Bitcoin (BTC) trades at an rising top class on Upbit, as South Korean traders behold security from the weakening nationwide currency. Merchants offered BTC as the South Korean won fell to a 15-Twelve months low in opposition to the US greenback.

Bitcoin traded with a widening top class on Upbit, one in all the main South Korean exchanges. Whereas a top class on the Korean won pair isn’t very unfamiliar, this time, the disparity is rising.

BTC traded at $94,574.92 on most pickle exchanges. On Upbit, the price changed into $96,722.63, maintaining a pickle of better than $2,000. The Bithumb top class changed into lower, with BTC trading at $96,571.21. Other trading pairs remained within their frequent differ, with minimal fluctuation.

The Korean won markets assemble up ethical 1.78% of all BTC trading exercise. Extra than 24.83% of trading is in opposition to the US greenback, whereas 51.46% is in opposition to USDT, with an intuitive greenback-primarily based completely mostly build of dwelling.

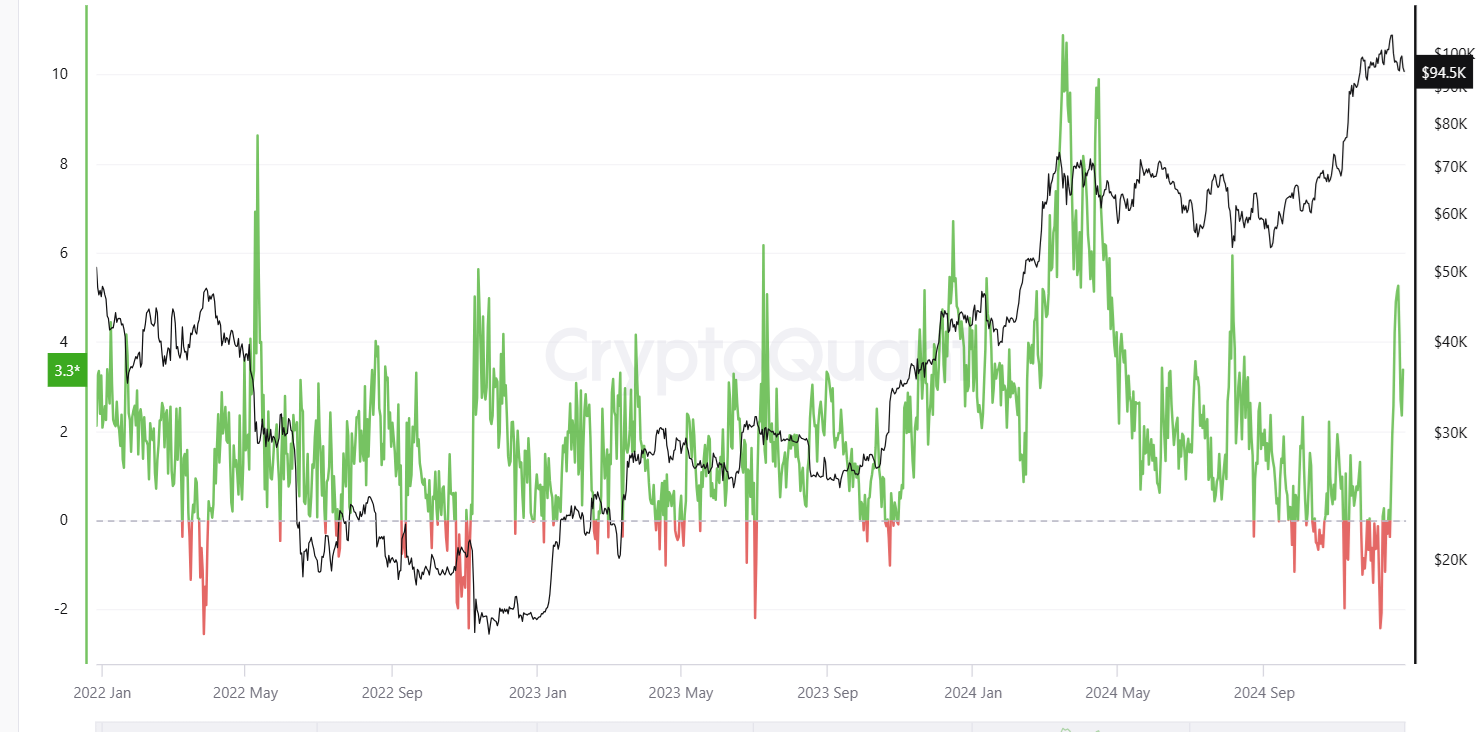

Typically, the highest class rises without problems with the remaining of the market, nevertheless the most traditional spike of the Korean won index signals a brief-term toddle to aquire BTC. The Korean won slid extra without warning in opposition to the greenback from October onward, accelerating its decline and inflicting a shift to BTC as an offset.

Investors in South Korea flock to crypto in Q4

The Korean won has returned to ranges not considered for the reason that 2008 monetary disaster, sparking worries about South Korea’s economy. The nation is one in all the foremost crypto hubs, where retail search recordsdata from of is high as a intention to offset stagnant incomes. In step with contemporary records from the Bank of Korea, home crypto investors exceeded 15 million for the foremost time.

Whereas South Korean investors possess been highly intelligent in previous bull cycles, the most traditional extend in exercise started within the final months of 2024. Following the US elections and the accelerated losses of the won in opposition to the greenback, a further 610K South Koreans made their first crypto purchases. As a consequence, roughly 30% of all South Koreans possess invested in crypto coins.

Crypto investors feeble the cease 5 centralized exchanges within the nation, Upbit, Bithumb, Coinone, Korbit, and GOPAX. The exchanges are largely closed to open air investors without a checking story within the nation, which does not allow global traders to arbitrage without problems. These markets are also slightly conservative in itemizing unique coins and tokens, so BTC serene principles as a exchange funding.

South Korea added some other layer of regulations below the Virtual Asset Particular person Safety Act, which got right here into power in July. The unique regulations also intended the nation’s central bank tracked the crypto market extra carefully. This allowed the Bank of Korea to be aware the boost of crypto investors within the nation for the foremost time.

Basically based completely mostly on Representative Lim Gwang-hyun of the Democratic Celebration of Korea, crypto markets are catching up to fashioned stock markets when it comes to volumes and retail exercise. Volumes on South Korean digital asset exchanges reached the the same of $100B in November, surpassing the nation’s KOSPI and KOSDAQ markets.

Inflows to exchanges also accelerated within the past three months, exhibiting search recordsdata from of for dangerous resources with high doable returns. South Korean traders possess increased inflows to centralized exchanges every month within the past Twelve months.

The pattern accelerated within the past few weeks, after the incident of declaring martial legislation for two hours, elevating questions in regards to the nation’s political stability. There were also signs that crypto markets were not most effective catching up to stock markets, nevertheless investors were captivating their funds from shares into digital coins. Moreover, the KOSDAQ index has been sliding within the Twelve months to this point, ranging from 871 points in January and posting losses appropriate down to 675 points as of December 27.

Since tracking began, the replacement of latest investors grew on average by 100K users a month. Complete holdings for South Korean investors were round 58 trillion won in July, rising to over 100 trillion at the cease of 2024, in maintaining with the BTC rally to a series of recordsdata. Within the 2d half of of 2024, individual holdings on average were below $2,500, doubling to over $5,000 after the Q4 rally.

A Step-By-Step Machine To Launching Your Web3 Profession and Landing High-Paying Crypto Jobs in 90 Days.