Trump’s Truth Predict brings prediction markets to Truth Social as lawmakers accuse his administration of working “essentially the most circulation authorities in historical previous.”

- Trump Media & Expertise Team partnered with Crypto.com Derivatives to open Truth Predict, a recent characteristic that lets customers alternate on steady-world events.

- Truth Predict enters the short-rising prediction-market sector, the attach Trump Jr. already holds advisory and investment ties thru Kalshi and Polymarket.

- Following the announcement, the TRUMP token jumped 20% in 24 hours and 42.5% over the week, drawing heavy speculative interest.

- Critics relate the administration as “essentially the most circulation authorities in historical previous,” fueling scrutiny over conflicts of interest and transparency.

Table of Contents

Trump’s contemporary “Truth Predict” open

On Oct. 28, Trump Media & Expertise Team, the company in the abet of Truth Social, introduced a recent collaboration with Crypto.com Derivatives (North The usa) to introduce a characteristic known as “Truth Predict.”

The venture targets to let customers alternate contracts on the outcomes of steady-world events, in conjunction with elections, interest-fee selections, commodity costs, and even sports outcomes.

The company described Truth Social as turning into the “world’s first social-media platform offering prediction markets,” a dauntless strive and merge social interaction with monetary speculation.

The initial rollout will delivery in the U.S. below a beta fraction ahead of expanding internationally. Alternatively, essentially the most absorbing constructing of prediction markets in the country remains uncertain.

Reckoning on how they’re framed, such platforms may per chance presumably fall below the jurisdiction of the Commodity Futures Procuring and selling Rate and even face restrictions linked to playing rules. The regulatory will largely resolve how the platform operates at scale.

Truth Social, launched in February 2022, used to be before every thing designed as a replacement to well-known social-media networks following Trump’s bans from several platforms.

TMTG, the company that owns Truth Social, used to be based in 2021 and is majority-owned by the Donald J. Trump Revocable Belief, giving Trump an economic interest in the company and making him the final beneficiary of its success.

The announcement of the Truth Predict partnership has already rippled thru the crypto market. The Reliable Trump (TRUMP) token, a memecoin constructed on the Solana (SOL) blockchain and associated with the Trump mark, saw a intelligent uptick in shopping and selling process.

As of this writing on Oct. 29, the TRUMP token used to be shopping and selling spherical $8.3, representing a 20% develop over the prior 24-hour duration, making it the largest gainer amongst the pinnacle 100 crypto property by market cap. The token has also won spherical 42.5% over the prior seven days.

The timing suggests the announcement can cling served as a catalyst for the surge, transferring the token out of its earlier shopping and selling vary and attracting heightened speculative interest.

Trump Jr.’s footprint in the event-shopping and selling increase

Truth Predict operates on a binary-event contract model linked to that passe by established prediction platforms equivalent to Kalshi and Polymarket.

Contributors can map terminate positions on whether or no longer a negate event will happen, equivalent to “Will the Federal Reserve lower interest rates in December?” or “Will a Republican fetch abet watch over of the Senate in 2026?”

Every contract trades between $0 and $1, and the price represents the market’s collective expectation of the end result. If the event occurs, the “sure” contract settles at $1 and the “no” contract at $0, offering an instantaneous intention for customers to alternate on probabilities.

Experiences show that Truth Predict is anticipated to be fully integrated into the Truth Social interface, allowing customers to keep up a correspondence about, post, and music predictions within the the same ambiance the attach they already keep up a correspondence and portion updates.

Kalshi Inc. affords a regulated model for comparability. It operates below U.S. derivatives law thru the CFTC, allowing every retail and institutional merchants to purchase and promote event contracts tied to economic, political, and social outcomes.

In accordance to the Monetary Cases, Kalshi also lists Donald Trump Jr. as an adviser, inserting him in a order linked to an already licensed alternate.

In incompatibility, Polymarket, launched in 2020, makes use of cryptocurrency to let customers bet on world events. The platform used to be fined $1.4 million by the CFTC in 2022 for working with out registration and is currently barred from serving U.S. possibilities whereas it prepares to reenter the market thru the acquisition of a licensed alternate.

On Aug. 26, Reuters reported that Polymarket bought investment from 1789 Capital, the venture-capital firm the attach Trump Jr. is a accomplice, and that he joined Polymarket’s advisory board.

