VISTA rose 74% over the last day as decentralized alternate Ethervista launched its token deployer Etherfun.

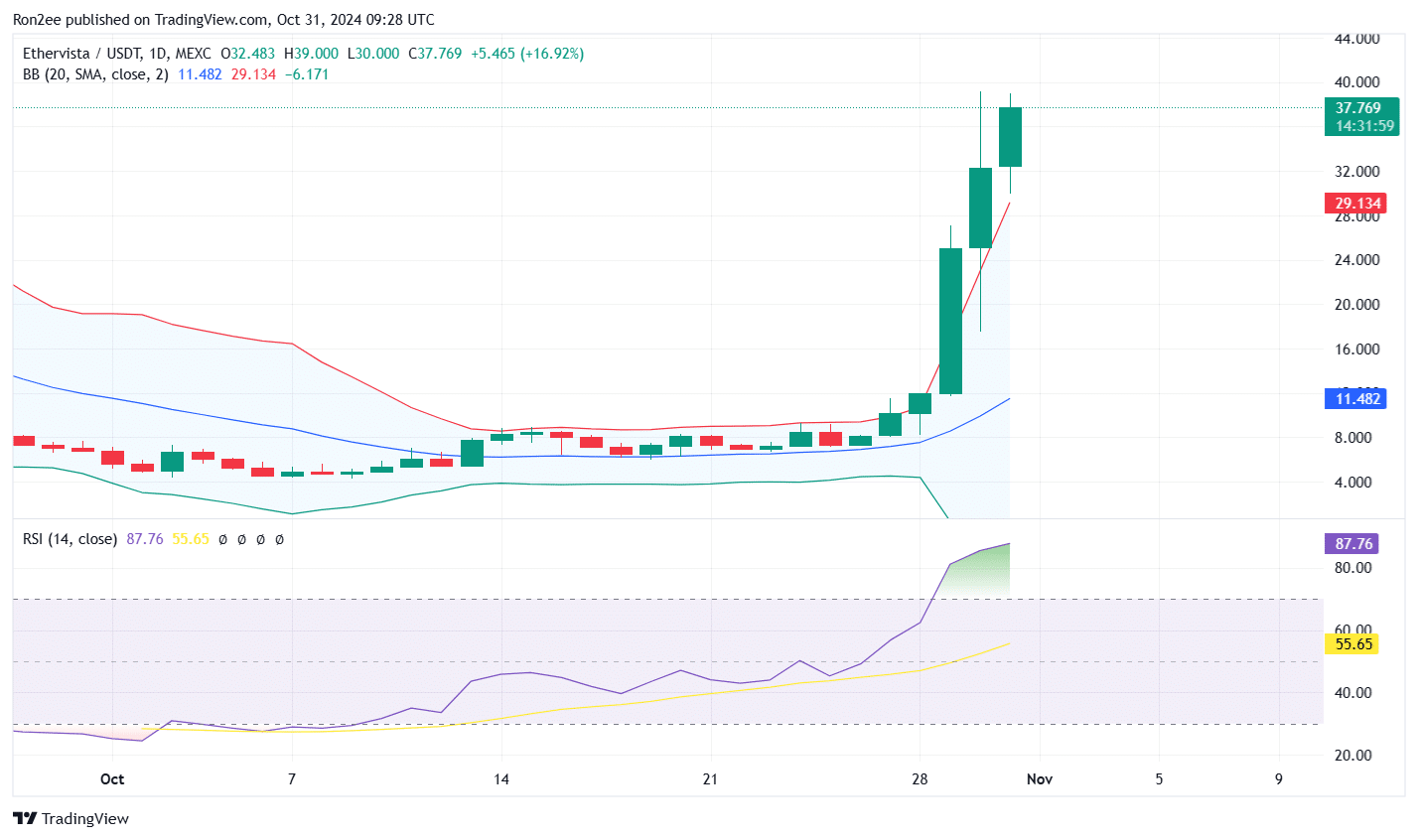

VISTA soared from $8.41 on Oct. 28 to an intraday excessive of $38.54 on Oct. 31, representing a surge of over 350%. The value bounce boosted VISTA’s market capitalization from $8.9 million to $31.8 million as of the time of writing.

The altcoin’s rally coincided with a bounce in its trading quantity hovering over $22.6 million up 63% correct through the last day.

Vista’s rally started on October 28, fueled by the launch of Etherfun, an Ethereum-basically based mostly token deployer. Etherfun seeks to capitalize on the reputation of identical platforms cherish Solana’s Pump.stress-free and Tron’s Sun Pump both of which maintain garnered necessary interest for the length of the meme coin neighborhood.

In maintaining with the reliable documentation shared by Ethervista, Etherfun is “taking what Pump.stress-free started,” enhancing its substances, and “merging it with Ethervista’s enhancements” to verbalize a premier memecoin trading and launch platform, optimized for Ethereum’s excessive gasoline charges.

What differentiates the platform is that liquidity from tokens launched on Etherfun is permanently locked on Ethervista, with a a part of the prices ragged to automatically buy and burn VISTA tokens.

Within a day following its launch, 100 tokens had been deployed on the platform.

The buzz spherical the new platform also propelled Ethervista’s decentralized alternate past SushiSwap in 24-hour trading quantity, in conjunction with additional momentum to this day’s rally.

As of essentially the most up-to-date files, Ethervista’s DEX recorded a trading quantity of approximately $5.62 million, while SushiSwap’s quantity remained factual above $3 million.

VISTA had been trading in an accumulation zone since tiring September sooner than the Etherfun launch, as seen by one neighborhood member. The launch helped it flee of that zone, a switch on the total seen as a bullish signal.

Nonetheless, technical indicators are flashing warning indicators. VISTA used to be trading above the upper Bollinger Band at $29.13 suggesting it used to be far above overbought ranges which typically ends in a effect reversal within the short term.

Within the interim, the Relative Strength Index has also risen to overbought territory on Oct. 28 and has continued to rise to 87 additional confirming that a effect reversal would be looming within the upcoming days.

Yet, social sentiment spherical the altcoin remains bullish, with many traders on X watching for VISTA to hit a new all-time excessive. Despite bearish technical indicators, solid neighborhood hype and solid fundamentals would possibly possibly back the token’s upward momentum alive, potentially pushing prices higher within the short term.