Regional exchanges are reporting a spike in crypto activity as the President-elect’s knowledgeable-Bitcoin stance resonates in inflation-hit economies.

The president-elect’s pledge to set a national Bitcoin reserve and ease regulatory burdens arrives as Latin The US emerges as a key exclaim market, processing over $85 billion in crypto transactions yearly, per Chainalysis files.

Regional gamers be taught about Trump’s gain as a doable catalyst for elevated institutional adoption and awful-border flows.

“Trump’s 2nd term in the White Apartment might perchance well in all probability further enhance the crypto market, giving room for further appreciation,” Sebastian Serrano, CEO of Argentina-essentially essentially based alternate Ripio, acknowledged in statements shared by Cointelegraph. “We’re searching at a decisive period for Bitcoin and the cryptocurrency market as an complete.”

The implications might perchance well in all probability be particularly significant for countries struggling with foreign money instability.

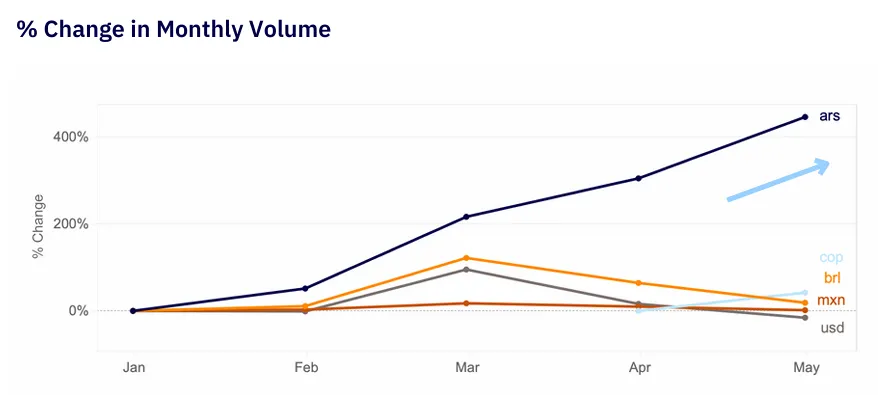

In Argentina, the set the poverty charges spiked to over fifty three% below Milei’s libertarian administration, Bitcoin trading volumes surged 160% in October—and extra than 400% in 2024— as customers sought refuge from devaluation. Venezuela shows identical patterns, with over 92% of crypto activity flowing through centralized exchanges as electorate look doable selections to the bolivar.

Regional crypto companies are already positioning themselves for skill exclaim. Lemon Money, which currently expanded to Peru, reported processing over $20 million in local foreign money transactions in its first three months.

“Definite U.S. guidelines might perchance well in all probability relieve us speed adoption across extra LatAm markets,” acknowledged Marcelo Cavazzoli, Lemon’s CEO, in an interview with Decrypt en Español.

“Donald Trump’s victory gave (crypto) an further enhance, as his advertising campaign showed obvious assist for the field,” Cavazzoli added, “Trump recommend policies to incentivize Bitcoin mining in the united states, aligning with the rising interest in the crypto market. This was especially mirrored in Argentinean and Peruvian customers, who started amassing Bitcoin at the head of October.

Cavazzolli told Decrypt that Bitcoin trading quantity hit a account on November 6 in Argentina, with Peru additionally seeing a 160% in trading activity vs the day prior.

Some regional gamers, on the opposite hand, warning that Trump’s advertising campaign promises, while encouraging market sentiment, accrued beget to contend with the significant adjustments going through LatAM’s crypto ecosystem and don’t clear up the explicit desires of the crypto commercial.

“The regulatory shift helps, nevertheless we accrued beget to clear up significant infrastructure challenges,” illustrious Matías Reyes from TruBit alternate in an interview with Decrypt en Español. “Inappropriate-border settlement and banking relationships are needed for our location.”

Latin The US’s strange mixture of high crypto awareness, no longer easy financial stipulations, and stressful remittance flows positions it to doubtlessly profit from Trump’s crypto agenda. Regional exchanges account rising institutional interest as regulatory clarity improves.

“We’re seeing elevated inquiries from ragged financial gamers,” acknowledged Hongyi Tang of TruBit. “U.S. policy shifts might perchance well in all probability speed this pattern by providing clearer frameworks for banks and price suppliers.”

For a location the set centralized exchanges contend with over 60% of transaction quantity—vastly above the worldwide reasonable of Forty eight%—diminished regulatory friction might perchance well in all probability unlock contemporary exclaim. Brazil, Argentina, and Mexico already outrageous among the head 20 countries globally for crypto adoption.

The prospect of a Bitcoin-pleasant U.S. administration comes as Latin American countries grapple with their very accumulate regulatory frameworks. Argentina’s CNV is finalizing guidelines for digital asset provider suppliers, while Brazil implemented comprehensive crypto guidelines in 2023 and is predicted to open its blockchain-essentially essentially based CBDC subsequent year.

“Regional regulators gape U.S. policy intently,” explained Alfonso Martel Seward from Lemon Money. “A extra accommodating U.S. stance might perchance well in all probability have an effect on local frameworks, especially spherical stablecoins and alternate operations.”

As Trump prepares to rob workplace, the US-Latin The US crypto market—currently processing spherical $300 million in on daily foundation transfers—stands at a doable inflection point.

Whether Trump’s advertising campaign promises translate into policies that profit regional adoption, drifting a ways flung from what he did and acknowledged on his first mandate, remains to be viewed, nevertheless local gamers are cautiously optimistic.

Edited by Sebastian Sinclair and Josh Quitter. Marco Lanz contributed to this tale.