Bitcoin miners beget continuously been a first price indicator of the general sentiment right thru the market. By monitoring their earnings and actions, we are able to salvage a approach of where the worth of BTC could head next. Listed right here, we will detect the most contemporary traits in Bitcoin mining, how miners are reacting to contemporary market stipulations, and what we are able to study from key indicators to gauge how Bitcoin miners are positioning themselves for the upcoming weeks and months.

Impart of Miner Earnings

No doubt one of many most productive ways to evaluate Bitcoin miner sentiment is to sight their earnings in terms of ancient records. This would possibly be done the utilization of The Puell More than one, which measures contemporary miner earnings against the yearly sensible from the outdated year.

As of the most contemporary records, the Puell More than one is hovering around 0.8, which manner miners are earning 80% of what they had been making on sensible all around the final year. Here’s a marked enhance from about a weeks ago when the multiple used to be as tiny as 0.fifty three, indicating miners had been earning exact over half of their outdated year’s sensible.

This principal tumble earlier in the year seemingly build monetary stress on many miners. Alternatively, despite these challenges, the very fact that the Puell More than one is recovering suggests that the outlook for miners would possibly per chance well very properly be making improvements to.

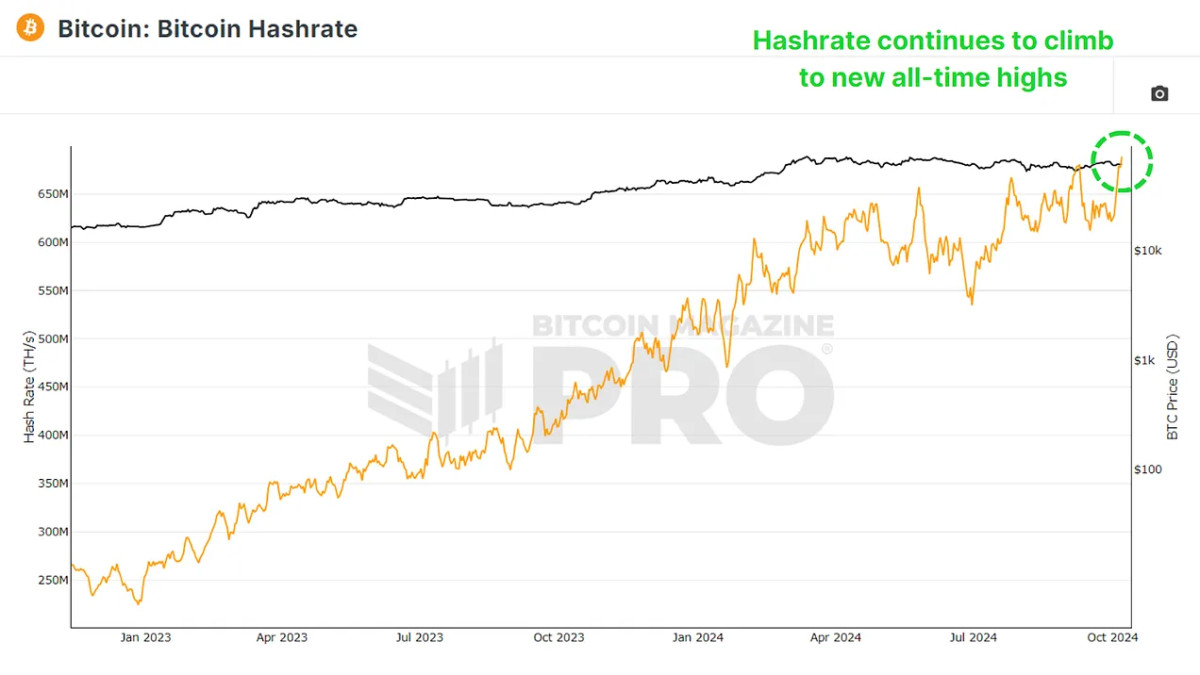

Hashrate and Community Boost

Even supposing earnings are down, there are no longer any signs of miners leaving the community. In actuality, Bitcoin’s hashrate, which is the total computational energy damaged-all the plot down to precise the community, has been continuously increasing. This surge in hashrate implies that more miners are entering the community or gift miners are upgrading their equipment to compete for block rewards.

