Ethena Labs, the issuer of like a flash-rising stablecoin USDe, is throwing its hat into the ring to recount Hyperliquid’s upcoming USDH stablecoin, and it is doing so with heavyweight backing.

The corporate has partnered with BlackRock’s BUIDL fund via USDtb, a token issued with Anchorage Digital Financial institution, to space itself as a frontrunner in belief to be one of primarily the most closely watched races in crypto.

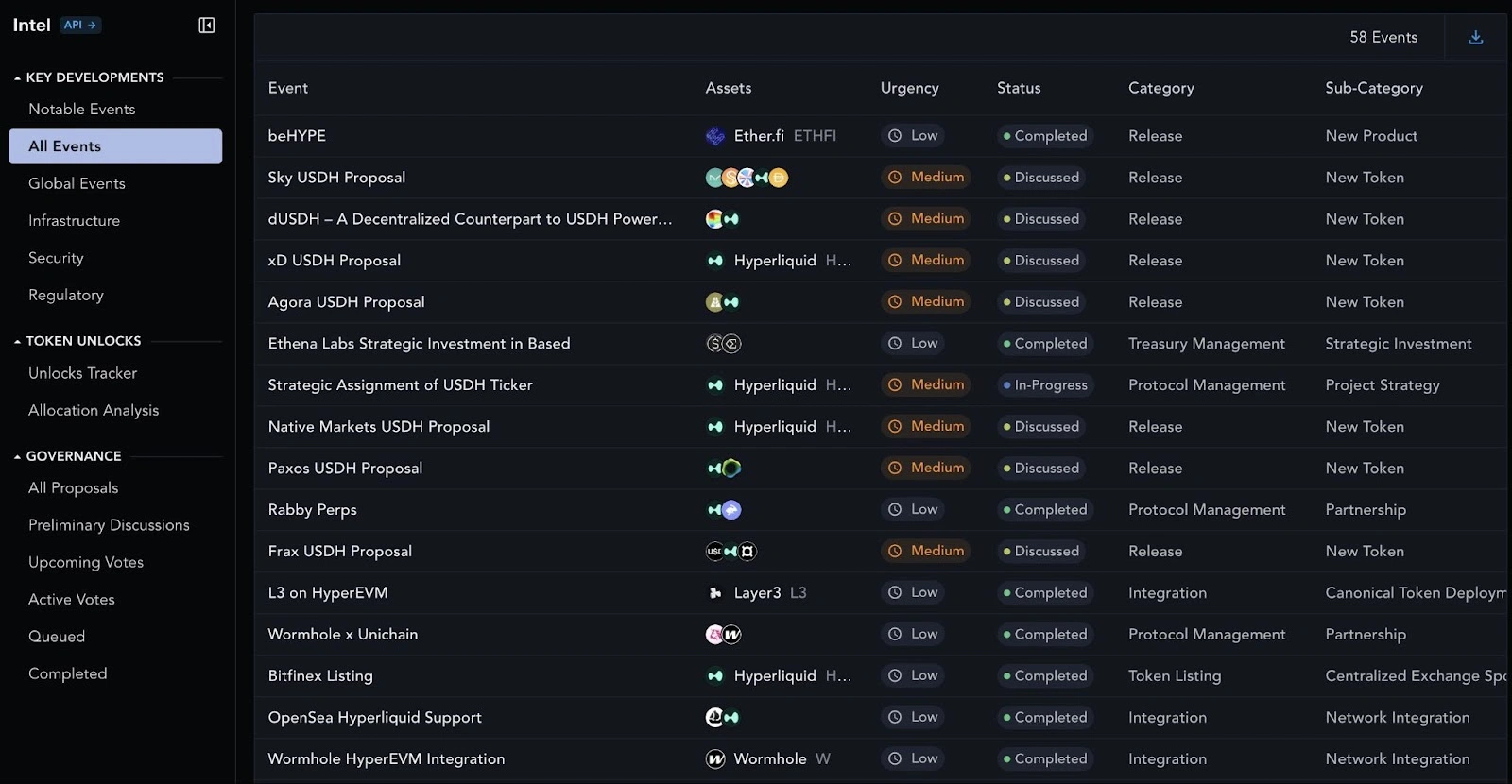

Leading decentralized trade, Hyperliquid, is getting willing to start USDH as its native stablecoin. The resolution over which issuer will oversee its minting and redemption has attracted a slate of foremost gamers.

In August, Hyperliquid processed around $400 billion in perpetuals trading volume and has a stablecoin market cap of over $5.7 billion, so the stakes are high. Whoever wins the mandate can contain catch admission to to belief to be a few of the ideal stablecoin liquidity bases available in the market, and Ethena’s proposal reveals it in actuality wishes to emerge as the winner.

Ethena pitches revenue-sharing, migration, and security

Ethena is providing a kit designed to allure to both Hyperliquid validators and its neighborhood. Central to its proposal is a pledge to redirect 95% of procure USDH reserve revenues abet to the ecosystem. The corporate said this will be carried out via the aquire and distribution of HYPE tokens, validator rewards, and ecosystem building funding, among thoroughly different intention most smartly-most in fashion by the neighborhood.

Ethena has also promised to shoulder the prices of migrating fresh USDC trading pairs to USDH.

Security is one other pillar of the thought as Ethena proposed introducing a guardian network of Hyperliquid validators, including infrastructure partners admire LayerZero, to oversee USDH operations.

Segment of the aim is to steer obvious of a single level of failure and make sure clear governance of the fresh stablecoin. “We desire to play a operate in supporting this story no topic whether or no longer the neighborhood grants us the privilege and responsibility of delivering USDH,” Ethena wrote in its proposal.

Ethena wishes to give bigger than an usual USDH stablecoin

Ethena’s ambitions lag previous simply issuing USDH. The corporate laid out plans for hUSDe, a Hyperliquid-native synthetic buck product that builds on its fresh USDe mannequin. To jumpstart adoption, Ethena has earmarked $75 million in incentives, with the aptitude to develop that figure to $150 million as the ecosystem scales, to beef up market building under the HIP-3 proposal.

The inducement program would fund fresh markets, entrance-pause integrations, and liquidity initiatives that tie collectively USDH, USDe, and hUSDe under a single umbrella. The corporate also said it goes to integrate with Securitize to enable tokenization of true-world resources and bring USDtb, the BlackRock-backed token, onto HyperEVM.

That integration would enable for seamless minting and redemption flows, giving institutional customers a clearer direction to tap into Hyperliquid’s ecosystem.

The self-discipline is competitive

Since the announcement, Hyperliquid’s native token HYPE has been on the upward thrust. At the time of writing, it sits at $53.55 per token, having risen by over 6% in 24 hours, with a market cap of $14.39 billion based on records from Messari.

Ethena’s narrate brings it true into a crowded self-discipline of suitors. Paxos, identified for its regulated custodial mannequin, has pitched itself as primarily the most compliant possibility. Frax has proposed integrating its algorithmic stablecoin mannequin into Hyperliquid, while Sky, Native Markets and Agora, among others contain also submitted competing frameworks.

Every proposal focuses on a definite philosophy on be taught the device in which to steadiness transparency, scalability, and user adoption.

The final consequence will be made up our minds by Hyperliquid’s validators, who are anticipated to vote on September 14. With billions of bucks in probably liquidity at stake, the resolution will likely form the trajectory of Hyperliquid’s boost in the impending years.

For Ethena, winning the mandate may per chance per chance per chance cement its space as belief to be one of primarily the most influential gamers in the stablecoin market.