Someday before the U.S. CPI print, crypto whales are exhibiting particular positioning. Whereas Bitcoin stays strategy highs, it’s mid-cap altcoins that are drawing consideration from the high wallets.

All the draw in which by the last 7 days, tokens like 1inch (1INCH), Chainlink (LINK), and Curve (CRV) hang seen contemporary accumulation, seen by holder steadiness spikes and minute alternate outflows. Here’s a more in-depth sight at where the money’s piquant and what it can point out.

1inch (1INCH)

In the final 24 hours, whale holdings for 1inch rose by 5.65%, pushing the final steadiness held by these wallets to 9.56 million tokens. At the the same time, the high 100 addresses gentle protect about 1.26 billion 1INCH, although their portion somewhat of dipped, hinting at redistribution in preference to exits.

The steadiness chart reveals a valid clutch from round midday onwards on July 14, indicating contemporary query whereas the token trace hovered between $0.32 and $0.33. Meanwhile, neat money and alternate balances barely moved, suggesting the action used to be basically great wallet accumulation.

Despite a 5.65% surge in whale holdings, the 1INCH trace dipped by nearly 8% day-on-day, suggesting whales would be positioning early forward of anticipated on-chain volume spikes, in preference to chasing temporary positive aspects.

Crypto whales would be rotating into 1inch as a likelihood on DEX mutter surging if CPI drops and risk-on sentiment returns, boosting on-chain shopping and selling volumes.

Chainlink (LINK)

From July 10 onward, LINK seen a 6.19% extend in whale holdings, now sitting at 2.84 million tokens. The most well-known surge got right here between July 11 and 12, with a seen soar in steadiness devoted before the token trace hit native highs strategy $16.

Top 100 addresses now protect 654.73 million LINK, up somewhat of from earlier within the week. Commerce balances dropped 1.51%, supporting the look that LINK is piquant to self-custody or chilly wallets. The price of LINK surged nearly 18% at some level of the last week, which reveals that crypto whales were amassing.

This hints at renewed optimism.

Curve DAO (CRV)

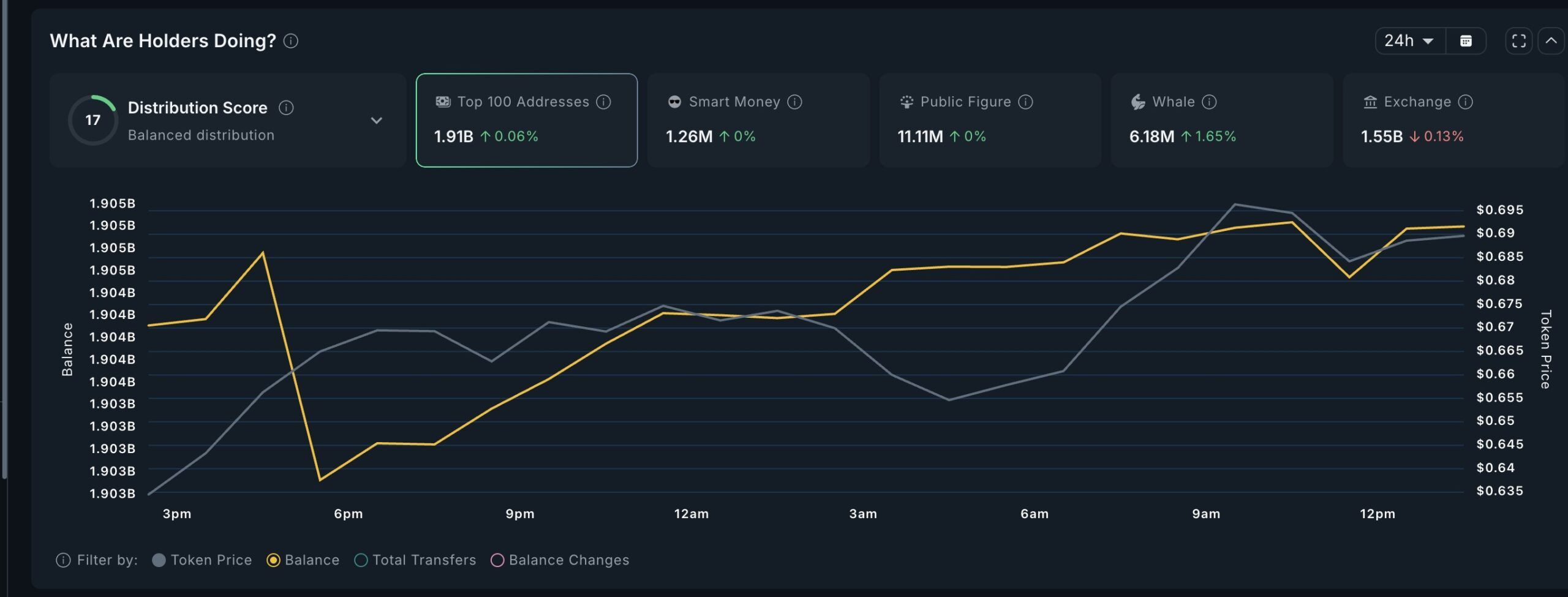

CRV’s crypto whale wallets added 1.65% more tokens, taking total holdings to 6.18 million. Even supposing the shift is minute, the pattern is fixed throughout the final 24 hours; the yellow steadiness line reveals a valid climb at some level of the night and into the morning of July 14.