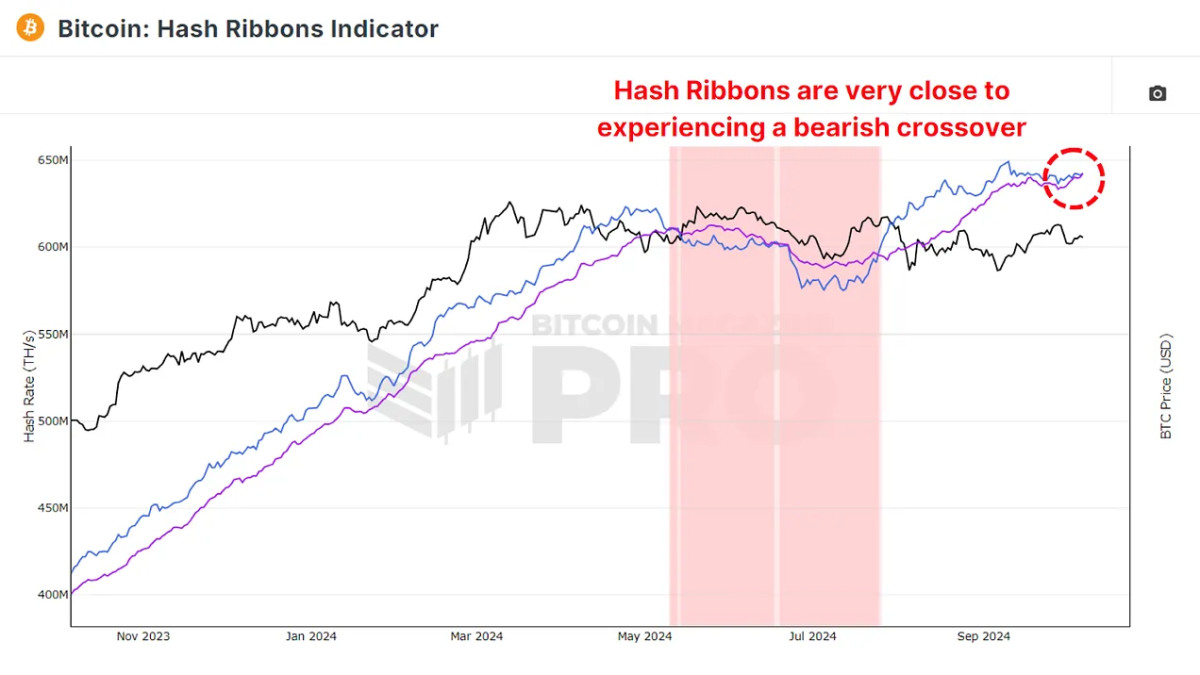

Alternatively, having a take a look at on the Hash Ribbons Indicator, which tracks the 30-day (blue line) and 60-day (crimson line) transferring averages of Bitcoin’s hashrate, these two averages beget been getting closer to crossing, which could doubtlessly repeat a bearish outlook for the immediate time duration. When the 60-day sensible rises above the 30-day sensible, it historically capabilities to miner capitulation, a time when miners, beneath monetary stress, shut off their equipment.

Except we gaze a bearish crossover, there’s no rapid signal of bearishness. One obvious is that at any time when this happens, it has been adopted by a duration of accumulation, which normally precedes a upward push in Bitcoin prices. Traders continuously cling in mind these capitulation periods mountainous alternatives to buy BTC at decrease prices.

How Grand Are Miners Making?

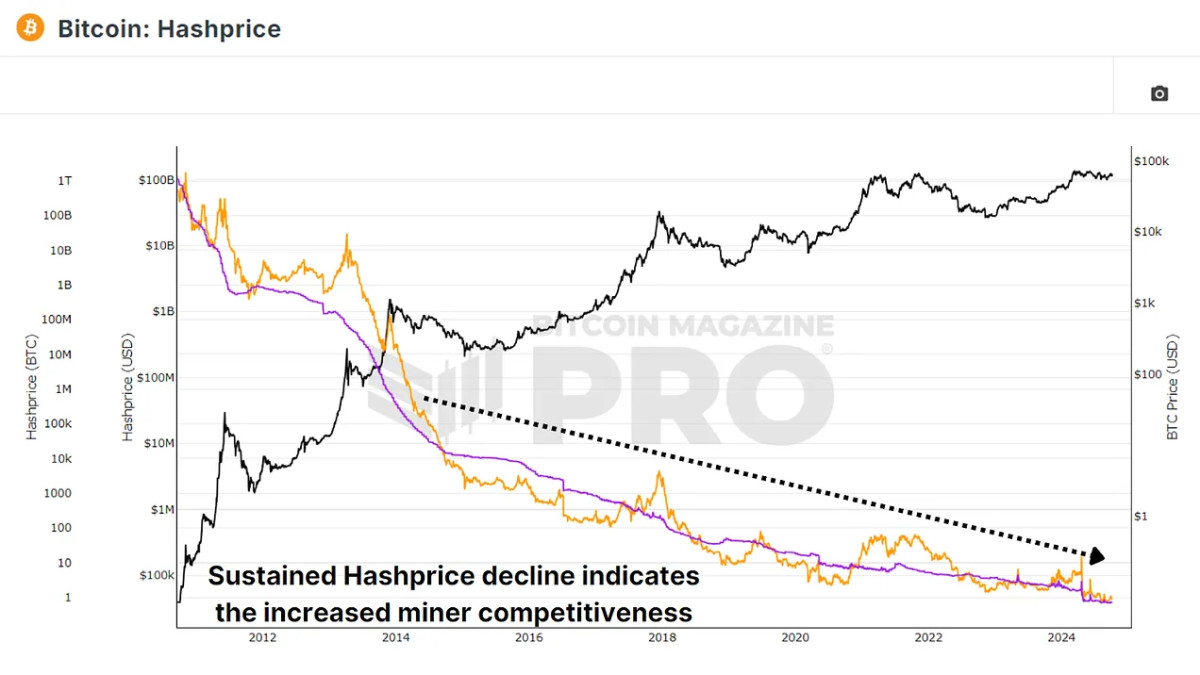

Whereas we’ve discussed miner earnings in terms of Bitcoin’s mark, one more vital element is the Hashprice, the amount of BTC or USD miners can fabricate for every terahash (TH/s) of computational energy they make a contribution to the community.

