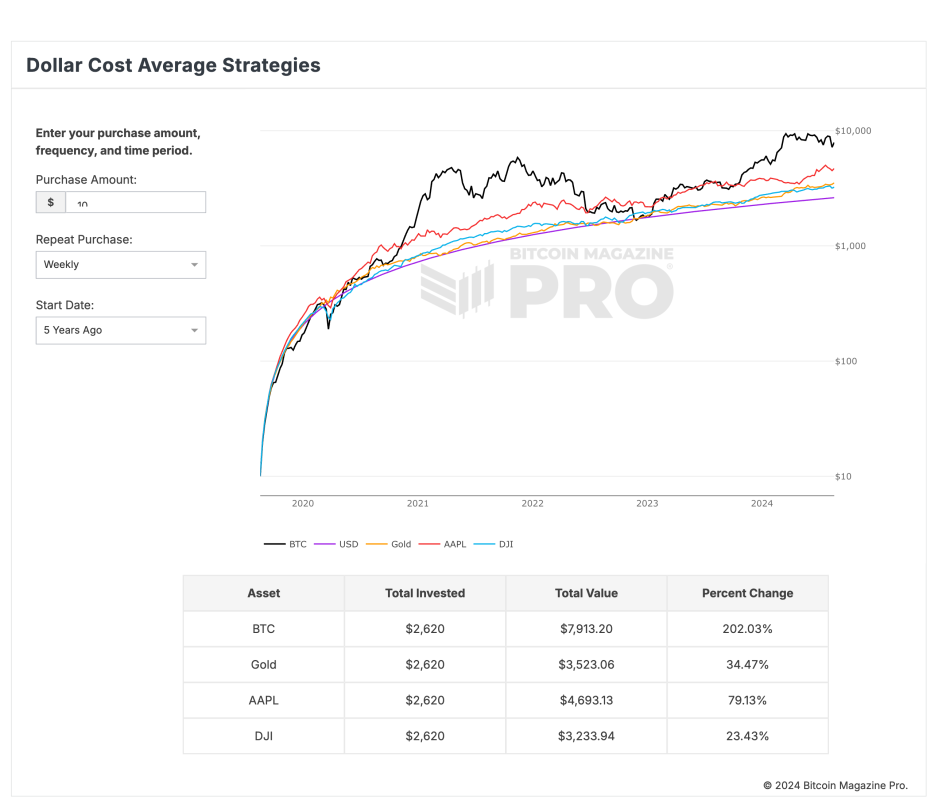

A most in model diagnosis from Bitcoin Journal Pro showcases the vitality of buck-designate averaging (DCA) in Bitcoin compared to faded resources admire gold, Apple stock, and the Dow Jones Industrial Moderate (DJI). The details finds that constantly investing $10 weekly into Bitcoin over the last 5 years would obtain grown a complete funding of $2,620 into $7,913.20, reflecting a outstanding 202.03% return.

In difference, the same $10 weekly funding in gold yielded a return of 34.47%, rising the preliminary $2,620 to $3,523.06. Apple stock also performed effectively, with a 79.13% return, turning the $2,620 funding into $4,693.13. Meanwhile, the Dow Jones equipped the least return, with a 23.43% amplify, rising the funding to $3,233.94.

This details underscores Bitcoin’s skill to be one of many greatest resources, if no longer the greatest asset, for traders to incorporate into their long-term funding ideas. The precept in the abet of buck-designate averaging—continuously investing a put sum of cash without reference to designate fluctuations—has confirmed namely efficient with Bitcoin, allowing traders to amass wealth over time.

Saving $10 a week into Bitcoin thru Greenback Trace Averaging (DCA) offers an affordable and accessible formula for newbies to begin investing in Bitcoin. This system is mainly moving for folks that will also very effectively be hesitant to make investments monumental sums upfront or are soundless finding out concerning the volatile nature of the Bitcoin market. By investing a minute, fixed quantity continuously, people can step by step originate their Bitcoin holdings, reducing the affect of market fluctuations and making it more straightforward to adopt a protracted-term funding mindset. This attain enables for consistent progress over time, without the stress of attempting to time the market completely.

The Greenback Trace Moderate Ideas application from Bitcoin Journal Pro enables customers to uncover diversified funding ideas, optimizing their Bitcoin investments across varied time horizons. The appliance compares Bitcoin’s efficiency in opposition to other resources admire the US buck, gold, Apple stock, and the Dow Jones, illustrating Bitcoin’s skill as a superior retailer of designate in a effectively-rounded funding portfolio.

For additional detailed details, insights, and to price up for to procure admission to Bitcoin Journal Pro’s details and analytics, scoot to the official web web page right here.