Chainlink (LINK) model goes via challenges as technical indicators expose bearish momentum. LINK’s EMA strains honest honest as of late formed a death sinful, indicating continued bearish stress.

Whale exercise and the MVRV ratio present blended indicators about LINK’s future.

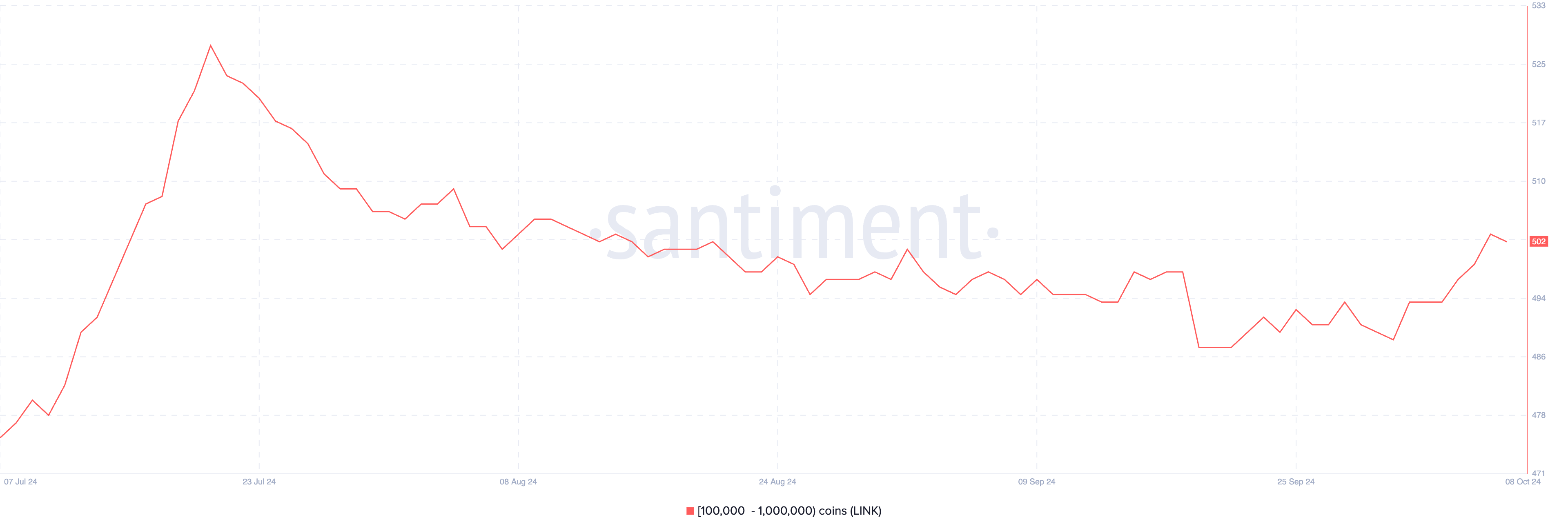

Whale Exercise Signals LINK Recovery

Users preserving between 100,000 and 1,000,000 LINK tokens seem like recuperating after the present correction. Monitoring these whales is wanted because they in most cases greatly impact market course. Whales dangle the energy to sway costs attributable to the ravishing volumes they regulate, making their conduct a key indicator of market sentiment.

When whales acquire or retain ravishing quantities of a token, it goes to signal sturdy self belief in the asset, whereas a reduction in whale holdings can blow their own horns bearish sentiment or uncertainty. Their numbers grew from 489 on October 1 to 502 on October 8, showing a distinguished restoration in whale exercise.

This expand means that whales are as soon as extra gathering LINK, which may well demonstrate an expectation of future features.

Read extra: Chainlink (LINK) Trace Prediction 2024/2025/2030

The present surge in whale holdings, although modest, in most cases is a definite signal for LINK’s model, suggesting renewed self belief amongst ravishing holders and the aptitude for upward stress. A upward thrust in whale exercise in most cases indicates accumulation, which can moreover merely precede a model rally as making an strive to search out stress mounts.

Astronomical holders returning to the market can beget a extra sturdy foundation for LINK model to web misplaced ground, especially if broader market cases open to stabilize or turn bullish. Moreover, whale exercise is incessantly a precursor to most well-known market moves.

As extra whales return, it goes to beget a ripple form, using renewed hobby amongst retail buyers and smaller merchants, in the terminate contributing to a sustained model rally.

