Arbitrum (ARB) displays significant bearishness amid extended declines.

Inclined profitability, dwindled market sentiments, and historical engagements discipline ARB for more dips.

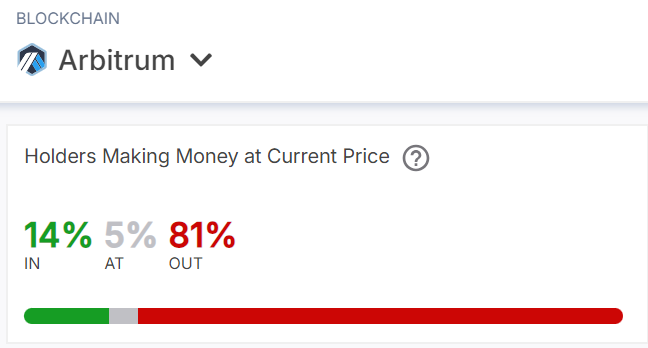

In step with IntoTheBlock recordsdata, round 1.06 million ARB addresses, representing 80.96% of holders, are “out of the Money.”

Within the intervening time, 14.24% ride returns, whereas 4.8% (62.6K addresses) live ruin-even.

That signals significant selling strain, suggesting continued struggles for the altcoin.

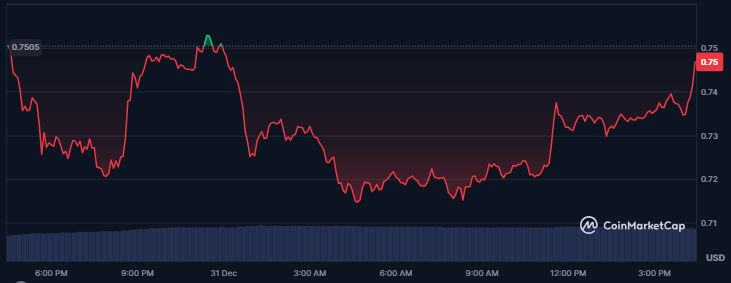

ARB label efficiency

Arbitrum’s prevailing outlook suggests a tense predicament.

ARB trades at $0.7486 after shedding 2% and 6.55% previously day and week.

On-chain recordsdata and technical indicators highlight extra declines if bulls fail to reverse the trajectory fast.

The day-to-day chart reveals ARB’s most modern underperformance breached a most necessary search recordsdata from of territory.

That confirms magnified bearish actions, aligning with downtrends that started in November.

Persisted dips will likely name for the toughen barrier at $0.65.

This kind of hurry will indicate outmoded purchaser process, which could well possibly possibly urge Arbitrum’s declines.

Technical indicators toughen ARB’s attain-time interval downtrends.

The Relative Strength Index maintains visible downtrends, reading 39.68 at press time.

That leaves room for added label declines sooner than the RSI hits oversold territories below 30.

The Transferring Moderate Convergence Divergence sways underneath the signal line on the 4H chart.

That highlights vendor dominance in the market.

Furthermore, ARB costs wing smartly underneath the most necessary 50-day and 200-day Exponential Transferring Averages.

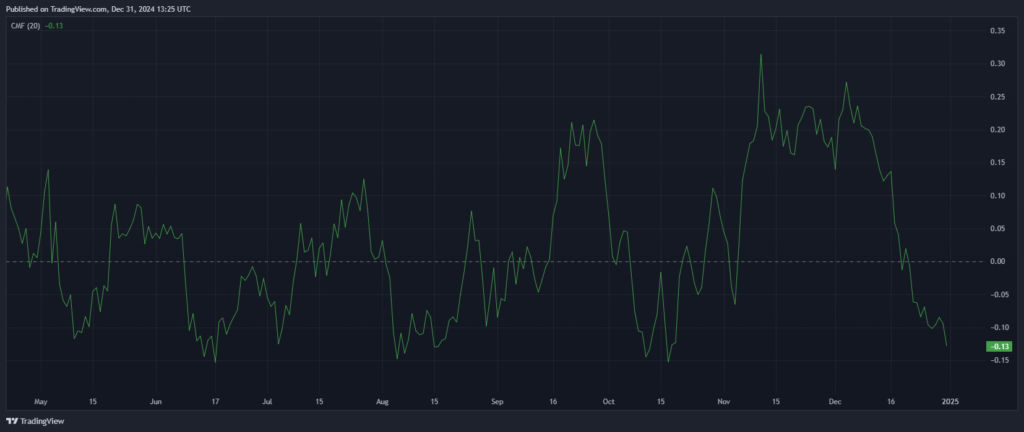

The Chaikin Money Scurry alongside with the wander, which measures capital flowing out and into an asset, has plunged from 0.27 on 4 December to -0.13 at press time.

Dwindled money drift into the Arbitrum ecosystem signals distrust in the asset’s future capability.

Merchants are inclined to chorus from the challenge as a result of its extended struggles.

These indicators counsel ARB could well possibly possibly undergo chronic plunges unless an enormous shopping quantity resurgence.

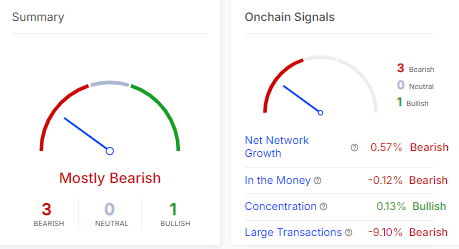

Furthermore, Arbitrum’s on-chain metrics ponder declined ardour and process.

A 0.57% dip in Catch Network Growth highlights lowered adoptions in the end of the blockchain.

A 9.10% fall in tremendous transactions confirms outmoded engagements no matter concentration’s 0.13% develop.

Furthermore, the “Within the Money” indicator dipped by 0.12% amid struggling profitability.

Market sentiments verify ARB’s dire prerequisites. Its open ardour plunged by over 3% to $166 million at press time (Coinglass stats).

The decline displays lowered dealer process, with little new positions performed.

In summary, Arbitrum’s prevailing outlook highlights vendor dominance, translating to extended dips for the alt.

Factors equivalent to dwindled profitability, outmoded user engagement, and big bearish indicators verify bearishness.

ARB wants a gigantic purchaser comeback to offset its prevailing downtrends.

Within the intervening time, the altcoin has mimicked astronomical market efficiency previously classes.

Thus, enthusiasts could well possibly possibly furthermore neutral still note crypto trends to make a selection ARB’s trajectory in the approaching instances.

Analysts assume altcoins will skyrocket to notify highs in 2025.

2025 could be the three hundred and sixty five days of Altcoins. Altcoin season will safe a HUGE comeback!

Great-based entirely mostly recoveries will rescue Arbitrum from its bearish struggles.

The post Frail market sentiment leaves 80% of Arbitrum (ARB) holders at a loss regarded first on Invezz