Bitcoin Label: BTC, the leading cryptocurrency by market cap, became once aggressively bullish in February because the charge jumped from $42279 to $46000 to register 51.4% enhance. Nevertheless, the digital asset witnessed a surge in volatility coming into the march because the overhead provide at $64000 stalled the restoration momentum. The consolidation pattern within the weekend reflects the formation of a bullish continuation sample known as Pennant.

Additionally Be taught: Bitcoin Provide and Request Files Suggests over 20% Disparity, Label Surge Forward?

Flag Pattern Projects Bitcoin Label to Surpass $70000

The ongoing restoration pattern in Bitcoin faces provide rigidity at $64000 evidenced by the prolonged-wick rejection candles. The overhead promoting has shifted the BTC trace sideways, alongside with main altcoin indicating the market sentiment of publish-rally consolidation.

An diagnosis of the 4-hour timeframe charts this lateral circulation is confined inside two converging trendlines predicting the formation of symmetrical patterns. The chart affords a temporary breather for the asset to win strength for the next leap.

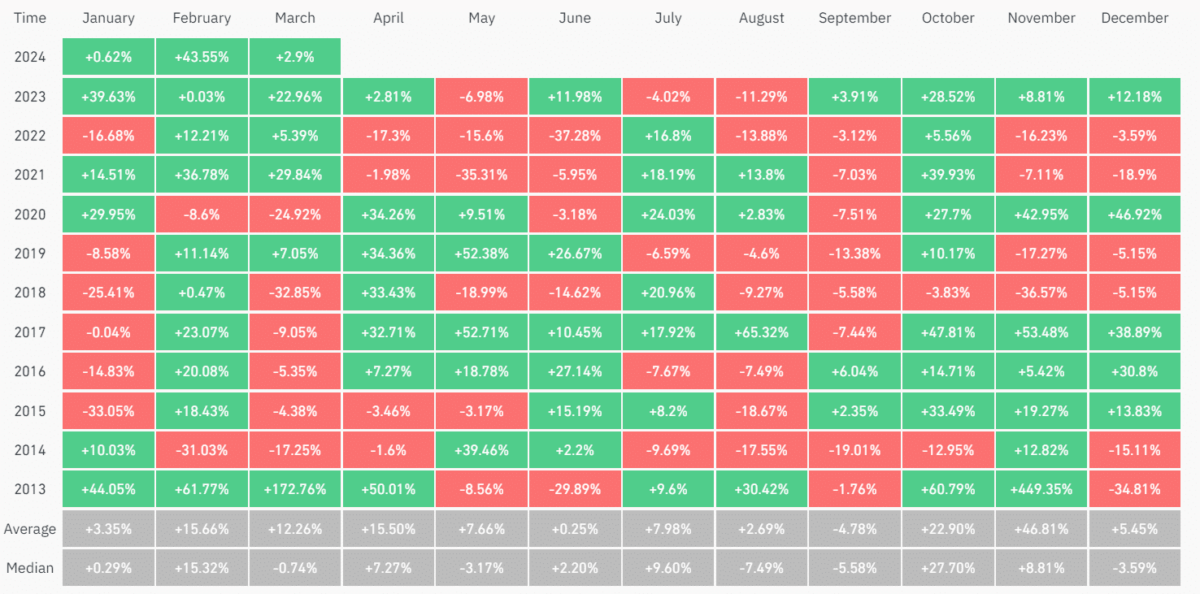

Furthermore, fresh recordsdata from Coinglass reveals Bitcoin’s month-to-month returns from 2013 to 2024. Examining the March efficiency particularly, the pattern appears to be mixed, with optimistic returns in five out of the eleven years listed.

The returns for March bask in seen essential fluctuations, starting from a high of +172% in 2013 to a low of -32.85% in 2018. Nevertheless, the in model March return over these years is +12.20%, and the median is -1.11%, indicating that sources remain a tiny bit on a optimistic insist.

—

The presence of each high optimistic and unfavorable returns in March suggests a lack of consistent inclinations all over this duration, making it no longer easy to foretell future efficiency basically based fully on historical recordsdata.

Will Bitcoin Label Upward thrust to $75,000?

For the time being shopping and selling at $62802, the Bitcoin trace teases a bullish breakout from the upper boundary of the pennant chart sample. A profitable breakout with a 4-hour candle closing will signal the continuation of the present pattern. If the sample holds correct, the Bitcoin trace is probably going to fling a doable goal of $66655, followed by $75,000.

Technical Indicator

- Bollinger Band: The squeezed range of the Bollinger Band indicator accentuates elevated volatility in this asset.

- Common Directional Index: The downsloping ADX slope at 49% reflects that Bitcoin customers are restoring their strength amid present consolidation.

Connected Articles

- BTC, DOGE, AR Label Prognosis As Crypto Market Hit By Post-Rally Consolidation

- Crypto Markets to Glimpse These 3 Trends Before Upcoming Bitcoin Halving

- Crypto Market Forecast: Key Events To Witness This Week Amid Fed Chair’s