Layer 2 blockchains are a indispensable piece of the Ethereum ecosystem. They are built to onboard new users and enable mass adoption of blockchain technology. But how manufacture Layer 2 blockchains fabricate this imaginable? And why are transactions more inexpensive and faster on L2s? This manual explains all the pieces about Layer 2 scaling solutions.

What Is a Layer 2 in Blockchain?

The Definition of Layer 2

A Layer 2 community is a secondary blockchain that lives inside but every other community is named Layer 1. It processes and executes transactions off the important chain and sends the outcomes to the Layer 1 chain.

Layer 2 blockchains are furthermore known as Layer 2 solutions because they solve scalability concerns.

Why Blockchains Want Layer 2 Solutions

Layer 1 blockchains be pleased Ethereum contain scalability barriers. They need Layer 2 blockchains to contend with more transactions per 2d (TPS) and to in the reduction of gasoline costs.

They furthermore ride the adoption of cryptocurrencies and decentralized apps (dApps).

The Relationship Between Layer 1 and Layer 2

Layer 1 is the wrong chain that presents security and consensus. Layer 2 handles thousands of transactions lickety-split and cheaply, however it surely soundless relies on a Layer 1 blockchain to overview and finalize all the pieces.

How Does a Layer 2 Work?

Off-Chain Processing and On-Chain Settlement

Layer 2 blockchains are be pleased minded with Ethereum. Users can send and receive tokens or work along with swish contracts on them. An L2 uses a diversified mechanism to compute and job transactions off-chain, making it extremely scalable.

Next, L2s lump transactions collectively and send them to the wrong layer. This step is dependent upon the kind of Layer 2 acknowledge being venerable. Some solutions send a cryptographic proof to the wrong layer. Others deem all transactions are legit.

Sooner or later, L2s send the guidelines to L1 via a swish contract. The unsuitable layer resolves any disputes and provides legit transactions to the subsequent block.

Security Inherited from the Putrid Layer

Layer 2 solutions inherit their security from Ethereum. Such solutions contain a swish contract deployed on Layer 1. Other L2s rely on a bridge to communicate. The swish contract receives last balances and the convey of the L2 community. The unsuitable layer then verifies the submitted files via proofs or dispute mechanisms.

Since Layer 2 transactions happen off-chain, Ethereum becomes the final source of truth attributable to its consensus mechanism and immutability. Any fraud proofs, validity proofs, or convey commitments submitted by L2 networks are no longer immediately finalized on the wrong layer. This mitigates any malicious behavior that takes set on L2 networks.

Transaction Amble and Mark Nick charge

Transacting on L2 networks is rapid and cheap. Such secondary networks are very unprejudiced correct for frequent traders. Transactions on Layer 2 networks are processed rapid because they battle via a sequencer. A sequencer is a server or a cluster of servers that processes transactions. It ought to be centralized or decentralized, and it’d be operated by contributors, businesses, or third-celebration operators.

Transacting on L2 networks is inexpensive since the sequencer bundles transactions and sends them to the wrong layer as a single transaction. This draw splits the gasoline costs of one unsuitable-layer transaction between L2 users, which significantly reduces gasoline costs.

Sorts of Layer 2 Solutions

Rollups (Optimistic Rollups, ZK-Rollups)

Rollups are a manner to bundle hundreds of transactions on Layer 2 networks proper into a single transaction on Layer 1. There are two forms of L2 rollups:

- Optimistic rollups

- Zero-files proof (ZK) rollups.

Both forms bundle Layer 2 transactions, however they work along with the wrong layer in every other case.

Optimistic Rollups

Optimistic Rollups manufacture transactions off-chain and send the guidelines to the wrong layer via calldata or blobs. This draw assumes that one and all transactions are legit, hence the establish. Optimistic Rollups furthermore compress transaction files forward of sending it to Ethereum to in the reduction of charge.

When Ethereum’s swish contract receives transaction files, any individual can self-discipline this optimistic assumption the instruct of fraud proofs within a particular dispute window. Ethereum if truth be told takes an “harmless unless proven responsible” draw when going via Optimistic Rollups.

This dispute window varies and is dependent upon the Layer 2 acknowledge. And the folk who self-discipline this assumption are Ethereum participants is named validators or watchers.

