Key takeaways:

- Uniswap (UNI) also can reach as high as $17.16 in 2025.

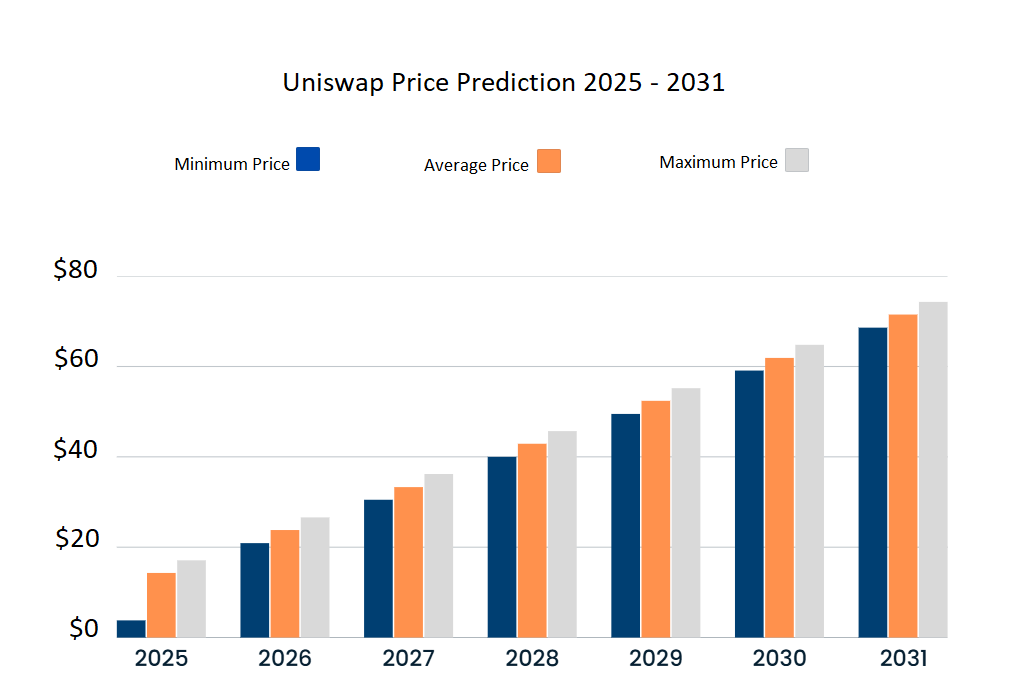

- Estimates for Uniswap’s common designate in 2028 differ from $40.04 to $forty five.76.

- UNI’s common designate in 2031 will seemingly be $71.50, with a maximum designate of $74.36.

Uniswap, a DeFi protocol founded in 2018 by ragged mechanical engineer Hayden Adams. The Uniswap replace is a 100% on-chain computerized market maker (AMM) protocol on the Ethereum blockchain. The AMM permits DeFi customers to swap ether (ETH) for any ERC-20 token without intermediaries, solving many liquidity concerns most exchanges face. Uniswap’s uncommon parts and utility produce its token, UNI, lovely to merchants and merchants.

Will UNI reach $100? How high can UNI inch in 5 years? Let’s take a count on at Uniswap’s technical diagnosis and designate prediction to create solutions to these queries.

Overview

| Cryptocurrency | Uniswap |

| Abbreviation | UNI |

| Present Payment | $7.54 (-1.44%) |

| Market Cap | $4.75B |

| Shopping and selling Quantity (24-hour) | $257.62M |

| Circulating Supply | 630.33M UNI |

| All-time Excessive | $44.97 Could well maybe well also 03, 2021 |

| All-time Low | $1.03 Sep 17, 2020 |

| 24-hour Excessive | $7.64 |

| 24-hour Low | $7.35 |

Uniswap designate prediction: Technical diagnosis

| Metric | Price |

| Payment Volatility (30-day Variation) | 7.11% |

| 50-Day SMA | $9.86 |

| 200-Day SMA | $8.03 |

| Sentiment | Bearish |

| Danger & Greed | 33 (Danger) |

| Green Days | 15/30 (50%) |

Uniswap designate diagnosis: UNI faces stable resistance at $7.65

TL;DR Breakdown:

- Uniswap designate diagnosis reveals a downward trend at $7.54.

