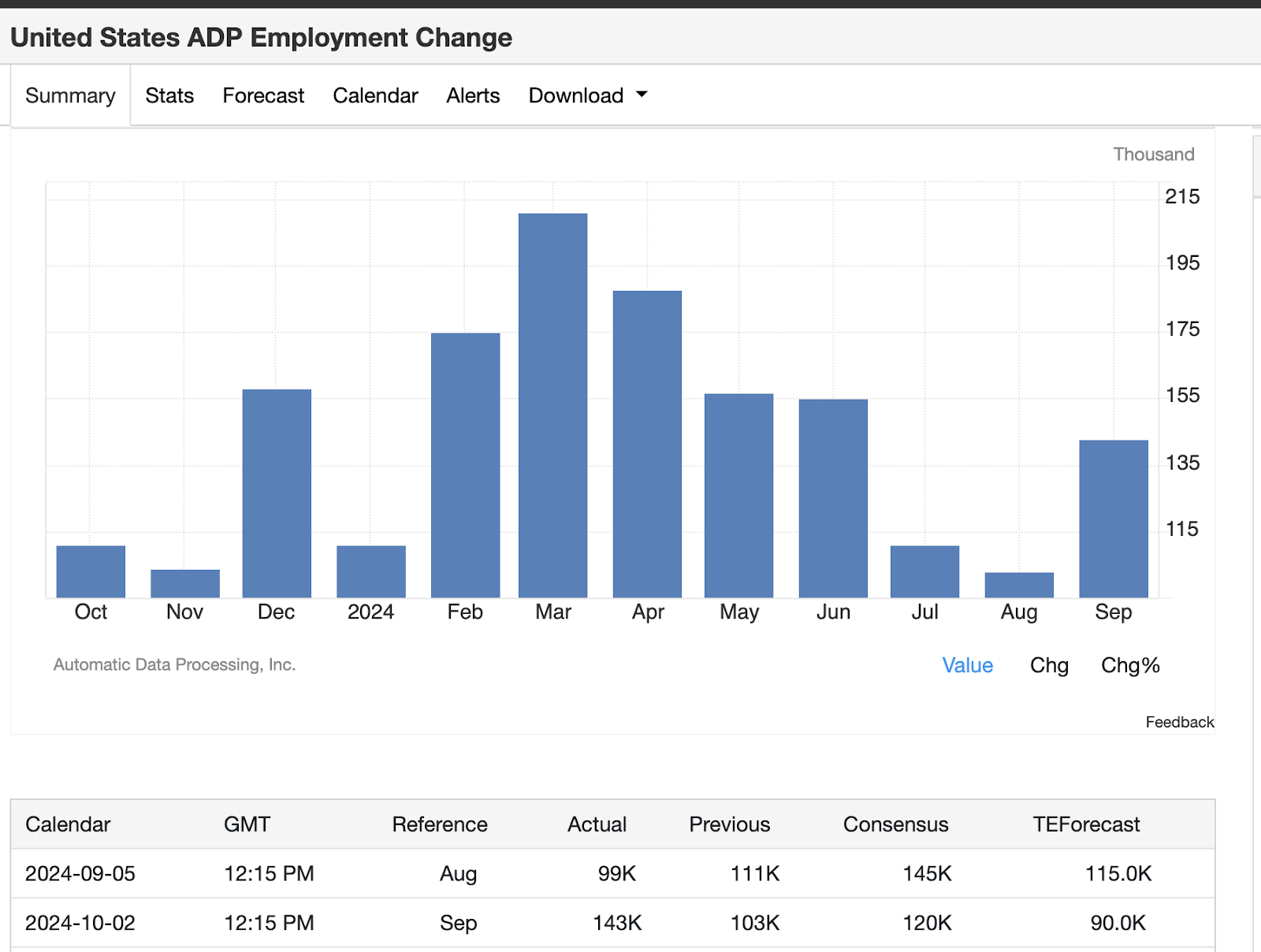

Within the ruin, the ADP employment switch blew previous expectations of 120,000 and printed at 143,000 — up from the prior month’s 103,000.

The ADP print is a right gauge of what to anticipate within the upcoming jobs picture. With such a colossal upside surprise, it gets rid of rather a lot of the tail threat within the encourage of capacity harmful outcomes the following day.

