- Bitcoin mark displays no indicators of a directional bias as it hovers around $66,000.

- The 2019 BTC mark fractal hints at a possible correction need to the US Fed reduce curiosity charges.

- Merchants can demand a retest of the $60,000 to $forty five,000 phases reckoning on the severity of the nosedive.

There aren’t any excessive-impact events that will perhaps maybe sway the market this week. So, let’s level of curiosity on the cryptocurrency market’s lack of directional bias. From a huge-portray level of view, the motive for this uncertainty would be attributed to the US Federal Reserve or the macroeconomic panorama. However Bitcoin (BTC) is furthermore liable for this directionlessness and choppy market outlook.

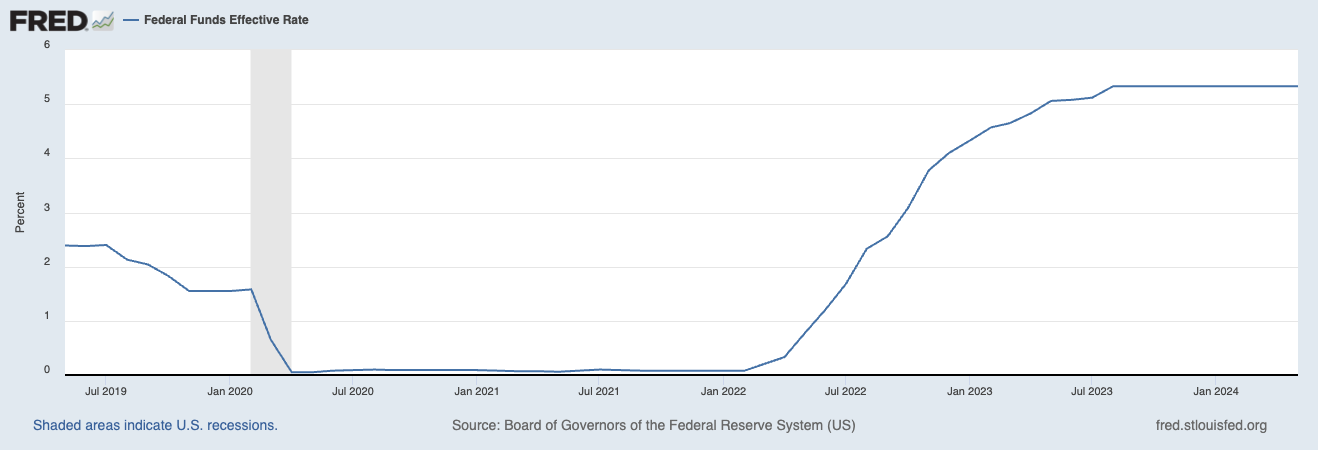

US Fed’s battle in opposition to inflation

The Fed has been battling inflation on yarn of the 2020 pandemic and has brought it down from a peak of 9.1% in mid-2022 to three.3%. Peaceable, the central bank has did now not elevate it down to its 2% target no topic conserving the federal funds target rate, aka curiosity rate, stylish at the 5.25% to 5.50% fluctuate since July 2023.

US Federal Reserve fed funds rate

Ancient evidence suggests that if curiosity charges remain greater for longer, it might perhaps maybe ruin the economy, triggering a marketwide promote-off.