- Cryptocurrency loses 1.44% of its fee.

- UNI coin to search out toughen around $8.91.

On September 27, 2025, Uniswap designate diagnosis published a downward trend for the day. The altcoin’s designate lowered to $7.54 in the previous 24 hours. General, the cryptocurrency misplaced up to 1.44% of its fee. Sellers have persisted their lead again following the retreat noticed the day gone by, as resistance seemed around $7.65. This speak additionally indicates that promoting stress is high all the procedure thru the $8 level, because the coin has faced a most modern rejection below that designate level.

Uniswap designate diagnosis on the day-to-day time body

The one-day designate chart of Uniswap coin confirmed a bearish trend available in the market. The UNI/USD fee has dipped to an intraday low of $7.54. Purple candlesticks on the worth chart signify a continuous promoting stress and a continuation of a downtrend.

The space between the Bollinger bands defines the volatility. This distance is widening again, resulting in an lengthen in volatility. Furthermore, the upper restrict of the Bollinger Bands indicator, acting because the resistance, has shifted to $10.75. Whereby its lower restrict, serving because the toughen, has moved to $7.29.

The Relative Strength Index (RSI) indicator is trending in the oversold reputation. The indicator’s fee has been recorded at index 28.61 nowadays, and the decreasing trend is represented by a downward curve on the RSI graph. Extra instability available in the market will seemingly be expected if the marketing momentum continues.

Uniswap designate diagnosis on 4-hour chart

The four-hour designate diagnosis of Uniswap reveals the presence of some stage of merchants’ toughen. The coin has been struggling to agree with its designate above $7, nonetheless the worth is slowly increasing and also can lengthen extra in the approaching hours. Furthermore, the light volatility signifies a lower probability of a reversal or extra designate oscillations.

The Bollinger bands are keeping less reputation, resulting in mediocre volatility. This light volatility indicators increased market predictability. The upper Bollinger band has shifted to $8.16, indicating the resistance level. Conversely, the lower Bollinger band has moved to $7.23, establishing the toughen level.

The Relative Strength Index (RSI) indicator is trending all the procedure thru the lower impartial reputation. The indicator’s fee has increased to 32.95 in the previous few hours, with its curve pointing upwards. This situation reveals merchants’ toughen around toughen zones on the 4-hour designate chart. Extra appreciation in the coin’s fee can no longer be dominated out if attempting to search out momentum persists for about a extra hours.

Uniswap technical indicators: Ranges and action

Day-to-day straightforward transferring common

| Duration | Price ($) | Action |

| SMA 3 | 8.41 | SELL |

| SMA 5 | 8.33 | SELL |

| SMA 10 | 9.00 | SELL |

| SMA 21 | 9.36 | SELL |

| SMA 50 | 9.86 | SELL |

| SMA 100 | 9.22 | SELL |

| SMA 200 | 8.03 | SELL |

Day-to-day exponential transferring common

| Duration | Price ($) | Action |

| EMA 3 | 9.08 | SELL |

| EMA 5 | 9.31 | SELL |

| EMA 10 | 9.65 | SELL |

| EMA 21 | 9.98 | SELL |

| EMA 50 | 9.81 | SELL |

| EMA 100 | 9.11 | SELL |

| EMA 200 | 8.66 | SELL |

What to count on from Uniswap designate diagnosis subsequent?

Uniswap designate diagnosis offers a bearish prediction when it comes to the continuing market dispositions, because the coin’s designate is decreasing after a persisted bearish wave noticed over the most modern trading session. If sellers agree with the continuing momentum, UNI’s designate also can plunge below the $7 differ.

Is Uniswap a aesthetic funding?

