The cryptocurrency market has hit an exceptionally tough patch in newest buying and selling with, for instance, Bitcoin (BTC) collapsing $10,000 in correct two days to its press time impress of $85,811 — its lowest level for the reason that Trump re-election rally started in early November.

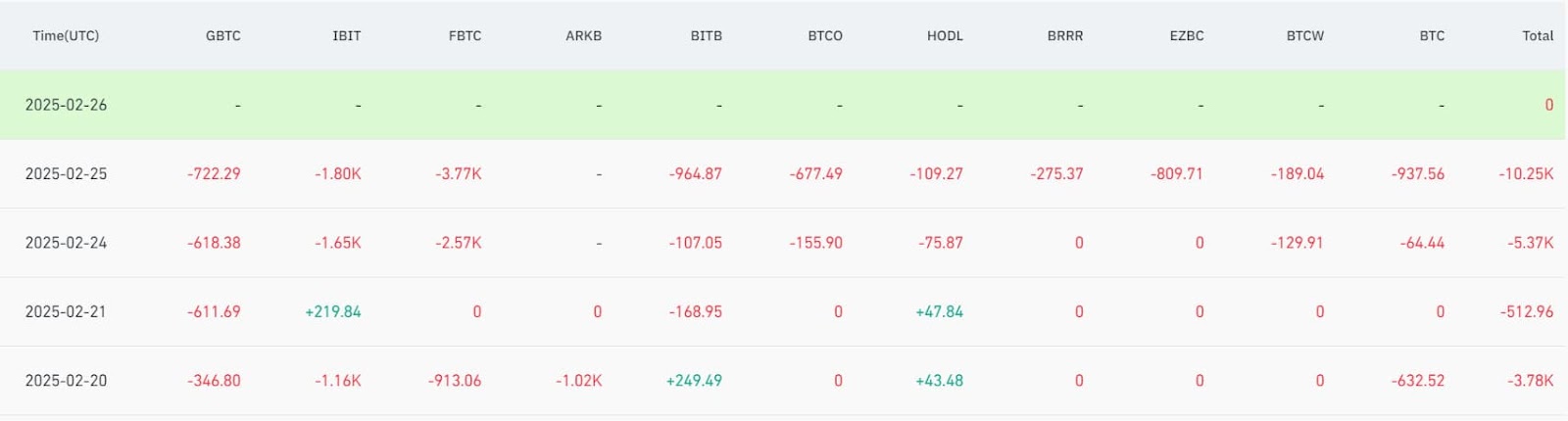

Given the sheer volume of promoting that led to such a interesting decline, it’ll attain as no shock that monetary establishments working whisper BTC alternate-traded funds (ETFs) were offloading the cryptocurrency at a yarn hump, with February 25 alone seeing virtually $940 million in outflows.

Is Bitcoin poised to rally after the huge selloff?

The supreme seller by some distance on the day proved to be Fidelity Wise Origin Bitcoin Fund (FBTC), as it sold bigger than 3,770 BTC worth virtually $345 million. Even VanEck Bitcoin (HODL), the smallest seller by volume on February 25, proved unfaithful to its ticker as it let plod of 109,000 Bitcoins worth $10 million.

No topic the huge offloading, some investors speedily grew to became hopeful that the huge strain would with out warning ship BTC into ‘oversold’ territory, main to a rebound. Certainly, buying and selling of February 25 regarded speedily to possess fulfilled such hopes as the coin whipsawed after falling below $88,000.

The realm’s premier cryptocurrency as soon as again gave hope that the bloodbath that wiped bigger than $300 billion from the digital assets’ total market capitalization was as soon as at extinguish as it reclaimed $89,000 earlier on February 26 however, as much as now, to no avail.

Certainly, though some investors, corresponding to Cas Abbé on X, pointed out that BTC was as soon as rather speedily to salvage a native bottom after main ETF selloffs, history shows that isn’t primarily the case.

Bitcoin ETFs had the supreme outflow the day previous to this, with virtually $938 million worth of BTC sold by BlackRock, Fidelity, and assorted establishments.

The correct ingredient is that every and every main outflow has marked the native bottom.

End you deem $BTC’s bottom is in?

— Cas Abbé (@cas_abbe) February 26, 2025

For instance, a prolonged length of outflows in silly April 2024 had Bitcoin first tumble to roughly $63,000, most productive to crumple below $60,000 by early Can even merely. Equally, a mid-June selloff first took the cryptocurrency from $72,000 to $65,000 and then even decrease to $55,000 after a temporary rebound.

A identical incidence would be observed in silly August as Wall Road was as soon as promoting broadly as BTC was as soon as falling towards $59,000 most productive to, as soon as again, speedily get better earlier than collapsing towards $Fifty three,000.

Why Bitcoin would possibly perchance presumably alternate decrease for months

No topic the dire inform within the cryptocurrency market on February 26, some silver lining can also stay for the more bullish investors.

As Finbold reported on Tuesday, it’s some distance extremely now now not actually that Bitcoin will topple below $83,000 throughout the contemporary downturn, as there would possibly be a solid indication it stays in global consolidation within the weekly and each day timeframes.

Peaceable, both ancient examples — throughout the summer of 2024, BTC suffered from a prolonged and moderately bearish setup as it remained mounted within the tough vary between $63,000 and $67,000 earlier than lastly taking off months later upon Donald Trump’s election victory — and technical analysis hint that the coin can also fight with regaining bullish momentum.

At press time, Bitcoin stays an awfully good deal below the $89,400 to $90,000 that would possibly perchance presumably enable it to reverse course.

Featured image through Shutterstock