Revolut Targets CFD Merchants with Contemporary App within the EU

High in this week’s headlines, Revolut launched a standalone platform, Revolut Make investments, to amplify its wealth management choices, including contracts for variations (CFDs). The brand new app presents spherical 5,000 other property, including US and European shares, alternate-traded funds, commodities, and bonds.

The British fintech agency is providing CFDs by its Lithuania-regulated entity, Revolut Securities Europe UAB. It is first providing CFDs in three European international locations: the Czech Republic, Denmark, and Greece, in keeping with the phrases and prerequisites on its net station.

Respectable! #Revolut’s new Revolut Make investments app, will provide about 5,000 property on debut, including US and EU shares,ETFs, commodities and bonds, as well to new CDFs.https://t.co/JD56yxV9Jg

Currently endeavor checking out in Dermark, Greece and Czechia.Equity and bond investments… https://t.co/BsY4TMAnRL

— Max Karpis (@maxkarpis) September 24, 2024

CMC Join Breaks Down CFD Cope with Revolut

In June this year, CMC Markets partnered with Revolut to fabricate CMC’s contracts for incompatibility (CFDs) available by the Neobank app. Finance Magnates sat down with Richard Elston and Michael Bogoevski, the Head of Institutional ANZ at CMC Join, to talk in regards to the deal and uncover what the future holds for the 35-year-extinct agency.

“As a starting point out net a deal of this form, you desire a abilities framework,” Elston, CMC’s Neighborhood Head of Institutional Sales, stated on the dealer’s agreement with Revolut. “We furthermore drew a schematic of what we felt could presumably work and [what] wished enhancement. However you should presumably even private bought to private a ideal, solid starting level.”

XM and Shopping and selling.com UK Operator Reduces Win Loss in 2023

In the financial reviews, extra brokerage corporations within the UK released their financial results this week. Shopping and selling Point UK, an FCA-licensed entity liable for brokerage producers equivalent to XM and Shopping and selling.com, printed its operational results for 2023. Though revenue clearly elevated for one other year in a row, rising fees avoided the company from reaching the spoil-even level. Nonetheless, the salvage loss became diminished to £844,000.

Shopping and selling Point of Monetary Instruments UK Restricted (Shopping and selling Point) is liable for Shopping and selling Point’s operations within the UK. It manages buyers from this fragment of the sector for XM and Shopping and selling.com producers. Per the most modern document printed within the UK Companies Rental, the agency done revenue of £1.4 million in 2023, growing by 40% when put next with £1.1 million reported the earlier year.

Darwinex Operator’s Revenue Rises by over 50%

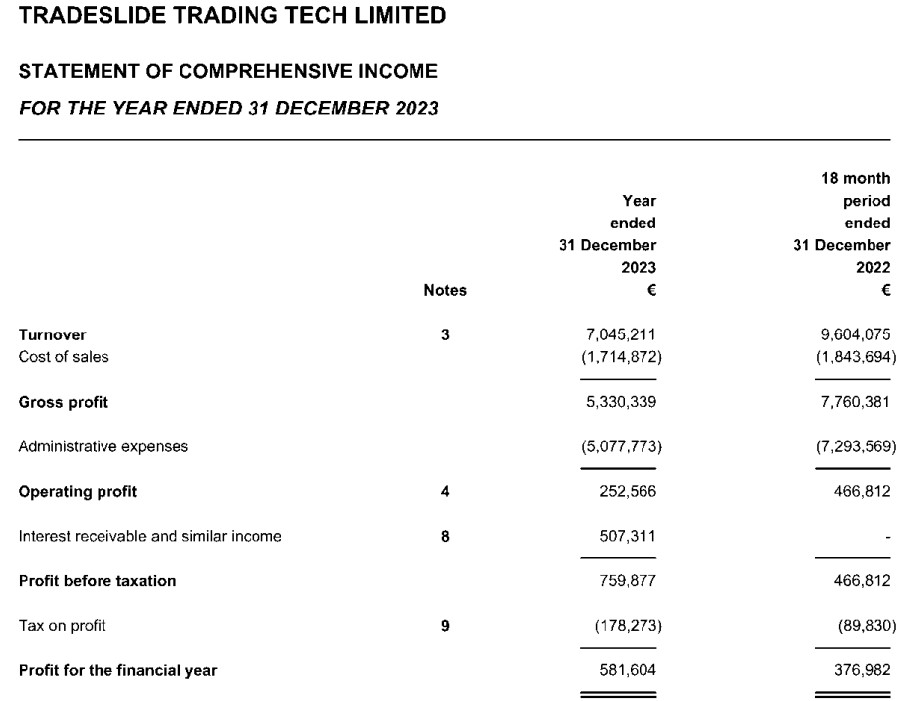

Tradeslide Shopping and selling Tech Restricted, the company within the reduction of the Darwinex stamp within the UK, furthermore released its financial results for closing year. The implications highlighted an develop in profit no topic a decline in revenue. The agency’s equity jumped 29% when put next with the earlier year, which covered an 18-month interval that led to December 2022.