Insist outlook looks first price

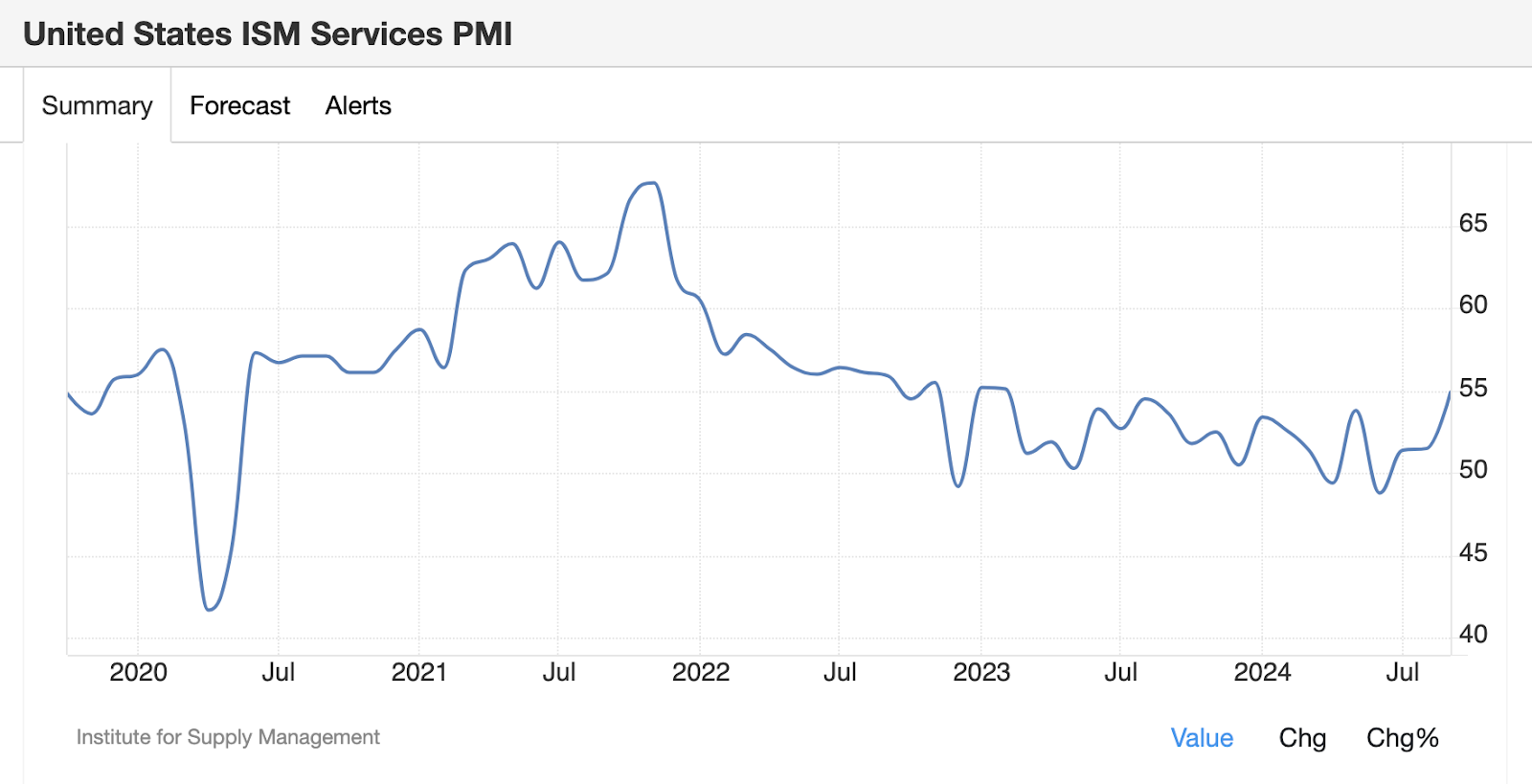

This morning, we got the ISM Services and products PMI. That came in deal above expectations of 51.7, printing a 54.9. Right here’s the perfect print in over a twelve months and an extremely prescient indication that growth within the economic system remains right.