A tradition-up Reuters sage on Sep. 8, 2025, mentioned that 1789 Capital had crossed $1 billion in property below administration.

The same Reuters investigation cited four authorities ethics specialists who described 1789 Capital’s constructing as a doable wrestle of interest since Trump Jr. is every a accomplice in the firm and the son of a sitting president.

Richard Painter, dilapidated White Home ethics lawyer, remarked, “I don’t think the founders would cling tolerated this in 1789, that’s the irony of it.”

Ann Skeet, Senior Director of Management Ethics at a college institute, added that “there’s no getting spherical the look” that the firm’s non-public-catch admission to club creates “non-public catch admission to to the administration.”

Truth Predict as a consequence of this fact enters a market the attach Trump Jr. already holds advisory and investment ties with two well-known prediction-market entities, Kalshi and Polymarket, every packed with life in the the same enterprise region.

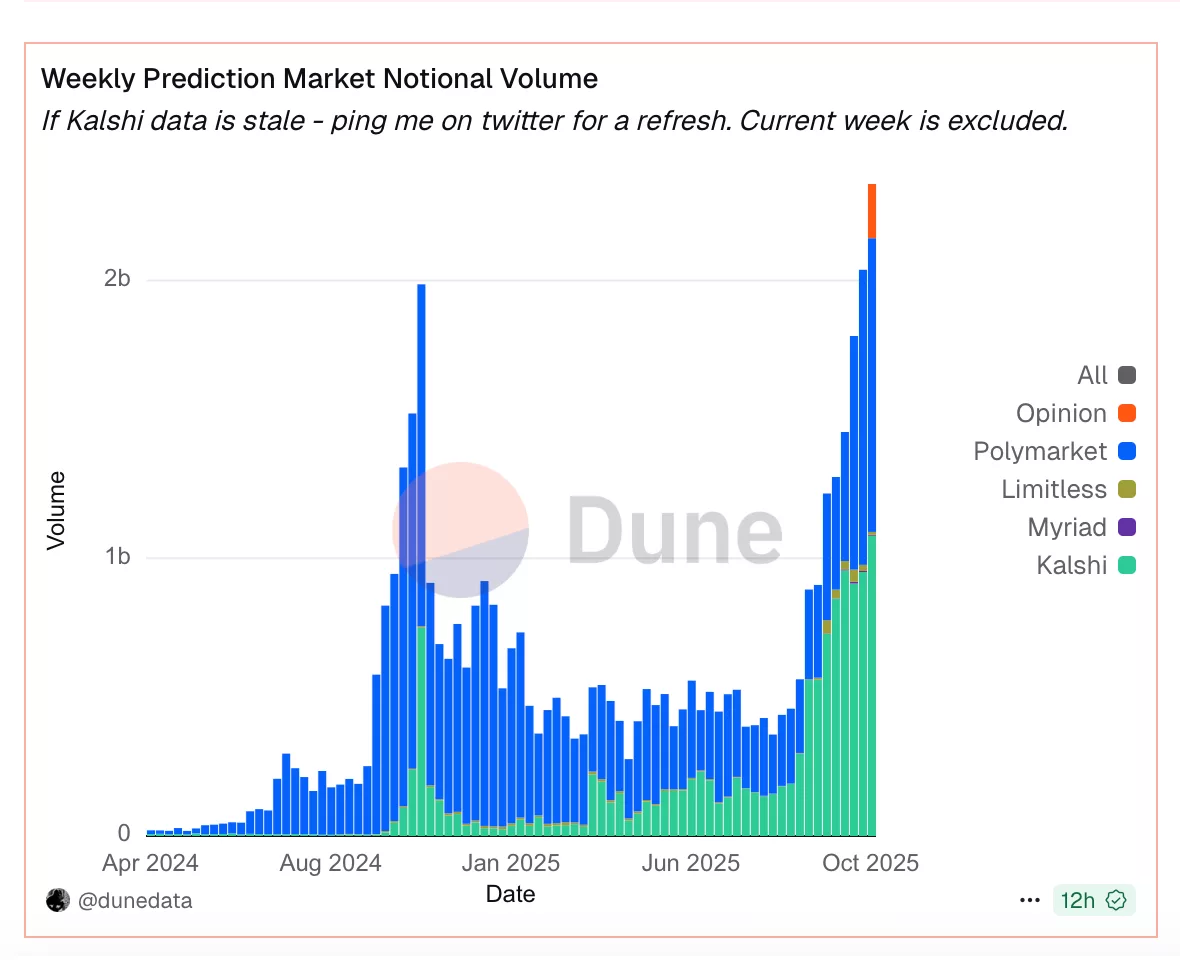

Information from Dune Analytics exhibits weekly shopping and selling volumes all the intention thru main prediction platforms fair no longer too long ago reached over $2.3 billion as of Oct. 20, pointing to the short growth of the event-shopping and selling market.