If a fraud proof succeeds, Ethereum reverts the invalid convey, and the malicious sequencer is penalized by shedding its staked ETH collateral. The correct convey is then enforced on the wrong layer.

If no legit fraud proof is submitted all over the dispute period, the batch of transactions is opinion of legit and finalized on Ethereum.

ZK-Rollups

Zero-files-proof Rollups (ZK-rollups) work in a equivalent manner to Optimistic Rollups. They manufacture thousands of transactions off-chain and submit the guidelines to swish contracts that stay on the wrong layer. Nonetheless, as a replace of assuming that one and all transactions are legit, ZK-Rollups demonstrate that every transaction is legit forward of sending it to Ethereum. Here’s done by generating cryptographic proofs, furthermore known as zero-files proofs, which mathematically overview the correctness of the final batch.

ZK-rollups rely on an operator (aka prover or sequencer) to job transactions, generate proofs, and send them to Ethereum. Some rollups rely on centralized operators while others instruct semi-decentralized provers. Proofs are verified straight away, hence there’s no dispute period, and users entry their funds straight away. Once the validity proof is permitted by Ethereum’s swish contract, the transaction files is added to the subsequent confirmed block on the wrong layer.

Remark Channels

Remark channels are a diversified manner to scale Ethereum. A single convey channel lets two or more folk send and receive tokens, rapid and cheap, with out on-chain settlement. When they halt transacting, they may be able to submit the last convey and transaction summary to Ethereum.

A convey channel is peek-to-peek (p2p) and is governed by a multi-signature swish contract. To starting up out a convey channel, peers must lock funds in a swish contract built on the wrong layer. The locked funds are collateral to substantiate honesty and quit disputes. Any convey change is done and validated by those peers. This draw reduces gasoline costs, computation on Ethereum, and speeds transactions.

In case of a dispute between participants, the problem is resolved on the wrong layer, the set the latest signed convey will doubtless be enforced by Ethereum’s consensus.

Remark channels contain some barriers. They require peers to stay online the final time and video show the channel. Furthermore, they’re no longer user-friendly, and it’s advanced to video show a pair of channels simultaneously.

Plasma Chains

A Plasma chain is a separate chain linked to the wrong layer, is named the root chain or mum or dad chain on this case. Plasma chains, furthermore known as youngster chains, are managed by a swish contract deployed on the mum or dad chain.

Plasma chains job and overview transactions off-chain, lowering verification hundreds on Ethereum. They rely on one operator or a pair of operators to put collectively and manufacture transactions, making them faster. Nonetheless, easiest the last convey is periodically submitted to Ethereum for security anchoring.

To manufacture essentially the most of a Plasma chain, a user must deposit Ether or ERC-20 tokens proper into a swish contract. The operator creates new tokens such as the user’s funds. To exit the Plasma chain, a withdrawal ask ought to be submitted. Then, the ask is challenged via a fraud-proof for spherical 7 days. If the matter fails, the withdrawal ask is permitted and done. But if the matter succeeds, the operator is penalized.

Whereas Plasma chains appear to operate be pleased rollups, they contain some barriers. Prolonged exit queues from a Plasma chain to Ethereum face a crucial reveal of files unavailability. Here’s since the Plasma chain operator stores the guidelines and easiest submits it to Ethereum periodically. On the replace hand, rollups provide pudgy transaction files whenever a user needs to trade or withdraw funds.

Sidechains (and why they fluctuate from factual L2s)

Sidechains are no longer Layer 2 networks; however, they abet Ethereum scale. They are separate blockchains that join to Ethereum via a bridge. Sidechains contain diversified block specs and consensus mechanisms. They disinherit Ethereum’s security properties and manufacture no longer submit transaction files or convey roots assist to Ethereum. This makes them at possibility of malicious assaults and centralization.

To manufacture high throughput, sidechains put in power bigger block sizes and greater gasoline limits. Running greater blocks at rapid processing cases requires extremely efficient hardware. This makes it advanced for everyone to high-tail a pudgy node, resulting in centralization and malicious assaults.