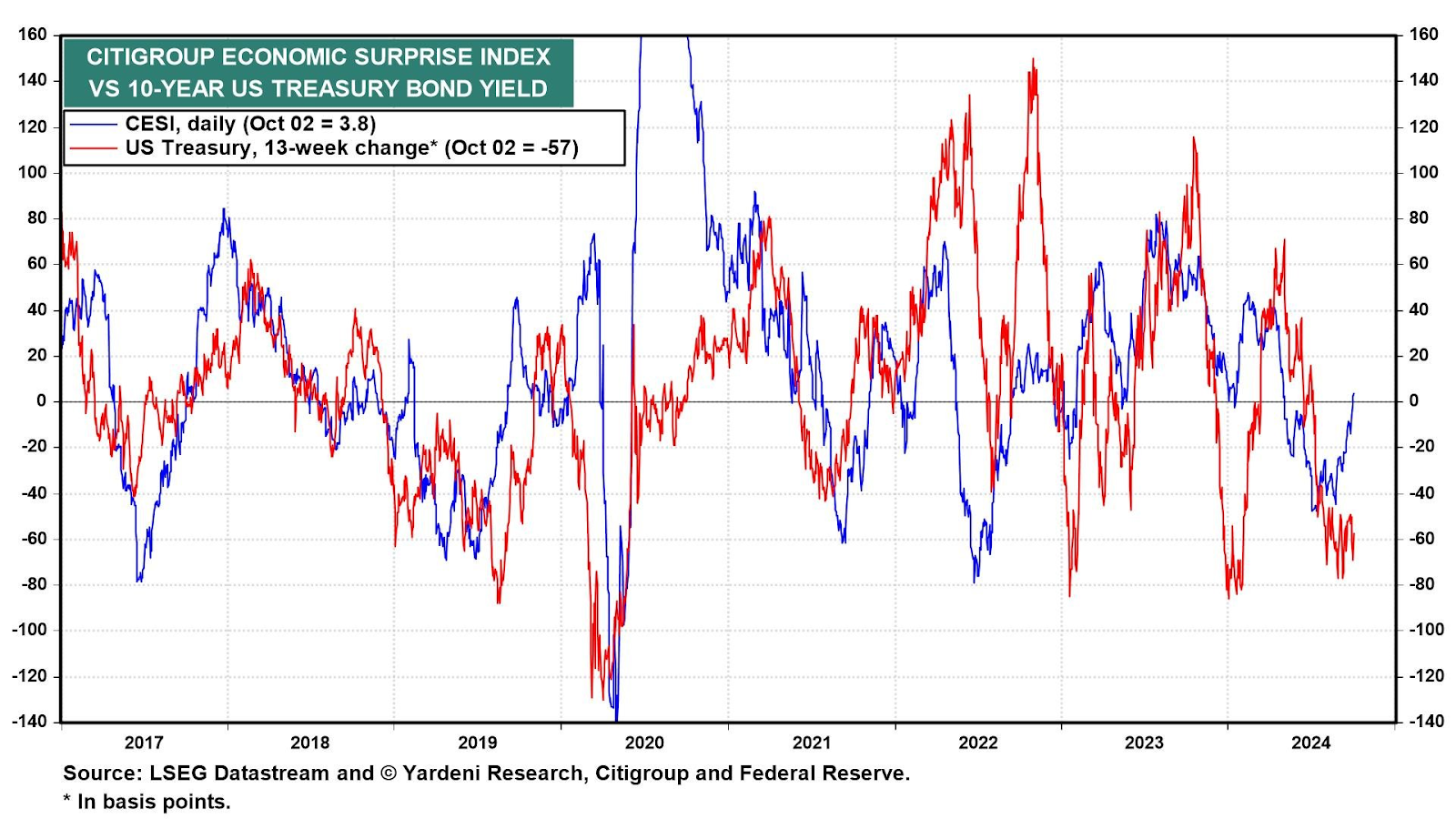

Bringing all these recordsdata components together, let’s now survey at the economic surprise index:

After a colossal lag downward — implying worse-than-forecasted economic recordsdata prints — we now earn got now reversed encourage into particular territory. What that leaves us with on the eve of the biggest jobs picture of our lifetime (till the following one comes out, needless to claim), is that the economic system is surprisingly resilient. In step with the simpler frequency labor market recordsdata that’s near out this week, the jobs picture the following day it’s miles going to be dazzling.

— Felix Jauvin

1

The gathering of equal-weight S&P 500 sectors that outperformed their market cap-weighted counterparts at some level of the first three quarters of the twelve months. The sphere in query changed into as soon as exact estate.

Why does this topic? It displays us it’s now not fair tech main the market cap S&P to unique heights this twelve months.

The equal weight S&P 500 index is up fair over 12% in 2024, whereas the market cap-weighted model has won shut to 20% for the rationale that launch of the twelve months.

Did Grewal sell out?

The head of the SEC’s enforcement division will be departing the company subsequent week.

Gurbir Grewal, who has led the US securities regulator’s enforcement operations since July 2021, joined the company fair months after Gary Gensler changed into as soon as sworn in as chair.

Crypto-connected enforcement actions, which had been on the upward push sooner than Grewal and Gensler took over, were a first-rate allotment of Grewal’s tenure.