Tradeslide’s profit elevated 54% from €377k to €582k, whereas the working profit declined 45% from €466,812 to €252,566. “The corporate greatly improved tainted profit when put next with the closing 12-month interval, as well to optimized its mounted trace rotten. Profitability enabled the company to shore up its capital station for the duration of 2023,” Tradeslide commented on the financial document.

FxPro UK Rebounds to Revenue

London-essentially based entirely retail dealer FxPro UK released its financial document for the year ended December 2023, as printed by Companies Rental UK. The document reveals that the company bounced reduction to profit, boosted by a double-digit revenue boost. FxPro moved from an absence of £614,558 within the earlier year to a profit of £153,103.

The retail dealer furthermore managed to turn spherical an working lack of £611,497 to a profit of £93,283. Though the company’s distribution fees elevated from £212,780 to £331,517, FxPro managed to diminish administrative fees from £1,511,382 to £1,182,292. The corporate plans to present its buyers the dealing of bodily shares this year as well to the CFD choices.

Trive Africa Launches CFD Shopping and selling for MENA Prospects

Trive Africa launched contracts for incompatibility (CFD) shopping and selling companies and products for buyers within the Middle East and North Africa (MENA) space. This new providing is facilitated by Trive World, a British Virgin Islands-regulated entity, Finance Magnates learned completely.

Per the company, this step marks a genuinely valuable milestone in its ambition to conceal a elevated market share across Africa and the Middle East. It followed the most modern onboarding of CFD merchants by Trive South Africa. Thrive Africa presented new incentives accompanying the starting up of the service to buyers within the MENA space, including a deposit bonus of up to $100,000 and net admission to to leverage of up to 1:2000.

Trive South Africa Begins Onboarding CFD Prospects

Trive’s most modern pattern followed the onboarding of derivatives shopping and selling buyers by its South Africa’s affiliate and marked its entry into the aggressive African financial markets. The corporate, which operates below a license from the Monetary Sector Habits Authority (FSCA), is led by Marius Grobler, who beforehand served as Trive’s Chief Operating Officer (COO) within the MENA space.

Moreover providing the MetaTrader 4 and 5 platforms, Trive South Africa has presented plans to begin a reproduction shopping and selling characteristic called Trive Social, whereas furthermore developing its private proprietary shopping and selling platform. Grobler, now the CEO of Trive South Africa, mentioned that the company aims to assign itself as “the premier preference for derivatives shopping and selling” in this fragment of the sector.

Zlatan Ibrahimović Becomes Respectable Ambassador of XTB

Following closing year’s addition of legendary goalkeeper Iker Casillas to its ambassador crew, XTB unveiled one other surprise for football followers. This time, the publicly traded Polish fintech has partnered with indubitably one of the dear most vibrant figures within the sports activities world, Zlatan Ibrahimović, Finance Magnates learned completely.

XTB is launching a brand new media campaign featuring Zlatan Ibrahimović as its ambassador. This coincides with the fintech’s twentieth-anniversary celebrations and the unveiling of a refreshed logo. Ibrahimović, indubitably one of the dear most charismatic football gamers of the closing generation with over 120 million social media followers, stood out with his unfamiliar targets and even extra long-established ways of being.

eToro Acquires Australian Investing App for $55M

In varied locations, eToro presented this week its acquisition of the Australian investing app Spaceship in a deal valued at AUD 80 million ($55 million). With this pass, the Israel-essentially based entirely company demonstrated its diagram to bolster its station within the financial savings sector and level of curiosity on extra passive, lengthy-term investments.

The acquisition aims to bolster eToro’s presence in Australia whereas expanding its lengthy-term financial savings choices globally. Spaceship, founded in 2017, has gathered over 200,000 buyers and manages greater than AUD 1.5 billion AUD ($1 billion) in property by its superannuation funds and managed investment portfolios.

Retail Patrons Flock to Stocks from Foreign change After Fed Rate Scale back

eToro’s most modern files revealed that world retail patrons are growing their publicity to equities following the Federal Reserve’s (Fed) first hobby rate lower in four years. Riskier property are gaining in desire of the Foreign change (FX) market and cash, where a decline in investor hobby is changing into extra evident.

The eToro’s quarterly Retail Investor Beat behold, which polled 10,000 retail patrons across 12 international locations, revealed a marked shift in direction of shares and far from cash property within the third quarter of 2024. The proportion of patrons preserving within the neighborhood listed shares jumped from 49% to 54%, whereas those invested in global equities surged from 31% to 36%.

CySEC Unveiled Contemporary Solutions for Fractional Shares

The Cyprus Securities and Alternate Commission (CySEC) released new guidelines for investment corporations providing fractional shares, addressing the growing pattern of on-line brokers allowing patrons to aquire handiest runt portions of publicly listed shares.

