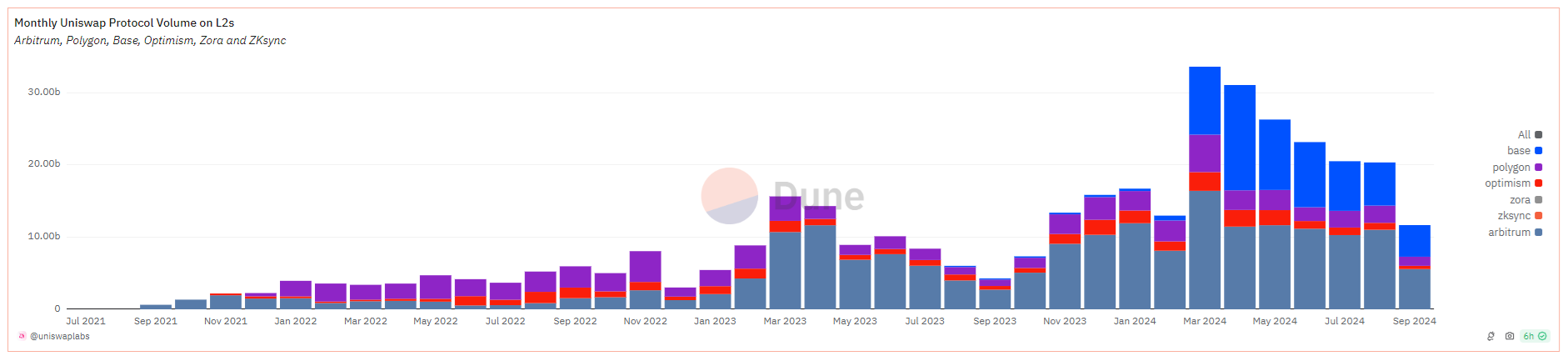

Uniswap is increasing its presence on L2 chains, irrespective of fears of a slowdown in September. The past 365 days marked a switch to L2 attributable to the inquire of for added favorable bills.

Uniswap V3 increased its presence on L2 chains within the past 365 days. For September, the leading DEX marked triple the volumes in contrast to the identical month last 365 days. Uniswap carried $11.68B in swaps, in contrast to $4.29B for September 2023.

All the intention by means of that point, Uniswap expanded its presence to a total of 23 chains. The dominant ones continue to be Bad and Arbitrum, attributable to low bills and interesting advertising and marketing and marketing. Soon after its open, Bad began displacing liquidity pools for Ethereum, mostly attributable to the creation of meme tokens.

Because the DEX liveliness, Uniswap reached $43.28M in monthly bills. Whereas Uniswap saw a slowdown in September, the previous couple of months had been essentially the most successful within the history of the DEX. The speedy inflow of customers on Bad grew to develop into Uniswap into the chief for meme token swaps.

The past 365 days additionally saw Uniswap magnify on the Celo protocol. Celo continues to be an L1 but would possibly presumably turn out to be into an L2 to greater align with the culture of Ethereum (ETH).

Uniswap’s progress on L2 reached extra than 20X since 2021. For 2024, Uniswap would possibly presumably like to break its like sage of $192B in annual trades. At the identical time, Ethereum stays the layer that also carries $3.72B in cost locked, attributable to legacy pools and pairs. Ethereum continues to be the glorious source of stablecoins, irrespective of the inflows of USDT into Arbitrum and numerous L2.

Arbitrum leads in volumes, but Bad has essentially the most pools

Uniswap’s success hinges on carrying both natty-scale volumes and a pair of tiny pools. Arbitrum is the chief by strategy of volumes, with extra than $211M in day-to-day hiss.

On Arbitrum, Uniswap V3 carries 251 cash in 485 pairs. The an analogous version on Bad shows grand extra interesting token minting, with 338 cash and tokens in 694 total pairs. Judicious one of the glorious problems for Bad is the presence of low-liquidity pairs. Just a few dozen addresses on Bad like indeed boosted website visitors, but mostly by means of low-quality rug pulls.

The previous few months saw the creation of a few pools, most now sluggish. Whereas growth on Bad is viewed as a creep for Uniswap, the presence of unverified tokens and correct-launched pools is skewing the particular procuring and selling characterize.

Uniswap competes with Aerodrome by strategy of cost locked. Aerodrome objectives for excessive liquidity pairs, whereas Uniswap provides a wider selection of tokens. As of September 25, Uniswap locks $215M in cost in its Bad version and is the 2nd most interesting app.

On Arbitrum, the Uniswap V3 pools safe $291.99M in all liquidity pairs. Uniswap is the glorious DEX on the L2 chain, outcompeted handiest by GMX perpetuals and Aave’s lending pools.

Uniswap continues to be the high Ethereum gas burner

No topic the shift to L2, Uniswap nonetheless relies on Ethereum. The Uniswap routing provider is basically the most inclined L1 tidy contract. Prices on Uniswap reached about $45K per hour, or $896K within the past 24 hours.

Ethereum itself carries 37.7% of all DEX volumes, for both major and niche markets. WETH continues to be essentially the most influential asset for pairings, in conjunction with USDT and USDC. The presence of bridged or native stablecoins on L2 extra boosted decentralized volumes in 2024.

Uniswap now has to face the competition of numerous DEX which like additionally grown within the past 365 days. The leading market nonetheless has a 45% portion of the total DEX market. Varied hubs fancy Aerodrome are fleet catching up with a portion of 20.6%.

CurveDEX is additionally building up its volumes, already carrying $1.78B in liquidity. DEXs are already adding aspects for centered liquidity, a tool that enables minimal slippage in a predetermined stamp differ.

As Uniswap prepares to open V4 pools, the UNI token continues to be in consolidation. UNI traded advance its one-month excessive at $6.84, though nonetheless a ways from the 365 days’s peak at $15.20. UNI nonetheless awaits a breakout, with $20 a likelihood one day of a bull market. UNI additionally performed all token unlocks as of September 18, leaving unhurried one source of seemingly stamp stress.

Cryptopolitan reporting by Hristina Vasileva