Crypto whales are making intrepid moves following Donald Trump’s 90-day tariff quit, with Ethereum (ETH), Mantra (OM), and Onyxcoin (XCN) drawing major accumulation.

ETH whales pushed holdings to their top doubtless stage since September 2023, while OM holders are quietly increasing publicity amid the growing steady-world asset memoir. XCN, within the intervening time, noticed a pointy spike in whale exercise alongside a 50% imprint surge in just 24 hours.

Ethereum (ETH)

The broader crypto market rallied after Donald Trump announced a 90-day quit on tariffs—with the exception of China—boosting investor sentiment across risk assets.

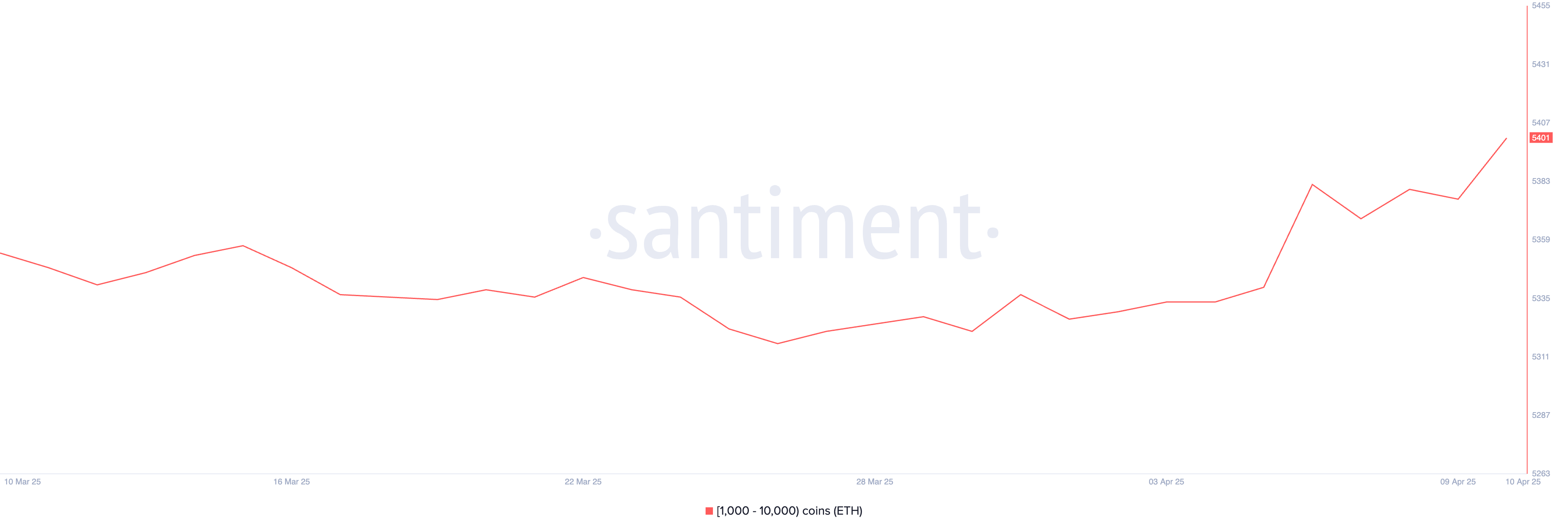

Ethereum adopted swimsuit, with on-chain files showing a rise in crypto whales exercise; the gathering of addresses holding between 1,000 and 10,000 ETH climbed from 5,376 to 5,417 between April 9 and 10, reaching its top doubtless stage since September 2023.

If Ethereum can bear this renewed momentum, it can probably well furthermore just test key resistance ranges at $1,749 and presumably rally extra in direction of $1,954 and $2,104. However, macroeconomic uncertainty restful looms.

A sentiment reversal could maybe well accumulate out about Ethereum imprint retesting the $1,412 aid zone. If that stage fails, a deeper decline in direction of $1,200—and even $1,000—is doable.

Some analysts maintain long gone as some distance as evaluating Ethereum’s decline to Nokia’s historical collapse, warning of lengthy-term structural weak point.

Mantra (OM)

Proper-world assets (RWAs) on the blockchain maintain hit a contemporary all-time high, surpassing $20 billion in total cost, reinforcing their growing significance as a crypto memoir and sector.

Binance Research furthermore highlighted that RWA tokens maintain proven extra resilience than Bitcoin throughout tariff-linked volatility, extra boosting confidence within the field.