The high 100 wallet holdings elevated somewhat of by 0.06%, suggesting great holders are ceaselessly re-amassing. CRV’s trace climbed in direction of $0.69, up nearly 7% day-on-day, consistent with the whale accumulation patterns.

Curve makes a speciality of stablecoin swaps, offering low prices and deeper liquidity: traits that attract monumental money shopping for a hedge when inflation data is due, like the U.S. CPI start the next day to come.

Honorary Mention: SPX6900 (SPX)

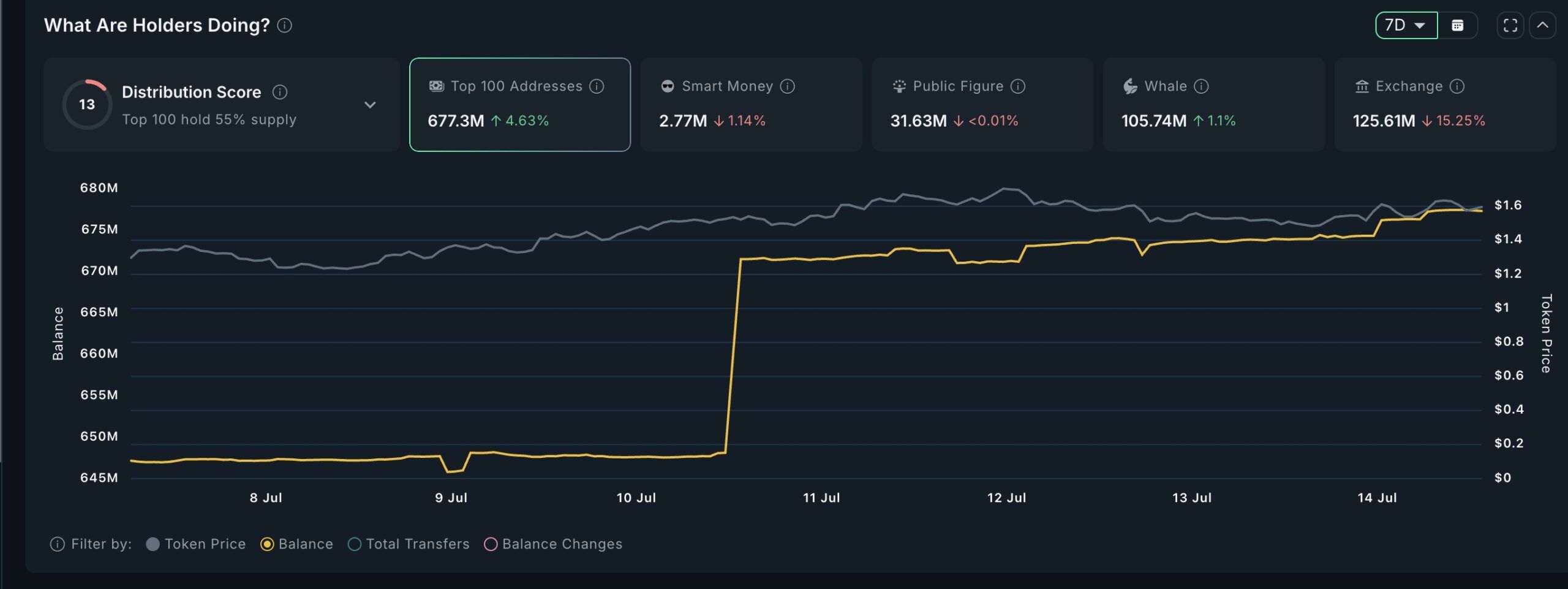

The SPX6900 token, most ceaselessly seen as the field index for meme cash, showed a 1.1% rise in crypto whale holdings, and high 100 wallets added 4.63% more tokens this week. Whereas smaller in scale in comparison to the others, the directional inch adds weight to the broader meme coin rotation legend.

The token trace moved closer to $1.60, and the influx pattern from July 10–13 reveals coordinated entry facets.

Even with CPI-pushed caution, this gentle uptick in SPX hints that some merchants are gentle making a bet on the meme coin supercycle to continue, especially if inflation data favors risk-on sentiment.