When Donald Trump returned to the White Condominium, grand of the crypto market anticipated a neatly-identified script. Pro-crypto rhetoric, friendlier law, institutional inflows, and renewed threat dawdle for food enjoy been all alleged to mix staunch into a defining bull market.

As an alternative, as 2025 draws to a shut, the crypto market is ending the three hundred and sixty five days markedly decrease, sitting at factual 20% of its height from the Biden generation.

Even with Trump, Crypto Market Is Quiet Valid 20% of Biden-Technology Ranges

That contradiction is on the guts of a rising debate over whether crypto is stuck in a interesting share, or whether something extra traditional has broken.

“It’s time to acknowledge and admit the crypto market is broken,” said Ran Neuner, analyst and host of Crypto Banter.

The analyst highlighted an unprecedented disconnect between fundamentals and costs. In step with Neuner, 2025 had “all of the requirements for a bull market”:

- Abundant liquidity,

- A pro-crypto US executive,

- Space ETFs (namely Bitcoin and Ethereum-basically based mostly mostly)

- Aggressive Bitcoin accumulation from figures cherish Michael Saylor,

- Nation-command and sovereign fund participation, and

- Macro sources such as equities and treasured metals cherish gold and silver hitting all-time highs.

“Even with all of the above,” Neuner said, “we are ending 2025 decrease and entirely 20% the build we enjoy been with Biden.”

Which means that ragged explanations no longer protect. Theories around four-three hundred and sixty five days cycles, trapped liquidity, or an IPO moment for crypto feel extra and extra cherish put up-hoc rationalizations in desire to exact solutions.

In step with Neuner, the tip outcome is a market with entirely two plausible paths forward:

- A hidden structural seller or mechanism is suppressing costs, or

- Crypto is constructing for what he calls “the mum of all get-up trades” as markets within the slay revert to equilibrium.

No longer Every person Has the same opinion That The rest Is Broken

Market commentator Gordon Gekko, a preferred particular person on X, pushed encourage, arguing that the grief is intentional and structural, however no longer dysfunctional.

“Nothing is broken; this is factual how market makers supposed. Sentiment is at its lowest in years; leverage traders are losing all the pieces. It isn’t alleged to be straightforward; entirely the solid will likely be rewarded,” he wrote.

That divide shows a deeper shift in how crypto behaves when put next with earlier cycles. Below Trump’s first period of time, from 2017 to 2020, crypto thrived in a regulatory vacuum.

Retail speculation dominated, leverage became as soon as unchecked, and reflexive momentum drove costs a ways previous their traditional price.

Below Biden, in difference, the market modified into institutionalized. Enforcement-first law constrained threat-taking, whereas ETFs, custodians, and compliance frameworks reshaped capital allocation and drift.

Satirically, masses of crypto’s most anticipated tailwinds arrived all the blueprint thru this extra constrained generation:

- ETFs unlocked entry, however basically for Bitcoin

- Establishments distributed, however generally hedged and rebalanced mechanically.

- Liquidity existed, however flowed into TradFi wrappers in desire to on-chain ecosystems.

The tip outcome is scale with out reflexivity.

Bitcoin Holds While Altcoins Fracture within the Contemporary Crypto Regime

This structural shift has been namely painful for altcoins, with analysts and KOLs cherish Shanaka Anslem, amongst others, arguing that the unified crypto market no longer exists.

As an alternative, 2025 has destroy up into “two video games”:

- Institutional crypto: Bitcoin, Ethereum, and ETFs with crushed volatility and longer time horizons, and

- Consideration crypto: Where thousands and thousands of tokens compete for fleeting liquidity and most collapse inner days.

