Tron (TRX) has skilled a solid mark rise, reaching a 5-month high. However, the fresh bullish momentum appears to be like to be losing steam, signaling the doubtless of a mark correction.

While the asset has carried out successfully, there are indicators that TRX shall be overrated within the short term, that would possibly perchance well also suggested a pullback.

Tron Is Overrated

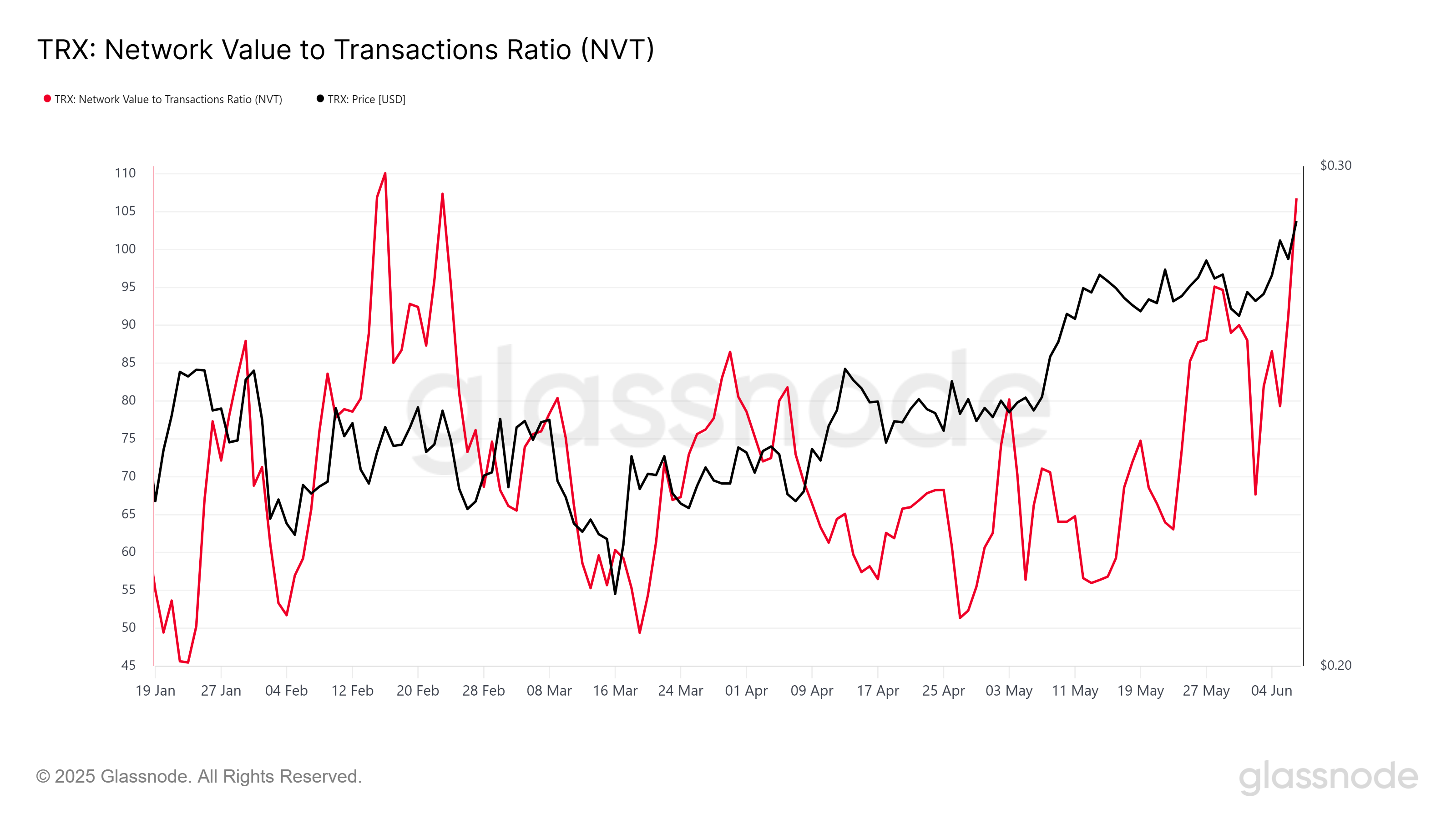

The Community Worth to Transactions (NVT) ratio for Tron has spiked, reaching its perfect degree in a month and a half. NVT measures the ratio between a community’s market worth and its transaction volume.

A rising NVT frequently signals that the market worth of an asset is outpacing its transactional job, suggesting overvaluation. Within the case of TRX, this amplify in NVT is a attainable crimson flag.

With the NVT ratio rising, TRX would possibly perchance well also face downward stress as investors alter their expectations. The token’s overvaluation would possibly perchance well also lead to a sell-off, in particular if market sentiment shifts toward warning.

This potential that, a mark correction seems seemingly, in particular if the broader cryptocurrency market experiences a cooling-off duration.

No subject the considerations about overvaluation, the final macro momentum for TRX would possibly perchance well also no longer lead to a consuming correction. The IntoTheBlock’s IOMAP indicator reveals a solid query zone between $0.268 and $0.276, the place spherical 13.89 billion TRX, worth unbiased about $4 billion, was once purchased.