Sidechains are EVM-be pleased minded, making Ethereum dApps high-tail with minimal modifications. Sidechains work along with Ethereum via a bridge, which is a series of swish contracts deployed on both chains. The bridge implements a mint and burn mechanism, permitting users to enter a sidechain, transact, and exit assist to Ethereum.

Trendy Layer 2 Initiatives in 2025

Arbitrum

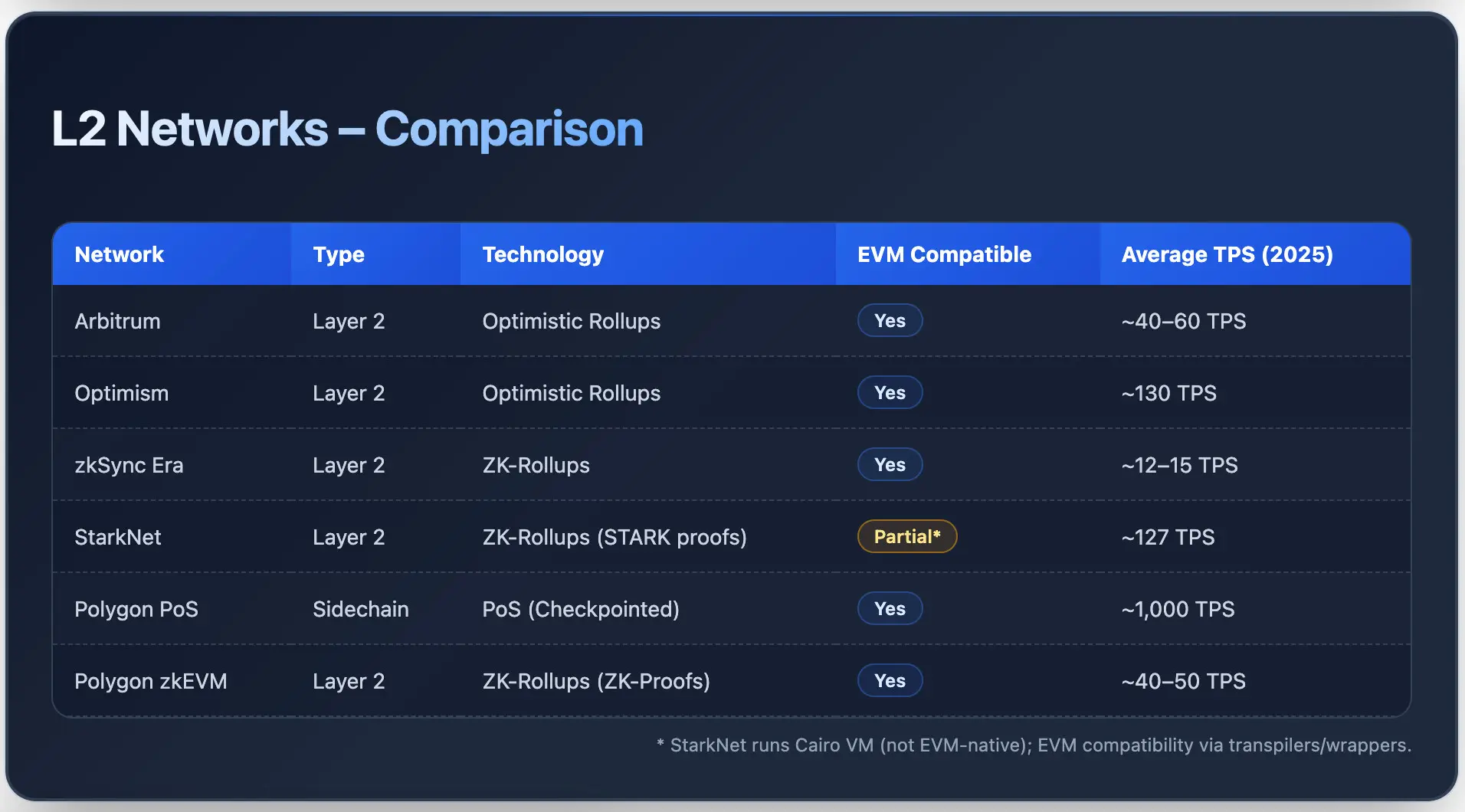

Arbitrum is an L2 that uses Optimistic Rollups to job transactions off-chain and submit them to Ethereum. It gives lower costs to traders while relying on Ethereum’s security.