Presently, miners fabricate roughly 0.73 BTC per terahash, or about $forty five,000 in USD phrases. This quantity has been continuously reducing in the months following the most contemporary Bitcoin halving occasion, where miners’ block rewards had been sever abet in half, reducing their profitability. Despite these challenges, miners are soundless increasing their hashrate, this skill that they’re making a wager on future BTC mark appreciation to atone for their decrease earnings.

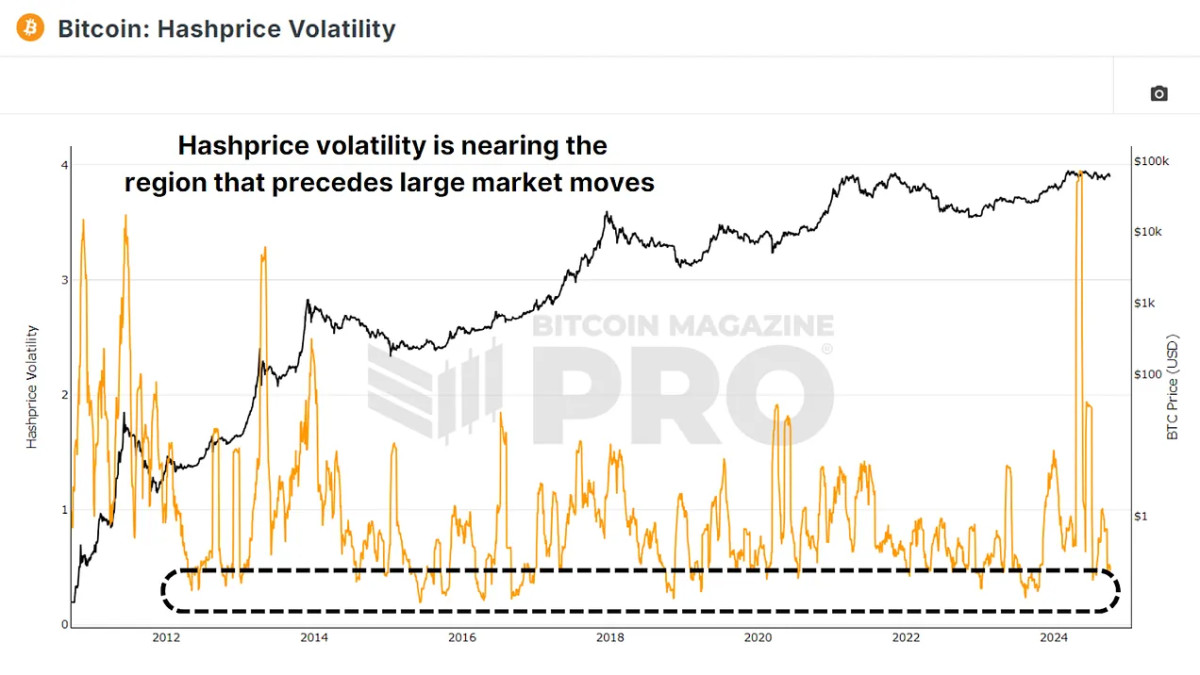

No doubt one of many most enthralling metrics to detect is the Hashprice Volatility, which tracks how precise or volatile miner earnings are over time. Historically, periods of low hashprice volatility beget preceded principal mark movements for Bitcoin. As of the most contemporary records, hashprice volatility has begun to tumble again, suggesting we are able to be nearing a duration of wide mark hump for Bitcoin.

Conclusion

Bitcoin miner earnings are down when compared with a ancient sensible put up-halving, however they’re recovering from a contemporary principal low. Bitcoin’s hashrate is soundless rock climbing; which manner miners are pouring more computational energy into the community despite decrease profitability. The hashprice continues to tumble, however miners remain optimistic, seemingly attributable to anticipated future mark appreciation. Hashprice volatility is falling, historically indicating that a mountainous scramble in BTC’s mark would be forthcoming.

Bitcoin miners appear to be bullish about the long-time duration doable of BTC, despite contemporary challenges. If contemporary metric traits cling, we are able to be on the verge of a principal mark hump, with most indications pointing in direction of a obvious outlook.

For a more in-depth detect into this topic, take a look at out a contemporary YouTube video right here:

What Attain Bitcoin Miners Request Next?