As 2025 draws to a shut, Bitcoin and altcoins are attracting consideration with their weak efficiency. Whereas Bitcoin is anticipated to create the year beneath $100,000, Coinshares has released its weekly cryptocurrency characterize, stating that there became an influx of $864 million closing week.

“There became a total influx of $864 million into cryptocurrency investment products. This marks the third week of in total modest inflows, and we imagine this reflects a cautious however extra and extra optimistic investor nasty.”

No topic the Federal Reserve’s recent interest rate lop, imprint efficiency remained slack, and combined sentiment and erratic flows were noticed within the trading days following the reduction.

Entries were concentrated in Bitcoin and Ethereum!

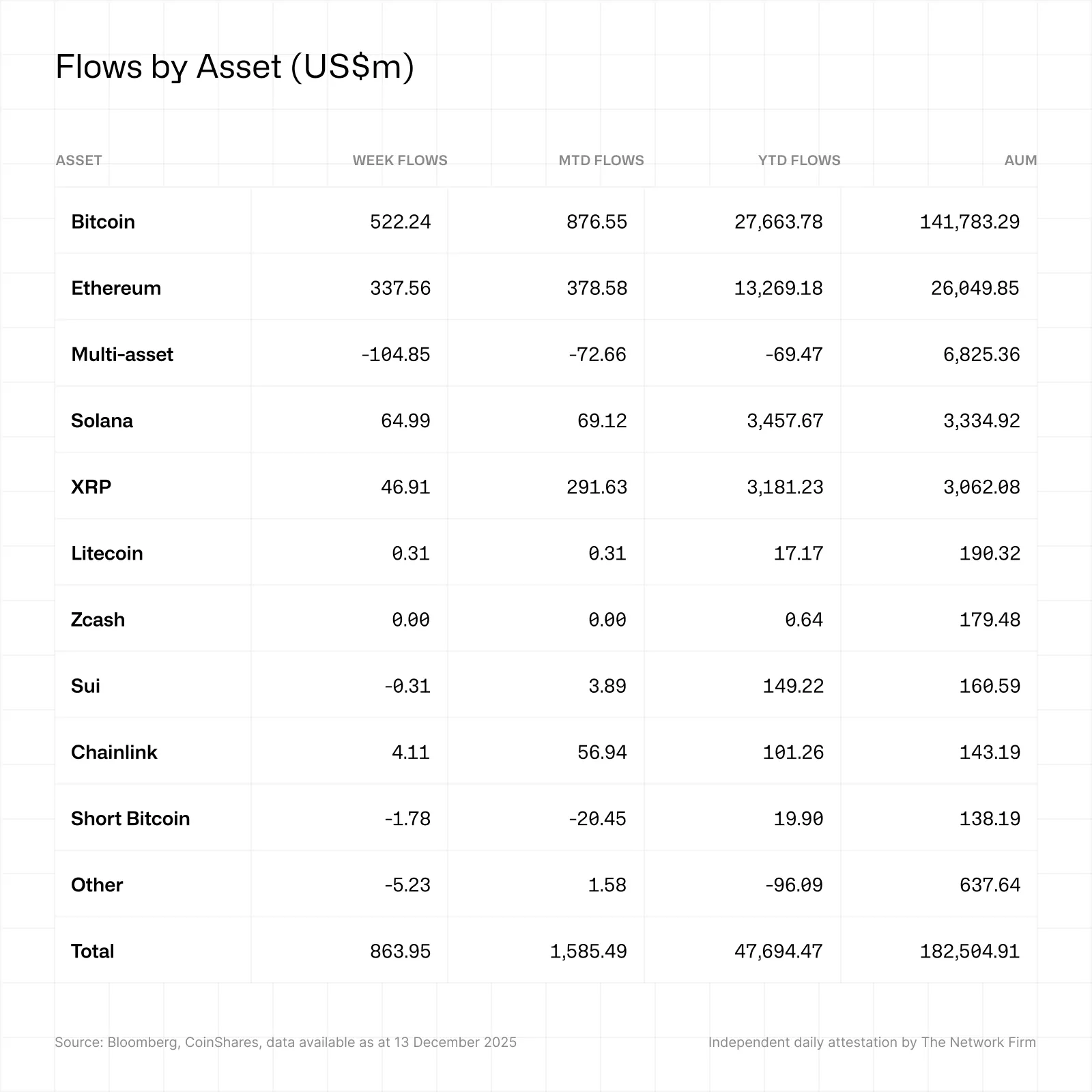

Taking a survey at crypto funds individually, it became noticed that nearly all of inflows were in Bitcoin.

Bitcoin noticed inflows worth $522 million, while Ethereum (ETH) experienced inflows of $337 million.

Taking a survey at other altcoins, Solana (SOL) noticed inflows of $64.9 million, XRP $46.9 million, Aave $5.9 million, and Chainlink (LINK) $4.1 million, while Hyperliquid experienced outflows of $14.1 million.

“Bitcoin attracted $522 million in inflows. No topic this, Bitcoin has lagged slightly within the lend a hand of this year. Inflows since the initiating of the year are $27.7 billion, in contrast with $41 billion in 2024.”

Ethereum recorded $337 million in inflows closing week, bringing total inflows since the initiating of the year to $13.3 billion, a 148% boost in contrast with 2024.

Entries to Solana devour remained at a decrease level of $3.5 billion since the initiating of the year, however this restful represents a tenfold boost in contrast with 2024.

Aave and Chainlink recorded inflows of $5.9 million and $4.1 million respectively closing week, while Hyperliquid experienced outflows of $14.1 million.

Taking a survey at regional fund inflows and outflows, the US ranked first with an influx of $796 million.

After the US, Germany noticed inflows of $68.6 million, and Canada got $26.8 million.

In distinction to those inflows, Switzerland experienced a dinky outflow of $41.4 million, while Brazil noticed a dinky outflow of $1.7 million.

*Right here’s no longer investment advice.