The Uniswap (UNI) tag reached a two-365 days excessive of $12.85 on February 24 nevertheless has fallen a little since.

UNI broke out from long-term horizontal and diagonal resistance phases all the plan throughout the upward motion.

UNI Breaks Out Above Resistance

The weekly time physique technical prognosis reveals that UNI has elevated since October 2023, when it bounced at a protracted-term horizontal help inform. The upward motion precipitated a breakout from a descending resistance pattern line the following month. On the time, the pattern line had existed for 480 days.

After several retests, the UNI tag began one other upward motion originally of 2024 and broke out from a horizontal resistance inform. The magnify culminated with a excessive of $12.86 last week. UNI fell a little afterward.

The weekly Relative Energy Index (RSI) helps the magnify. Market traders spend the RSI as a momentum indicator to title overbought or oversold stipulations and to resolve whether to amass or sell an asset. Readings above 50 and an upward pattern point out that bulls unexcited own an succor, whereas readings below 50 imply the reverse.

First and indispensable, the upward motion became preceded by a bullish divergence in the RSI (inexperienced pattern line). The RSI has trended upward since and moral moved above 70. There is now not this kind of thing as a bearish divergence to advise the preceding upward motion.

UNI Mark Prediction: The put Will the Breakout Lead?

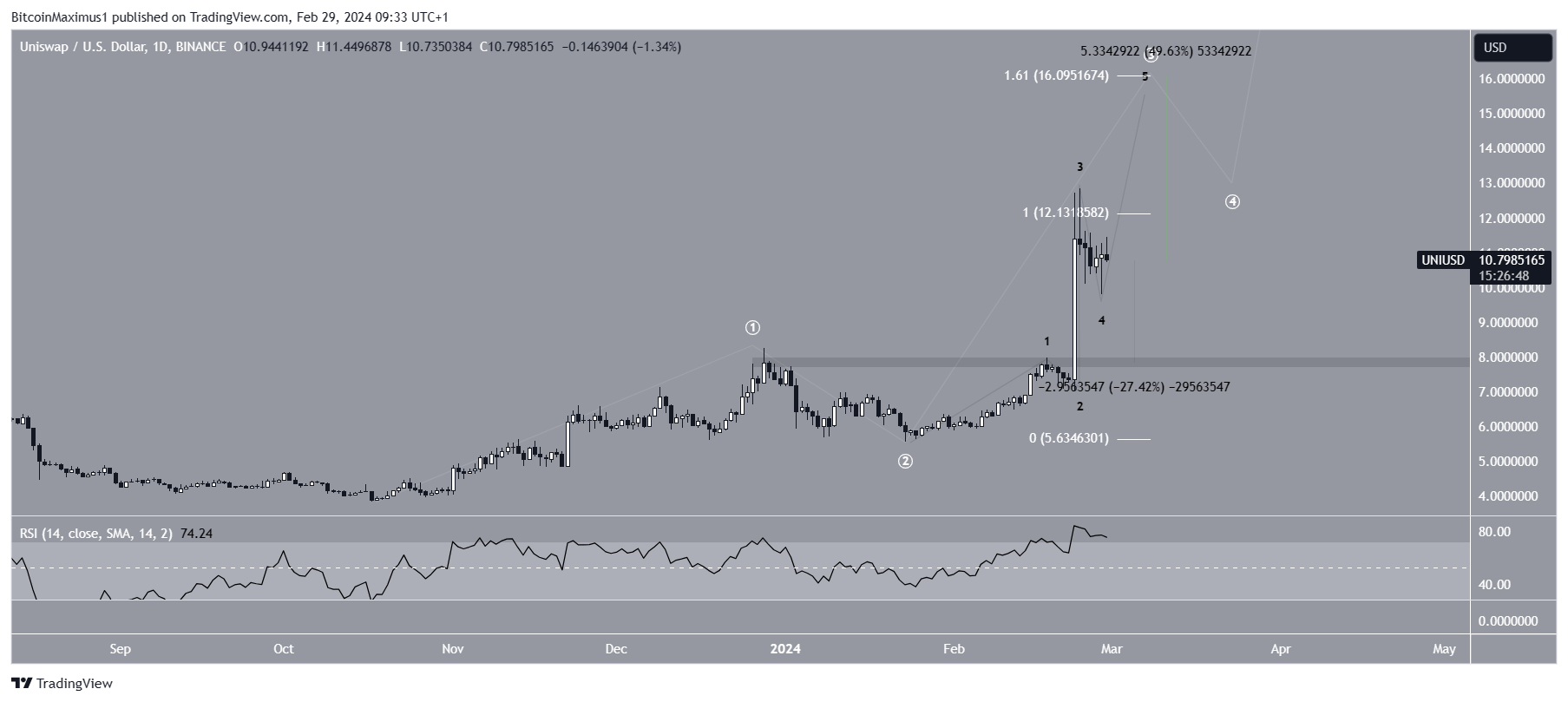

The technical prognosis of the each day time physique aligns with the weekly one, offering a bullish finding out. Right here is on account of the wave count and RSI readings.

The maybe wave count predicts the UNI upward motion will continue. Technical analysts abolish the most of the Elliott Wave theory to ascertain the pattern’s route by finding out habitual long-term tag patterns and investor psychology.

The wave count predicts that UNI is in wave three of a 5-wave upward motion (white). The sub-wave count is given in gloomy, suggesting that UNI is in sub-wave four.

If the count is sweet, the UNI tag will initiating one other upward motion after the fresh correction is complete. This is able to maybe rob the UNI tag to the following resistance at $16.10, giving waves one and three a 1:1.61 ratio. This is able to maybe be an upward jog of fifty%.

The each day RSI helps this chance since the indicator is increasing and is above 70.

Despite the bullish UNI tag prediction, failure to win faraway from the $12.10 highs can inform off a practically 30% descend to the closest help at $7.80.

For BeInCrypto‘s most up-to-date crypto market prognosis, click on here.

Disclaimer

The total files contained on our online page is printed in correct religion and for total files capabilities easiest. Any action the reader takes upon the records stumbled on on our online page is precisely at their bear threat.