This mammoth accumulation zone provides a buffer for TRX, as investors who purchase at these levels are no longer actually to sell without a profit.

The query zone is compulsory because it represents a mark floor that would possibly perchance well also cessation TRX from falling too a ways. As the market has demonstrated interest in this mark vary, the chances of TRX shedding below $0.276 within the short term are diminished.

If TRX does experience a correction, it’s expected to derive steady enhance internal this zone, keeping the worth above the essential $0.276 degree.

Will TRX Imprint Hold shut A Dip?

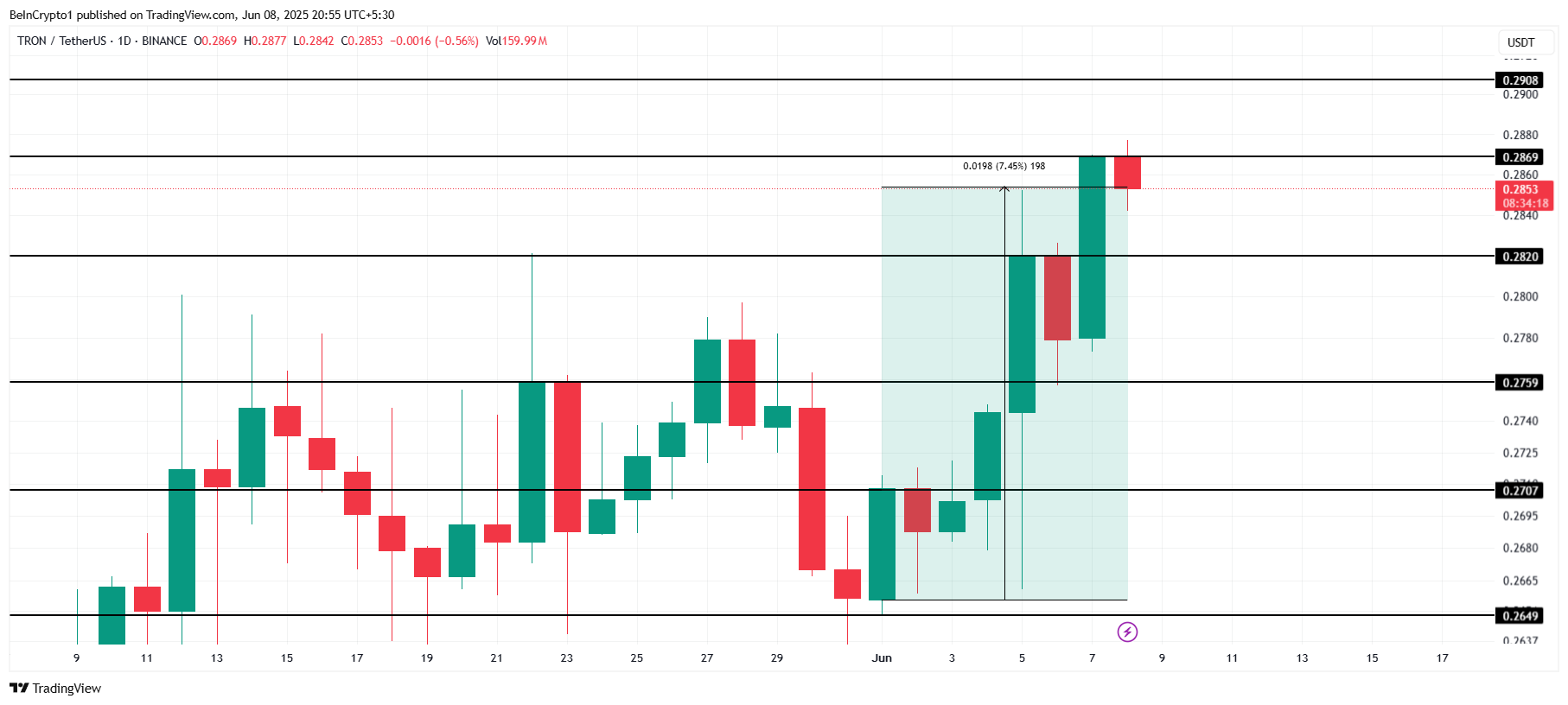

TRX has obtained 7.forty five% over the past week, buying and selling at $0.285 on the time of writing. It is presently facing resistance at $0.286, which has confirmed to be a tough degree to spoil. Given the fresh rise in mark, the token is nearing a essential level.

If TRX fails to breach the $0.286 resistance, it could perchance well well well also face a pullback as investors steal profits.

Must the overrated situation space off a mark decline, TRX would possibly perchance well also fall below $0.282 and head toward the $0.275 enhance degree. A fall below this degree is no longer actually as a result of solid query zone spherical $0.268 to $0.276, which must present enhance for the worth. The correction is anticipated to be real looking, with the query zone preventing a more extreme decline.

On the diversified hand, if the broader market stays bullish, TRX would possibly perchance well also push past the $0.286 resistance degree. A a hit breach of this barrier would possibly perchance well also peep TRX transfer toward $0.290. This would perchance invalidate the bearish outlook and space the stage for extra mark appreciation.