Trump’s crypto ventures reignite wrestle-of-interest allegations

The Trump household’s rising involvement in crypto has already drawn strong criticism, and the disclosing of Truth Predict has simplest intensified the debate.

Within the weeks main as a lot as the announcement, lawmakers and ethics specialists issued several public statements accusing the president and his household of using political office to fetch higher their non-public wealth thru digital-asset ventures.

On Oct. 29, Representative John Garamendi accused the Trump administration of working as “essentially the most circulation authorities in historical previous.”

The Trump Administration is basically the most circulation authorities in historical previous!

From non-public jet gifts from the Qataris to $2 billion “crypto-coin” investments in the Trump household, the corruption is off the charts.@SpeakerJohnson, it’s time to abet Trump in fee. pic.twitter.com/XhxMiwmuvW

— John Garamendi (@RepGaramendi) October 28, 2025

He cited reports of “non-public jet gifts from the Qataris” and “$2 billion crypto-coin investments in the Trump household,” arguing that the overlap between public energy and non-public enterprise had reached an phenomenal level. He known as on Home Speaker Mike Johnson to map terminate action.

A day earlier, on Oct. 28, Senator Chris Murphy pointed to what he described as a troubling sequence of events surrounding Trump’s pardon of Binance founder Changpeng Zhao.

One week after Trump pardoned Binance’s proprietor (for an gorgeous array of crimes linked to terrorist and sex predator financing), Binance begins promoting Trump crypto.

The White Home is a corpulent time, 24/7 corruption machine. https://t.co/vfFqJ9Jvhq

— Chris Murphy 🟧 (@ChrisMurphyCT) October 28, 2025

“One week after Trump pardoned Binance’s proprietor for crimes linked to terrorist and s*x predator financing, Binance started promoting Trump crypto,” Murphy wrote.

He mentioned the timing published how political authority and non-public promotion had change into inseparable, describing the White Home as “a corpulent-time, 24/7 corruption machine.”

On Oct. 25, Representative Ro Khanna warned that “we cling a president who is constructing more wealth thru his office than any in historical previous.”

We cling a president who is constructing more wealth thru his office than any in historical previous. We are in a position to no longer turn a blind gape to this corruption.

On Monday, I will be introducing a decision to atomize the president, his household, and contributors of Congress from shopping and selling in crypto and accepting… pic.twitter.com/lY1TBp3MUr

— Ro Khanna (@RoKhanna) October 25, 2025

He mentioned such conduct amounted to corruption and introduced plans to introduce a decision banning the president, his household, and contributors of Congress from shopping and selling in crypto or accepting foreign funds.

The criticism started earlier in the month. On Oct. 15, Norm Eisen, a dilapidated White Home ethics lawyer, mentioned Trump “kept his enterprise interests, then passe public office to counterpoint himself, from foreign money to crypto schemes.”

Trump kept his enterprise interests

Then passe public office to counterpoint himself

From foreign money to crypto schemes

I call it what it is: corruption—& essentially the most circulation presidency in as a lot as date historical previous

I show on @ABCaustralia’s Chasing Trump’s Billions -TNhttps://t.co/5sSPQ2hgVu pic.twitter.com/We6HSndjZf

— Norm Eisen (@NormEisen) October 15, 2025

He known as it “essentially the most circulation presidency in as a lot as date historical previous” and expanded on the claim in an interview for ABC Australia’s Chasing Trump’s Billions, which examined Trump’s monetary operations world huge.

Repeated criticism from lawmakers and ethics specialists has change into a fixed backdrop to the Trump household’s expanding enterprise process. Every contemporary venture linked to digital property has renewed questions about monetary transparency, disclosure requirements, and the concentration of business interests within a sitting administration.

Truth Predict’s progress will unfold within that ambiance, the attach oversight and transparency dwell central to how politically linked enterprises are judged.