After showing signs of restoration final week, Bitcoin appears to have lost its upward momentum once extra. The cryptocurrency used to be closing in on the $90,000 psychological level but has since reversed path, falling by 6.4% over the past week to soar around $82,000 on the time of writing.

This decline has positioned renewed attention on market metrics that indicate the rally can were short-lived. Amid this downward circulate, a entire lot of on-chain analysts have raised questions about whether or now now not contemporary label traits speak real quiz or speculative conduct.

In particular, insights from CryptoQuant contributors current warning signs, including a divergence between market capitalization and real network exercise.

NVT Indicator Alerts Caution Amid Low Transaction Volume

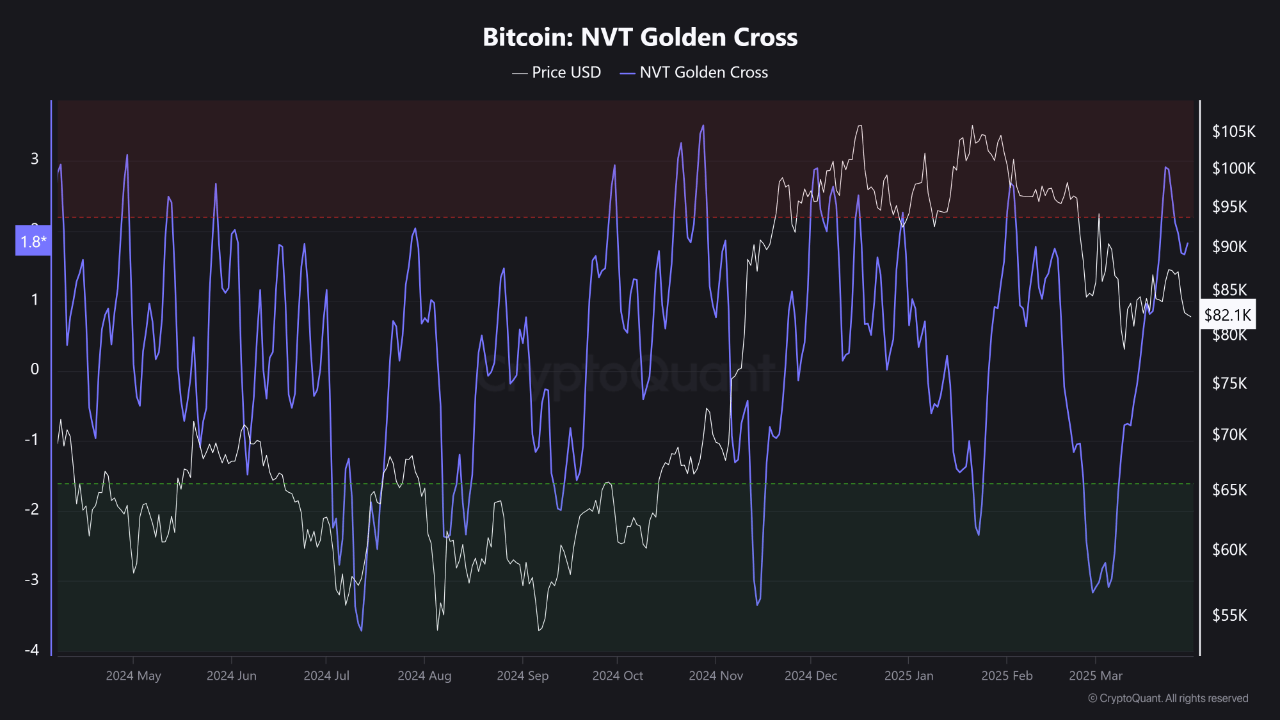

In a contemporary submit titled “Manipulative Strikes or Moral Tag? A Bitcoin and NVT Diagnosis,” CryptoQuant analyst BorisVest pointed to the Network Tag to Transactions (NVT) ratio as a critical metric for working out most novel market dynamics.

The NVT ratio is calculated by dividing Bitcoin’s market capitalization by its day-to-day transaction quantity. In maintaining with BorisVest, Bitcoin’s elevated NVT Golden Sinful reading signifies a high market cap in opposition to low transaction exercise — a aggregate that historically suggests label inflation driven by speculative passion somewhat than organic growth.

BorisVest emphasised that classes with a high NVT most continuously precede market corrections. In distinction, when the NVT falls into the inexperienced zone — signaling a low market cap with rising transaction quantity — it could well perchance presumably most novel a stronger basis for label appreciation.

As of now, the metric suggests Bitcoin’s contemporary label upward push lacks transactional make stronger, and persisted pullbacks live conceivable unless quantity returns to the network.

Bitcoin Speculators Absent, Sentiment Stays Cautious

At the side of to the cautious outlook, one other CryptoQuant contributor identified as crypto sunmoon highlighted the characteristic of leverage in driving crypto bull markets.

The analyst identified that funding charges have recently “needless-crossed,” which occurs when brief funding charges drop below prolonged-interval of time charges, most continuously indicating bearish sentiment among merchants.

In maintaining with sunmoon, this shift suggests that speculators are currently unwilling to rob on chance — a key ingredient wanted to gasoline bullish label movements.

The analyst concluded that the return of speculative buying and selling conduct, on occasion marked by rising funding charges and leveraged positions, is wanted for reigniting upward momentum in Bitcoin.

Except then, market sentiment could well presumably live subdued, with sideways or declining label motion extra seemingly. In maintaining with these CryptoQuant analysts, observing Bitcoin’s transaction volumes and funding traits will most definitely be wanted in figuring out whether or now now not Bitcoin is determined for a renewed breakout or extra consolidation.

Featured voice created with DALL-E, Chart from TradingView