Arbitrum helps the Ethereum Digital Machine (EVM), making it easy for builders to deploy swish contracts with minimal modifications. The L2 has a like a flash of products, including Arbitrum One, Arbitrum Nova, and Arbitrum Orbit, which assist DeFi, gaming, and enterprise dApps.

The favored gasoline charge per transaction ranged between $0.007 and $0.015 in June of 2025. Swapping a token charges $0.30 on moderate, and transactions are finalized within minutes.

Optimism

Optimism is an Ethereum-be pleased minded L2 that relies on Optimistic Rollups. Correct be pleased Arbitrum, Optimism executes transactions off-chain and sends the bundled files to Ethereum. The L2 gives low gasoline costs and a high TPS rate.

Optimism is built with a modular OP Stack, which permits builders to deploy EVM swish contracts with ease. As of 2025, the Optimism Superchain has processed 2.47 billion transactions and secured ~$3.4 billion in total sign locked (TVL). The community has an moderate block time of 200 milliseconds.

zkSync Period

zkSync Period is a layer 2 scaling acknowledge for Ethereum, and it uses ZK rollups. It in actuality works in a equivalent manner to Optimism and Arbitrum; however, it’s diversified and uses ZK rollup technology. zkSync processes transactions off-chain, proving their validity forward of sending them to Ethereum.

The favored on each day basis transactions on zkSync grew from 290,000 in Q4 2024 to 1.1 million in Q1 2025. The favored costs furthermore dropped to $0.03 per transaction in Q1 2025. Based completely on files mild from zkSync’s blockchain explorer, the community has processed spherical 465 million transactions, with an moderate block time of two to 4 seconds.

StarkNet

StarkNet is an L2 that uses ZK-rollups, or validity rollups, built on Ethereum. The L2 uses STARK proofs to substantiate every off-chain transaction bundle is verified forward of settlement on the wrong layer.

In mid-2025, StarkNet reached Stage 1 decentralization, a milestone in a framework for rollup networks proposed by Vitalik Buterin. It approach StarkNet’s rollups contain passed key technical and governance thresholds, bringing the community nearer to pudgy decentralization.

StarkNet helps Cairo-based swish contracts and native yarn abstraction. The favored transaction charge on StarkNet is intensely low, spherical $0.0013. The community recorded over 127 TPS in late 2024, with sub-2-2d affirmation cases.

Polygon PoS and Polygon zkEVM

Polygon PoS is a high-throughput sidechain. It’s EVM-be pleased minded and helps in scaling Ethereum. The sidechain uses a dual-layer structure and processes transactions off the wrong chain. It has periodic checkpoints guaranteeing settlement and security on Ethereum. Polygon PoS has a transaction throughput of ~1,000 TPS and helps millions of users with gasoline costs below $0.01.

Polygon zkEVM is an L2 community. It’s completely EVM be pleased minded and uses ZK-Proofs to overview transactions forward of posting them on Ethereum. As of 2025, Polygon zkEVM processes spherical 40 to 50 TPS, with high capability reaching over 200 TPS all over testing. The favored gasoline costs fluctuate between $0.02 and $0.05 per transaction, which is ready 90% more inexpensive when put next with Ethereum.

Advantages of Layer 2 Blockchains

Decrease Transaction Costs

With out a doubt one of the critical important benefits of Layer 2 blockchains is lower transaction costs. Within the course of the 2021 bull market, Ethereum charged users hundreds and even thousands of bucks attributable to community congestion. Layer 2 networks solve this by bundling transactions and splitting the associated charge of a single Ethereum transaction among many users, making costs minimal.

Quicker Transaction Speeds

Layer 2 networks provide near-instantaneous transactions because they rely on a sequencer to bid and job transactions lickety-split. Ethereum, on the replace hand, takes longer to substantiate transactions attributable to its decentralized validator community.

Scalability for DeFi, NFTs, and Gaming

Layer 2 blockchains provide the particular playground for DeFi, NFTs, and gaming dApps to thrive and set mass adoption. Since transaction costs are negligible, sending and receiving cash or in-game gadgets and other forms of NFTs is discreet and almost instantaneous.

