What is Bitcoin hashrate?

Bitcoin hashrate refers to the total computational energy that miners contribute to the Bitcoin community. It represents the entire collection of calculations (hashes) that the community can map every 2nd to validate and earn transactions.

A hash is an alphanumeric code generated randomly, and hashing involves making an strive to guess that code or something very shut to it. The hash price represents the gathering of guesses per 2nd made by computer programs on the community, whether or now not it be from a single miner, a mining pool, or the total community mixed.

The worldwide Bitcoin community hashrate, measured in hashes per 2nd (H/s), is optimistic by components respect mining field and block time. Because the hashrate will enhance, abbreviations respect EH/s are venerable to signify the tremendous numbers enthusiastic.

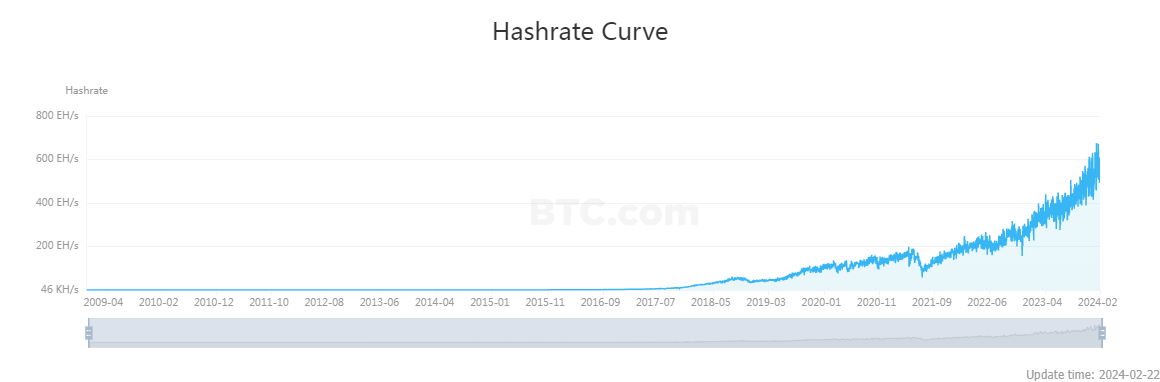

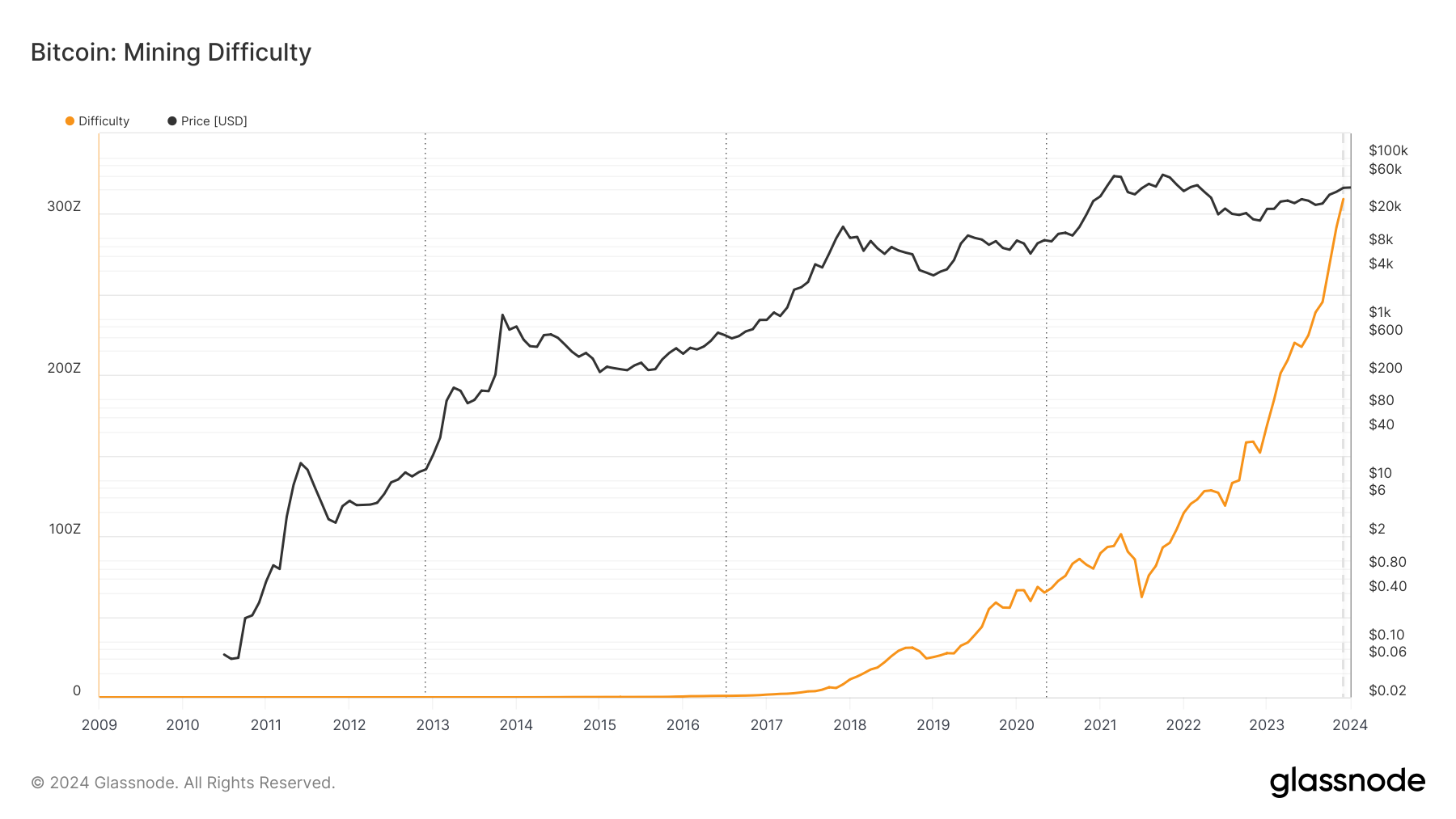

At the moment, the Bitcoin hashrate stands at 582.96 EH/s, with a mining field of 81.73 T at block prime 831,437. The hashrate doesn’t dictate block-fixing velocity; block time is regulated by mining field modifications.

Historic context

On the muse, Bitcoin mining may perchance be completed the usage of regular computer programs. On the change hand, as the community grew, miners developed extra worthy hardware, similar to ASIC (Application-Direct Built-in Circuit) machines, to compete for block rewards. This led to a basic expand in the Bitcoin hashrate over time.

The hashrate has experienced fluctuations due to quite lots of issues, including modifications in mining field, the introduction of extra atmosphere pleasant mining tools, and shifts in the cost of Bitcoin. No topic these fluctuations, the total vogue has been upward, reflecting the rising ardour and funding in Bitcoin mining.

How does it work?

Miners use if truth be told expert computer hardware to resolve complex mathematical considerations, identified as cryptographic hashes. These calculations ensure the integrity of transactions and help create new blocks in the Bitcoin blockchain. The hashrate measures how hasty miners can map these calculations.

To calculate Bitcoin mining earnings, use our Bitcoin mining calculator according to the present hashrate and field. The Bitcoin hashrate is calculated according to components respect the present field stage, outlined block time, and common block time of contemporary blocks. You may well take a look at the global Bitcoin hashrate the usage of the “getnetworkhashps” state in most paunchy Bitcoin nodes.

The hash price measures the gathering of hashes (or guesses) per 2nd on a blockchain community, indicating its processing energy. The bigger the community, the increased the hash price. Hash price is most incessantly expressed in varied units:

- Kilohash per 2nd (KH/s): 1,000 hashes per 2nd, veritably silly.