Under Grewal’s leadership, the company issued 35 crypto enforcement actions in 2022 and 40 in 2023. Plus, the division of enforcement practically doubled its crypto resources and cyber unit in Could well maybe also fair 2022, bringing the crew’s headcount to 50.

In 2024 (as of Sept. 6), the company had brought 18 crypto enforcement actions.

Most critically, the company’s cases against Coinbase, Binance, Kraken and Consensys were all brought below Grewal. Every suit has, in allotment, addressed token classification — a first-rate theme below the Gensler/Grewal regime. The SEC additionally launched and closed its so-referred to as “Ethereum 2.0” investigation below Grewal.

The company, at some level of Grewal’s tenure, has additionally shown vital amplify in NFTs, which the SEC on the general considers to be securities.

Gensler has rather a lot of time left in his length of time, so I don’t request we’ll scrutinize a colossal switch in enforcement patterns below the following director. The sizzling deputy director of the division, Sanjay Wadhwa, will step in as appearing director beginning Oct. 11. The SEC declined to roar on who will take over the aim completely.

If I had to bet, I’d verbalize Grewal’s headed to the non-public sector, but we can fair earn to encourage and scrutinize.

— Casey Wagner

Banks rep set of dwelling to exercise Swift for new transaction trials

It feels like shall we scrutinize one other noteworthy step ahead on the crypto transaction front as banks rep set of dwelling for trials on a system powering billions of money transfers.

Monetary establishments will be ready to rapidly exercise Swift’s platform to test out the settlement of “digital resources and currencies,” the group stated Thursday.

These pilot transactions are set of dwelling to launch subsequent twelve months.

A handy book a rough reminder for these in want: Swift — the Society for Worldwide Interbank Monetary Telecommunication — changed into as soon as shaped in 1973 and provides a messaging network through which world payments are initiated.

With more than 11,000 establishments connected to the network, Swift carries more than 5 billion financial messages each and every twelve months.

Swift Chief Innovation Officer Tom Zschach place apart it merely in an announcement: “For digital resources and currencies to succeed on a global scale, it’s crucial that they may be able to seamlessly coexist with mature forms of money.”

The upcoming pilots were born from plentiful prior experimentation.

Swift claimed in 2022 it had efficiently shown that CBDCs and tokenized resources can lag seamlessly on existing financial rails. When setting up a global CBDC system, it added, familiarity (alongside the infrastructure) is a needed side.

Then last twelve months, Swift sought to link non-public and public blockchains in a trial collaboration with Chainlink and finance giants equivalent to BNP Paribas and BNY Mellon (assessments it indirectly deemed a success).

Swift additionally has its hand in other efforts connected to tokenized resources — a local Standard Chartered stated may possibly well well well attain $30 trillion by 2034.

It’s taking piece in Mission Agora (led by the Bank for World Settlements), which is exploring how tokenization can encourage wholesale defective-border payments. Swift is additionally looking out into how its “interlinking capabilities” may possibly well well well integrate the US Regulated Settlement Community, as an instance, with TradFi systems.

Visa and Mastercard stated in Could well maybe also fair they may possibly possibly maybe well be part of banks like JPMorgan and Citigroup to test this so-referred to as Regulated Settlement Community. Colin Butler, Polygon’s global head of institutional capital, stated these entities getting closer to aligning on a mature represents “the 5-yard line for mass institutional adoption.”

Whereas most effective time will list what precisely we be taught from these future trials, the likelihood of financial establishments having a single level of access to digital asset lessons and tokens seems bullish.

— Ben Strack

Bulletin Board

- Funds huge Visa has created a platform to establish out to wait on financial establishments field fiat-backed tokens and test out their exercise cases. Spain-primarily primarily based BBVA has been working at some level of the Visa Tokenized Asset Platform (VTAP) sandbox this twelve months and seems to launch an preliminary pilot with decide clients in 2025 on the Ethereum blockchain.

- A CFTC subcommittee voted to pass ideas connected to insurance policies to encourage utilizing blockchain for non-cash collateral, Bloomberg reported, citing unnamed sources “acquainted with the topic.” The Global Markets Advisory Committee will now withhold in mind the ideas and is anticipated to vote later this twelve months. Such approval may possibly well well well raze it more uncomplicated for establishments to accept tokenized resources as collateral.

- Grayscale Investments launched an Aave belief Thursday after introducing an XRP belief last month. The crypto-centered asset supervisor has been on a product-launching kick this twelve months, additionally debuting trusts retaining bittensor (TAO), sui (SUI), maker (MKR) and avalanche (AVAX) in August.