Uniswap is a decentralized cryptocurrency replace (DEX) with huge attainable. Unlike extinct exchanges, Uniswap makes use of an computerized market-matching (AMM) machine. Uniswap has shown aesthetic efficiency over time and is anticipated to prevail in the $36.22 level by 2027 and above $74.36 by 2031.

Why is UNI down?

The broader crypto market is experiencing a bearish allotment nowadays. Plenty of the tip cryptocurrencies are shedding fee, and so is UNI. As sellers won ground around $7.65, detrimental sentiment returned to the market.

How noteworthy will Uniswap be worth in 2025?

The utmost UNI can reach in 2025 is $17.16, whereas the fresh designate is anticipated to be around $14.30.

Will UNI reach $20?

Uniswap is trading exact above the $9 differ, down from $18.59, which it carried out in December final year. Basically the most modern resistance ranges are $10 and $10.7; a fracture above them can lead to $11. If UNI gets extra toughen, $20 will seemingly be carried out by the year 2026.

Will UNI reach $50?

In Could well maybe well also 2021, UNI touched $44.9, its all-time high and no longer noteworthy below $50. This possibility can come up again if the broader cryptocurrency market turns bullish on political and financial components.

Can Uniswap reach $100 bucks?

Consistent with the Uniswap designate prediction, UNI is never any longer expected to prevail in come $100 by the final quarter of 2031. Despite the incontrovertible reality that it’s miles a 5-year time body, it’s worth ready, because the coin’s fee will lengthen nonetheless also can no longer reach $100.

Does UNI have a aesthetic long-term Future?

UNI is the token of the notorious Uniswap decentralized replace. It has a huge person corrupt and aesthetic liquidity, so the coin has aesthetic possibilities. Market analysts count on UNI’s designate to prevail in $74.36 by the tip of 2031, seriously increased than its most modern designate.

Recent data/opinions on Uniswap Network

- Uniswap Labs published the tip tokens swapped by volume for the period of the previous week, other than WBTC, ETH, and stablecoins. LINK, BIO, and PEPE were amongst the tip three tokens swapped on Uniswap apps.

Your top swaps final week on Uniswap Apps 🦄 pic.twitter.com/dPZwWwIvm1

— Uniswap Labs 🦄 (@Uniswap) September 1, 2025

- Philip London of Uniswap Labs said that a contemporary liquidity pool (LP) custom differ selector will soon be launched on the platform. In older programs like Uniswap V2, an LP’s funds were unfold evenly all the procedure thru a designate differ from zero to infinity. This changed into as soon as inefficient because most trading occurs internal a if truth be told little designate differ. To resolve this, Uniswap V3 launched concentrated liquidity. This characteristic permits LPs to settle a particular, or “custom,” designate differ on a chart where they’re trying to create their liquidity.

New LP custom differ selector coming soon to @Uniswap

In expose so that you just can offer it a are trying sooner than GA let me know pic.twitter.com/xVaMvX77i1

— Philip London (@plondon514) August 29, 2025

Uniswap designate prediction September 2025

For September 2025, UNI reveals a ability to swing wildly; the anticipated minimal fee of Uniswap is $7.58. The worth also can soar to $11.69, nonetheless the fresh trading designate of $9.35 is anticipated all the procedure thru the month.

| Month | Ability Low ($) | Average Payment ($) | Ability Excessive ($) |

| September 2025 | $7.58 | $9.35 | $11.69 |

Uniswap designate prediction 2025

For 2025, UNI’s designate also can reach a maximum of $17.16. The minimal designate is anticipated to be $3.85, with the year’s common trading designate estimated at around $14.30.

| 365 days | Ability Low ($) | Average Payment ($) | Ability Excessive ($) |

| 2025 | $3.85 | $14.30 | $17.16 |

Uniswap designate predictions for 2026-2031

| 365 days | Ability Low | Average Payment | Ability Excessive |

| 2026 | $20.97 | $23.83 | $26.69 |

| 2027 | $30.50 | $33.36 | $36.22 |

| 2028 | $40.04 | $42.90 | $forty five.76 |

| 2029 | $49.57 | $52.43 | $55.29 |

| 2030 | $59.10 | $61.96 | $64.82 |

| 2031 | $68.64 | $71.50 | $74.36 |

UNI designate prediction 2026

For 2026, Uniswap’s designate is projected to have a minimal fee of $20.97. The worth also can wing up to $26.69, with a median of $23.83.