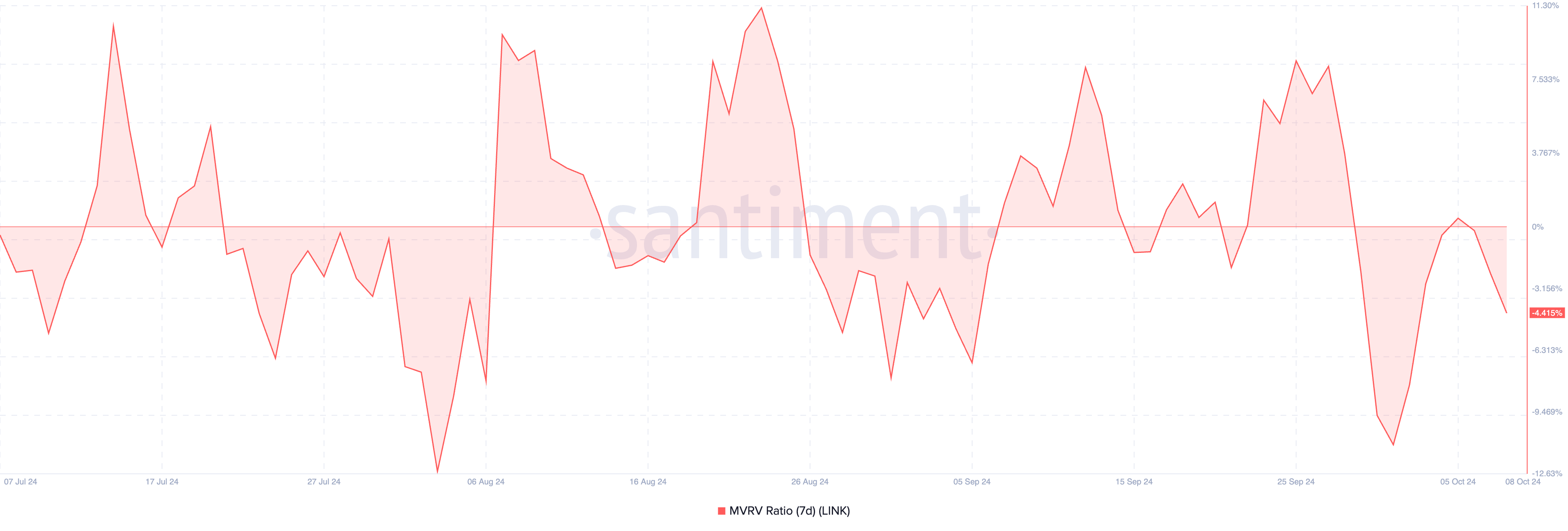

MVRV Ratio Suggests Means for LINK Rebound

The LINK 7-day MVRV ratio is for the time being at -4.41%, down from 8.12% on September 27. This decline is important because the MVRV ratio helps gauge market sentiment and seemingly model actions. A declining MVRV ratio indicates that extra holders are now at a loss, which is ready to shift investor conduct.

The 7-day MVRV ratio measures the moderate earnings or loss of LINK tokens which had been held for the final seven days, providing insights into non eternal investor conduct. When the ratio turns negative, it in most cases indicators that the asset is oversold, which can moreover lead to decreased selling stress and elevated making an strive to search out hobby from buyers making an strive to search out a bargain.

A model of -4.41% plan that, on moderate, current LINK holders are at a loss, indicating a length of market stress. Historically, when the 7-day MVRV ratio drops below -6%, LINK has shown a tendency to rebound. This implies that as losses deepen, selling stress decreases, and the likelihood of a model restoration will improve.

When the ratio reaches deeply negative levels, it in most cases attracts opportunistic buyers who ogle the aptitude for upside, ensuing in elevated accumulation and a subsequent rebound in LINK model. If the present construction continues and the ratio falls further, it may well draw the stage for a seemingly LINK model rebound.

LINK Trace Prediction: Bearish EMA Traces Level to Means LINK Trace Challenges

LINK’s EMA strains are for the time being in a bearish assert. On October 1, they formed a death sinful, a bearish technical signal that occurs when a non eternal EMA crosses below a prolonged-term EMA. On October 7, LINK tried to rating better, but the non eternal strains were unable to sinful above the prolonged-term EMA, and the bearish pattern continued.

EMA strains, or Exponential Transferring Averages, are a form of transferring moderate that provides extra weight to current costs, making them conscious of current market cases.

Read extra: Aquire Chainlink (LINK) With a Credit Card: A Step-By-Step Files

According to various metrics, equivalent to whale exercise and the MVRV ratio, moreover to the EMA strains, LINK’s correction may well continue in the following couple of days. Nevertheless, whale accumulation and ancient conduct blow their own horns that LINK may moreover merely be getting willing for a rebound as soon as the selling stress eases.

If the downtrend continues, LINK model will seemingly take a look at reinforce levels round $9.9 and $9.3. If these helps fail, the price may well tumble as shrimp as $8, which would characterize a seemingly 23.8% decline. On the many hand, if the construction reverses, because it almost did honest honest as of late, LINK’s model may well upward thrust reduction to $11.7. Will dangle to that resistance spoil, the next purpose would be round $13, representing a seemingly 23% impression.