MicroStrategy (NASDAQ: MSTR), for the time being shopping and selling at roughly $1,495.54, has experienced a essential year-to-date magnify of 118.28%. This surge is fueled by the firm’s aggressive Bitcoin (BTC) acquisition scheme, remodeling it into the largest publicly traded corporate holder of Bitcoin.

With holdings accounting for 1.1% of the enviornment’s Bitcoin present, valued at around $14.5 billion, MicroStrategy’s fearless strikes continue to capture the attention of investors and analysts alike.

Right here’s driven by the firm’s strategic initiatives, including an upsized $700 million debt offering to fund additional Bitcoin acquisitions, demonstrating MicroStrategy’s dedication to leveraging market opportunities and solidifying its plight within the Bitcoin condominium.

Lately, Canaccord Genuity reaffirmed its “aquire” score on MicroStrategy stock and raised its label aim from $1,590 to $2,047, in step with its strategic diagram to leveraging digital property and the sure outlook for Bitcoin.

Overall, attention remains on how MSTR will fare within the arrival months. Wall Boulevard analysts and OpenAI’s most developed synthetic intelligence (AI) tool, ChatGPT-4o, be pleased supplied insights into where the stock might perhaps well be headed within the next Twelve months.

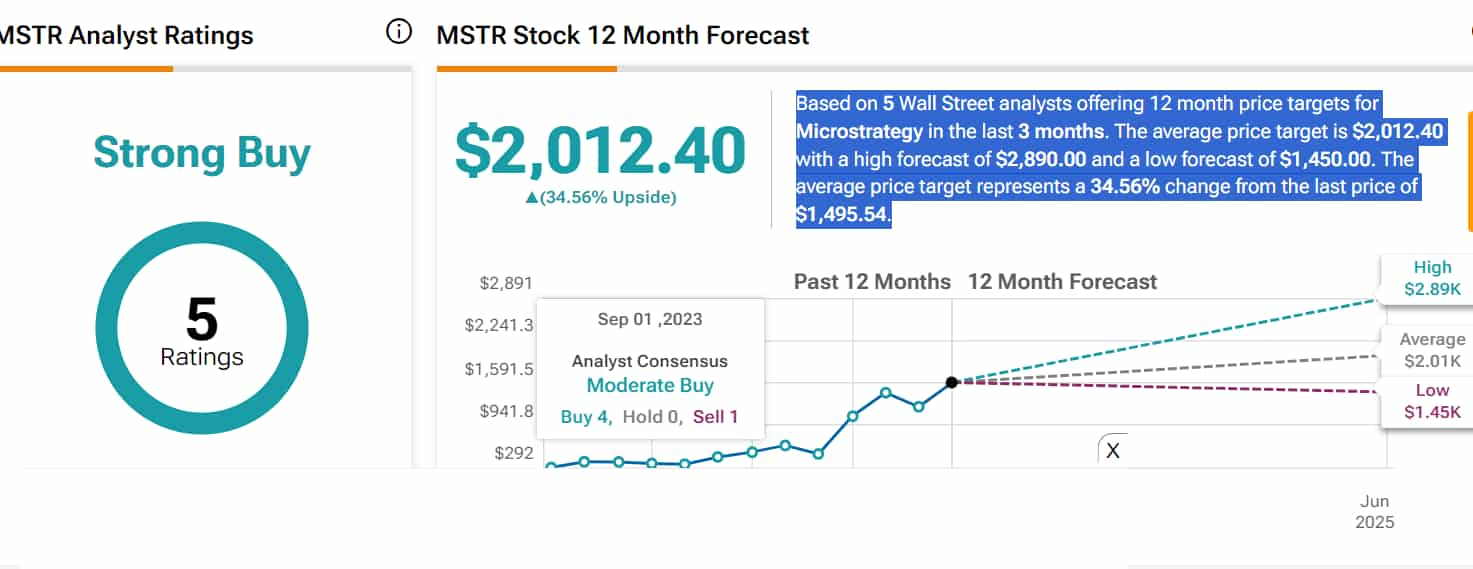

Wall Boulevard predictions on MSTR stock

Lately, analysts at Bernstein initiated coverage on MicroStrategy with an Outperform score, setting an formidable label aim of $2,890. This aim suggests a potential 95% upside from the present shopping and selling label of $1,495.54.

Bernstein’s bullish outlook is driven by MicroStrategy’s aggressive Bitcoin acquisition scheme and its market positioning as a main corporate holder of Bitcoin.

As wisely as to Bernstein’s diagnosis, a broader consensus among Wall Boulevard analysts presents a comprehensive search of MicroStrategy’s possible stock efficiency.

Over the past three months, five Wall Boulevard analysts be pleased supplied 12-month label targets for MSTR where the everyday label aim is $2,012.40, with a excessive forecast of $2,890 and a low forecast of $1,450.

The moderate label aim represents a 34.56% switch from the final label of $1,495.54.

ChatGPT-4o prediction for MSTR

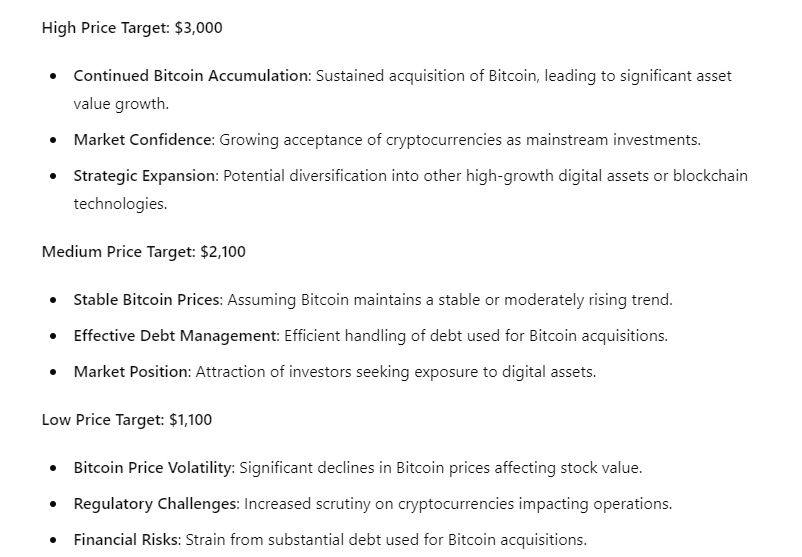

ChatGPT-4 predicts a vary of possible outcomes for MicroStrategy’s stock. In the optimistic scenario, the stock might perhaps well attain as excessive as $3,000. This excessive aim is in step with persevered aggressive Bitcoin accumulation, sustained market confidence, and possible strategic expansions into other excessive-boost digital property or blockchain applied sciences.

Conversely, in a bearish scenario, the stock might perhaps well drop to $1,100, brooding about dangers equivalent to Bitcoin label volatility, regulatory challenges, and financial stress from substantial debt veteran for Bitcoin acquisitions.

A balanced medium-case scenario sets the price aim at around $2,100, assuming salvage or pretty rising Bitcoin prices and efficient debt management.

Each sets of predictions underscore the main affect of Bitcoin prices on MicroStrategy’s stock. While there is truly intensive upside possible for MicroStrategy, investors must also be titillating for the inherent dangers linked to its Bitcoin-centric scheme.

The firm’s uncommon plight as a main Bitcoin holder makes it an magnificent possibility for these looking out out for exposure to digital property, however this comes with substantial volatility and regulatory dangers.

Disclaimer:The screech on this station must now not be regarded as investment recommendation. Investing is speculative. When investing, your capital is at possibility.