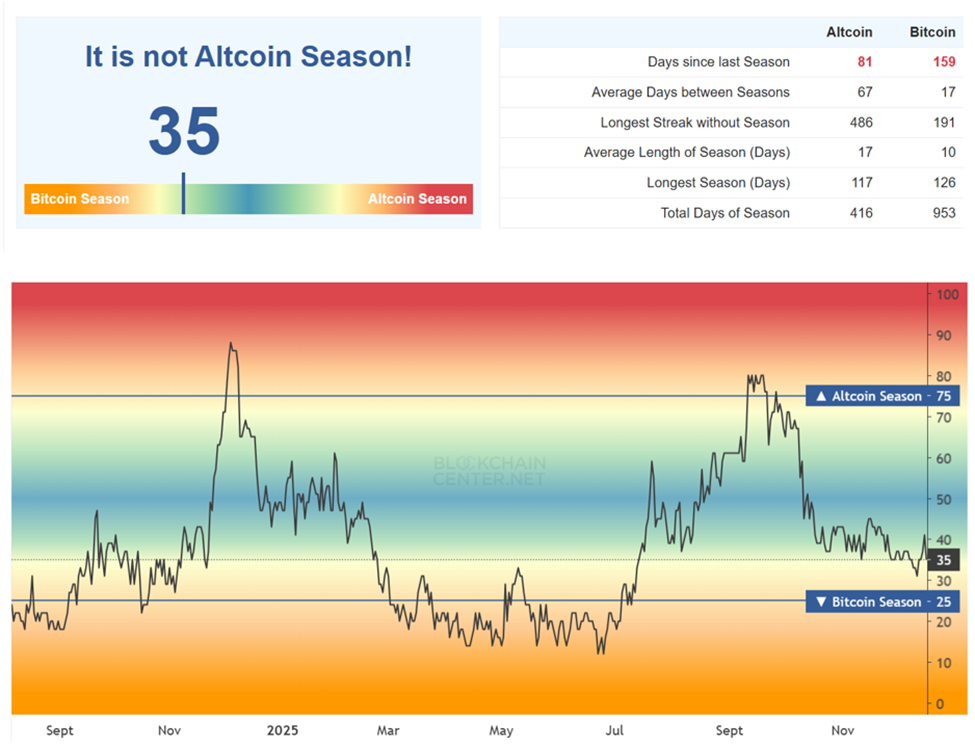

Capital no longer rotates smoothly from Bitcoin into alts, the colloquial altcoin season, or alt season. It flows straight to whichever mandate it is miles designed to back.

“…Your entirely picks now: Play Institutional Crypto with persistence and macro consciousness. Or play Consideration Crypto with tempo and infrastructure,” wrote Anslem.

In step with this conception chief, conserving altcoins on thesis for months is now the worst that you just may perchance maybe be ready to factor in approach.

“You may perchance maybe perchance be no longer early to the altseason. You may perchance maybe perchance be anticipating a market structure that no longer exists,” he added.

Maybe, this is the inspiration of a trader’s conviction, radiant the build to see. Lisa Edwards supports this thesis, calling for market contributors to win liquidity flows.

“Issues shift, cycles switch, cash moves in new ways. When you may perchance maybe even be anticipating the feeble altseason, you may perchance maybe omit the stuff that’s genuinely running factual in front of you,” she said.

Quinten François echoes that peek, noting that 2025’s token depend dwarfs earlier cycles. With extra than 11 million tokens in existence, the inspiration of a enormous-basically based mostly mostly altseason equivalent to 2017 or 2021 may perchance maybe even merely merely be earlier faculty.

Every person keeps anticipating a classic altseason cherish 2017 or 2021.

But your whole market structure has modified.2017 had a number of hundred coins competing for capital.

2021 had a number of thousand.

2025 has extra than 11 million tokens, memecoins, and worthless experiments.The days the build…

— Quinten | 048.eth (@QuintenFrancois) December 2, 2025

Between Repricing and Restoration: Crypto’s Put up-Institutional Test

Meanwhile, macro pressures continue to weigh on sentiment. Nic Puckrin, funding analyst and co-founder of Coin Bureau, notes that Bitcoin’s trudge in opposition to its 100-week transferring common (MA) shows renewed AI bubble fears, uncertainty around future Fed management, and three hundred and sixty five days-live tax-loss selling.

“This all makes for a lacklustre live to 2025,” he said in an email to BeInCrypto, warning that BTC may perchance maybe in transient dip underneath $80,000 if selling speeds up.

It is any one’s wager whether crypto is broken or merely transforming, and traders may perchance maybe enjoy to quiet conduct their very have be taught.

However, what’s obtrusive is that Trump-generation expectations are colliding with a Biden-generation market structure, and the feeble playbook no longer applies.

Discussions between economists and traders on mainstream desks counsel a brutal repricing or a violent get-up rally, doubtlessly defining the put up-institutional identification of crypto.

The put up Trump’s Return Could perchance well quiet Contain Saved Crypto, But Market Ends 2025 A long way Below Biden-Technology Highs looked first on BeInCrypto.