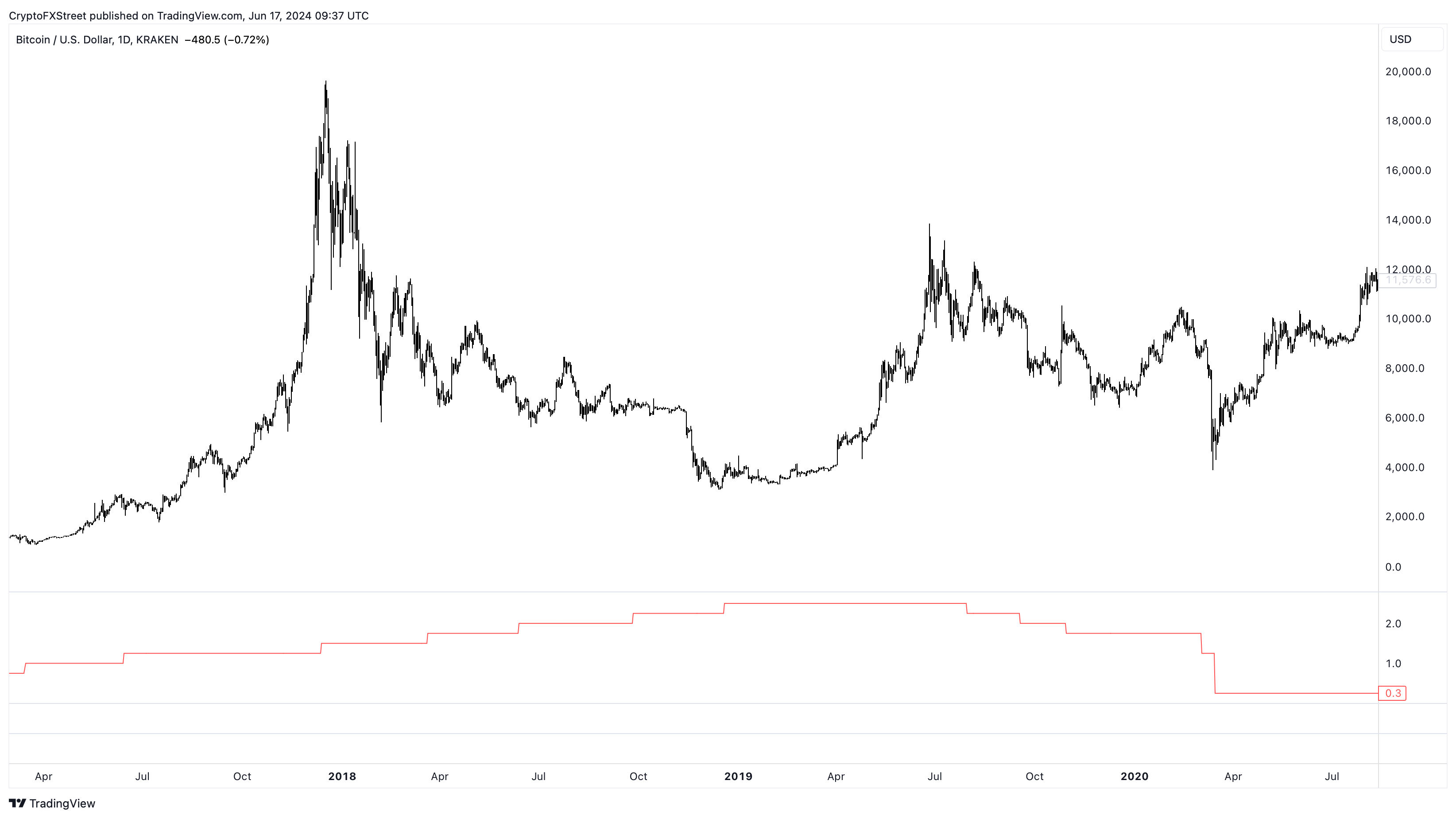

The US Fed ramped up curiosity charges from 0.75% in January 2017 to 2.5% in December 2018. After this, the charges remained at the peak stage till unhurried July 2019. Then again, the Fed decided to reduce curiosity charges in February 2020 shut to zero in narrate to cushion the effects of the marketwide nosedive this potential that of the COVID-19 pandemic.

BTC/USD 1-day vs Fed Funds Price chart

Curiously, the crypto markets had been the first to break and started their descent after the Fed started slicing the curiosity charges in July 2019. It makes sense that BTC fashioned a native high in 2019 and crashed as merchants would determine to offload the riskiest assets first. So, the Fed pivot created a risk-off space, main to a correction for crypto.

BTC 2019 fractal

For now, the curiosity rate has remained at 5.25% to 5.50% for nearly a year, with rumors of a Fed pivot to decrease charges across the nook. This upcoming pattern has precipitated many to invest that crypto would be forming a native mark high.

The type of pattern might maybe maybe be aware BTC label the $61,000 to $60,000 stage first. Previous this, BTC might maybe maybe spin as low as 24% to $forty five,400, especially if the 2019 fractal repeats.

BTC/USD 1-day, 12-hour chart

A total invalidation of this bearish outlook might maybe maybe occur if BTC manages to beat the $71,150 resistance stage and flip it true into a fortify ground. The type of switch might maybe maybe be aware BTC contest the all-time excessive of $73,794 and enviornment up a unusual one at $80,000.