- Megahash per 2nd (MH/s): 1 million hashes per 2nd, in general from a single GPU or CPU.

- Gigahash per 2nd (GH/s): 1 billion hashes per 2nd, from a smaller mining pool or GPU cluster.

- Terahash per 2nd (TH/s): 1 trillion hashes per 2nd, veritably from a single ASIC or tremendous mining pool.

- Petahash per 2nd (PH/s): 1 quadrillion hashes per 2nd, incessantly from a fanciful mining pool.

- Exahash per 2nd (EH/s): 1 quintillion hashes per 2nd, in general from a enormous mining pool or the total community.

Since the mining field determines the gathering of hashes required to resolve the subsequent block, it be most effective to use the present field stage to estimate how many Bitcoins may perchance be mined inner a definite timeframe.

Why is it basic?

A increased hashrate indicates a extra earn community, because it turns into increasingly complex for any single entity to govern the majority of the computational energy. It also enhances the community’s resistance to assaults and ensures the swish functioning of transactions.

The hash price serves as a basic metric indicating the protection stage of a blockchain community and the mining field for miners to receive block rewards. A increased hash price signifies increased community safety, as extra miners are actively engaged in mining blocks, reducing the likelihood of malicious assaults on the community.

In essence, the Bitcoin hashrate serves as a extraordinarily basic metric for assessing the community’s safety and efficiency, taking part in a extraordinarily basic role in asserting the integrity of the Bitcoin blockchain.

A decrease hash price indicates diminished computing energy wished to validate and add transactions to a cryptocurrency blockchain. This may perchance maybe perchance decrease the decentralization of the crypto community, as fewer miners may perchance be required to govern it.

Reduced decentralization poses increased dangers for investors and crypto platforms. If a malicious entity beneficial properties protect a watch on of the community, they’ll disrupt its operations greatly, leading to capacity monetary losses for investors and customers.

A increased hash price signifies an increased stage of computing energy wished to validate and add transactions to a cryptocurrency’s blockchain. This heightened computational requirement enhances the protection of the cryptocurrency, because it can necessitate a bigger collection of miners, in conjunction with increased energy consumption and time, to perchance seize protect a watch on of the community.

