Here’s a segment from the Forward Guidance e-newsletter. To read fat editions, subscribe.

So the Fed decrease charges by 25bps yesterday and markets threw a fit. Hell, we even ran a headline talking about a Santa rally that became about to ensue. Whoops. It happens.

However what provides? What in fact came about? Let’s destroy it down.

Going into an FOMC meeting, a constellation of factors come collectively to fabricate the rigidity that outcomes within the worth consequence of the occasion. This mixture of the market’s expectations is in step with the FOMC’s forward guidance (the name of this e-newsletter!) and the positioning of market gamers going into the occasion with admire to these expectations. Let’s destroy the two down.

Expectations

Going into the meeting, the SOFR curve, which is willing to be conception-referring to the market implied forecast of the fed funds rate direction in opposition to its terminal rate, had departed greatly from the Fed’s previous summary of business projections forecast from September.

This largely reflected a valuable segment shift upward in economic strength and resilience of the labor market, requiring much less rate cuts than what all and sundry expected in September.

In 2025, the market became most productive expecting three-ish rate cuts. Due to this reality, to surprise the market to the hawkish facet of things, the hurdle became very excessive to construct this.

To my surprise, the FOMC managed to enact it whereas additionally reducing charges yesterday. A hawkish decrease? What a time to be alive.

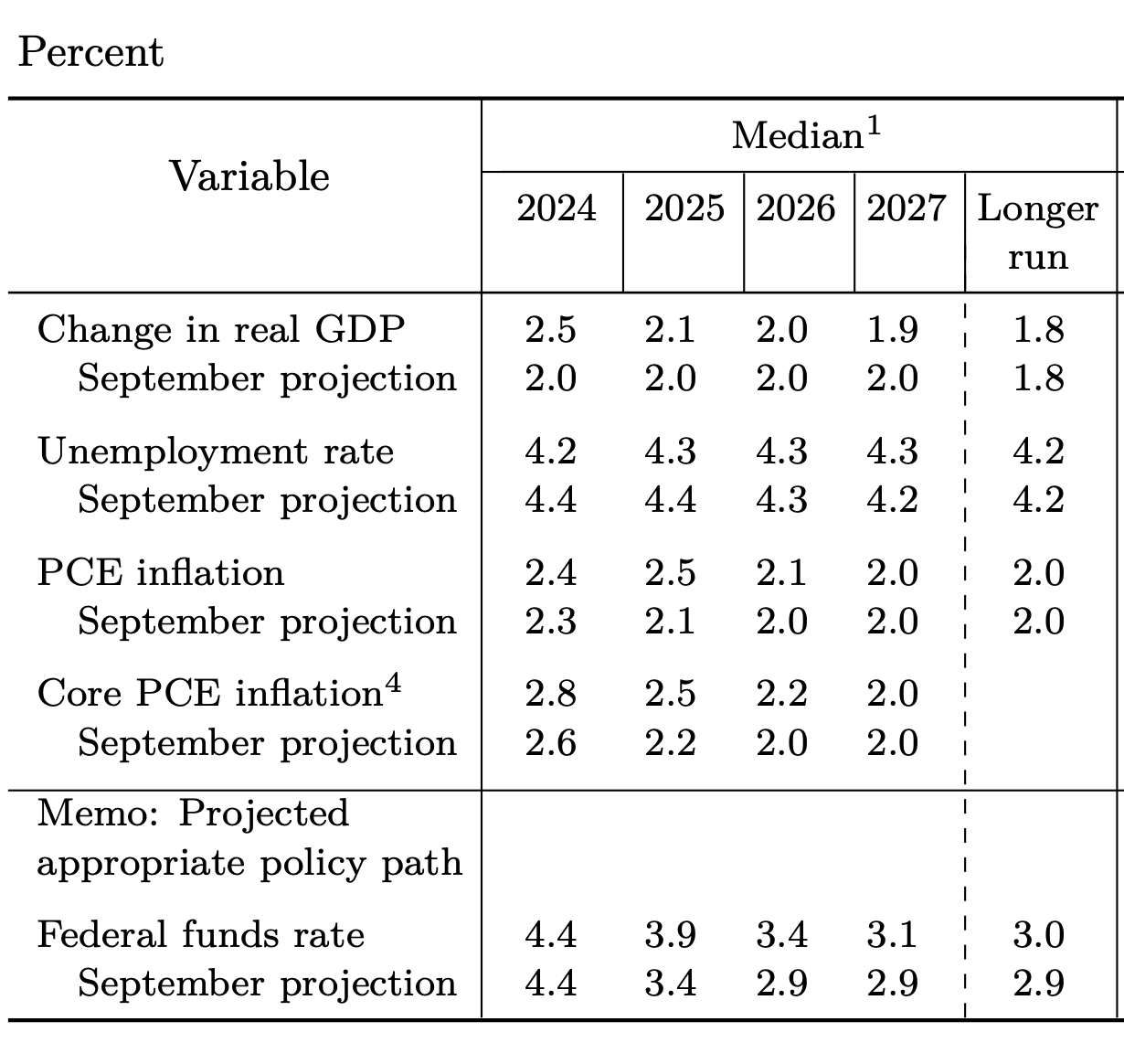

By transferring up the expected fed funds rate to three.9% (from 3.4%), the FOMC forecasted most productive two cuts in 2025 vs. the already hawkishly positioned market that expected three.

