On December 18th, Wednesday, the crypto market witnessed a surge in selling stress following the U.S. Federal Reserve’s solution to decrease passion rates by 25 bps to 4.25-4.5%. Thus, the pioneer digital forex, Bitcoin, dropped 5%, triggering renewed selling stress in most predominant altcoins, including UNI. The correction improvement in Uniswap mark accelerated with whale selling hints of doable breakdown beneath $10.

In step with Coinmarketcap, the UNI mark trades at $15.05 with an intraday loss of seven.2%. Consecutively, the asset’s market cap drops to $9.03 Billion, and the 24-hour trading volume is at $879.6 Million.

Key Highlights:

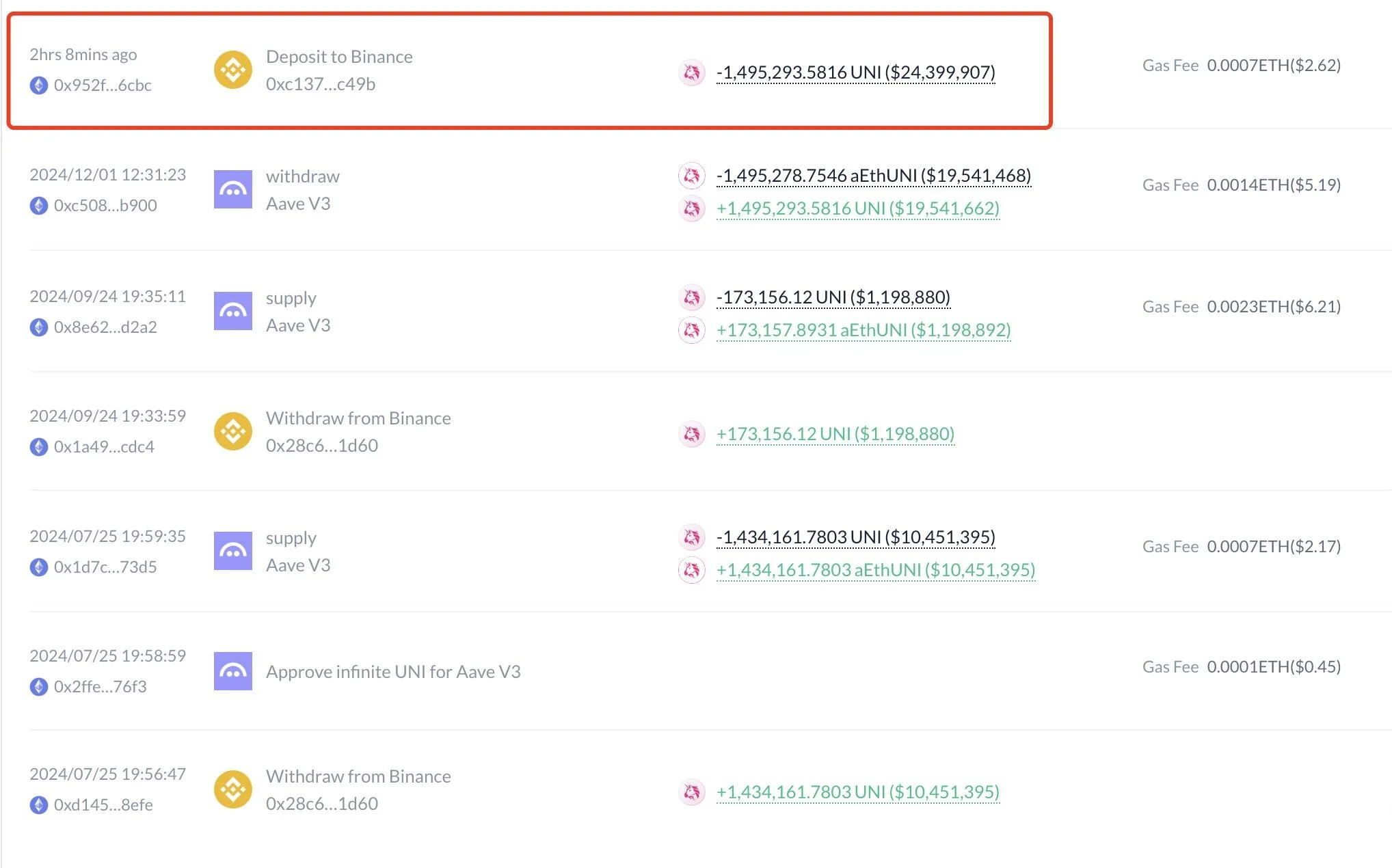

- A crypto whale now now not too long within the past transferred over a million UNI tokens to Binance, raising the threat of doable correction ahead.

- The formation of a double-prime reversal pattern plunged the Uniswap mark from $18.9 to $14.8, registering a weekly loss of 21.5%

- The $14 diploma, backed by a 200-day exponential shifting reasonable, creates solid enhance for crypto patrons.

Uniswap Mark Correction Looms as Whale Offloads 1.495M UNI

In a recent tweet, EmberCN highlights a major transaction of 1.495 million UNI tokens, valued at roughly $24.39 million, transferred to the Binance alternate.

The connected whale pockets had previously withdrawn the an identical amount of UNI tokens from Binance between July and September at a median accept mark of $7.69 per token. With the quiet mark of UNI, the whale now stands to compose a intrepid 108% profit.

The aptitude promote-off would possibly maybe maybe extra bolster the bearish momentum in Uniswap mark as whale job seriously, including the market sentiment. As such transactions are now and then recorded sooner than doubtless mark tops, the UNI coin would possibly maybe maybe drives a chronic correction segment.

Double-High Formation Threatens $10 Breakdown

Within the closing two weeks, the Uniswap mark recorded two fascinating reversals from the $9 resistance, signaling the formation of a double-prime pattern. The chart setup resembles the letter ‘M”, indicating an intense selling stress from above.

Amid the quiet market correction, the UNI mark would possibly maybe maybe descend 5.5% to anguish the pattern neckline enhance at $14. A most likely breakdown beneath this diploma will lope the selling stress and would possibly maybe maybe force a 40% downfall to hit $8.57.

On the contrary, if patrons protect $14 enhance, the worth would possibly maybe maybe force a short consolidation to improve the existing buying for momentum.