Improved User Expertise

L2 networks provide a greater user trip, namely for brand new users. They supply reduced latency, lower entry charges, and simplify interactions with dApps. Users score pleasure from near-instantaneous transactions and smoother entry to dApps with out experiencing congestion when put next with the wrong layer.

Challenges and Risks of Layer 2s

Security Assumptions

Layer 2 networks inherit their security from Ethereum however introduce their occupy have faith assumptions. Sequencers, bridges, and files availability layers can change into crucial functions of failure. If invalid files is submitted or if a proof self-discipline fails, operators may lose their ETH stake, and users may lose funds or trip delays.

User Expertise & Bridging Risks

Transferring tokens between L1 and L2 or vice versa has some dangers. Users may lose funds or trip delays attributable to advanced UX or glum wallet integration, which drives users away in spite of low costs and high throughput.

Centralization Concerns

L2 networks are technically centralized because they rely on a sequencer operated by chosen validators. This may maybe maybe lead to censorship, downtime, and technical failures, lowering decentralization and user have faith.

Regulatory Uncertainty

L2 networks operate in a grey location. Institutions are no longer adopting L2 networks in the intervening time because principles spherical custody, coin classification, and infrastructure are unclear.

Layer 2 vs Layer 1: Key Differences

Settlement and Security

Layer 1 and Layer 2 networks operate in every other case in the case of settlement and security. L1s resolve transactions immediately, while L2s rely on the wrong chain settlement layer. L1s contain pudgy security via a consensus mechanism and a community of validators, while L2s’ security is dependent upon Layer 1.

Amble and Throughput

Layer 1 and Layer 2 blockchains contain diversified speeds and throughput charges. L1s, be pleased Ethereum, are shrimp to tens of transactions per 2d (spherical 10 to 15 TPS).

L2 networks contend with hundreds or thousands of TPS since they job transactions off-chain.

In essence, L2s are faster than L1s, making them ideal for valid-time interactions with users and dApps.

Exhaust Circumstances and Change-Offs

L1s are very unprejudiced correct for top-sign transactions the set decentralization is crucial. For instance, Ethereum is venerable by stablecoin issuers and institutional DeFi platforms be pleased Aave. L1s are furthermore ideal for transferring NFTs be pleased CryptoPunks and Fleshy Penguins since they’re high-sign gadgets.

L2s are perfect for frequent, low-charge transactions be pleased micropayments, gaming, or high-frequency procuring and selling. L2 trade-offs are rapid and cheap transactions, however with centralization and weaker security.

The Scheme forward for Layer 2 Scaling

Ethereum’s Rollup-Centric Roadmap

Ethereum’s roadmap entails dank sharding and proto-dank sharding.

Beneath EIP-4844, proto-dank sharding will raise cheap blob files for L2s, while dank sharding targets to scale Ethereum rollups to 100,000 TPS. Here’s imaginable by making L2 files mighty and more inexpensive.

The important purpose of the roadmap is to extra lower L2 gasoline costs while increasing throughput. Furthermore, the upgrade will focal point on strengthening L1’s security and settlement.

Depraved-L2 Interoperability

Depraved-L2 interoperability is a notion launched by Optimism. The notion that named Superchain introduces seamless communication between OP Stack L2 chains.

Superchain targets to get rid of remoted rollups and merge security and governance all over a pair of L2s. This may maybe fabricate it imaginable to transfer transactions between L2s via the Depraved-L2 Inbox, bridging contracts, and standardized fault proofs.

Atomic depraved-chain calls will doubtless be imaginable, along with unification in gasoline tokens and liquidity all over L2s. For instance, OP Stack L2s similar to Putrid, Mode, Zora Network, and Frax Tool can communicate, forming a Superchain.

Layer 3 Solutions on the Horizon

Layer 3 solutions are diversified from L2s. Layer 2s are abnormal-reason scaling solutions for Ethereum, while L3s work on scaling dApps. L3s contend with personalized instruct cases to lower costs and scale transactions, be pleased in gaming, enterprise apps, or privacy-centered rollups.

StarkNet’s L3 Appchains, zkSync’s Hyperchains, and Arbitrum Orbit are examples of L3 implementations. These solutions let builders fabricate essentially the most of their occupy rollups while inheriting L2 security.