This decrease within the amount of cuts became largely driven by increased uncertainty on the direction of inflation within the next Three hundred and sixty five days, as viewed here:

All of that files got distilled into this straight forward circulation — the second dot here transferring above the market’s expectation in 2025:

Now what made this circulation so brutal yesterday? The second portion: positioning.

Positioning

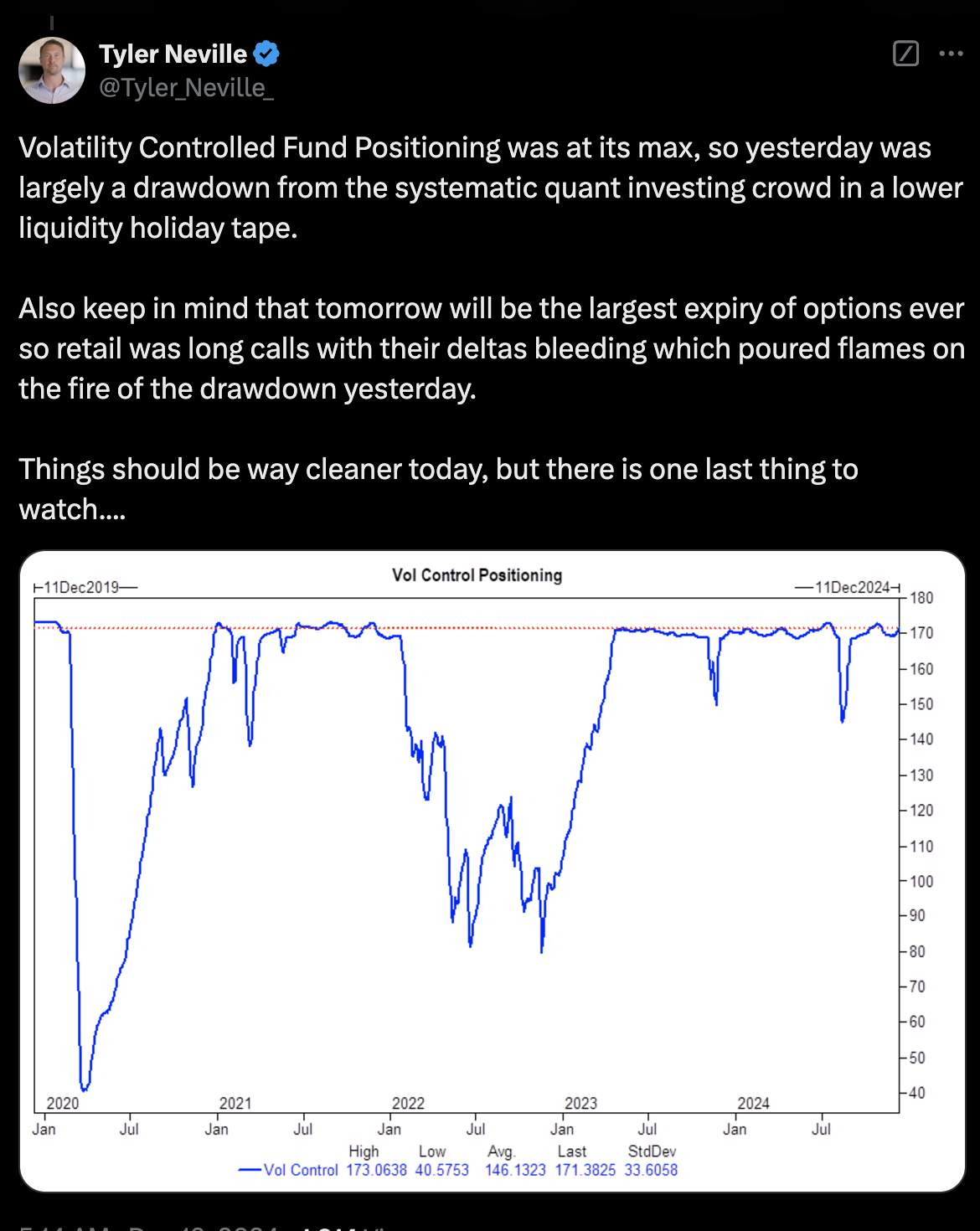

There’s a trifecta of positioning dynamics that got here collectively to manual to the acceptable kindling, sparking the fire that became yesterday. As Tyler Neville (co-host of the roundup) discusses here, with the VIX being so low into the occasion, the systematic crowd became aggressively lengthy:

Additional, there were frequent expectations of seasonality dynamics in markets (i.e. the Santa rally we alluded to yesterday) to rob us to the promised land. This ended in all and sundry piling in on the the same alternate of longing excessive beta risk sources under an assumption of continued dovishness from Powell.

Indirectly, we like one of the best alternate choices expiry in historical previous occurring this week. With such wide originate interest, sellers who like to hedge their delta publicity stay up chasing gamma in a reflexive manner that amplifies strikes in markets. This extra ended in yesterday’s acceleration.

As continually, there’s no single motive for market strikes on any day. Extra so, it’s the constellation of a unfold of factors that come collectively to motive the consequence. And some days these stay up being fairly aggressive strikes, cherish we saw yesterday.