In a spherical issued this week, CySEC outlined the regulatory framework for Cyprus Funding Companies (CIFs) that enables buyers to invent fractional publicity to shares by belief preparations. The pass comes as fractional investing has gained reputation, specifically among retail patrons within the hunt for to diversify their portfolios with smaller capital outlays.

OTC Derivatives vs ETPs: Which Is a Larger Revenue Generator for CFDs Brokers?

No topic a tricky financial year for some brokers, the interrogate for over-the-counter (OTC) derivatives and alternate-traded products stays sturdy. Contracts for variations (CFDs) and alternate-traded instruments are riding valuable boost in explain areas and segments. While some brokers, adore XTB, are experiencing sturdy boost pushed by CFDs and alternate-traded products, others, equivalent to IG Neighborhood and Swissquote, private confronted challenges, including declining revenues and diminished consumer command.

Filip Kaczmarzyk, the Head of Shopping and selling and member of the management board, explained that the platform’s revenues are dominated by CFDs, which accounted for greater than ninety nine% of revenues closing year and lawful below 98% within the major half of 2024. “Alternatively, it is a must wish to level the dynamic boost in revenues generated by shares and ETPs,” he stated. “Files for the major half of this year reveals that alternate-traded instruments generated nearly thrice extra revenues than within the corresponding interval of 2023.”

Robinhood Plans to Enter the Stablecoin Market: Can It Suppose Tether?

After Revolut, American zero-commission dealer Robinhood is now pondering launching stablecoins. Alternatively, a representative from the company stated it has “no drawing shut plans to begin this providing” without dismissing the document.

Though it started as a disruptor within the American stock brokerage market, Robinhood expanded its choices to crypto. It now generates a prime share of its revenue from companies and products spherical digital property. Its crypto transactions revenue doubled to $81 million within the 2nd quarter of 2024, whereas the total transaction-essentially based entirely revenue became $327 million.

PayPal Launches Crypto Companies for US Industry Accounts

Aloof with crypto, PayPal presented toughen for cryptocurrency for US industry account holders. The fintech broad stated the new service permits retailers to aquire, shield, and promote digital property straight by their PayPal industry accounts.

Alternatively, this new efficiency could presumably no longer be available to agencies in Contemporary York at delivery. PayPal’s possibility to begin cryptocurrency instruments to agencies is reportedly a response to rising interrogate.

Binance Serves Customers No topic 2023 Exit, Sees 43% Decline in Russian Visitors

Binance continues to relieve some Russian buyers no topic its earlier announcement of a paunchy exit from the Russian market in 2023. A spokesperson from the alternate confirmed that it maintains companies and products for a restricted preference of existing Russian users. This, they stated, is to fabricate obvious the security of their digital property.

Binance silent serves restricted Russian users no topic 2023 exit

Binance continues to relieve a restricted preference of Russian users for asset security, no topic its 2023 exit. Per Cointelegraph, Russian traffic to Binance’s station dropped 43% from August 2023 to July 2024, nonetheless…

— CoinNess World (@CoinnessGL) September 26, 2024

The spokesperson emphasized Binance’s adherence to world sanctions and compliance with global rules, “absolutely complies with restrictions on participants, entities, and international locations area to global sanctions,” the representative stated.

Jamie Dimon: Inflation May maybe well Now no longer Be Going Away

The CEO of JPMorgan Bound has been beating the inflation drum for over a year, and frankly, we must all be paying attention. Dimon’s most modern pronouncements at The Atlantic Festival made it particular that he believes inflation gained’t be fading quietly into the background. His reasoning? Inflation is deeply rooted in components that aren’t going away anytime rapidly.

And here is the item: many specialists accept as true with he’s correct. The golf green economic system, world rearmament, and national debt aren’t lawful speaking functions for Dimon; they’re severe lengthy-term drivers of inflation.

Jamie Dimon of @jpmorgan sits with @jeffreygoldberg to discuss inflation and if the president has vitality over the route of the economic system.

Watch the #TAF24 dialog here: https://t.co/iwm2feeUvu pic.twitter.com/5ekQ0jfxH4

— AtlanticLIVE (@AtlanticLIVE) September 20, 2024

Kamala Harris: Mic Earrings, Scale back-Off Conspiracies and Crypto News

Lastly, from mic-dangling earrings to digital property, Kamala Harris is caught in a whirlwind of conspiracy theories, nonetheless finally she’s participating within the entirely conspiracy-free world of crypto. Kamala Harris has change correct into a straightforward aim for out of the ordinary conspiracies.

From accusations that her earrings had been secret microphones for the duration of the September 10 debate with Donald Trump to rumors that her CNN interview with Minnesota Governor Tim Walz became lower brief because of some sinister cause—it is almost as if some americans are working a bingo game for baseless theories.

Overjoyed weekend!