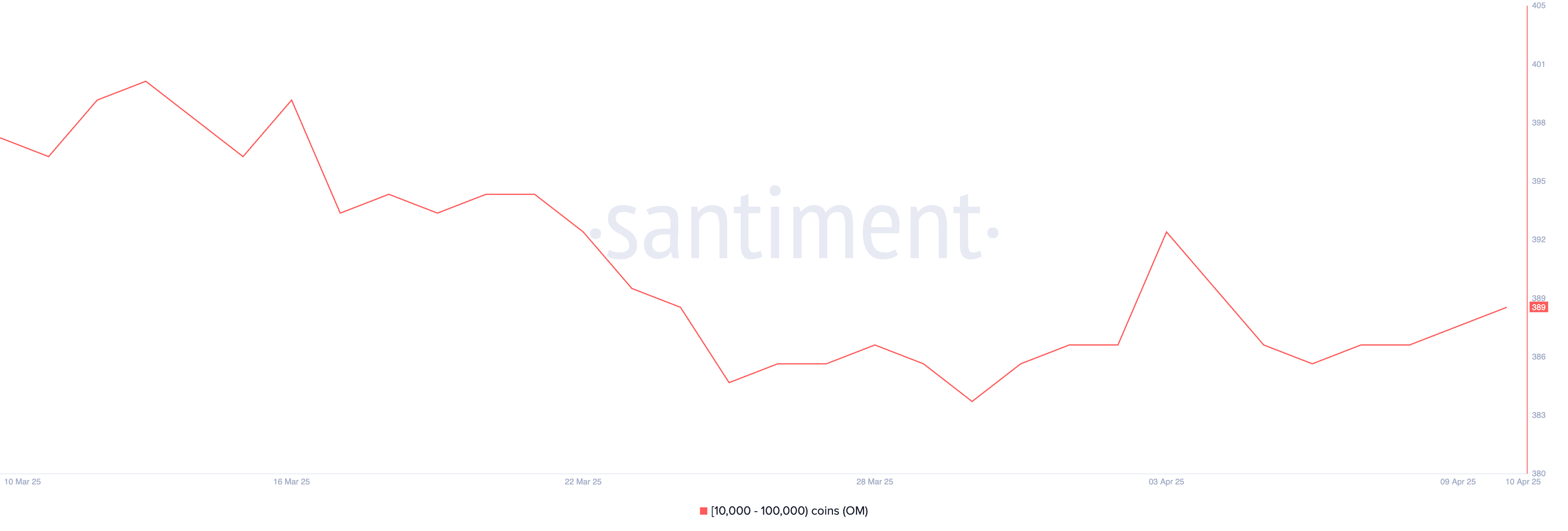

With the RWA memoir gaining traction, OM could maybe well accumulate out about major upside. Between April 6 and April 10, the gathering of OM whale addresses holding between 10,000 and 100,000 tokens rose from 386 to 389, signaling restful accumulation.

If OM breaks past the resistance ranges at $6.51 and $6.85, it can probably well climb above $7. However, if the momentum fades, a correction could maybe well push the token the total map down to $6.11, with extra downside risk in direction of $5.68.

Onyxcoin (XCN)

Onyxcoin (XCN) has surged over 50% within the past 24 hours, breaking above the $0.02 stamp as whale accumulation intensifies.

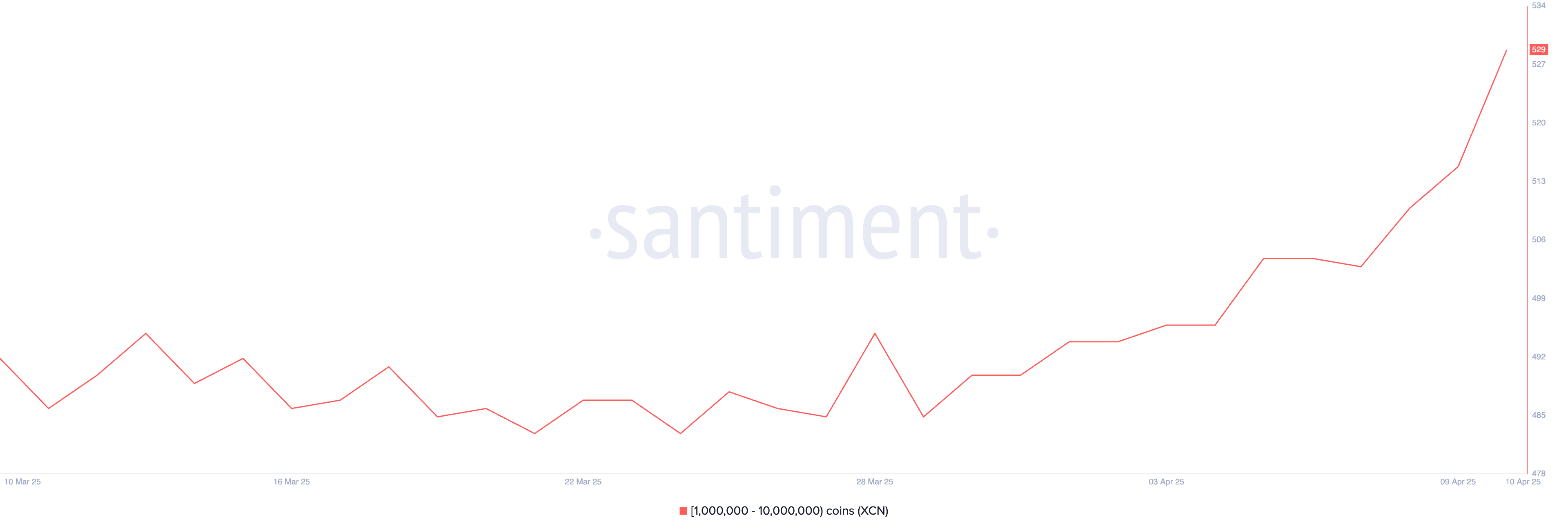

Between April 7 and April 10, the gathering of addresses holding between 1 million and 10 million XCN rose from 503 to 532, signaling renewed hobby from huge holders.

If this solid bullish momentum continues, XCN could maybe well rally in direction of resistance ranges at $0.026, $0.033, and even $0.040. However, given the like a flash imprint elevate in a rapid timeframe, a correction could maybe well furthermore just practice.

If that is the case, XCN could maybe well retest aid at $0.020, with means downside extending to $0.014 if promoting stress hastens.