Current bid

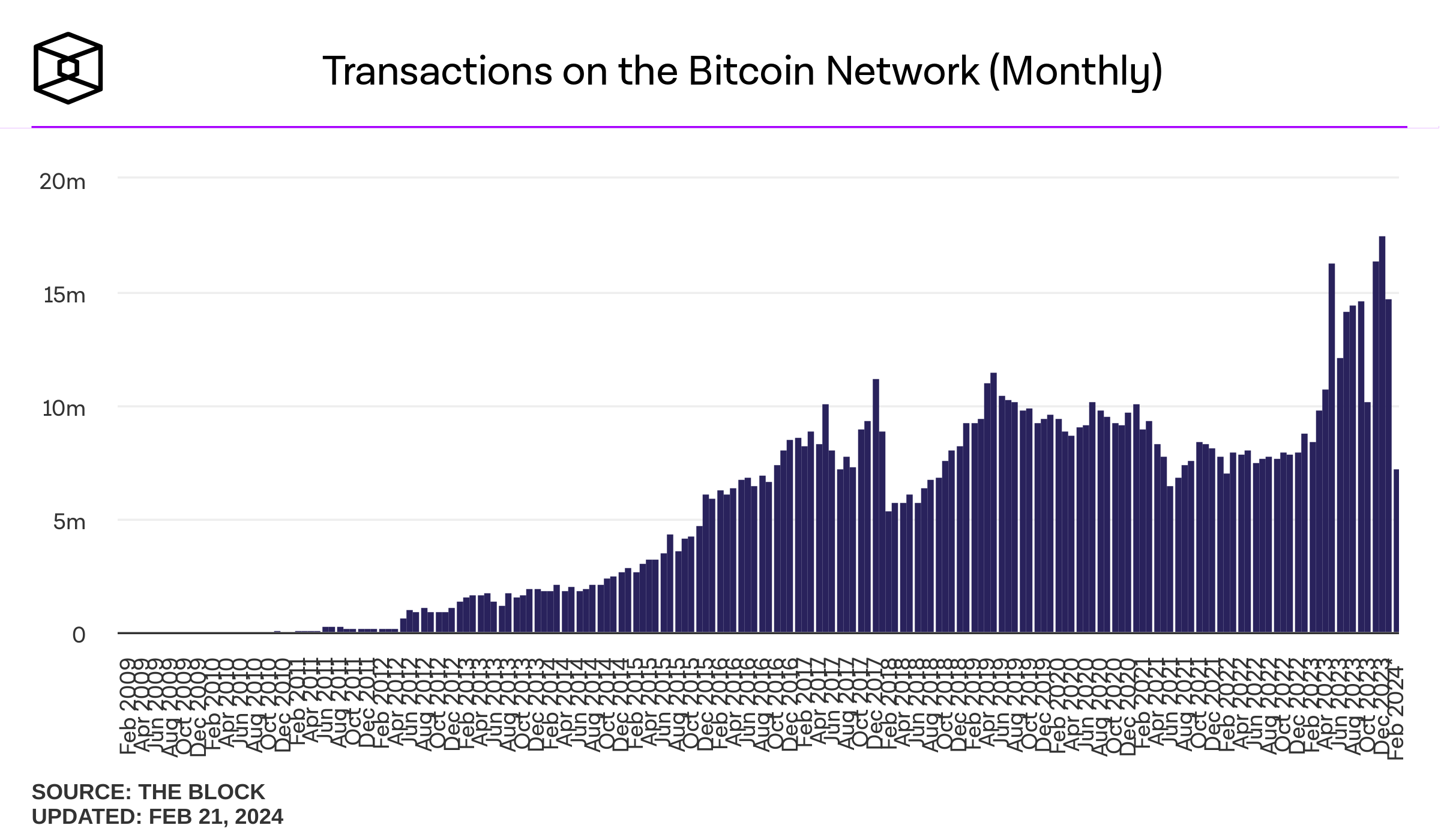

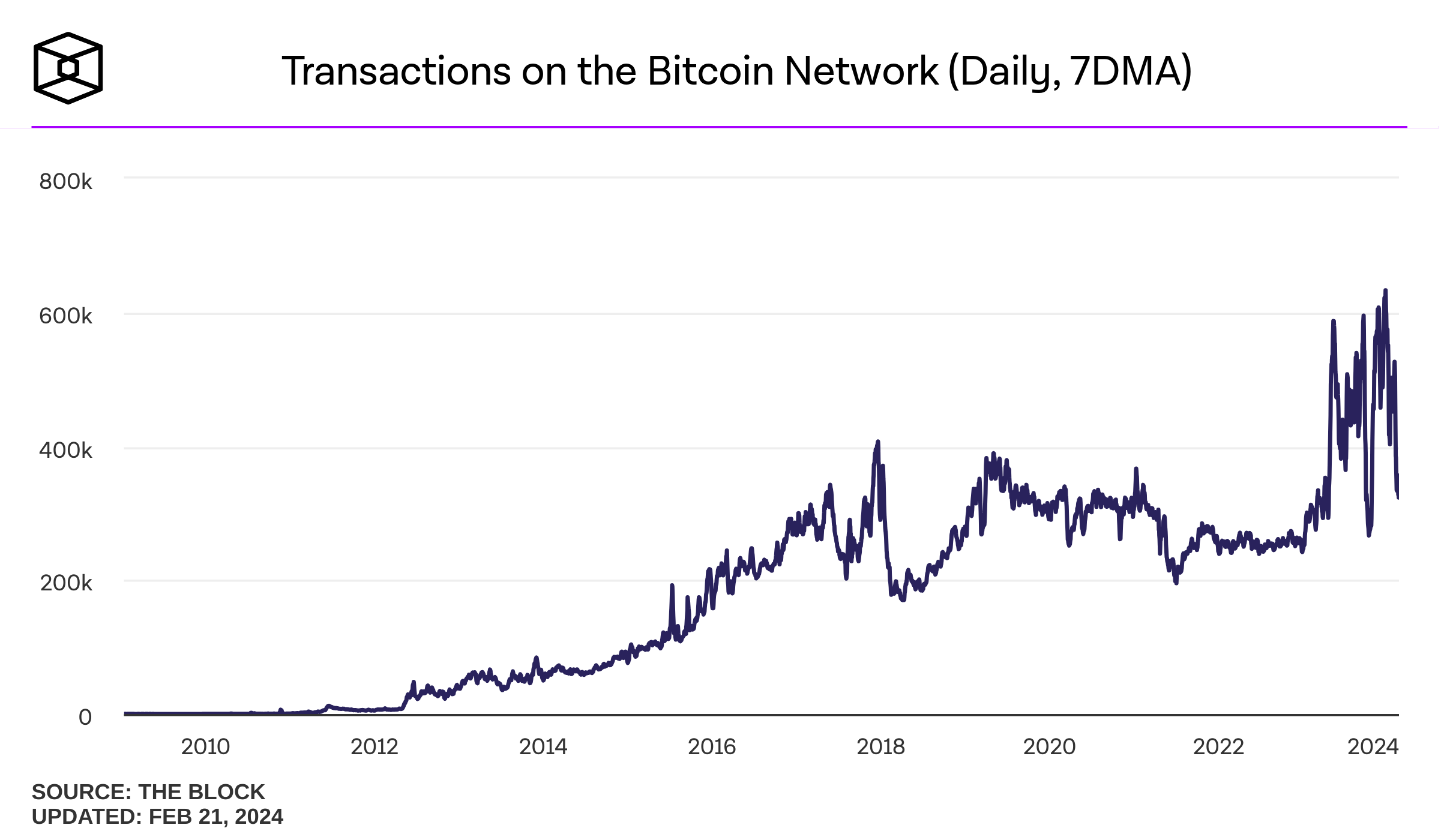

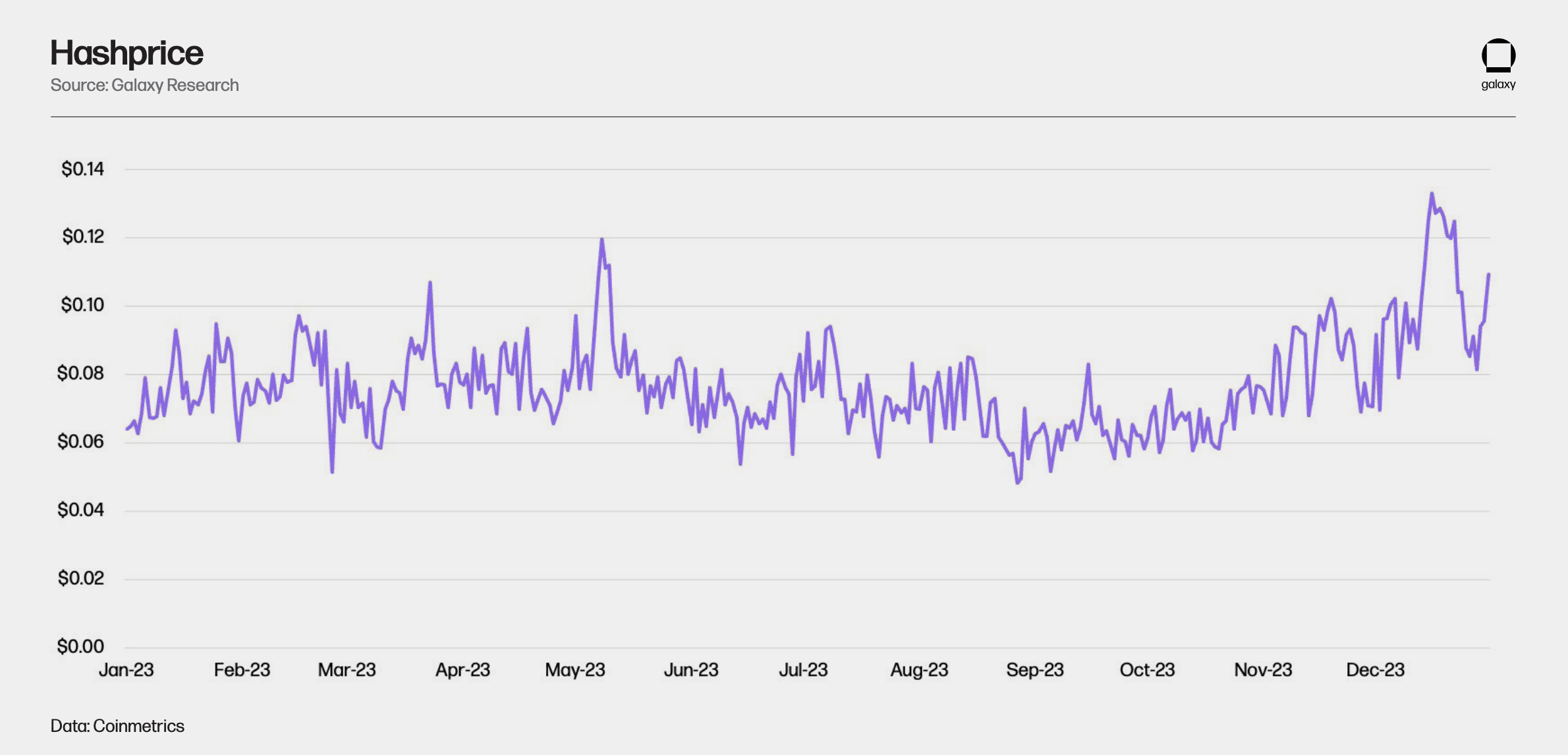

Current data indicates that the surge in Bitcoin’s costs has greatly impacted both community field and hash price. These modifications non-public had implications for miner income.

As of the most contemporary update, Glassnode’s data indicates that the hash price has surpassed 610 trillion. Despite the proven fact that now not the most life like seemingly recorded hash price, it remains among the many stop ranges noticed in contemporary months. While Bitcoin’s community field and hash price non-public surged, miner charges have not adopted swimsuit. An examination of miner income charges unearths a recent decline.

Starting the month at over 5%, the price peaked at over 15% at one point. On the change hand, as of the most contemporary update, the price has dropped to around 3%, marking the lowest point in the year up to now. It is price noting that while this present price is low, it’s now not the lowest noticed in contemporary months. Between July and October 2023, charges ranged around 1.6%.

After a turbulent 2022, miners experienced a great-wished relief in 2023 due to improvements in bitcoin mark, will enhance in transaction charges, and an excellent aquire in energy costs. On the change hand, these beneficial properties non-public been partially offset by the quite lots of expand in hash price, which surged by 104% in 2023.

Galaxy Digital file anticipates that as much as twenty% of the community hash price from eight mining machine fashions may perchance be offline by the time of the subsequent bitcoin halving.

Roughly 15-20% of the community hash price, estimated to be between 86-115 EH, would perchance maybe perchance journey offline at the time of the halving. The prognosis suggests that the community hash price for 2024 is anticipated to fluctuate between 675 EH and 725 EH by the stop of the year.

The upcoming halving, scheduled for April, will study per-block rewards for mining bitcoin gash from 6.25 BTC to three.125 BTC. Miners non-public been focusing on bettering efficiency and reducing costs earlier than the occasion, as the good aquire in rewards is anticipated to stress the field financially.