Fistbump (FIST), a token from the BNB Chain ecosystem, is facing a doable liquidity disaster. The token had an outsized rally, with indicators of whales cashing out on the hype.

Fistbump (FIST) is a token that heated up in the previous few days, sparking fears of a doable rug pull. Extra than one on-chain analysts suggest FIST will seemingly be facing a unexpected liquidity disaster, as whales spend the non permanent hype to cash out.

FIST at this time depends handiest on PancakeSwap pairs for many of its liquidity. This also methodology the token can return to its rather indolent declare if the largest liquidity suppliers plod on, or whales cash out. No matter its years-long history, FIST never gained listings on centralized exchanges.

FIST staged a rally after three years of declare of no activity

The FIST venture just isn’t any stranger to snappy crashes, following its preliminary initiating on the discontinue of July 2022. FIST straight spiked to a top of $3.36, then erased most of its heed, drifting below a penny for years. FIST is belief to be one of the most uncommon tokens to plod after a prolonged have market, and even temporarily substitute above its all-time represent at $3.52.

After being nearly forgotten, the FIST venture all straight away confirmed exercise, and miraculously recovered its heed differ above $3.20 inner days. FIST bought hype from old holders, however also dire warnings about a doable shatter an identical to the one in 2022.

Extra than one sources launched warnings that FIST changed into as soon as exhibiting indicators of whales cashing out following the long interval of procuring and selling at a low differ. Doubtlessly the most up-to-date procuring and selling pairs readily available may maybe well well furthermore unbiased furthermore dry out if the liquidity pools are drained.

Because FIST changed into as soon as launched assist in 2022, all the intention in which thru development instances, it created a commotion and changed into as soon as widely adopted. FIST reached a filled with 226,842 wallets, the majority of which suffered severe losses. Some FIST house owners curiously held thru the 2022-2023 have market.

FIST shows on-chain warning indicators of insider place a watch on

FIST tokens are mostly focused on a single PancakeSwap pair, which carries over 95% of volumes. The asset reached $30M in day-to-day volumes, an anomalous exercise level.

As of August 28, the leading procuring and selling pair mute held over $7M in readily available liquidity. Nonetheless, that liquidity is mostly depending on a single whale provider. The top liquidity provider carried over 77% of the pair’s liquidity, essentially based on DexScreener recordsdata.

All the intention thru essentially the most up-to-date rally, multiple whales cashed out round $600K every, with no single entity exhibiting mammoth-scale earnings. Nonetheless, if retail and contemporary patrons join, older holders may maybe well well furthermore unbiased are trying to cash out.

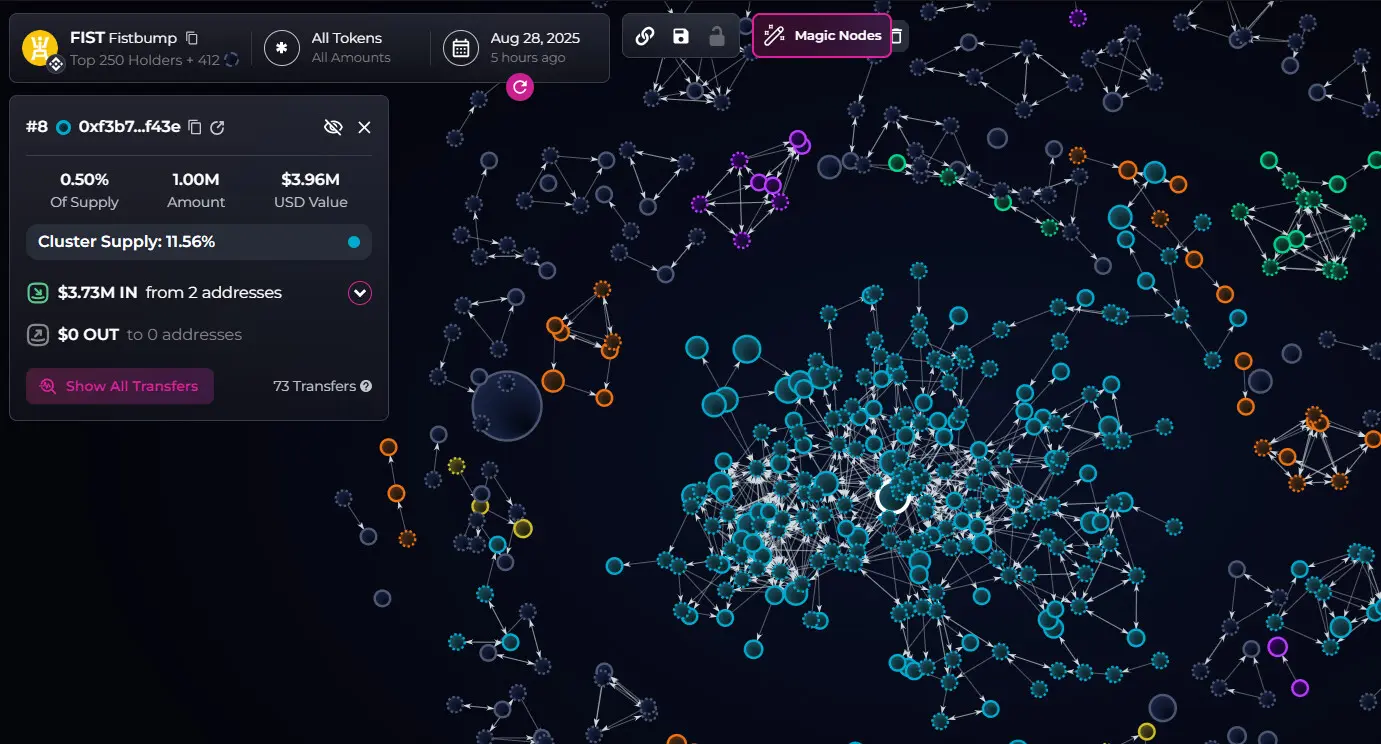

Moreover, FIST shows indicators of insider holdings. Though there are a pair of fundamental whales with unheard of wallets, the tip 20 holders are connected in a wallet cluster, essentially based on Bubblemaps recordsdata.

The Fistbump venture is also busy advertising and marketing and marketing its FST Swap decentralized substitute. No matter the hype, the FST Swap substitute mute advertises the FIST token below a ‘parody story’.

Fistbump started its aggressive advertising and marketing and marketing on social media all the intention in which thru the 2025 bull market. The token objectives to position itself as a DeFi hub in the BNB Chain ecosystem, whereas mute procuring and selling with a risk an identical to a brand contemporary meme token. No matter the aim of ‘making FIST colossal yet again’, the token raises multiple red flags after its advance-vertical rally, which took place all the intention in which thru an overall market reversal for BTC and other leading cash.