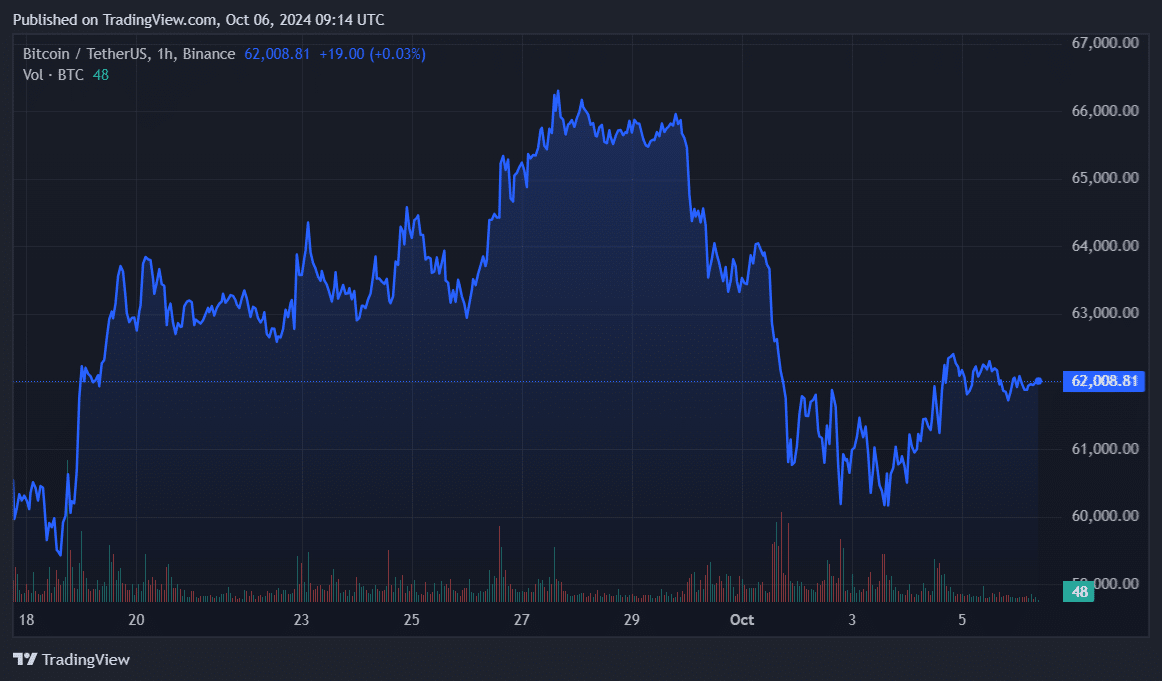

Bitcoin faces but one other correction after surpassing the $62,000 ticket on Oct. 2. On the other hand, records reveals that whales haven’t taken allotment within the most up-to-date selloff.

Bitcoin (BTC) consolidated throughout the $60,000 zone between Oct. 1 and 4 as the geopolitical tension between Iran and Israel heated up.

Right type after the U.S. jobs document, the flagship cryptocurrency reached a neighborhood high of $62,370 on Oct. 5 as the broader crypto market witnessed bullish momentum.

Bitcoin declined by 0.2% within the previous 24 hours and is shopping and selling at $61,950 on the time of writing. Its on daily basis shopping and selling quantity plunged by fifty three% and is for the time being hovering at $12.2 billion.

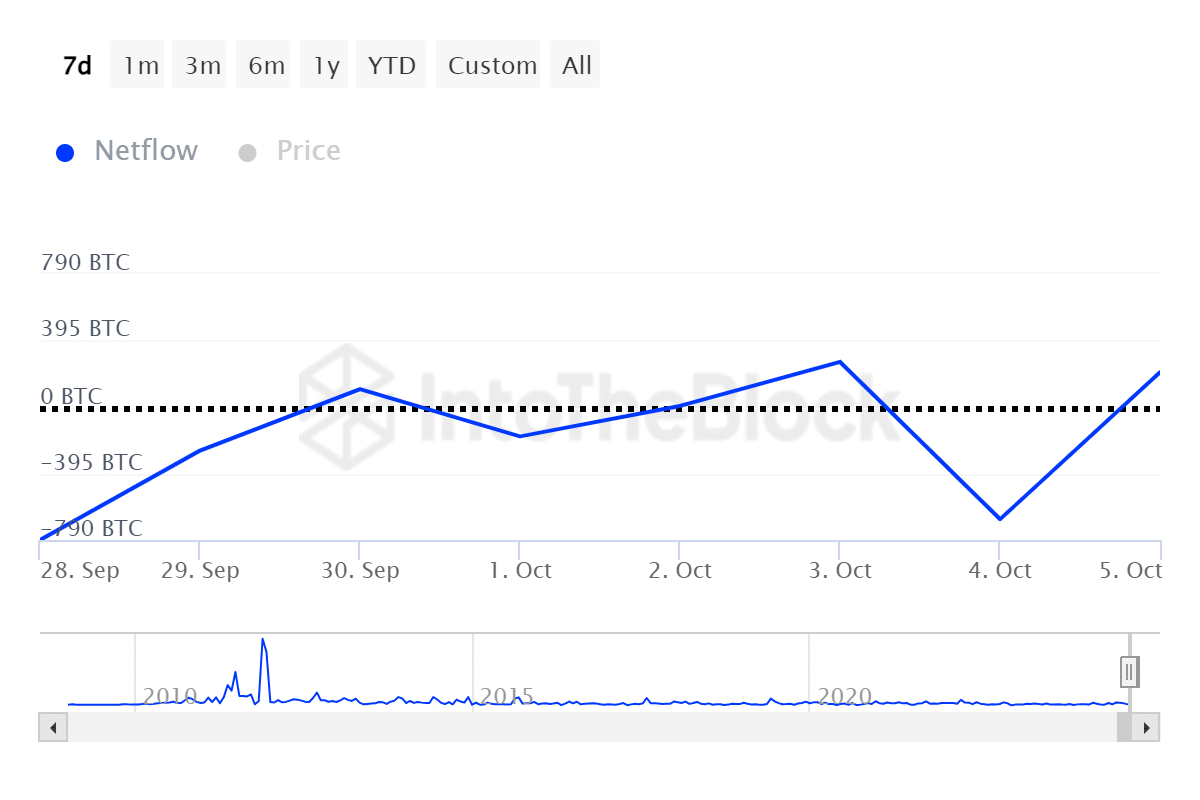

Primarily based entirely on records provided by IntoTheBlock, attention-grabbing Bitcoin holders recorded a fetch influx of 205 BTC on Oct. 5 as the outflows remained neutral. The on-chain indicator reveals that whales didn’t sell Bitcoin as its mark surpassed the $62,000 ticket.

In the period in-between, Bitcoin’s whale transaction quantity decreased by forty eight% on Oct. 5 — falling from $forty eight billion to $25 billion price of BTC. Lower shopping and selling and transaction volumes in most cases hint at mark consolidations and lower volatility.

Recordsdata from ITB reveals that Bitcoin registered a fetch outflow of $153 million from centralized exchanges over the previous week. Increased change outflows counsel accumulation as the bullish expectations for October rise.

It’s essential to exclaim that macroeconomic occasions and geopolitical tension can with out warning trade the course of financial markets, in conjunction with crypto.