Uniswap (UNI) designate prediction 2027

In 2027, the worth of UNI is anticipated to hit no longer no longer up to $30.50. The utmost designate also can reach $36.22, with a median trading fee of $33.36.

Uniswap designate prediction 2028

The 2028 forecast for Uniswap predicts a minimal designate of Uniswap to be $40.04 and a maximum of $forty five.76, with a median designate of $42.90, many folds increased than the most modern Uniswap designate.

Uniswap designate forecast 2029

The Uniswap designate forecast for 2029 reveals that the coin is anticipated to open at a minimal UNI designate of $49.57 and climb to $55.29 whereas averaging $52.43.

Uniswap (UNI) designate prediction 2030

For the 2030 Uniswap coin designate prediction, the minimal projected designate for Uniswap is $59.10. Traders can count on a maximum designate of $64.82 and a median designate of $61.96, inquisitive about the future designate actions.

Uniswap designate prediction 2031

For the 2031 Uniswap forecast, it’s miles projected to have a minimal designate of $68.64. The worth also can wing up to $74.36, with a median of $71.50.

UNI market designate prediction: Analysts’ UNI designate forecast

| Company Name | 2025 | 2026 |

| DigitalCoinPrice | $20.85 | $24.Seventy nine |

| Coincodex | $20.24 | $17.85 |

Cryptopolitan’s Uniswap designate prediction

Our designate prediction for Uniswap reveals that UNI will reach a high of $17.16 come the tip of 2025. In 2026, this would maybe alternate between an expected differ of $20.97 and $26.69. In 2031, UNI will differ between $68.64 and $74.36, with a median designate of $71.50. It is miles major agree with in mind that the predictions are no longer funding recommendation. Professional consultation is steered, or it’s likely you’ll maybe maybe also make your have be taught.

Uniswap ancient designate sentiment

- Uniswap (UNI) token launched on September 17, 2020, starting at $3.00. It swiftly rose to $7.00 sooner than reaching an all-time low of $1.03 (CoinGecko) or $0.4190 (CoinMarketCap) on the same day. UNI ended the year at $5.00 after a unhurried restoration for the period of the 2020 bull scamper.

- In 2021, UNI surged 400% in January to $20. By March, it hit $28; on Could well maybe well also 3, it reached an all-time high (ATH) of $44.93. It ended the year come $18 after a valuable decline.

- For the period of 2022, UNI persisted to decline, losing to around $5.5 by June because the bearish trend persisted.

- The crypto market rebounded in 2023, and UNI noticed bullish momentum, peaking at $7.77 on December 28.

- UNI started 2024 on a downtrend, swiftly getting higher to $15 by March 6. After mid-Could well maybe well also, it faced promoting stress, falling to $0.14 by July 31.

- It stabilized in August at around $5 and traded above $6 at the delivery of September.

- In October, UNI reached a peak of $8, and November noticed a peak designate of $13.58. In December, UNI soared to $18.60.

- In February 2025, Uniswap changed into as soon as trading come $12, which changed into as soon as below January designate ranges of $15.

- In March, it dipped extra down, reaching the $7.4 differ, and the descent persisted into April with a designate of $4.7. On the different hand, some bullish designate action changed into as soon as noticed in Could well maybe well also, when UNI jumped to $7.5, and at final peaked at $11.74 in July.

- In August, UNI/USD reached a yearly high designate of $12.31, whereas at the delivery of September, it’s miles now trading come the $9.40 worth.