- In Forty eight hours, Cardano whales bought 120 million ADA tokens, and the associated rate went up to $0.716.

- RSI is exhibiting a undeniable signal at 61.11, and MACD is in its bullish train.

- A contemporary Cardinal bridge has been launched on Cardano so that Bitcoin users can exchange it straight for Dapps on Cardano.

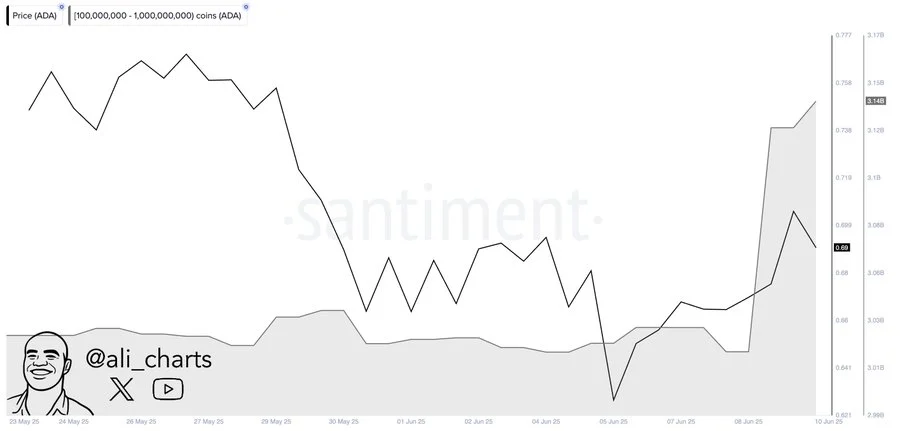

High-salvage-rate holders comprise renewed passion in Cardano (ADA), with latest onchain data exhibiting a massive whale accumulation. Within the excellent Forty eight hours, crypto analyst Ali notes that wallets maintaining between 100 million and 1 billion ADA collectively added about 120 million tokens. ADA’s surge in holdings comes in keeping with a four–day designate rally, which presentations bullish predictions from big investors. Ali shared a Santiment chart exhibiting the uptrend in whale accumulation, which looks to comprise picked up, especially from June 8 to June 10.

Additionally, ADA is buying and selling round $0.708, which peaked at $0.716 early on Tuesday. Whale confidence in ADA may maybe well also be traced to a undeniable swap available in the market sentiment, which changed into once, in turn, attributable to the breakout of Bitcoin above $110,000.

Technical Indicators Recommend Additional Positive aspects Seemingly

Essentially the latest performance of ADA helps the bullish view. The asset’s RSI stands at 61.11, indicating it is stable with out being overbought. Besides, the MACD strains are unruffled above the signal line, in most cases indicating that the associated rate is growing.

ADA’s green candlesticks over time, shown in TradingView data, cloak that the uptrend is persevering with. Within the previous 24 hours, quantity saw a colossal amplify of 64%, a stamp that each investors and sellers are getting extra involved. Cardano is now buying and selling shut to $0.6579, which is lawful above a key half of a Fibonacci retracement level associated with the possibility of a turnaround.

Sturdy resistance is unruffled round $0.58 to $0.61, the place loads of technical components coincide. This level can act as a spot to birth for further beneficial properties for the cryptocurrency. The 50-day and 200-day transferring averages are inside of reach at $0.724 and $0.82. Reaching above these ranges would maybe perhaps furthermore launch the formulation to long-vary targets at $1.0463, $1.2145, and $1.3984.

Contemporary Bitcoin Bridge Would possibly perhaps perhaps Force Future DeFi Exercise

Cardano’s bullish condition is occurring at a time of a a must-comprise project milestone. Enter Output Global (IOG) has presented “Cardinal,” a non-custodial bridge that permits each Bitcoin UTXOs and Ordinals to be damaged-down on Cardano-essentially based mostly platforms. Reasonably than utilizing ancient Bitcoin wrapping, Cardinal relies on the MuSig2 multi-signature design and hashed-timelock contracts, maintaining Bitcoin’s defective-level safety with out intermediaries.

Welcome to the first Bitcoin DeFi protocol developed for Cardano https://t.co/CoYvrYnIfI

— Charles Hoskinson (@IOHK_Charles) June 9, 2025

The protocol creates one NFT on Cardano per locked UTXO as a representation. While they are going to even be damaged-down in farming rewards, loans, or pledged as safety, Bitcoin does no longer swap hands.

BitVMX powers the fraud-proof place up by coping with off-chain processing and settling disagreements on-chain. The design seeks to chop belief-essentially based mostly dangers by tackling the shortcoming of over $2.5 billion to exploits in federated bridges.

Cardano’s founder, Charles Hoskinson, supported Cardinal and called it the initial Bitcoin DeFi protocol designed for the network. Despite being in the infrastructure stage, Ethereum, Solana, and Avalanche extensions comprise already been labored out.